Economy

US adds a strong 379000 jobs in hopeful sign for economy – Burnaby Now

WASHINGTON — U.S. employers added a robust 379,000 jobs last month, the most since October and a sign that the economy is strengthening as confirmed viral cases drop, consumers spend more and states and cities ease business restrictions.

The February gain marked a sharp pickup from the 166,000 jobs that were added in January and the loss of 306,000 in December. Yet it represents just a fraction of the roughly 9.6 million jobs that the economy needs to regain to return to pre-pandemic levels.

The pickup in hiring lowered the unemployment rate from 6.3% to 6.2%, the Labor Department said Friday in its monthly jobs report. That is down dramatically from the 14.8% jobless rate of April of last year, just after the virus erupted in the United States. But it’s well above the pre-pandemic unemployment rate of 3.5%.

Stock prices surged on the news of solid job growth, a day after Wall Street suffered deep losses on fears that inflation and interest rates could soon be headed higher.

One year after the pandemic triggered a violent recession, economists are increasingly optimistic that hiring will accelerate in the coming months as Americans seize the opportunity to once again travel, shop, attend sporting events and visit movie theatres and restaurants. Households as a whole have accumulated a huge pile of savings after having slashed spending on those services. Much of that money is expected to be spent once most people feel comfortable about going out.

Friday’s report showed that the nation’s job growth is still being driven by a steady recovery of bars, restaurants and other leisure and hospitality establishments. Bars and restaurants, in particular, snapped back last month, adding 286,000 jobs as business restrictions eased in California and other states. That trend will likely continue as Texas this week joined some other states in announcing that it would fully reopen its economy with no restrictions.

Also hiring last month were retailers, which added 41,000 jobs, health care companies with 46,000 and manufacturers with 21,000. On the other hand, construction companies shed 61,000 jobs, likely in part because of the severe storms and power outages in Texas.

Friday’s strong jobs report, by suggesting that the economy is on the mend, could complicate President Joe Biden’s push for his $1.9 trillion economic rescue package, which is being considered by the Senate after winning approval in the House. The Biden package would provide, among other things, $1,400 checks to most adults, an additional $400 in weekly unemployment aid and another round of aid to small businesses.

One discouraging note in the February data is that last month’s net job growth came entirely from people who reported that their layoffs had been temporary. By contrast, the number of people who said their jobs were permanently gone was largely unchanged compared with January. People who have permanently lost jobs typically face a tougher time finding new work. In many cases, their former employers have gone out of business.

With so much money being pumped into the economy, Oxford Economics forecasts that growth will reach 7% for all of 2021, which would be the fastest calendar-year expansion since 1984. The Congressional Budget Office projects that the nation will add a substantial 6.2 million jobs this year, though that wouldn’t be nearly enough to restore employment to pre-pandemic levels.

Still, the size of the Biden relief package, coming as the economy is already showing improvement, has stoked fears that growth could overheat and accelerate inflation, sending borrowing costs up and possibly leading the Federal Reserve to jack up interest rates. Those fears have roiled financial markets for the past two weeks.

Fed Chair Jerome Powell sought to assuage those concerns on Thursday — without success, based on sharp selloffs in the stock and bond markets — when he suggested that any meaningful rise in inflation would likely prove temporary and that the Fed would be in no hurry to raise its benchmark short-term rate.

Nor did Powell offer any hint that the Fed would act to push back against a surge in the yield on the 10-year Treasury note, which has jumped from about 0.9% last year to 1.5% late Thursday. Still, Powell sounded some optimistic notes. Citing in part the increasing distribution and administering of coronavirus vaccines, he said, “There’s good reason to expect job creation to pick up in the coming months.”

Other recent economic reports have also suggested better times ahead. Americans sharply increased their spending at retail stores and restaurants in January, when the $600 relief checks were mostly distributed. Retail sales jumped 5.3%, after three months of declines.

Factory output also picked up that month, and demand for long-lasting goods, such as autos and aircraft, rose 3.4%, the government said last week.

Home sales have been on a tear for most of the past year, driven by low mortgage rates and the desire of many Americans for more space during the pandemic. A huge jump in the proportion of people working from home has also driven up sales, which were nearly 24% higher in January than a year earlier.

Christopher Rugaber, The Associated Press

Economy

Climate Change Will Cost Global Economy $38 Trillion Every Year Within 25 Years, Scientists Warn – Forbes

Topline

Climate change is on track to cost the global economy $38 trillion a year in damages within the next 25 years, researchers warned on Wednesday, a baseline that underscores the mounting economic costs of climate change and continued inaction as nations bicker over who will pick up the tab.

