Economy

Racism Impoverishes the Whole Economy – The New York Times

Discrimination hurts just about everyone, not only its direct victims.

New research shows that while the immediate targets of racism are unquestionably hurt the most, discrimination inflicts a staggering cost on the entire economy, reducing the wealth and income of millions of people, including many who do not customarily view themselves as victims.

The pernicious effects of discrimination on the wages and educational attainment of its direct targets are being freshly documented in inventive ways by scholarship. From the lost wages of African-Americans because of President Woodrow Wilson’s segregation of the Civil Service, to the losses suffered by Black and Hispanic students because of California’s ban on affirmative action, to the scarcity of Black girls in higher-level high school math courses, the scope of the toll continues to grow.

But farther-reaching effects of systemic racism may be less well understood. Economists are increasingly considering the cost of racially based misallocation of talent to everyone in the economy.

My own research demonstrates, for example, how hate-related violence can reduce the level and long-term growth of the U.S. economy. Using patents as a proxy for invention and innovation, I calculated how many were never issued because of the violence — riots, lynchings and Jim Crow laws — to which African Americans were subjected between 1870 and 1940.

The loss was considerable: The patents that African-Americans could have been expected to receive, given equal opportunity, would have roughly equaled the total for a medium-size European country during that time.

Those enormous creative losses can be expected to have had a direct effect on business investment and therefore on total economic activity and growth.

Other economists are beginning to estimate harm to the economy caused by racism in broad ways.

An important principle suggests that the person who can produce a product or service at a lower opportunity cost than his or her peers has a comparative advantage in that activity. Recent research calculates the effects of the discriminatory practice of placing highly skilled African-American workers, who might have flourished as, say, doctors, into lower-skilled occupations where they had no comparative advantage. Such practices 50 years ago — which linger, to a lesser extent, today — have cost the economy up to 40 percent of aggregate productivity and output today.

Similarly, other research estimates that aggregate economic output would have been $16 trillion higher since 2000 if racial gaps had been closed. To put that total in context, the gross domestic product of the United States in 2019 was $21.4 trillion. The researchers estimate that economic activity could be $5 trillion higher over the next five years if equal opportunity is achieved.

Right now, if more women and African-Americans were participating in the technical innovation that leads to patents, the economist Yanyan Yang and I calculate that G.D.P. per capita could be 0.6 to 4.4 percent higher. That is, it would be between $58,841 to $61,064 per person compared with $58,490 per person in 2019.

This entire line of research suggests that organizations — companies, laboratories, colleges and universities — are leaving colossal sums of money on the table by not maximizing talent and living standards for all Americans.

I have thought and written a lot about remedies. Here are a few ideas aimed at addressing discrimination in the innovation economy. First, we need more training in science, technology, engineering and mathematics (STEM), like the extensive and highly successful program once sponsored by Bell Labs to encourage participation in these fields by women and underrepresented minorities

STEM fields should not be the sole target, however, because the innovation economy encompasses more than this narrow set of subjects. Two of the last three people I’ve talked to at tech firms have a B.A. in international relations and a Ph.D. in political science. Clearly, problem-solving skills matter, but these skills are not unique to the STEM majors.

Second, there is substantial evidence of systemic racism in education, which needs to be addressed. Research shows that professors are less likely to respond to email inquiries about graduate study from Black, Hispanic and female students than from people who are discernibly white and male. A system of incentives — and penalties — could hold those responsible accountable at every level of the education and training process.

At the invention stage, such as at corporate, government and university labs, my research shows that mixed-gender teams are more prolific than those whose members are all female or male. And a large body of literature has documented the positive effects of diversity in teams. Managers at each level should be held responsible for being good stewards of the resources of their companies and promoting diverse teams and behavior and, therefore, better outcomes.

When invention is commercialized and companies sell shares to the public, the wealth gaps are stark. Seven of the world’s 10 richest people on the Forbes list are associated with tech companies that commercialize inventions. Jeff Bezos, Bill Gates, Mark Zuckerberg and Elon Musk are in the top five. None among the top 10 (or 50) is Black.

The statistics for venture capital funding are striking. In 2014, less than 1 percent of venture capital funding went to businesses founded by African-American women, and in 2015, only 2 percent of all venture capitalists were African-American.

A number of worthwhile recommendations have been made to address the lack of diversity at the commercialization stage of innovation. These include:

-

Enhancing mentoring opportunities through programs such as those of the Small Business Administration.

