Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Investment

The Daily — Investment in building construction, July 2022 – Statistique Canada

Released: 2022-09-13

Investment in building construction continued its upward trend since October 2021, rising 0.8% to $21.0 billion in July. Both the residential (+1.0% to $15.7 billion) and the non-residential sectors (+0.1% to $5.3 billion) showed increases.

On a constant dollar basis (2012=100), investment in building construction increased 1.4% to $12.8 billion.

Non-residential sector remains unchanged

Investment in non-residential construction nudged up 0.1% to $5.3 billion in July.

Commercial investment was up 0.6% to $3.0 billion for the month, cooling down after posting strong gains in June. Notable growth for the component mainly came from British Columbia (+3.5%), stemming from multiple projects across Vancouver.

At the subcomponent level, new construction for Trade and Services and Warehouses contributed the most to the growth. In July, construction in Trade and Services has surpassed pre-COVID-19 pandemic levels, with substantial growth over the previous 12 months. Warehouses have also seen considerable growth, with an increase of 42.0% on an unadjusted basis since March 2021, coinciding with a strong growth in e-commerce and the need for large e-commerce companies to store goods locally for rapid delivery. Conversely, investment in new office buildings, after a temporary bounce back in June 2020, has been on a downward trend ever since, as the work-from-home model became more prevalent and the number of unoccupied offices across Canada continued to increase.

Investment in the industrial component advanced 2.2% to $1.0 billion in July, with gains in seven provinces. Ontario accounted for most of the gains for the component in the month, continuing its considerable growth since December 2021.

Institutional construction investment declined 2.3% to $1.4 billion in July, the largest decline for the component since April 2020.

Minor gains in residential sector

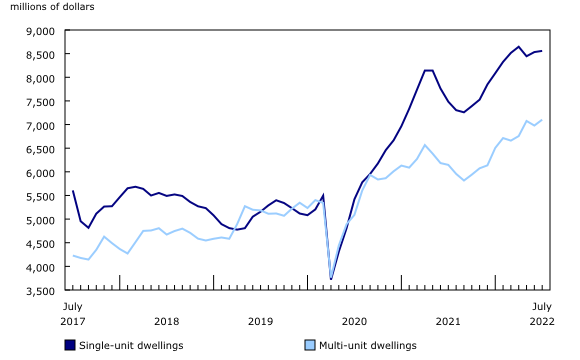

Investment in residential building construction advanced 1.0% to $15.7 billion in July.

Single-family home investment edged up 0.3% to $8.6 billion and has remained relatively stable over the five months ending in July.

Multi-unit construction investment increased 1.8% to $7.1 billion for the month, with apartment projects in Ontario and British Columbia contributing significantly to the gains.

On an unadjusted basis, new construction for both single-family homes and multi-unit construction have shown notable growth in the previous few months and are up 3.9% year over year in July.

For more information on housing, please visit the Housing statistics portal.

Note to readers

Data are subject to revisions based on late responses, methodological changes and classification updates. Unadjusted data has been revised for the previous month. Seasonally adjusted data has been revised for the previous three months.

Data presented in this release are seasonally adjusted with current dollar values unless otherwise stated. Using seasonally adjusted data allows month-to-month and quarter-to-quarter comparisons by removing the effects of seasonal variations. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Monthly estimates in constant dollars are calculated using quarterly deflators from the Building Construction Price Index (table 18-10-0135-01). Typically, the first two months of a quarter use the previous quarter’s price level, and the data are revised when the new quarterly price index becomes available.

Detailed data on investment activity by type of building and type of work are now available in the unadjusted current dollar series.

The Trade and Services subcomponent includes buildings such as retail and wholesale outlets, retail complexes and motor vehicle show rooms. More detailed information can be found on the Integrated Metadatabase at Types of Building Structure – 2.2.1 – Trade and services.

Next release

Data on investment in building construction for August will be released on October 17.

Products

Statistics Canada has a “Housing Market Indicators” dashboard. This web application provides access to key housing market indicators for Canada, by province and by census metropolitan area. These indicators are automatically updated with new information from monthly releases, giving users access to the latest data.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

Investment

Taxes should not wag the tail of the investment dog, but that’s what Trudeau wants

|

|

Kim Moody: Ottawa is encouraging people to crystallize their gains and pay tax. That’s a hell of a fiscal plan

The Canadian federal budget has been out for a week, which is plenty of time to absorb just how terrible it is.