Key Facts

Damages from climate change will set the global economy back an estimated $38 trillion a year by 2049, with a likely range of between $19 trillion and $59 trillion, warned a trio of researchers from Potsdam and Berlin in Germany in a peer reviewed study published in the journal Nature.

To obtain the figure, researchers analyzed data on how climate change impacted the economy in more than 1,600 regions around the world over the past 40 years, using this to build a model to project future damages compared to a baseline world economy where there are no damages from human-driven climate change.

The model primarily considers the climate damages stemming from changes in temperature and rainfall, the researchers said, with first author Maximilian Kotz, a researcher at the Potsdam Institute for Climate Impact Research, noting these can impact numerous areas relevant to economic growth like “agricultural yields, labor productivity or infrastructure.”

Importantly, as the model only factored in data from previous emissions, these costs can be considered something of a floor and the researchers noted the world economy is already “committed to an income reduction of 19% within the next 26 years,” regardless of what society now does to address the climate crisis.

Global costs are likely to rise even further once other costly extremes like weather disasters, storms and wildfires that are exacerbated by climate change are considered, Kotz said.

The researchers said their findings underscore the need for swift and drastic action to mitigate climate change and avoid even higher costs in the future, stressing that a failure to adapt could lead to average global economic losses as high as 60% by 2100.

!function(n) if(!window.cnxps) window.cnxps=,window.cnxps.cmd=[]; var t=n.createElement(‘iframe’); t.display=’none’,t.onload=function() var n=t.contentWindow.document,c=n.createElement(‘script’); c.src=’//cd.connatix.com/connatix.playspace.js’,c.setAttribute(‘defer’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c) ,n.head.appendChild(t) (document);

(function()

function createUniqueId()

return ‘xxxxxxxx-xxxx-4xxx-yxxx-xxxxxxxxxxxx’.replace(/[xy]/g, function(c) 0,

v = c == ‘x’ ? r : (r & 0x3 );

const randId = createUniqueId();

document.getElementsByClassName(‘fbs-cnx’)[0].setAttribute(‘id’, randId);

document.getElementById(randId).removeAttribute(‘class’);

(new Image()).src = ‘https://capi.connatix.com/tr/si?token=546f0bce-b219-41ac-b691-07d0ec3e3fe1’;

cnxps.cmd.push(function ()

cnxps(

playerId: ‘546f0bce-b219-41ac-b691-07d0ec3e3fe1’,

storyId: ”

).render(randId);

);

)();

How Do The Costs Of Inaction Compare To Taking Action?

Cost is a major sticking point when it comes to concrete action on climate change and money has become a key lever in making climate a “culture war” issue. The costs and logistics involved in transitioning towards a greener, more sustainable economy and moving to net zero are immense and there are significant vested interests such as the fossil fuel industry, which is keen to retain as much of the profitable status quo for as long as possible. The researchers acknowledged the sizable costs of adapting to climate change but said inaction comes with a cost as well. The damages estimated already dwarf the costs associated with the money needed to keep climate change in line with the limits set out in the 2015 Paris Climate Agreement, the researchers said, referencing the globally agreed upon goalpost set to minimize damage and slash emissions. The $38 trillion estimate for damages is already six times the $6 trillion thought needed to meet that threshold, the researchers said.

Crucial Quote

“We find damages almost everywhere, but countries in the tropics will suffer the most because they are already warmer,” said study author Anders Levermann. The researcher, also of the Potsdam Institute, explained there is a “considerable inequity of climate impacts” around the world and that “further temperature increases will therefore be most harmful” in tropical countries. “The countries least responsible for climate change” are expected to suffer greater losses, Levermann added, and they are “also the ones with the least resources to adapt to its impacts.”

What To Watch For

The fundamental inequality over who is impacted most by climate change and who has benefited most from the polluting practices responsible for the climate crisis—who also have more resources to mitigate future damages—has become one of the most difficult political sticking points when it comes to negotiating global action to reduce emissions. Less affluent countries bearing the brunt of climate change argue wealthy nations like the U.S. and Western Europe have already reaped the benefits from fossil fuels and should pay more to cover the losses and damages poorer countries face, as well as to help them with the costs of adapting to greener sources of energy. Other countries, notably big polluters India and China, stymie negotiations by arguing they should have longer to wean themselves off of fossil fuels as their emissions actually pale in comparison to those of more developed countries when considered in historical context and on a per capita basis. Climate financing is expected to be key to upcoming negotiations at the United Nations’s next climate summit in November. The COP29 summit will be held in Baku, the capital city of oil-rich Azerbaijan.