-

Seeking and recruiting founders to invest in places like Atlanta, and not exclusively in Silicon Valley.

-

Addressing systemic racism at every level of management and within venture capital firms.

-

Diversifying corporate boards so that senior leadership will be held accountable for diversity and workplace climate. (California has done this with women on the boards of public companies.)

The Kapor Center, a think tank that promotes participation by underrepresented minorities in tech fields and education, has proposed noteworthy remedies at many stages, including at the pre-college level.

The social compact most societies have with their governments is that standards of living will rise continually and that each successive generation will be better off than preceding ones. We are robbing countless people of higher standards of living and well-being when we allow racial discrimination to flourish from generation to generation.

Lisa D. Cook, a professor of economics at Michigan State University, is a member of the Biden-Harris transition team.

Economy

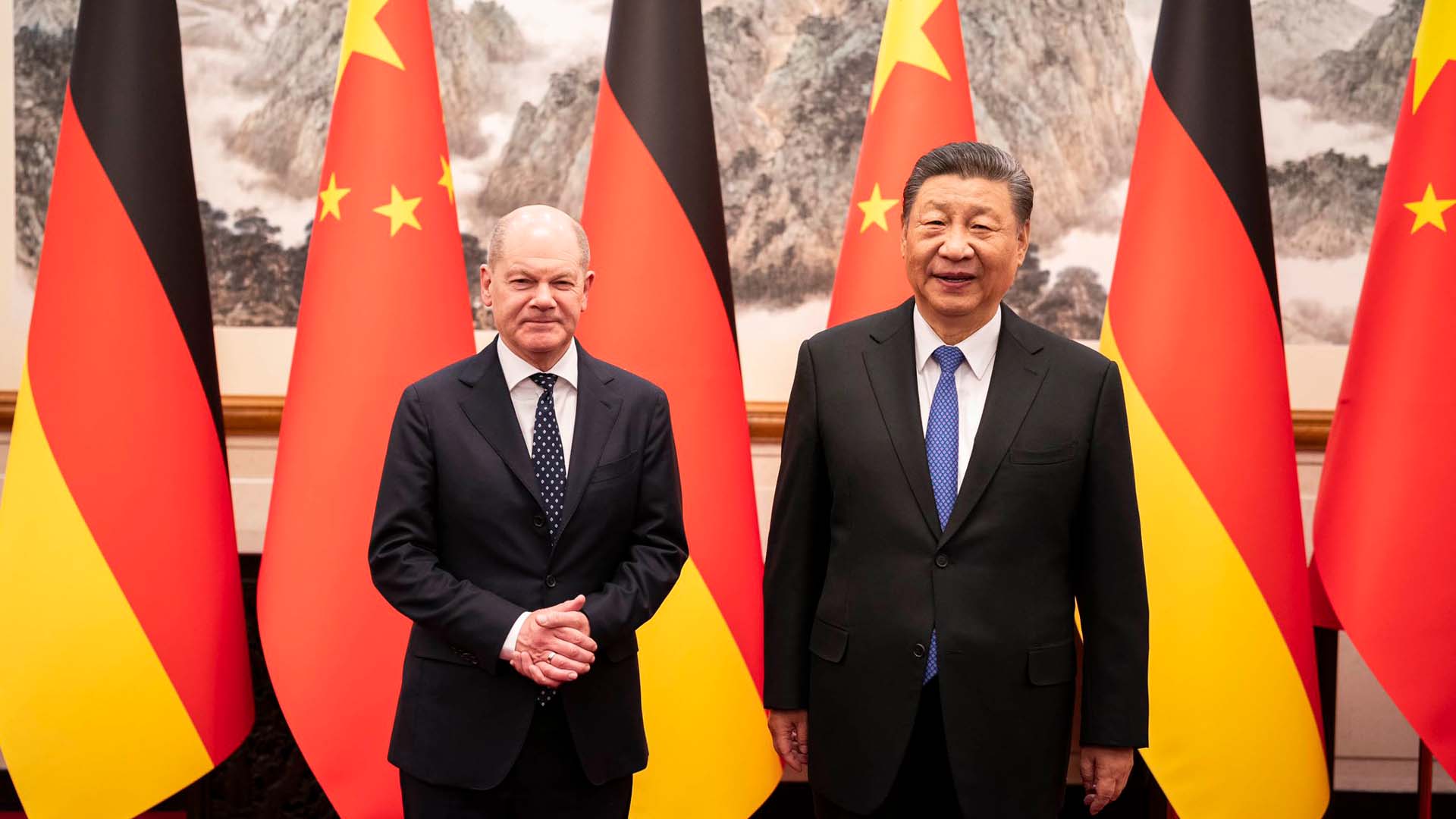

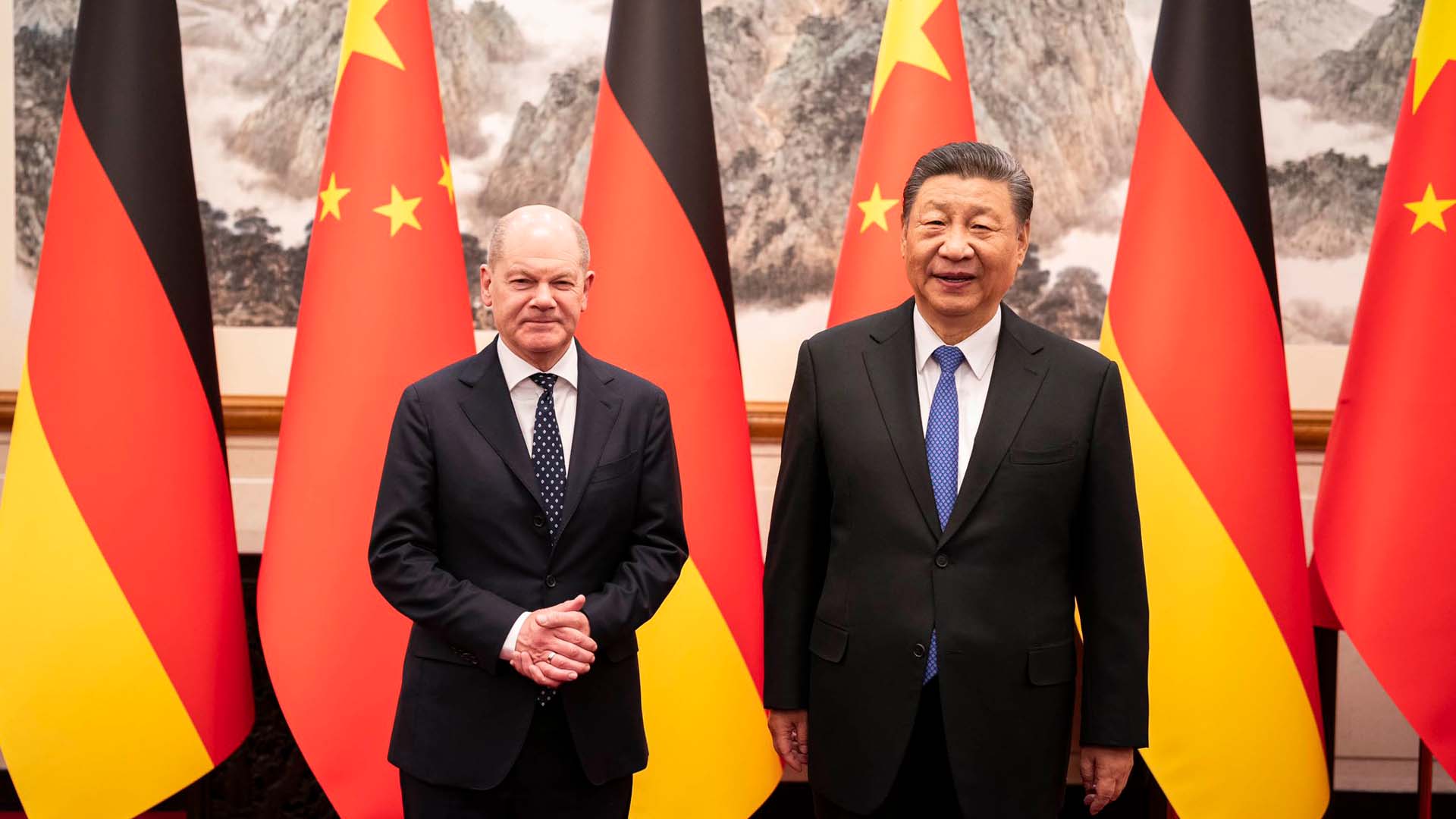

Why is Germany maintaining economic ties with China? – Al Jazeera English

German Chancellor Olaf Scholz has been on a three-day visit to China in a bid to shore economic ties.

