Tech

Shares of Sonos, Logitech fall after Apple removes their speakers from its stores – Yahoo Tech

TipRanks

Buy These 3 Dividend Stocks on Weakness, Say Analysts

The conventional wisdom would say that a stock with low share value and falling revenues and earnings would not be a great buying proposition. But the conventional wisdom also said that nothing would replace the horse in transportation, and that Hillary Clinton would be President. Sometimes, it pays to look under the hood, and see what’s really driving events – or stock potentials.And that is what several Wall Street analysts have done. In three recent reports, these analysts have highlighted stocks that all show the same combination of features: A Strong Buy consensus view, a high upside potential, a high dividend yield – and a strongly depressed share price. The analysts point to that share price weakness as an opportunity for investors.We ran the tickers through TipRanks database to find out what made these stocks compelling.ConocoPhillips (COP)First on the list is ConocoPhillips, the world’s largest oil and gas production company, with over $35 billion in annual revenues, $7 billion in annual income, and a market cap exceeding $36 billion. ConocoPhillips is based in Houston, Texas, and has operation in 17 countries. Just under half of the company’s 2019 production came from the US.With all of that strength behind it, COP shares are down 46% year-to-date. The key is low oil prices, which are depressing earnings. In the second quarter, the company recorded a net loss per share of 92 cents. The loss comes on the heels of declines prices; COP’s crude oil realized an average price of $25.10 per barrel, down 61% year-over-year, and natural gas liquids brought in $9.88 per barrel equivalent, a 54% yoy decline. Top line revenues fell 55% to $2.75 billion.Despite the falling revenues and earnings, COP has kept up its dividend payment. The company raised the payment from 31 cents to 42 cents last autumn, and the recent quarterly payment, sent out in early September, marked four quarters in a row at that level – and 5 years of dividend reliability. At $1.68 per common share annually, the dividend yields 5.08%.JPMorgan analyst Phil Gresh notes ConocoPhillips’ solid balance sheet and free cash flow, and points out the company’s logical path forward.“COP announced its intention to buy back $1B of stock with cash on hand, which we think is an acknowledgement that management views the stock as being over-sold, even considering the commodity price environment. We tend to agree with this view… COP continues to have plenty of cash and short-term investments on hand to be opportunistic with its capital allocation,” Gresh opined.Accordingly, Gresh rates COP an Overweight (i.e. Buy), and his $49 price target implies an upside of 44%. (To watch Gresh’s track record, click here)Overall, the Strong Buy consensus rating on COP shares is based on 13 reviews, including 11 Buys and 2 Holds. The stock sells for $33.90 and has an average price target of $48.08, in line with Gresh’s. (See COP stock analysis on TipRanks)Baker Hughes Company (BKR)Next up is Baker Hughes, an oil field support services company. These are the companies that supply the tech needed to make oil well work. The exploration companies own the rights and bring in the heavy equipment, but it’s the support service providers who send in the roughneck drillers and the tools that complete the wells and keep them in operation. Baker Hughes offers technical services to all segments of the oil industry, upstream, midstream, and downstream.Providing an essential set of services and products has not protected Baker Hughes from the prevailing low oil prices. BKR shares have underperformed, and are down 48% year-to-date. The company’s earnings and revenue fell sequentially in both Q1 and Q2, with second quarter EPS turning negative at a 5-cent loss per share. Revenue fell 12% to $4.7 billion for the quarter.Like COP above, Baker Hughes has made a point of maintaining its dividend. The company’s dividend has been reliable for the past 21 year – an enviable record – and management has prioritized that reputation. The payment, of 18 cents per common share quarterly, annualizes to 72 cents and gives a robust yield of 5.6%.Writing from RBC, analyst Kurt Hallead sees Baker Hughes at the start of a new path forward.“BKR’s strategy is to shed its oil services skin and transition into a global Energy Technology company. As many industries aggressively pursue carbon reduction targets and increase spend on renewable energy, BKR’s plan is to lever its technology portfolio and position its core businesses for new frontiers, notably carbon capture, hydrogen and energy storage,” Hallead noted. “In our opinion, pivoting to Energy Technology from Oil Services will be key to maintaining relevancy with investors, ensuring long-term viability with customers and outperforming its peers. BKR’s strong balance sheet and FCF generation provide a firm foundation. BKR is the only Energy Technology Services company on both the RBC Global ESG Best Ideas list and the RBC Global Energy Best Ideas list,” Hallead concluded.Hallead is optimistic about the company’s ability to effect this transition, as shown by his $20 price target, suggesting an upside of 55%. (To watch Hallead’s track record, click here)Overall, Wall Street agrees with Hallead on BKR. Of 12 reviews, 9 are Buys and 3 are Holds, making the consensus rating a Strong Buy. The average price target is $20.27, implying an upside of 58% from the trading price of $12.86. (See BKR stock analysis on TipRanks)Enerplus (ERF)Last on our list is Enerplus, another exploration and production company in North America’s oil and gas market. Enerplus operates in the Marcellus shale of Pennsylvania, producing natural gas, in the Williston Basin of North Dakota and Montana, producing light oil, and in several oil assets in Western Canada. The company estimates 2020 average production of 89,000 barrels of oil equivalent per day. And with all that to back it up, this small-cap ($419 million) energy player has seen its stock fall 73% this year.A 45% drop in top-line revenue, and earnings falling to a net loss of 14 cents per share in Q2, haven’t helped, but the real culprit, as with the companies above, is the current low oil price regime. The COVID-19 pandemic hit energy producers from several directions at once: reduced demand as economic activity declined, disruptions to production as workers were placed under stay-home orders, and disruptions to trade networks for both of those reasons.And yet, through all of this, Enerplus has consistently paid out its monthly dividend. The payment is small – only 1 cent in Canadian currency, or slightly less than 1 cent in US money – but the stock’s share price is low, as well. As a result, the 9 cent (US) annualized dividend payment gives a fairly robust yield of 4.8%.Analyst Greg Pardy, of RBC, watches the North American oil industry – especially the Canadian segments – carefully, and he believes Enerplus sits in a strong position to weather a tough market. “Enerplus remains our favorite intermediate producer given its consistent operational performance and best-in-class balance sheet… Liquidity wise, Enerplus is in excellent shape… [and] essentially undrawn on its US$600 million bank credit facility. Following repayments in May and June, Enerplus has no further debt maturities in 2020,” the analyst cheered. In line with this optimistic assessment, Pardy gives ERF a C$5.00 (US$3.76) price target indicating an upside of 100% for the coming year. (To watch Pardy’s track record, click here)All in all, with an 8:1 split between Buy and Hold, Enerplus’ 9 recent reviews support the Strong Buy analyst consensus. The share price is $1.85, and the US$3.72 average price target suggests it has room for 97% growth in the year ahead. (See ERF stock analysis on TipRanks)To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Tech

