Google has announced new features in its Maps app designed to help electric car drivers find a charge.

Tech

What the major record companies really think about the economics of music streaming – Music Business Worldwide

Senior executives from Spotify” href=”https://www.musicbusinessworldwide.com/companies/spotify/”>Spotify, Apple” href=”https://www.musicbusinessworldwide.com/companies/apple/”>Apple and Amazon” href=”https://www.musicbusinessworldwide.com/companies/amazon/”>Amazon were grilled live on camera by British politicians today in the final session of a UK Parliamentary inquiry into the economics of music streaming.

Yet just as this final act of the Parliamentary Committee’s investigation played out (with some of the panto-drama we’ve now come to expect), something arguably even more consequential was happening in an unloved corner of the internet.

In recent weeks, the UK arms of the major record companies – Universal Music UK” href=”https://www.musicbusinessworldwide.com/companies/universal-music-group/universal-music-uk/”>Universal Music UK, Sony Music UK” href=”https://www.musicbusinessworldwide.com/companies/sony/sony-music-group/sony-music-entertainment/sony-music-uk/”>Sony Music UK, and Warner Music UK” href=”https://www.musicbusinessworldwide.com/companies/access-industries/warner-music-group/warner-music-uk/”>Warner Music UK – have filed written submissions with this Parliamentary Committee, setting out their views on a number of streaming’s most fiercely-debated talking points.

Each of these submissions was published online today (February 23). And each replied to specific set of questions delivered by UK politicians to the majors – just as similar submissions from the likes of BMG, Hipgnosis Songs Fund, and Beggars Group did previously.

MBW has rifled through each of Universal, Sony” href=”https://www.musicbusinessworldwide.com/companies/sony/”>Sony, and Warner’s submissions to see what we could discover.

This is what we learned, in three parts…

1) User-centric licensing

In the written submissions, the Parliamentary Committee asks the majors: ‘Can you clarify whether your companies support user-centric payment systems, and if not, what alternative payment systems were being alluded to?’

Here are the responses….

“The issue of fair compensation for all music creators is essential to our mutual success, so we take the discussion around streaming’s payment model very seriously.

“We welcome any proposal that maximizes fairness and transparency and supports market growth.”

“Music’s rapid change offers the opportunity to optimise models for sustainable and mutually beneficial success, if approached properly. We are committed to getting it right.

“We welcome any proposal that maximizes fairness and transparency and supports market growth.”

“We are agnostic as to whether a user centric model is employed as it is not meant to change the pool of money available to the labels/artists. We feel that whether a user centric model is used is ultimately a matter for the DSPs (who will have to invest significant sums in changing royalty reporting systems) and the artist community (as some artists will win from a changing model and some will lose).

“It is extremely important to understand that a shift in reporting methodology will not increase the amount of money artists are paid in the aggregate.”

“However, due to the practical implications of such change for various stakeholders, we think it would require thorough and concerted impact assessments in order to establish an industry-wide support. It is extremely important to understand that a shift in reporting methodology will not increase the amount of money artists are paid in the aggregate.

“It will just shift money from some artists to other artists. Artists who lose in this scenario are not likely to see this as a more equitable way of dividing payments and thus we believe it is extremely important that the entire artist community weigh in on this shift before it is considered.”

Warner Music UK

“We have explored the concept of a user-centric model and have frequent conversations with digital services about it. It is always our goal to ensure that any business model implemented is reliable, fair, transparent, and underpinned by accurate data for artists and rightsholders.

“A user-centric model would not change the overall royalty pool and our analysis suggests that any changes in the allocation of payments to artists would not be significant.”

“A user-centric model would not change the overall royalty pool and our analysis suggests that any changes in the allocation of payments to artists would not be significant.

“A user-centric model would be far more complex and administratively burdensome for digital services to implement as it would require a tremendous amount of data – it is likely that digital services would want to pass off some of the associated costs to rightsholders and therefore to artists.”

2) Major label shareholdings in Spotify

The Committee asked the three major record companies to explain what they would say to those “who are concerned that the various shareholding arrangements between Spotify, your companies and your parent companies might lead to anti-competitive influences, such as when it comes to licensing, playlisting, etc?”

Remember: Warner Music Group” href=”https://www.musicbusinessworldwide.com/companies/access-industries/warner-music-group/”>Warner Music Group sold all of its shares in Spotify for just over half a billion dollars back in 2018, while Sony sold 50% of its Spotify shares for $768m that same year.

Universal continues to own the entire stake it bought in 2008, which is estimated to currently be valued at over $2 billion, and perhaps even over $3 billion.

Universal Music UK

“Like other music companies, we do hold some financial equity in Spotify. Our shares are not voting shares.

