Economy

The Throne Speech must focus on growing the economy – The Globe and Mail

/cloudfront-us-east-1.images.arcpublishing.com/tgam/PW657F64XVNERO7DMA5HFEYW4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/tgam/PW657F64XVNERO7DMA5HFEYW4Y.jpg)

Kevin Lynch is former vice-chair of BMO and former clerk of the Privy Council. Paul Deegan is CEO of Deegan Public Strategies and former deputy executive director of the National Economic Council of the White House.

Like a hurricane, the COVID-19 pandemic roared through the Canadian economy, leaving misery and destruction in its wake. Canadians are now turning to governments for help in the recovery efforts. The Speech from the Throne will be a focal point for Canadians’ expectations. While there will be promises of expensive ornaments on the tree, the litmus test for business owners and workers is whether it puts forward a credible and ambitious post-pandemic economic recovery plan.

A recovery plan will entail deficits and debt to finance investments in our long-term growth. This will push our trillion dollars of net debt even higher. But debt comes at both a cost and a risk. The cost is manageable while interest rates are at abnormally low levels, but the risk is that international financial markets begin to lose faith in our ability to manage our fiscal affairs, both federally and provincially. To avoid this and its caustic effects on growth and confidence, the government should articulate a fiscal anchor in the Throne Speech and commit to a long-term fiscal plan in the budget.

Rebuilding Canadian growth will require a clear path to improve our competitiveness and to create a Canadian advantage. What could an ambitious post-pandemic economic recovery plan include?

We should commit to becoming a global leader in the digital transformation. Government can play an important role in accelerating 5G network deployment, in urban and rural areas, through smarter spectrum policy that emphasizes the rapid release of large amounts of spectrum, on a cost-efficient basis. Smarter spectrum policy is driving the success of 5G leaders such as South Korea. Accenture estimates that widespread adoption of 5G in Canada by 2026 would add 250,000 jobs and bolster GDP by $40-billion annually.

We must build the infrastructure to ensure we remain competitive as a trading nation. We need to ensure that we have the infrastructure to move goods and digital services efficiently. The Infrastructure Bank should be a catalyst to enhance our information, multimodal transportation, and energy infrastructure by mobilizing private sector funds, but it will have to up its game to achieve its potential.

It needs to be easier to be an entrepreneur. Canada dropped from fourth position on the World Bank Ease of Doing Business rankings in 2006 to a dismal 23rd this year. It takes about 250 days to get a construction permit, compared to just 80 days in the United States. Interprovincial barriers hurt small businesses, keeping them local and less competitive. Federal review and approval of trade enabling infrastructure such as pipelines and terminals should not take five years, when competitors are moving faster. Speed matters and uncertainty kills projects.

Let’s rethink how to reduce carbon dioxide emissions in the oil sands through technology, not regulation. The government could support the deployment of Generation IV Small Modular Nuclear Reactors to meet the steam and heat requirements of Alberta’s heavy oil industry, which are currently met by natural gas and coal. This would dramatically limit greenhouse gas emissions from oil sands operations, allowing expansion, and would help to diversify the province’s economy.

Canada must become a magnet for talent. Immigration drives economic growth, and we need more immigrants to help address the demographic challenges of an aging population, especially in the Atlantic provinces. We could also establish a world-class scholarship, open to both Canadians and non-Canadians, so that our best and brightest remain in Canada and global talent chooses Canada over the U.S. and U.K.

It’s crucial that we move from innovation laggard to leader. To increase productivity and competitiveness, we have to be a leader in key indicators such as R&D spending, patents, and high technology intensive exports. We should set the goal of making Canada a global leader in digital transformation and a top three global player in artificial intelligence and data analytics. We need to make leading edge technology adoption the norm rather than the exception in Canadian business. And we should help workers displaced by the pandemic to upgrade their skills for the digital-driven economy.

Lastly, we must support Canadian firms through procurement, particularly innovative start-ups. Procurement is an important part of the federal government’s policy arsenal, yet it is rarely used strategically to grow our homegrown tech sector. It favours incumbents, who are often foreign behemoths. With the federal government’s $600-billion procurement budget, there is enormous scope to help Canadian companies progress from start-ups to Canadian-based global champions.

Governments cannot solve all problems, but they can create the conditions to make the private sector more successful. We are at one of those pivotal moments. This is a time for stimulus – not austerity – but stimulus that is well-designed, leverages the private sector, and is focused on growing the economy.

