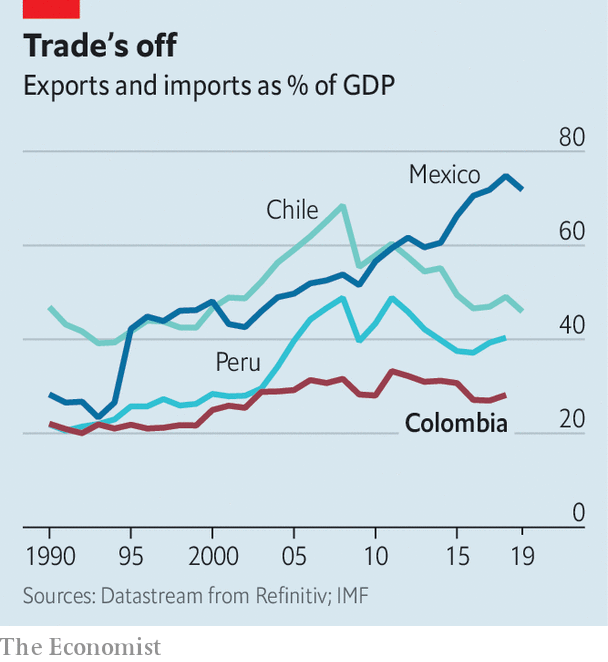

Colombia is now as closed as it was in the 1990s, according to a new book*. Total trade has increased fivefold, but the ratio of trade to GDP has not risen much (see chart). Non-tariff measures affect nearly four-fifths of imports, up from 27% in 1992, says the UN Conference on Trade and Development. The government has created new trade-related agencies, and has given existing bodies more power to meddle.

Economy

The costs of Colombia’s closed economy

COLOMBIANS PAY more for wine than most Latin Americans. The price shoots up as soon as a case reaches shore. Each time a shipment arrives, importers must submit at least eight forms to as many agencies. Officials can take up to 15 days to clear it. In the meantime, importers store their bottles in climate-controlled warehouses. When a permit finally comes, bad roads and high trucking charges mean that merchants pay among the highest freight bills in the world to ship the wine to Bogotá, the capital, where most customers are. By the time it reaches a dinner table a bottle of wine costs eight times more than in its country of origin. Its costly journey is the rule, not the exception, for products imported by Colombia.

It used to be easier. The government liberalised the economy in the early 1990s after decades of protectionism. At that time Colombia depended on exports of coffee, the price of which was plummeting. In an effort to diversify the economy and make it more productive, the government reduced tariffs and eliminated lists of items whose import was prohibited.

That openness lasted just a few years. Owners of factories and sugar mills, dairy farmers, rice growers and regional governments, which own distillers of aguardiente, a local tipple, were hurt by competition. They lobbied to restore protection. The government could not reimpose tariffs, in part because of its commitments as a member of the World Trade Organisation. So it put up lots of non-tariff barriers.

The coddling of domestic producers is one reason why productivity has barely grown since the 1990s. In 2012 farms produced less by value in real terms than they did in 1990. Peru and Chile, which have less variety in their growing conditions but more open economies, have doubled their output over the same period. Pricey imports raise exporters’ costs, making them less competitive.

Ports are suffering. Ships arrive in Buenaventura, the biggest port on the Pacific coast, loaded with containers, but they leave with nothing. Cartagena, on the Caribbean coast, makes its living as a transshipment port, shuffling goods from one ship to another. But that is less profitable than handling exports and imports. Colombia’s “main export is air”, says Anibal Ochoa, the port’s commercial director.

Until now, governments have ignored the costs of Colombia’s closed shop. That is partly because their priority was to defeat the FARC, a guerrilla group that waged a 50-year war against the state. From the early 2000s Colombia earned a decent living from oil and gas, which replaced coffee as the main export. They account for nearly 60% of goods exports.

Now pressure is building to liberalise. A peace agreement in 2016 ended the war. Oil prices fell in 2014 and have yet to recover fully. Reserves are running low. Trade could become the economy’s new engine, says Jorge García, one of the book’s editors.

