Economy

We aren’t restarting the economy. We’re climbing a mountain – The Globe and Mail

Mike Moffatt is an assistant professor at the Ivey Business School at Western University and senior director at the Smart Prosperity Institute. John McNally is a research associate at Smart Prosperity.

Canada has lost three million jobs since the beginning of the COVID-19 crisis, with most of those layoffs happening during the current lockdown. While there is optimism the economy will quickly bounce back once restrictions are lifted, there is a chance the worst is yet to come.

When dealing with the coronavirus, policy discussions have focused mostly on either weathering the short-term crisis or investing in the long-term recovery. However, the hardest problems that COVID-19 brings in the coming months will occur in the space between the two.

Governments have been calling this in-between phase “the restart.” That implies getting back to normal is like flipping a switch. It isn’t. Public-health restrictions will remain until we have an available vaccine. Businesses will have to adapt to a new normal, where growth and recovery are held back by the limits needed to prevent returning to lockdown. This process will swing between peaks and valleys, with steps backward and forward, taking several years.

Welcome to the climb: an extended period of ascents and descents before starting a recovery. No one knows how long this climb will last, or how slowly restrictions will lift. There are too many public-health variables. But we do know the economic impacts could be devastating. The trend line we will see in the next two years will look like a jagged mountain range. Policymakers need to start thinking today about what paths we will need to take to ensure this trek toward a recovery actually leads there.

The biggest risks during the climb will vary for each business. Large companies with problematically high debt levels will be more vulnerable. New debt on balance sheets will also make it harder to borrow and will dent credit ratings. That will slow investment and hiring. Those impacts will ripple through supply chains.

For small and medium-sized businesses, the threat is lower profits. Less money means less rehiring and, in relative terms, more expensive fixed costs. The lifting of restrictions also limits a business’ ability to claim losses against their insurance. If a business operating at 50-per-cent to 70-per-cent capacity – such as a restaurant – is forced to incur months of losses, it will have to close.

This will not stop the forces of creative destruction. E-commerce now makes up 27 per cent of total retail sales in the United States after sitting at 16 per cent only eight weeks ago. Consumers and markets are adapting fast. Some of these changes won’t be reversed when this is over. This will hit sectors such as commercial real estate, services and entertainment especially hard, deepening their pain.

This climb will also make predictions about everyone returning to work look too optimistic. One U.S. estimate notes four out of 10 jobs lost in the pandemic likely won’t return. Even if furloughed employees return immediately, earnings crunches during the climb will mean fewer staff hours are required, and companies will hire less or let people go. The newly unemployed may not have the skills needed to fill opportunities in growing sectors.

These forces show that the biggest danger in the climb is that balance sheets decay to the point of closure or default. If weeks turn to months or years, the losses will add up and begin to cascade throughout industries. This will, without further government action, create a hole so deep that the chance to invest in a better future once COVID-19 is over will disappear.

Governments need to start thinking now about how to prevent this. Job-creation programs, paid skills training for career changes, and issuing grants to companies may be expensive, but they are cheaper than a long-term depression. Policies will be needed to protect workers without stifling market forces. That will take the same creativity and decisiveness that governments have shown in supporting people through the lockdowns.

This short-term fight against the virus is over, but the trek toward normal is just beginning. If governments don’t act to ensure we come out the other side in good shape, we won’t have a chance at a better future. We need to prepare for the climb – it’s going to be rough.

Keep your Opinions sharp and informed. Get the Opinion newsletter. Sign up today.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Economy

IMF Sees OPEC+ Oil Output Lift From July in Saudi Economic Boost – BNN Bloomberg

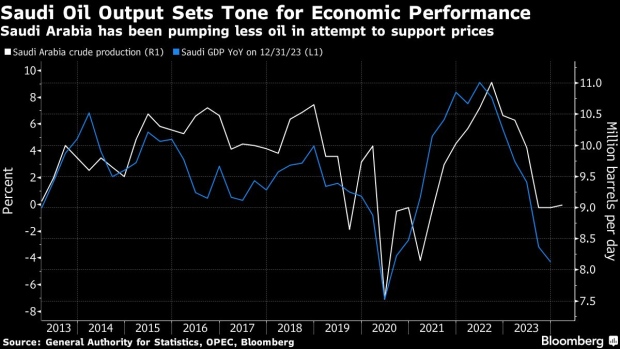

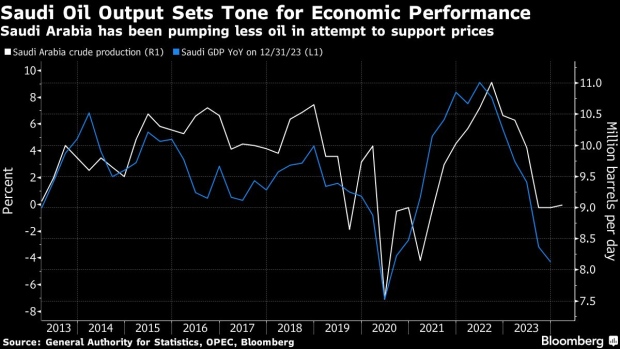

(Bloomberg) — The International Monetary Fund expects OPEC and its partners to start increasing oil output gradually from July, a transition that’s set to catapult Saudi Arabia back into the ranks of the world’s fastest-growing economies next year.

“We are assuming the full reversal of cuts is happening at the beginning of 2025,” Amine Mati, the lender’s mission chief to the kingdom, said in an interview in Washington, where the IMF and the World Bank are holding their spring meetings.