Keep your Opinions sharp and informed. Get the Opinion newsletter. Sign up today.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Economy

IMF Sees OPEC+ Oil Output Lift From July in Saudi Economic Boost – BNN Bloomberg

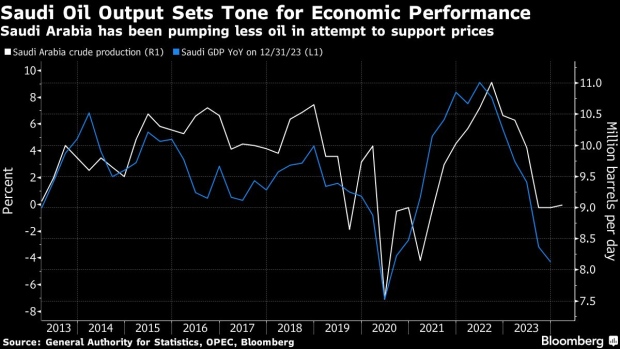

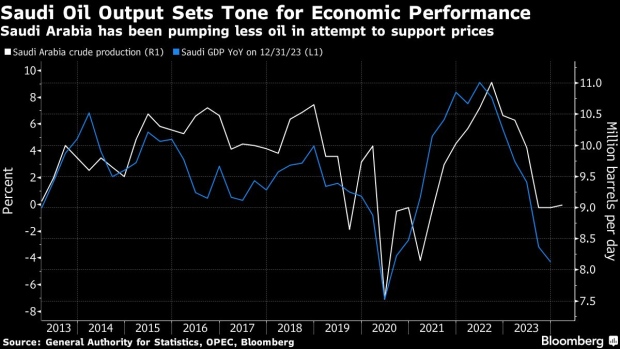

(Bloomberg) — The International Monetary Fund expects OPEC and its partners to start increasing oil output gradually from July, a transition that’s set to catapult Saudi Arabia back into the ranks of the world’s fastest-growing economies next year.

“We are assuming the full reversal of cuts is happening at the beginning of 2025,” Amine Mati, the lender’s mission chief to the kingdom, said in an interview in Washington, where the IMF and the World Bank are holding their spring meetings.

The view explains why the IMF is turning more upbeat on Saudi Arabia, whose economy contracted last year as it led the OPEC+ alliance alongside Russia in production cuts that squeezed supplies and pushed up crude prices. In 2022, record crude output propelled Saudi Arabia to the fastest expansion in the Group of 20.

Under the latest outlook unveiled this week, the IMF improved next year’s growth estimate for the world’s biggest crude exporter from 5.5% to 6% — second only to India among major economies in an upswing that would be among the kingdom’s fastest spurts over the past decade.

The fund projects Saudi oil output will reach 10 million barrels per day in early 2025, from what’s now a near three-year low of 9 million barrels. Saudi Arabia says its production capacity is around 12 million barrels a day and it’s rarely pumped as low as today’s levels in the past decade.

Mati said the IMF slightly lowered its forecast for Saudi economic growth this year to 2.6% from 2.7% based on actual figures for 2023 and the extension of production curbs to June. Bloomberg Economics predicts an expansion of 1.1% in 2024 and assumes the output cuts will stay until the end of this year.

Worsening hostilities in the Middle East provide the backdrop to a possible policy shift after oil prices topped $90 a barrel for the first time in months. The Organization of Petroleum Exporting Countries and its allies will gather on June 1 and some analysts expect the group may start to unwind the curbs.

After sacrificing sales volumes to support the oil market, Saudi Arabia may instead opt to pump more as it faces years of fiscal deficits and with crude prices still below what it needs to balance the budget.

Saudi Arabia is spending hundreds of billions of dollars to diversify an economy that still relies on oil and its close derivatives — petrochemicals and plastics — for more than 90% of its exports.

Restrictive US monetary policy won’t necessarily be a drag on Saudi Arabia, which usually moves in lockstep with the Federal Reserve to protect its currency peg to the dollar.

Mati sees a “negligible” impact from potentially slower interest-rate cuts by the Fed, given the structure of the Saudi banks’ balance sheets and the plentiful liquidity in the kingdom thanks to elevated oil prices.

The IMF also expects the “non-oil sector growth momentum to remain strong” for at least the next couple of years, Mati said, driven by the kingdom’s plans to develop industries from manufacturing to logistics.

The kingdom “has undertaken many transformative reforms and is doing a lot of the right actions in terms of the regulatory environment,” Mati said. “But I think it takes time for some of those reforms to materialize.”

©2024 Bloomberg L.P.

-

Sports23 hours ago

Sports23 hours agoAuston Matthews denied 70th goal as depleted Leafs lose last regular-season game – Toronto Sun

-

Media3 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Business21 hours ago

BC short-term rental rules take effect May 1 – CityNews Vancouver

-

Media5 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Art21 hours ago

Collection of First Nations art stolen from Gordon Head home – Times Colonist

-

Investment21 hours ago

Investment21 hours agoBenjamin Bergen: Why would anyone invest in Canada now? – National Post

-

Tech24 hours ago

Tech24 hours agoSave $700 Off This 4K Projector at Amazon While You Still Can – CNET

-

Tech23 hours ago

Tech23 hours ago'Kingdom Come: Deliverance II' Revealed In Epic New Trailer And It Looks Incredible – Forbes