Model doesn't feel safe wearing designer clothes in Canada's biggest city | Canada – Daily Hive

A model says she feels like a “sitting duck” wearing designer clothes in downtown Toronto amid a general state of unease in the city in response to an uptick in violent crimes.

Hanya Kizemchuk posted a video on Instagram and TikTok where the local model claimed that she sprinted two blocks to her car after a recent modelling shoot in Toronto after being overcome with the sense that her expensive attire read as “a stop sign screaming ‘rob me.’”

In the video, Kizemchuk describes the scene on a cold, rainy night after finishing a shoot, explaining, “I wrapped my head in my Louis Vuitton wrap. I had my Louis Vuitton duffle bag with all my shoes and makeup and whatever I need for that job. I was wearing my Gucci crossover and I was wearing my black leather Burberry coat.”

“And as I jumped out onto the street, I have to say that I realized for the first time ever in the city of downtown Toronto, I was truly like a sitting duck and that this is no longer okay to be running around like this, that I need to be a little more downplayed so that I don’t attract attention.”

Kizemchuk says she was “a little unnerved” and felt compelled to run “two blocks to my car and continuously check to see if anyone was popping out from somewhere because I was like a stop sign screaming, ‘Rob me.’”

“And that’s how I felt for the first time ever in this beautiful city of Toronto, which I grew up in and don’t recognize anymore.”

A few chimed in, sharing comments siding with Kizemchuk.

Unfortunately crime has increased everywhere. If you are on the street in downtown Toronto, and you are decked out head to toe in designer goods, you are calling attention to yourself and you would be lucky if you’re not mugged. Sadly, it is the same or worse in all big cities.

— john smith (@jsmith9999992) April 18, 2024

Others questioned why she would run away without identifying any specific threats and then make a post online about feeling unsafe.

So nothing happened? She just felt scared walking to her car and no one was around?

— Graeme 🦀 (@hexagraeme) April 18, 2024

One user pointed out how this video is another example of wealth inequality and the ever-growing divide between the rich and poor in Toronto.

lady with extreme wealth complains about wealth inequality

🤷♂️

lady, we’ve been screaming for years.

— Dave Jay (@DaveJayToronto) April 18, 2024

According to Toronto Police data, major crime indicators have spiked year-to-date in several categories during 2024, including assault (+10.9%) and robbery (+19.7%).

Tech

Forged by friendship, this year's Stampede boots pay tribute to Stoney Nakoda iconography – MSN

If not for Duane Mark and Lloyd Templeton’s budding friendship, this year’s Calgary Stampede boot design would have never existed.

While the boot was only constructed in recent months, the process began when Templeton, a Calgary-raised artist in his early 20s, approached Mark with a request to use images of the Stoney Nakoda teepee-holder and educator for artwork he was preparing for the Calgary Stampede.

The two clicked from the get-go. By November, after hours together, Templeton’s piece featuring Mark — dressed in full regalia standing in the foreground of the Calgary Tower among a diverse group of parade participants — was chosen as the 2024 Stampede poster artwork.

On Thursday, Templeton’s art was unveiled as the design for this year’s Stampede boot — now the second product of their friendship that’s been produced for this year’s 10-day rodeo and fair.

“What comes to mind is the growth of a young man named Lloyd,” Mark said, when asked what he sees in this year’s boot design.

