Business

US stocks close well off day's lows while bonds climb – BNN

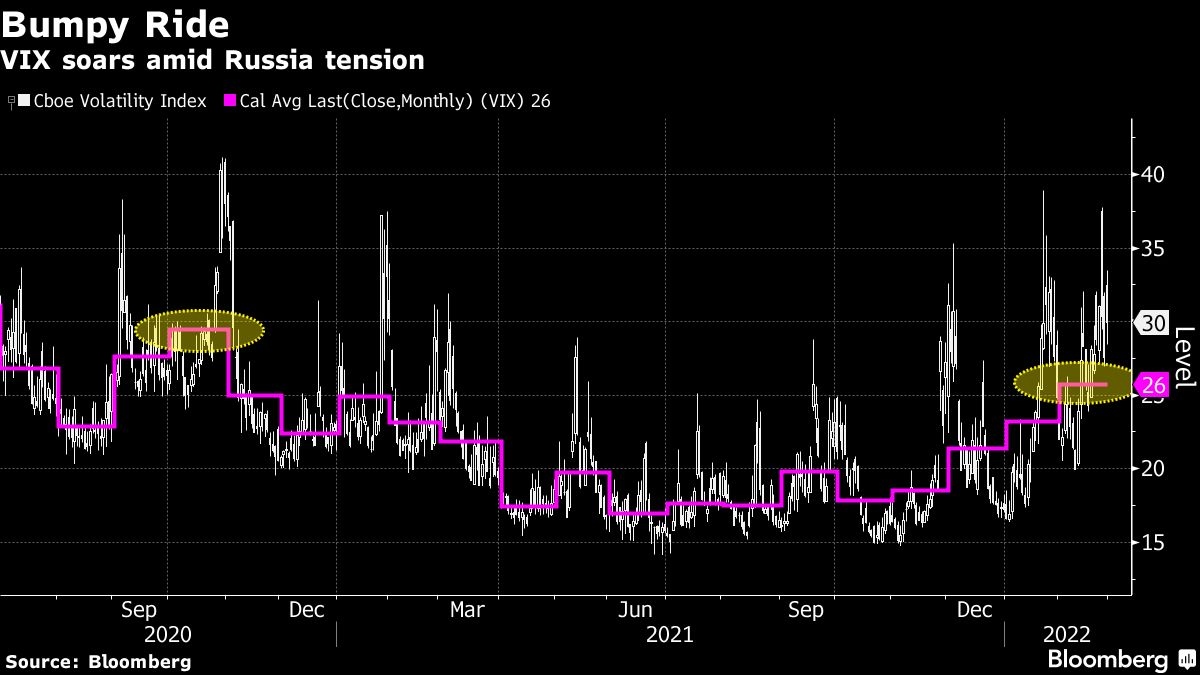

Stocks almost wiped out their losses, while bonds rose as traders assessed the latest developments after a wall of sanctions against Russia for the invasion of Ukraine.

The S&P 500 trimmed a drop that reached 1.6 per cent earlier in the day, while still notching its second month of declines — the longest losing streak since October 2020. The technology-heavy Nasdaq 100 finished higher on Monday. In late trading, Zoom Video Communications Inc. tumbled after the remote-conferencing giant projected sales that fell short of Wall Street’s estimates.

Treasuries jumped, driving two-year yields near where they were before a steeper-than-expected inflation report earlier this month. The Swiss franc staged its biggest gain against the euro since 2018, and gold held near the more than 13-month high hit last week. Oil pared its advance as the U.S. and its allies considered releasing about 60 million barrels of crude from emergency stockpiles to quell supply fears. Bitcoin rallied.

The mounting sanctions against Russia are increasing the risk for investors that the nation’s stocks and bonds could be kicked out of major global benchmarks, effectively cutting them off from a big segment of the investment-fund industry. MSCI Inc. said it is consulting with clients to understand the implications of those sanctions for markets and could move to kick the nation’s assets out of its key equity gauges. At the same time, Goldman Sachs Group Inc. warned of the risk of Russian debt being removed from a widely followed JPMorgan Chase & Co. index.