Germany is China’s biggest European trade partner.

But, Berlin also sees Beijing as a competitor and a rival.

And – in its first-ever “strategy on China” launched last year – pledged to reduce German dependence on the Chinese market.

But, during his visit last week to China, the German Chancellor signalled his intentions to maintain business ties.

That may have angered some of Olaf Scholz’s closest allies.

The European Union has launched several investigations into exports of Chinese green technology to protect European industry from competition.

Are Nigeria’s reforms working?

We speak to the president of the United Nations General Assembly on sustainability.

Economy

BMO chief says US economy improving, calls California ‘a strategically important market’

|

|

TORONTO (Reuters) – The U.S. economy was showing signs of stronger than expected growth, with California being a strategically important market, said the head of Bank of Montreal, which has rapidly expanded in its southern neighbour.

CEO Darryl White, addressing shareholders at the bank’s annual meeting, said the bank was well positioned to cater to clients between American and Canadian economies in a shifting global landscape.

BMO, Canada’s third largest bank by market capitalization, makes about a third of its income from the United States after its $16.3 billion Bank of the West acquisition last year, the biggest ever deal in Canadian banking history.

He said that trade and investment between Canada and the U.S. is key to economic competitiveness noting that it is one of the largest bilateral trade relationships in the world.

“The relationship is significant. Put into context, just counting the Great Lakes region… (it) would be the world’s third largest economy, nearly equal to that of Japan and Germany combined, and the region employs about a third of the U.S.-Canadian combined workforce,” he said.

“Then add in California, an economy almost twice the size of Canada’s, and you can see the global impact this North-South partnership has.”

Canadian banks are increasingly looking to expand south of the border or in other parts of the world as opportunities at home are limited in a saturated market.

White cautioned about a higher-for-longer interest rate environment as borrowing costs remain high and demand weakens. But when rates begin to ease, the market could see a “new normal, an environment with fundamentally different characteristics than that of the past two decades,” he said.

(Reporting by Nivedita Balu in Toronto; Editing by Aurora Ellis)

Economy

AUD to USD Forecast: Australian Economy in Focus Amid RBA Rate Path Speculation

|

|

According to the CME FedWatch Tool, the probability of a 25-basis point Fed June rate cut fell from 56.1% (April 9) to 18.8% (April 16). The chances of the Fed leaving interest rates at 5.50% in September increased from 8.5% to 31.5% over the same period.

Short-Term Forecast

Near-term AUD/USD trends will likely hinge on Australian employment data, stimulus chatter from Beijing, and Fed speakers. Weaker Australian labor market data could tilt monetary policy divergence toward the US dollar. However, a stimulus package from Beijing would boost buyer appetite for the Aussie dollar.

AUD/USD Price Action

Daily Chart

The AUD/USD sat well below the 50-day and 200-day EMAs, confirming the bearish price trends.

An Aussie dollar breakout from the April 16 high of $0.64446 would support a move to the $0.64582 resistance level. A break above the $0.64582 resistance level would bring the $0.65 handle and the 50-day EMA into play.

Considerations should include stimulus discussions from Beijing, updates from the Middle East, and statements from the Fed.

Conversely, an AUD/USD drop below the $0.64 handle could give the bears a run at the $0.62713 support level.

Given a 14-period Daily RSI reading of 35.73, the AUD/USD could fall to the $0.63500 level before entering oversold territory.

-

Sports7 hours ago

Sports7 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

Real eState15 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Tech15 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

Investment23 hours ago

Investment23 hours agoSo You Own Algonquin Stock: Is It Still a Good Investment? – The Motley Fool Canada

-

Science18 hours ago

Science18 hours agoSpace exploration: A luxury or a necessity? – Phys.org

-

Investment21 hours ago

Investment21 hours agoGoldman Sachs Backs AI in Hospitals With $47.5 Million Kontakt.io Investment – BNN Bloomberg

-

Sports21 hours ago

Sports21 hours agoMcDavid hits century mark for assists in 9-2 laugher over San Jose – Edmonton Journal

-

Science20 hours ago

SFU researchers say ant pheromones could help prevent tick bites – Global News