“As we have said previously, and consistent with our approach to artists’ compensation, if we should sell those shares in the future, we have voluntarily committed to share those proceeds with artists.”

“We do not play a role in the company’s governance; we do not hold any board seats and our financial equity confers absolutely no influence over Spotify’s licensing, playlisting or any other of Spotify’s strategic and operational decisions.

“As we have said previously, and consistent with our approach to artists’ compensation, if we should sell those shares in the future, we have voluntarily committed to share those proceeds with artists.”

Sony Music UK

“Our shareholding in Spotify is nominal (it is less than 3%) and we have absolutely no control over the business organisation and/or running of Spotify and do not have a place on its Board.

“We have to date shared more than $250m from the proceeds of our sale of Spotify shares directly with artists and distributed labels, disregarding whether their accounts may be recouped or unrecouped.”

“The quality and the popularity of our catalogue, the hard work of our artists and teams, and our continuous investment in creative and business capabilities help us in our often long and difficult negotiations with services like Spotify, where we are focused on obtaining maximum value for the use of our recordings, while at the same time building sustainable models to secure a healthy longterm business. We believe that succeeding on both these fronts is critical for us to remain competitive and attract talent.

“Finally, it is worth noting that the investments we made in Spotify have also yielded significant dividends for our artists and distributed independent labels – we have to date shared more than $250m from the proceeds of our sale of Spotify shares directly with artists and distributed labels, disregarding whether their accounts may be recouped or unrecouped.

“We have equity in other DSPs as well and will share proceeds from equity holdings we have obtained in relation to licensing activities in a similar manner to Spotify if we ever have a positive cash event.”

Warner Music UK

“WMG does not currently have an equity stake in Spotify nor does Spotify have an equity stake in WMG. There is no conflict of interest or anti-competitive influence.

“WMG does not currently have an equity stake in Spotify nor does Spotify have an equity stake in WMG. There is no conflict of interest or anti-competitive influence.”

“We did acquire an equity stake in Spotify in 2008 which we sold in 2018. We shared the proceeds of that sale with our artists as if it were revenue from our licence agreement with Spotify.

“When we held an equity stake in Spotify it had no influence on our behaviour and it did not appear to have any influence on Spotify’s behaviour.”

3) Streaming as a ‘sale’ vs. a ‘rental’

The Parliamentary committee asks the labels to explain in writing “precisely why streaming should be classified as ‘making available’” – i.e covered by the making available right. The point the committee is getting at is whether a stream should count as a “sale” or a “rental”.

The distinction here is important. The license for a “sale” – as a stream is currently defined in the UK – is negotiated directly between the DSPs and labels.

Defining a stream as a “rental” would make a stream more akin to a broadcast, for example music played on the radio or TV. The licensing for that is administered in the UK by collection society PPL” href=”https://www.musicbusinessworldwide.com/companies/ppl/”>PPL (the British equivalent of SoundExchange). Advocates for Equitable Remuneration argue that a similar blanket license for streaming ( i.e having royalties collected and distributed by PPL) would be fairer for artists.

Here’s what the majors had to say:

Universal Music UK

“On streaming services, a sound recording is made available to the consumer electronically in a way that they can choose which track to listen to, when to start listening to it, whether to listen to the whole song, skip it, pause it, rewind it, or save it and re-listen to it.

“Even streaming services that restrict the functionality on certain devices for advertising funded users (e.g. a Spotify user on mobile), allow users to listen with unrestricted functionality on other devices (e.g. PC, TV etc).

“The reason for introducing the exclusive making available right at the international level in the first place was to ensure that rights holders can authorise online uses that have the same commercial effect as the distribution of copies in the off-line world.”

“International Agreements (notably the WIPO Performances and Phonograms Treaty, WPPT) to which the UK is party, and international copyright law, provide an express and clear legal obligation for countries to guarantee that rights holders and performers can authorise or prohibit this type of electronic transmission.

“In fact the reason for introducing the exclusive making available right at the international level in the first place was to ensure that rights holders can authorise online uses that have the same commercial effect as the distribution of copies in the off-line world.”

Sony Music Uk

“In the streaming world you can access any song on that service at the time and place of your choosing and you can skip, pause or cancel any stream you receive. Accordingly, streaming clearly falls within the legal definition of the making available right.

“Broadcasts do not afford any interactivity to the end user because the user cannot influence the transmission of the music which can be listened to at a given time; he or she can only choose to turn off the station if the piece broadcast is not to his or her liking.

“If streaming was treated as broadcast and artists received direct a material share of the fees payable, the balance payable to the label would not be sufficient to maintain investment in new signing, A&R and marketing.”