The view explains why the IMF is turning more upbeat on Saudi Arabia, whose economy contracted last year as it led the OPEC+ alliance alongside Russia in production cuts that squeezed supplies and pushed up crude prices. In 2022, record crude output propelled Saudi Arabia to the fastest expansion in the Group of 20.

Under the latest outlook unveiled this week, the IMF improved next year’s growth estimate for the world’s biggest crude exporter from 5.5% to 6% — second only to India among major economies in an upswing that would be among the kingdom’s fastest spurts over the past decade.

The fund projects Saudi oil output will reach 10 million barrels per day in early 2025, from what’s now a near three-year low of 9 million barrels. Saudi Arabia says its production capacity is around 12 million barrels a day and it’s rarely pumped as low as today’s levels in the past decade.

Mati said the IMF slightly lowered its forecast for Saudi economic growth this year to 2.6% from 2.7% based on actual figures for 2023 and the extension of production curbs to June. Bloomberg Economics predicts an expansion of 1.1% in 2024 and assumes the output cuts will stay until the end of this year.

Worsening hostilities in the Middle East provide the backdrop to a possible policy shift after oil prices topped $90 a barrel for the first time in months. The Organization of Petroleum Exporting Countries and its allies will gather on June 1 and some analysts expect the group may start to unwind the curbs.

After sacrificing sales volumes to support the oil market, Saudi Arabia may instead opt to pump more as it faces years of fiscal deficits and with crude prices still below what it needs to balance the budget.

Saudi Arabia is spending hundreds of billions of dollars to diversify an economy that still relies on oil and its close derivatives — petrochemicals and plastics — for more than 90% of its exports.

Restrictive US monetary policy won’t necessarily be a drag on Saudi Arabia, which usually moves in lockstep with the Federal Reserve to protect its currency peg to the dollar.

Mati sees a “negligible” impact from potentially slower interest-rate cuts by the Fed, given the structure of the Saudi banks’ balance sheets and the plentiful liquidity in the kingdom thanks to elevated oil prices.

The IMF also expects the “non-oil sector growth momentum to remain strong” for at least the next couple of years, Mati said, driven by the kingdom’s plans to develop industries from manufacturing to logistics.

The kingdom “has undertaken many transformative reforms and is doing a lot of the right actions in terms of the regulatory environment,” Mati said. “But I think it takes time for some of those reforms to materialize.”

©2024 Bloomberg L.P.

Economy

IMF Boss Says ‘All Eyes’ on US Amid Risks to Global Economy – BNN Bloomberg

(Bloomberg) — The head of the International Monetary Fund warned the US that the global economy is closely watching interest rates and industrial policies given the potential spillovers from the world’s biggest economy and reserve currency.

“All eyes are on the US,” Kristalina Georgieva said in an interview on Bloomberg’s Surveillance on Thursday.

The two biggest issues, she said, are “what is going to happen with inflation and interest rates” and “how is the US going to navigate this world of more intrusive government policies.”

The sustained strength of the US dollar is “concerning” for other currencies, particularly the lack of clarity on how long that may last.

“That’s what I hear from countries,” said the leader of the fund, which has about 190 members. “How long will the Fed be stuck with higher interest rates?”

Georgieva was speaking on the sidelines of the IMF and World Bank’s spring meetings in Washington, where policymakers have been debating the impacts of Washington and Beijing’s policies and their geopolitical rivalry.

Read More: A Resilient Global Economy Masks Growing Debt and Inequality

Georgieva said the IMF is optimistic that the conditions will be right for the Federal Reserve to start cutting rates this year.

“The Fed is not yet prepared, and rightly so, to cut,” she said. “How fast? I don’t think we should gear up for a rapid decline in interest rates.”

The IMF chief also repeated her concerns about China devoting too much capital and labor toward export-oriented manufacturing, causing other countries, including the US, to retaliate with protectionist policies.

China Overcapacity

“If China builds overcapacity and pushes exports that create reciprocity of action, then we are in a world of more fragmentation not less, and that ultimately is not good for China,” Georgieva said.

“What I want to see China doing is get serious about reforms, get serious about demand and consumption,” she added.

A number of countries have recently criticized China for what they see as excessive state subsidies for manufacturers, particularly in clean energy sectors, that might flood global markets with cheap goods and threaten competing firms.

US Treasury Secretary Janet Yellen hammered at the theme during a recent trip to China, repeatedly calling on Beijing to shift its economic policy toward stimulating domestic demand.

Chinese officials have acknowledged the risk of overcapacity in some areas, but have largely portrayed the criticism as overblown and hypocritical, coming from countries that are also ramping up clean energy subsidies.

(Updates with additional Georgieva comments from eighth paragraph.)

©2024 Bloomberg L.P.

-

Investment22 hours ago

Investment22 hours agoUK Mulls New Curbs on Outbound Investment Over Security Risks – BNN Bloomberg

-

Media1 hour ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Sports21 hours ago

Sports21 hours agoAuston Matthews denied 70th goal as depleted Leafs lose last regular-season game – Toronto Sun

-

Business19 hours ago

BC short-term rental rules take effect May 1 – CityNews Vancouver

-

Media3 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Art19 hours ago

Collection of First Nations art stolen from Gordon Head home – Times Colonist

-

Investment19 hours ago

Investment19 hours agoBenjamin Bergen: Why would anyone invest in Canada now? – National Post

-

Tech22 hours ago

Tech22 hours agoSave $700 Off This 4K Projector at Amazon While You Still Can – CNET