The problems start with weak fiscal policy, excessive spending and growing public-debt charges estimated to be $54.1 billion for the upcoming year. That is more than $1 billion per week that Canadians are paying for things that have no societal benefit.

Why? Well, for the CEI, virtually every entrepreneurial industry (except technology) is not eligible. If you happen to be in an industry that qualifies, the $2-million exemption comes with a long, stringent list of criteria (which will be very difficult for most entrepreneurs to qualify for) and it is phased in over a 10-year period of $200,000 per year.

For transfers to EOTs, an entrepreneur must give up complete legal and factual control to be eligible for the $10-million exemption, even though the EOT will likely pay the entrepreneur out of future profits. The commercial risk associated with such a transfer is likely too great for most entrepreneurs to accept.

Capital gains tax hike

But the budget’s highlight proposal was the capital gains inclusion rate increase to 66.7 per cent from 50 per cent for dispositions effective after June 24, 2024. The proposal includes a 50 per cent inclusion rate on the first $250,000 of annual capital gains for individuals, but not for corporations and trusts. Oh, those evil corporations and trusts.

Some economists have come out in strong favour of the proposal, mainly because of equity arguments (a buck is a buck), but such arguments ignore the real world of investing where investors look at overall risk, liquidity and the time value of money.

If capital gains are taxed at a rate approaching wage taxation rates, why would entrepreneurs and investors want to risk their capital when such investments might be illiquid for a long period of time and be highly risky?

They will seek greener pastures for their investment dollars and they already are. I’ve been fielding a tremendous number of questions from investors over the past week and I’d invite those academics and economists who support the increased inclusion rate to come live in my shoes for a day to see how the theoretical world of equity and behaviour collide. It’s not good and it certainly does nothing to help Canada’s obvious productivity challenges.

The government messaging around this tax proposal has many people upset, including me. Specifically, it is the following paragraph in the budget documents that many supporters are parroting that is upsetting:

“Next year, 28.5 million Canadians are not expected to have any capital gains income, and 3 million are expected to earn capital gains below the $250,000 annual threshold. Only 0.13 per cent of Canadians with an average income of $1.4 million are expected to pay more personal income tax on their capital gains in any given year. As a result of this, for 99.87 per cent of Canadians, personal income taxes on capital gains will not increase.” (This is supposedly about 40,000 taxpayers.)

Bluntly, this is garbage. It outright ignores several facts.

Furthermore, public corporations that have capital gains will pay tax at a higher inclusion rate and this results in higher corporate tax, which means decreased amounts are available to be paid out as dividends to individual shareholders (including those held by individuals’ pensions).

The budget documents simply measured the number of corporations that reported capital gains in recent years and said it is 12.6 per cent of all corporations. That measurement is shallow and not the whole story, as described above.

Tax hit for cottages

There are also millions of Canadians who hold a second real estate property, either a cottage-type and/or rental property. Those properties will eventually be sold, with the probability that the gain will exceed the $250,000 threshold.

And people who become non-residents of Canada — and that is increasing rapidly — have deemed dispositions of their assets (with some exceptions). They will face the distinct possibility that such gains will be more than $250,000.

The politics around the capital gains inclusion rate increase are pretty obvious. The government is planning for Canadian taxpayers to crystallize their inherent gains prior to the implementation date, especially corporations that will not have a $250,000 annual lower inclusion rate. For the current year, the government is projecting a $4.9-billion tax take. But next year, it dramatically drops to an estimated $1.3 billion.

This is a ridiculous way to shield the government’s tremendous spending and try to make them look like they are holding the line on their out-of-control deficits. The government is encouraging people to crystallize their gains and pay tax. That’s a hell of a fiscal plan.

I hope the government has some second sober thoughts about the capital gains proposal, but I’m not holding my breath.

Investment

Everton search for investment to complete 777 deal – BBC.com

-

2 hours ago

Everton are searching for third-party investment in order to push through a protracted takeover by 777 Partners.

The Miami-based firm agreed a deal to buy the Toffees from majority owner Farhad Moshiri in September, but are yet to gain approval from the Premier League.

On Monday, Bloomberg reported the club’s main financial adviser Deloitte has been seeking fresh funding from sports-focused investors and lenders to get 777’s deal over the line.

BBC Sport has been told this is “standard practice contingency planning” and the process may identify other potential lenders to 777.

Sources close to British-Iranian businessman Moshiri have told BBC Sport they remain “working on completing the deal with 777”.

It is understood there are no other parties waiting in the wings to takeover should the takeover fall through and the focus is fully on 777.