“If streaming was treated as broadcast and artists received direct a material share of the fees payable, the balance payable to the label would not be sufficient to maintain investment in new signing, A&R and marketing and so would materially reduce the opportunity to mitigate its risk on the majority of signings which do not succeed and in respect of which we are unable to break even.”

Warner Music UK

“Because of its interactive nature, streaming clearly falls within the definition of the ‘making available’ right. From the perspective of the user’s experience, the making available right is essentially the internet age form of what was previously a sale.

“Because of its interactive nature, streaming clearly falls within the definition of the ‘making available’ right.”

“An individual listener can choose what to play, when to play it, skip forward or replay, create their own curated playlists, indicate whether they like a particular track (which in turn informs algorithmically generated playlists based on the listener’s listening history), and retrieve album or artist information and credits on demand.

“Most premium streaming services allow their users to download tracks to their own devices to listen while not connected to the internet. None of these interactions are possible via broadcast where every listener hears the same track at the same time with no possibility for individual selection of or interaction with the content.”

“Commercially, streaming is substitutable for and has largely replaced physical goods and downloads. Listeners today prefer to access music through streaming rather than through physical CDs.”Music Business Worldwide

Tech

Aaron Sluchinski adds Kyle Doering to lineup for next season – The Grand Slam of Curling

Aaron Sluchinski’s team announced Wednesday on social media that Kyle Doering has joined the club for next season.

Sluchinski was searching for a new player after second Kerr Drummond stepped back from competitive curling late last month. The Airdrie, Alta., team also includes third Jeremy Harty and lead Dylan Webster.

Sluchinski had a breakout season, winning the Boston Pizza Cup to represent Alberta at the Montana’s Brier for the first time and also competed in three Grand Slam of Curling events. The team finished 16th in the world rankings and seventh among Canadian clubs.

Doering has spent the past two years playing with Edmonton’s Karsten Sturmay and was also on the lookout for a new squad after his skip announced his departure from competitive curling.

Winnipegger Doering earned a silver medal at the world men’s curling championship earlier this month as the alternate on Team Canada, skipped by Brad Gushue.

Doering captured the Canadian junior title and a world junior bronze medal in 2016 playing with skip Matt Dunstone.

The Canadian men’s curling landscape has seen several shifts in recent days. Brendan Bottcher’s teammates announced Tuesday they were looking for a new skip and Reid Carruthers’ team revealed Wednesday it has parted ways with skip Brad Jacobs.

Skip Glenn Howard also announced his retirement Tuesday.

Meanwhile, skip John Epping unveiled his new team last week, featuring third Tanner Horgan, second Jacob Horgan and lead Ian McMillan.

Tech

New EV features for Google Maps have arrived. Here’s how to use them. – The Washington Post

The updates include a tool to help drivers find nearby chargers with real-time information about availability and charging speed, the ability to find charging stops on longer road trips and more detailed instructions about how to find chargers within parking lots and garages.

Google expects to start rolling out these features “in the coming months,” according to a blog post. Some will come first to people who drive a car that comes with “Google Built-in,” the company’s driver-assistance software. Google updated its other route-finding app, Waze, with information on EV chargers last month.

The update addresses one of Americans’ top concerns about owning an electric vehicle: finding a place to charge. Range anxiety remains a significant barrier for EV sales — especially for drivers who don’t own a house. Among people who don’t drive an EV, roughly half say they think finding a place to charge would be “extremely” or “very” difficult, according to a 2023 Washington Post-University of Maryland poll.

EVs make up roughly 7 percent of new U.S. car sales, which some experts believe is a tipping point at which electric cars will quickly become popular and take over the market. But lately, the EV market appears to be cooling off. Sales slowed in the first quarter of this year.

In addition to building more charging stations, companies can make driving an EV easier by building apps that help drivers find chargers, said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive. “That could be really helpful with mitigating some of those concerns about charging anxiety,” she said.

Find available EV charging stations

For electric-car drivers who need a last-minute charge, Google is developing a feature that can find nearby chargers with updated information about how many ports are available and their charging speed. The company says this feature will eventually be available to all drivers but will be available first for drivers with Google Built-in.

Plan a road trip with EV charging stops

The Maps update will allow EV owners with Google Built-in to plan where they can power up when taking long trips with multiple stops, such as a cross-country road trip. The feature will access information about your car’s battery life to suggest the best places to charge up.

The company also announced a search feature that allows travelers to look for hotels with electric car chargers.

Locate hard-to-find EV charging stations

Some EV chargers are tucked in hard-to-find corners of parking garages. The Maps update will crowdsource information from Google reviewers to generate more detailed instructions about how to get to a charger. According to the company’s blog post, the instructions might read something like, “Enter the underground parking lot and follow the signs toward the exit. Just before exiting, turn right.”

