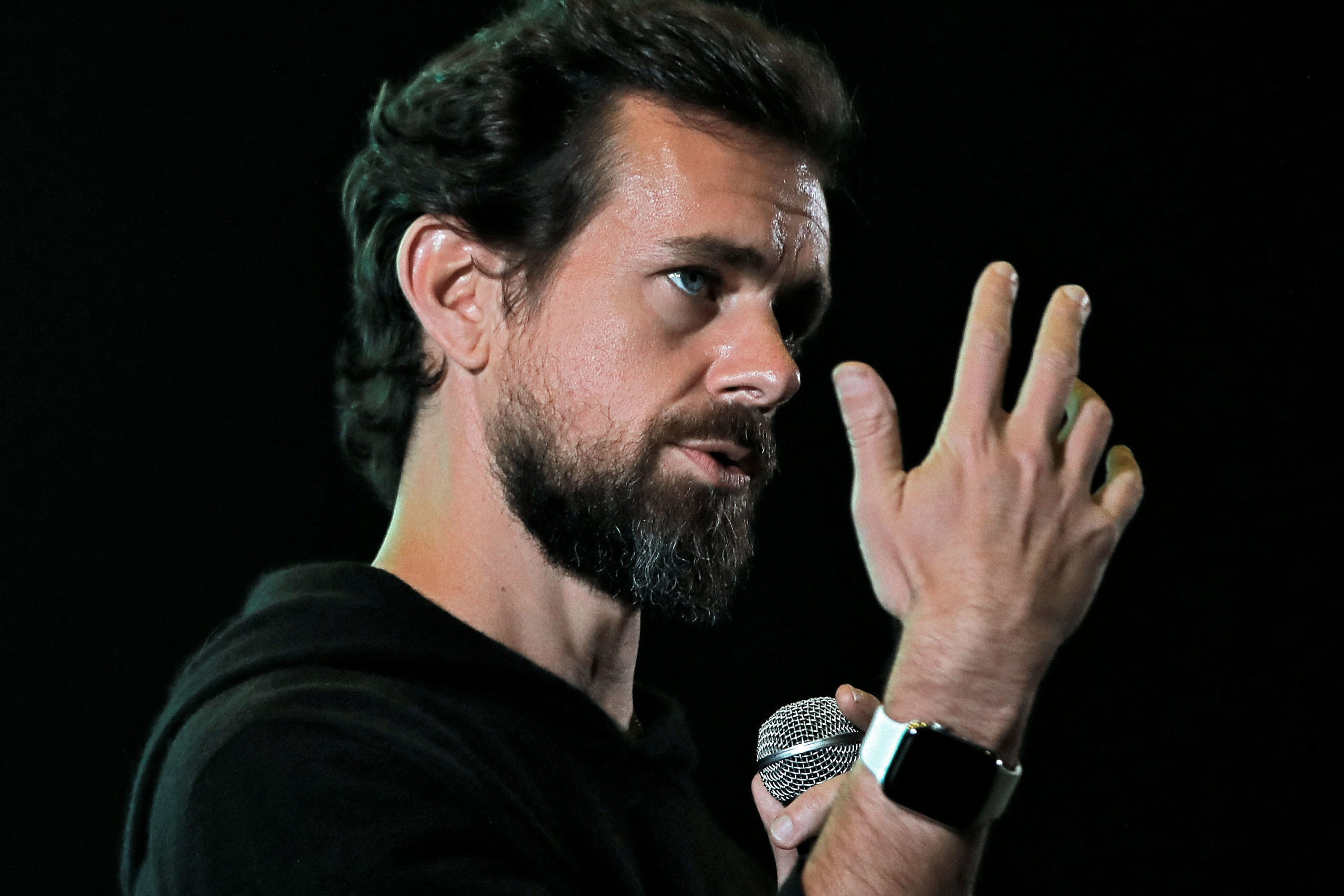

Twitter has reached a deal with investment firms Elliott Management and Silver Lake, the company announced Monday. The deal comes after Elliott’s attempt to oust Jack Dorsey as CEO.

The deal, which does not change Dorsey’s role as CEO, includes a $1 billion investment in Twitter from Silver Lake. As a result, the company will fund a $2 billion share repurchase program, according to the announcement.

The investment firms will each be awarded a seat on Twitter’s board, according to the announcement. Silver Lake co-CEO and managing partner Egon Durban and Elliott partner Jesse Cohn will join the board as Twitter continues to search for a third new independent director with expertise in technology and artificial intelligence. Twitter hopes to find a candidate “that reflect the diversity of the Twitter service,” according to the release.

Twitter’s board will create a temporary committee “that will build on our regular evaluation of Twitter’s leadership structure,” lead independent director Patrick Pichette said in a statement. Pichette will chair the committee, which “will provide a fresh look at our various structures, and report the findings to our Board on an ongoing basis,” he said.

Elliott’s campaign to remove Dorsey as CEO came after the executive announced plans to temporarily move to Africa while running both Twitter and Square. Dorsey is the only person to lead two public companies with market valuations greater than $5 billion as CEO. While under pressure from Elliott, Dorsey said last week he’d reconsider the move to Africa, blaming coronavirus fears “and everything else going on.”

Pichette’s statement also expressed confidence in Dorsey’s ability to run both companies at once.

“As a Board, we regularly review and evaluate how Twitter is run, and while our CEO structure is unique, so is Jack and so is this Company,” Pichette said.

Twitter also shared new metric goals in its announcement. “[I]n 2020 and beyond,” the company seeks to grow monetizable daily active users (mDAUs) “at 20% or more.” The company recently changed its reported user metric to mDAUs, which it says only counts users that can be targeted with ads and are not comparable to other common industry metrics like DAUs. Twitter also said that beyond 2020, it plans to “accelerate revenue growth on a year-over-year basis and gain share in the digital advertising market.”

According to the terms of the agreement, Elliott Management and Silver Lake will not “comment on or influence, or attempt to influence, directly or indirectly, any Twitter policies or rules, or policy or rule enforcement decisions, related to the Twitter platform.”

A source familiar with the agreement told CNBC that Silver Lake reached out to Twitter about an investment after Elliott took its stake in the company and attempted to oust Dorsey. Although Twitter did not need to raise new capital, the company viewed Silver Lake’s $1 billion investment as an opportunity to return more capital to investors and to name someone new to the board in addition to an Elliott representative, the source said.

Shares of Twitter were down more than 1% Monday morning, but briefly spiked on news of the deal.

WATCH: Facebook and YouTube need to be more aggressive about false information, says former Twitter CEO