So far, though, the push to open up has had little support from the top. The government has made some permits easier to apply for, but did not reduce their number or cost. For now, it seems, only rich Colombians will be able to afford wine. Others will drown their sorrows in aguardiente.■

*“Comercio Exterior en Colombia: Política, Instituciones, Costos y Resultados”, edited by Jorge García García, Enrique Montes Uribe, Iader Giraldo Salazar. Banco de la República.

This article appeared in the The Americas section of the print edition under the headline “The costs of Colombia’s closed economy”

Economy

S&P/TSX composite gains almost 100 points, U.S. stock markets also higher

TORONTO – Strength in the base metal and technology sectors helped Canada’s main stock index gain almost 100 points on Friday, while U.S. stock markets also climbed higher.

The S&P/TSX composite index closed up 93.51 points at 23,568.65.

In New York, the Dow Jones industrial average was up 297.01 points at 41,393.78. The S&P 500 index was up 30.26 points at 5,626.02, while the Nasdaq composite was up 114.30 points at 17,683.98.

The Canadian dollar traded for 73.61 cents US compared with 73.58 cents US on Thursday.

The October crude oil contract was down 32 cents at US$68.65 per barrel and the October natural gas contract was down five cents at US$2.31 per mmBTU.

The December gold contract was up US$30.10 at US$2,610.70 an ounce and the December copper contract was up four cents US$4.24 a pound.

This report by The Canadian Press was first published Sept. 13, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

Statistics Canada reports wholesale sales higher in July

OTTAWA – Statistics Canada says wholesale sales, excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain, rose 0.4 per cent to $82.7 billion in July.

The increase came as sales in the miscellaneous subsector gained three per cent to reach $10.5 billion in July, helped by strength in the agriculture supplies industry group, which rose 9.2 per cent.

The food, beverage and tobacco subsector added 1.7 per cent to total $15 billion in July.

The personal and household goods subsector fell 2.5 per cent to $12.1 billion.

In volume terms, overall wholesale sales rose 0.5 per cent in July.

Statistics Canada started including oilseed and grain as well as the petroleum and petroleum products subsector as part of wholesale trade last year, but is excluding the data from monthly analysis until there is enough historical data.

This report by The Canadian Press was first published Sept. 13, 2024.

The Canadian Press. All rights reserved.

Economy

S&P/TSX composite up more than 150 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 150 points in late-morning trading, helped by strength in the base metal and energy sectors, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 172.18 points at 23,383.35.

In New York, the Dow Jones industrial average was down 34.99 points at 40,826.72. The S&P 500 index was up 10.56 points at 5,564.69, while the Nasdaq composite was up 74.84 points at 17,470.37.

The Canadian dollar traded for 73.55 cents US compared with 73.59 cents US on Wednesday.

The October crude oil contract was up $2.00 at US$69.31 per barrel and the October natural gas contract was up five cents at US$2.32 per mmBTU.

The December gold contract was up US$40.00 at US$2,582.40 an ounce and the December copper contract was up six cents at US$4.20 a pound.

This report by The Canadian Press was first published Sept. 12, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

Sports10 hours ago

Armstrong scores, surging Vancouver Whitecaps beat slumping San Jose Earthquakes 2-0

-

News10 hours ago

As plant-based milk becomes more popular, brands look for new ways to compete

-

News7 hours ago

Looking for the next mystery bestseller? This crime bookstore can solve the case

-

News7 hours ago

Labour Minister praises Air Canada, pilots union for avoiding disruptive strike

-

News17 hours ago

CF Montreal finds its groove with 2-1 win over Charlotte

-

News17 hours ago

Toronto FC downs Austin FC to pick up three much-needed points in MLS playoff push

-

News10 hours ago

Liberal candidate in Montreal byelection says campaign is about her — not Trudeau

-

News10 hours ago

Inflation expected to ease to 2.1%, lowest level since March 2021: economists