As Russia canceled trading of stocks in Moscow on Monday, London-listed shares of Russian companies cratered. Depositary receipts for lender Sberbank of Russia sank 74 per cent, the most on record, while retailer Magnit slid 80 per cent. Gas giant Gazprom dropped 53 per cent. Traders struggled to price the ruble, with the currency losing a third of its value in offshore trading at one point. Quotes were infrequent and volatile at the start of the session, with low liquidity making it difficult to match buyers and sellers.

Russia banned its residents from transferring hard currency abroad, as President Vladimir Putin sought countermeasures against countries imposing sanctions over the invasion of Ukraine. The drumbeat of penalties against Russia continued, as the European Union approved sanctions on some of Russia’s wealthiest tycoons, and Britain told ports not to service Russian-flagged vessels. The government in Kyiv reported that civilians were killed by shelling in the second-largest city Kharkiv as fighting intensified across the nation.

Comments:

- “The situation in Ukraine remains highly unpredictable with no simple off-ramp. Investors are advised to stretch their time horizon, as events in the region continue to create challenges in the near term,” said Robert Teeter, managing director of Silvercrest Asset Management.

- “This invasion simply adds another risk to the mix that’s unlikely to disappear quickly,” wrote Morgan Stanley strategists led by Mike Wilson, referring to the Russian invasion of Ukraine. “In a world where valuations remain elevated and earnings risk is rising, last week’s tactical rally in equities will likely run out of momentum in March as the Fed begins to tighten in earnest and the earnings picture deteriorates,”

- “We do not view this as a time to de-risk,” said Solita Marcelli, chief investment officer Americas at UBS Global Wealth Management. “Drawdowns based on geopolitical events have been brief: If we look at S&P 500 performance following key military conflicts since 1945, markets were usually down within the first week. But on 14 of the 18 occasions they were up within three months, with a median performance of around 2 per cent.”

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.3 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 0.3 per cent

- The Dow Jones Industrial Average fell 0.5 per cent

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.5 per cent to US$1.1212

- The British pound was little changed at US$1.3417

- The Japanese yen rose 0.5 per cent to 114.96 per dollar

Bonds

- The yield on 10-year Treasuries declined 13 basis points to 1.83 per cent

- Germany’s 10-year yield declined 10 basis points to 0.13 per cent

- Britain’s 10-year yield declined five basis points to 1.41 per cent

Commodities

- West Texas Intermediate crude rose 4.6 per cent to US$95.81 a barrel

- Gold futures rose 1.3 per cent to US$1,911.60 an ounce

Business

All Magic Spells (TM) : Top Converting Magic Spell eCommerce Store

Product Name: All Magic Spells (TM) : Top Converting Magic Spell eCommerce Store

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

All Magic Spells (TM) : Top Converting Magic Spell eCommerce Store is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Business

Turn Your Wife Into Your Personal Sex Kitten

Product Name: Turn Your Wife Into Your Personal Sex Kitten

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Turn Your Wife Into Your Personal Sex Kitten is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Business

CPC Practice Exam

Product Name: CPC Practice Exam

Click here to get CPC Practice Exam at discounted price while it’s still available…

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

CPC Practice Exam is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

-

News24 hours ago

Defying Convention to Deepen Connections: Booking.com’s 8 Travel Predictions for 2025

-

Sports11 hours ago

In The Rings: Curling Canada still looking for Canadian Curling Trials title sponsor

-

News10 hours ago

After hurricane, with no running water, residents organize to meet a basic need

-

Politics11 hours ago

N.B. election debate: Tory leader forced to defend record on gender policy, housing

-

News11 hours ago

Alberta government shifts continuing care from Health to Seniors Ministry

-

News11 hours ago

Buhai, Green and Shin lead in South Korea after 8-under 64s in first round

-

News11 hours ago

Manitoba government halts school building plan, says other methods will be found

-

News10 hours ago

‘Significant overreach’: Ontario municipalities slam province over bike lane rules