The Americans have so far loaned £180m to Everton for day-to-day operational costs, which will be turned into equity once the deal is completed, but repaying money owed to MSP Sports Capital, whose deal collapsed in August, remains a stumbling block.

777 says it can stump up the £158m that is owed to MSP Sports Capital and once that is settled, it is felt the deal should be completed soon after.

Related Topics

Investment

Warren Buffett Predicts 'Bad Ending' for Bitcoin — Is It a Doomed Investment? – Yahoo Finance

Currently sitting in sixth on Forbes’ Real-Time Billionaires List, Berkshire Hathaway co-founder, chairman and CEO Warren Buffett is a first-rate example of an investor who stuck to his core financial beliefs early in life to become not only a success but a once-in-a-lifetime inspiration to those who followed in his footsteps.

One of the most trusted investors for decades, the 93-year-old Buffett isn’t shy to pontificate on his investment philosophy, which is centered around value investing, buying stocks at less than their intrinsic value and holding them for the long term.

Read Next: Warren Buffett: 6 Best Pieces of Money Advice for the Middle Class

Find Out: 5 Genius Things All Wealthy People Do With Their Money

He’s also quite vocal on investments he deems worthless. And one of those is Bitcoin.

Buffett’s Take on Bitcoin

Over the past decade, it’s been clear that the crypto craze isn’t something Buffett wants any part of. He described Bitcoin as “probably rat poison squared” back in 2018.

“In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending,” Buffett said in 2018. And his stance hasn’t wavered since. According to Benzinga, Buffett believes that cryptocurrencies aren’t a viable or valuable investment.

“Now if you told me you own all of the Bitcoin in the world and you offered it to me for $25, I wouldn’t take it because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything,” Buffett said at the Berkshire Hathaway annual shareholder meeting in 2022.

Although the Oracle of Omaha has his misgivings about the unpredictable investment, does that mean crypto is doomed as an investment? Not necessarily.

For You: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Is Buffett Wrong About Bitcoin?

Bitcoin bulls argue that while it’s not government-issued, cryptocurrency is as fungible, divisible, secure and portable as fiat currency and gold. Because they occupy a digital space, cryptocurrencies are decentralized, scarce and durable. They can last as long as they can be stored.

Crypto boosters continue to predict massive growth in the coin’s value. Earlier this year, SkyBridge Capital founder and former White House director of communications Anthony Scaramucci told reporters that Bitcoin could exceed $170,000 by mid-2025, and Ark Invest CEO Cathie Wood predicts Bitcoin will hit $1.48 million by 2030, according to Fortune.

“They really don’t understand the concept and the whole history of money,” Scaramucci said of crypto critics like Buffett on a recent episode of Jason Raznick’s “The Raz Report.” Because we place a value on “traditional” currency, it is essentially worthless compared with the transparent and trustworthy digital Bitcoin, Scaramucci said.

Currently trading around the $66,000 mark, Bitcoin is up nearly 50% in 2024. This means it’s massively outperforming most indexes this year, including the S&P 500, which is up about 6% in 2024.

Although Berkshire Hathaway has invested heavily in Bitcoin-related Brazilian fintech company Nu Holdings, which has its own cryptocurrency called Nucoin, it’s possible Buffett will never come around fully to crypto, despite its recent surge in value. It’s contrary to the reliable investment strategy that has served him very well for decades.

“The urge to participate in something where it looks like easy money is a human instinct which has been unleashed,” Buffett said. “People love the idea of getting rich quick, and I don’t blame them … It’s so human, and once unleashed you can’t put it back in the bottle.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Warren Buffett Predicts ‘Bad Ending’ for Bitcoin — Is It a Doomed Investment?

-

Health4 hours ago

Health4 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Art10 hours ago

Mayor's youth advisory council seeks submissions for art gala – SooToday

-

News16 hours ago

Some Canadians will be digging out of 25+ cm of snow by Friday – The Weather Network

-

Science18 hours ago

Science18 hours ago"Hi, It's Me": NASA's Voyager 1 Phones Home From 15 Billion Miles Away – NDTV

-

Media15 hours ago

Jon Stewart Slams the Media for Coverage of Trump Trial – The New York Times

-

Art22 hours ago

Made Right Here: Woodworking art – CTV News Kitchener

-

Investment9 hours ago

Investment9 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

Sports19 hours ago

Sports19 hours agoAuston Matthews turns it up with three-point night as Maple Leafs slay Bruins in Game 2 – Toronto Sun