Further Reading

Economy

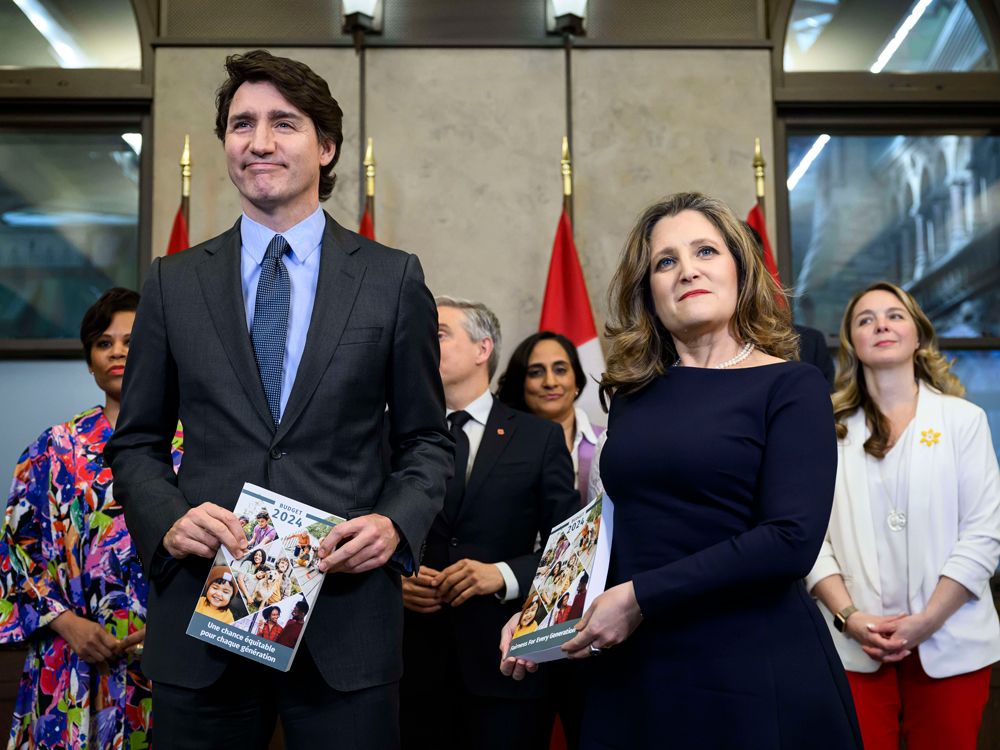

Canada's budget 2024 and what it means for the economy – Financial Post

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Economy

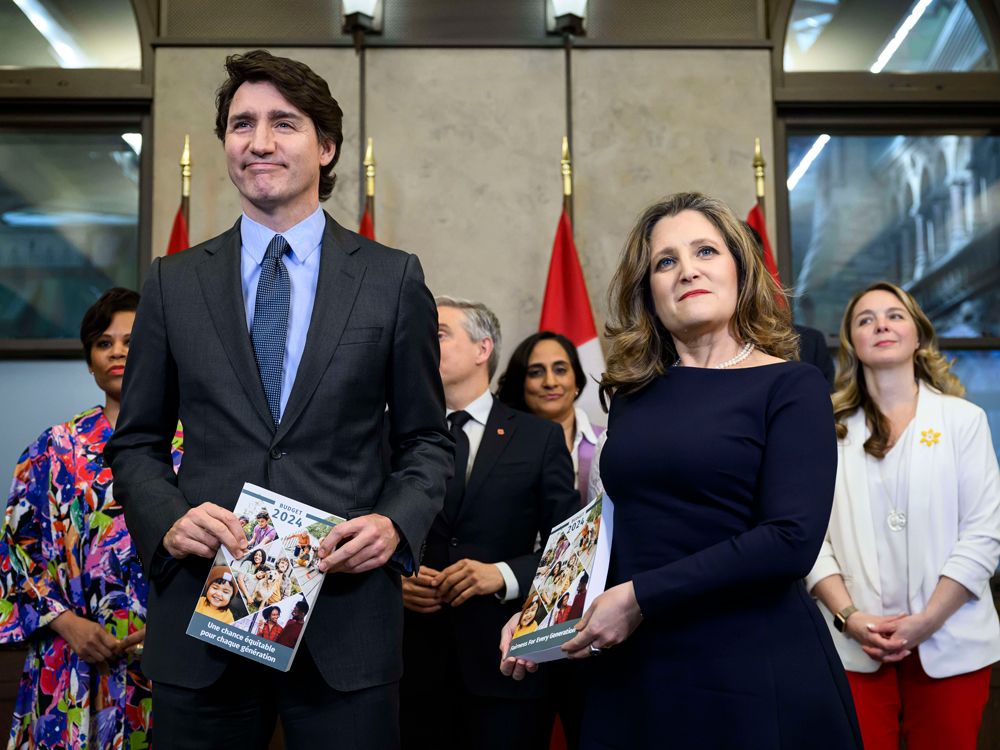

Opinion: Canada's economy has stagnated despite Trudeau government spin – Financial Post

Article content

Growth in gross domestic product (GDP), the total value of all goods and services produced in the economy annually, is one of the most frequently cited indicators of economic performance. To assess Canadian living standards and the current health of the economy, journalists, politicians and analysts often compare Canada’s GDP growth to growth in other countries or in Canada’s past. But GDP is misleading as a measure of living standards when population growth rates vary greatly across countries or over time.

Article content

Federal Finance Minister Chrystia Freeland recently boasted that Canada had experienced the “strongest economic growth in the G7” in 2022. In this she echoes then-prime minister Stephen Harper, who said in 2015 that Canada’s GDP growth was “head and shoulders above all our G7 partners over the long term.”

Article content

Unfortunately, such statements do more to obscure public understanding of Canada’s economic performance than enlighten it. Lately, our aggregate GDP growth has been driven primarily by population and labour force growth, not productivity improvements. It is not mainly the result of Canadians becoming better at producing goods and services and thus generating more real income for their families. Instead, it is a result of there simply being more people working. That increases the total amount of goods and services produced but doesn’t translate into increased living standards.

Let’s look at the numbers. From 2000 to 2023 Canada’s annual average growth in real (i.e., inflation-adjusted) GDP growth was the second highest in the G7 at 1.8 per cent, just behind the United States at 1.9 per cent. That sounds good — until you adjust for population. Then a completely different story emerges.

Article content

Over the same period, the growth rate of Canada’s real per person GDP (0.7 per cent) was meaningfully worse than the G7 average (1.0 per cent). The gap with the U.S. (1.2 per cent) was even larger. Only Italy performed worse than Canada.

