Income-seekers have many more investment options now that interest rates are higher. One they won’t want to overlook is MPLX (MPLX 0.64%). The master limited partnership (MPL) currently yields 8.8%. The energy midstream company’s monster payout is on an extremely firm foundation.

That was evident in its recently reported second-quarter results. Here’s why MPLX is such an attractive option for income-seekers these days.

A cash flow machine

MPLX generated more than $1.3 billion in distributable cash flow during the second quarter and almost $2.6 billion through the first half of the year (6% higher than the year-ago level). That’s free cash the MLP can use as it sees fit, including distributing it to investors.

The company currently pays a fixed quarterly distribution of $0.775 per unit ($3.10 annualized), an 8.8% yield at the recent unit price. The MLP paid $799 million in distributions during the second quarter. It produced enough cash to cover that payout by a very comfortable 1.7 times.

That high coverage ratio enabled MPLX to retain substantial cash, which it used to finance expansion projects while maintaining a strong balance sheet. It invested $203 million into growth capital projects during the second quarter. Meanwhile, the remaining funds strengthened its already solid balance sheet.

MPLX ended the second quarter with a 3.5 times leverage ratio, well below its 4.0 times target. It also had significant liquidity, including $755 million in cash, $2 billion available on its bank credit facility, and $1.5 billion available through an intercompany loan with its parent, refining giant Marathon Petroleum.

As MPLX’s financial metrics clearly show, its distribution is on a very firm foundation. It produces more cash than it needs to cover that payout and its growth capital projects. That enabled it to strengthen what’s becoming a fortress-like balance sheet.

More growth is coming down the pipeline

MPLX continues to invest money to expand its energy midstream operations. It’s currently advancing several projects across its logistics & storage (L&S) and gathering & processing (G&P) platforms.

In its L&S segment, MPLX is working with its joint venture partners to expand the Whistler pipeline and its Agua Dulce Corpus Christi (ADCC) pipeline lateral to increase the flow of natural gas out of the Permian Basin. The company also recently agreed to expand its BANGL natural gas liquids pipeline, which should enter service by the first half of 2025.

Meanwhile, its G&P segment is building several new natural gas processing plants in the Permian and Marcellus basins. It recently agreed to construct the Secretariat processing plant in the Permian, its seventh in the region, which should come online in the second half of 2025.

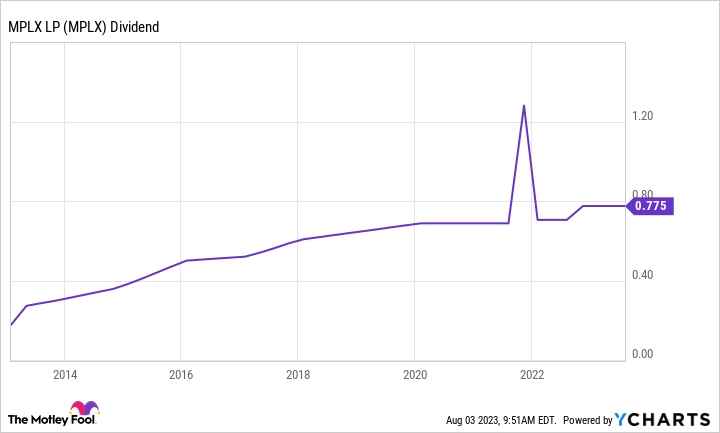

These and other projects will supply MPLX with incremental cash flow when they come online over the next few years. That will give it the fuel to continue growing its distribution. MPLX has steadily increased its payout since Marathon Petroleum formed the company more than a decade ago:

MPLX Dividend data by YCharts. (NOTE: MPLX made a special distribution payment in 2021 of $0.5750 per unit.)

The MLP most recently increased its distribution by 10% last November. The payout will likely continue rising. Driving that view is the 6% growth in distributable cash flow over the past year and the pipeline of expansion projects it will complete over the next couple of years.

An income-producing machine

MPLX has treated income-seeking investors very well over the years. The MLP has steadily increased its distribution, which seems likely to continue. It backs its current payout with rock-solid financial metrics, enabling it to keep expanding its operations and distribution. These features make its 8.8%-yielding payout a very attractive option for those seeking to generate sustainable investment income these days.