The artwork on the exterior reflects key Stoney Nakoda First Nation and Treaty 7 iconography, Templeton said at Thursday’s unveiling. Stitchings of Alberta’s mountain range and the golden eagle flying through a rising sun — two important symbols for the First Nation’s culture — line the outside of the boot.

The boot’s interior has the words Oyadé Gichiyabi, Ahogichopabi Îyûhabith inscribed, which roughly translates in Stoney language to “be empowered to foster peace and respect,” which was selected at Mark’s recommendation.

A recent graduate from the Alberta University of the Arts, Templeton is becoming a household name in Calgary’s arts community at a pace that’s not lost on him.

“Just last year I was making school projects, and a year later, there’s going to be people wearing my art. That’s nuts,” he said.

Working in three dimensions was a new challenge for Templeton. To start, he would tape paper to the back of the boot to get a feel for the shapes he needed to produce. He then drew the designs by pencil, scanned them into his computer and produced it into a special file that allowed it to be etched by laser onto the boots.

“My poster was oil paint, a very traditional process,” he said. “I was kind of making it up on the go to see what worked. I liked the challenge of that.”

Margaret Holloway, the Stampede’s 2024 First Nations Princess who also provided input on the boot design, said she was “breathtaken, speechless” when she first saw the design. Breaking from tradition, this year’s design will be available on five different shades of boot. Alberta Boot normally creates one special boot for each Stampede.

The 22-year-old jingle dancer is the first person from Stoney Nakoda to be named First Nations Princess in more than 20 years.

Holloway’s family teepee at the Elbow River Camp has three large eagles on it, she said.

“Back home, we see the eagles fly and we feel blessed by their presence, and we feel amazed just by their beauty of soaring in the skies. To see that on this year’s Stampede boot was absolutely unbelievable.”

With their latest creation publicly revealed, Templeton and Mark’s friendship will extend far past their artistic collaboration.

“He’s the coolest dude. We have a lot in common — a good sense of humour, listen to the same music and movies. We make a lot of the same jokes,” Templeton said.

Mark said he’s watched the young artist grow and mature in front of his eyes. Over the past year they’ve discussed “deep Indigenous philosophy,” which Templeton has evidently absorbed into his own life, he said.

“We became the best of friends and will continue to be the best of friends,” Mark said.

X: @mattscace67

Tech

Huawei's new Kirin 9010 brings minor CPU improvements – GSMArena.com news – GSMArena.com

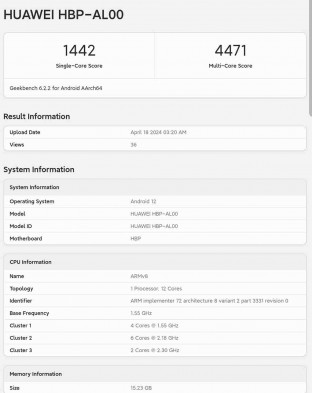

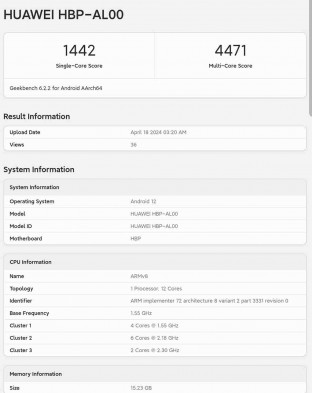

Huawei announced the Pura 70 series today, and once again offered no details regarding the chipsets. However, early benchrmarks confirmed they feature a new platform called Kirin 9010, which has an 8-core CPU, identified by apps as 12-core unit due to hyperthreading.

Hyperthreading is nothing new in the chipset industry, as the Taishan cores have been supporting the technology for some time; it has been part of the Kirin 9000s and now is a part of the 9010 as well.

First Geekbench results revealed a minor improvement in raw performance, coming from slightly faster core speeds. The numbers show improvement single digit percentage improvements in both single core and multi core tests.

Kirin 9010 vs Kirin 9000S on Geekbench

The actual octa-core combination of Kirin 9010 is as follows: one 2.30 GHz Taishan Big, three 2.18 GHz Taishan Mid and four 1.55 GHz Cortex-A510. The GPU remains Maleoon 910 at 750 MHz.

-

Tech11 hours ago

Tech11 hours agoSave $700 Off This 4K Projector at Amazon While You Still Can – CNET

-

Investment12 hours ago

Investment12 hours agoUK Mulls New Curbs on Outbound Investment Over Security Risks – BNN Bloomberg

-

Tech10 hours ago

Tech10 hours ago'Kingdom Come: Deliverance II' Revealed In Epic New Trailer And It Looks Incredible – Forbes

-

Science12 hours ago

Science12 hours agoJeremy Hansen – The Canadian Encyclopedia

-

Sports10 hours ago

Sports10 hours agoAuston Matthews denied 70th goal as depleted Leafs lose last regular-season game – Toronto Sun

-

Business9 hours ago

BC short-term rental rules take effect May 1 – CityNews Vancouver

-

Investment9 hours ago

Investment9 hours agoBenjamin Bergen: Why would anyone invest in Canada now? – National Post

-

Art9 hours ago

Collection of First Nations art stolen from Gordon Head home – Times Colonist