Why the inversion of results from good to bad? Because Canada has had by far the fastest population growth rate in the G7, an average of 1.1 per cent per year — more than twice the 0.5 per cent experienced in the G7 as a whole. In aggregate, Canada’s population increased by 29.8 per cent during this period, compared to just 11.5 per cent in the entire G7.

Starting in 2016, sharply higher rates of immigration have led to a pronounced increase in Canada’s population growth. This increase has obscured historically weak economic growth per person over the same period. From 2015 to 2023, under the Trudeau government, real per person economic growth averaged just 0.3 per cent. That compares with 0.8 per cent annually under Brian Mulroney, 2.4 per cent under Jean Chrétien and 2.0 per cent under Paul Martin.

Recommended from Editorial

Canada is neither leading the G7 nor doing well in historical terms when it comes to economic growth measures that make simple adjustments for our rapidly growing population. In reality, we’ve become a growth laggard and our living standards have largely stagnated for the better part of a decade.

Ben Eisen, Milagros Palacios and Lawrence Schembri are analysts at the Fraser Institute.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Share this article in your social network

-

Sports22 hours ago

Sports22 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

News23 hours ago

Richard Chevolleau Short Film “Marvelous Marvin” Set to go to Camera

-

Business21 hours ago

Firefighters battle wildfire near Edson, Alta., after natural gas line rupture – CBC.ca

-

Tech14 hours ago

Tech14 hours agoiPhone 15 Pro Desperado Mafia model launched at over ₹6.5 lakh- All details about this luxury iPhone from Caviar – HT Tech

-

Investment23 hours ago

Investment23 hours agoStephen Poloz will lead push to boost domestic investment by Canadian pension funds

-

Sports14 hours ago

Sports14 hours agoLululemon unveils Canada's official Olympic kit for the Paris games – National Post

-

News24 hours ago

Federal budget 2024: Some of the winners and losers

-

Investment21 hours ago

Investment21 hours agoWall Street bosses cheer investment banking gains but stay cautious