Tech

Cytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

The Xcellerex magnetic mixer, single-use mixing system was designed to address challenges in large-scale mAb, vaccine, and genomic medicine manufacturing processes.

Cytiva unveiled the Xcellerex single-use magnetic mixer at INTERPHEX 2024 in New York City on April 16, 2024. The single-use mixing system was designed to combat challenges in large-scale monoclonal antibody (mAb), vaccine, and genomic medicine manufacturing processes. The mixer is offered in 2000 L and 3000 L capacities and can be configured in several ways to accommodate diverse mixing processes. Its compact size benefits facilities with space constraints or complicated installation of large-scale consumables.

According to the company, minor leaks may cause significant delays and losses. “When dealing with a 3000 L batch of cell culture media, the estimated financial loss can cost between $60k to upwards of $100k” (1). The system helps prevent expensive leaks with a novel mixer biocontainer that incorporates user-centered design elements to improve durability and ease of use. The design provides enhanced safeguards and added protection from leaks that may occur during shipping, storage, and operation.

Time taken to mix batches can inhibit product development times, specifically the challenge of mixing floating powders such as cell culture media. Current systems have underpowered impellers with circular or cubical shapes that make producing large volumes challenging, according to Cytiva. This new single-use system “has a powerful impeller that when combined with the mixer’s hexagonal shape creates a vortex, enhancing the interaction at the liquid surface. This vortex effectively pulls down the floating powders into the main body of the liquid to allow for a more efficient and shorter mixing process,” the company stated in a press release.

“We’re tapping into our differentiated portfolio to solve a wide range of challenges for our customers. Our new magnetic mixing system is flexible and capable of meeting the many demands and constraints during buffer and cell culture media preparation,” said Amanda Halford, president, Bioprocess at Cytiva in the release. “By reimagining the design, we’ve tackled some of the biggest obstacles to downtime.”

Advertisement

Cytiva is also working to advance messenger RNA (mRNA) manufacturing. In an interview with Pharmaceutical Technology EuropeTM , Scott Ripley, general manager, Nucleic Acid Therapeutics and Precision Nanosystems at Cytiva, discussed technology that enables the “democratization” of mRNA manufacturing (2). Many mRNA therapies and other types of genetic medicines in clinical development are designed to be delivered with the help of lipid nanoparticles. One such platform is Cytiva’s Precision Nanosystems NanoAssemblr microfluidic-based nanoparticle manufacturing platform, which enables the development of genetic medicines with potentially increased stability, efficacy, yield, and quality of non-viral genetic medicines, according to Ripley.

Ripley was enthusiastic about this platform’s ability to “democratize” the good manufacturing practice (GMP) manufacturing aspects for advanced therapies, while managing to cope with the increased molecular diversity of the molecules being handled.

“For example,” Ripley says, “the mRNA platform is unique in that, on one end of the spectrum, it is vaccinating the planet, on the other end, it’s personalized cancer vaccines.”

Reference

1. Cytiva. Cytiva Unveils Latest Innovation for Large Scale Mab, Vaccine, and Advanced Therapy Manufacturing Processes–The Xcellerex Compact Single-Use Magnetic Mixing System. Press Release. April 16, 2024.

2. Spivey, C. Democratizing GMP Manufacturing for the New Therapeutic Pipeline. PharmTech.com. Nov. 21, 2023.

-

Tech22 hours ago

Tech22 hours agoiPhone 15 Pro Desperado Mafia model launched at over ₹6.5 lakh- All details about this luxury iPhone from Caviar – HT Tech

-

Sports22 hours ago

Sports22 hours agoLululemon unveils Canada's official Olympic kit for the Paris games – National Post

-

News20 hours ago

Toronto airport gold heist: Police announce nine arrests – CP24

-

Investment16 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum

-

News17 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Tech20 hours ago

Tech20 hours agoVenerable Video App Plex Emerges As FAST Favorite – Forbes

-

Sports19 hours ago

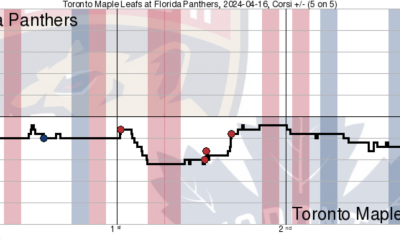

Sports19 hours agoGame in 10: Maple Leafs squander multi-goal lead to Florida, draw the Boston Bruins in the first round – Maple Leafs Hot Stove

-

Art16 hours ago

Squatters at Gordon Ramsay's Pub Have 'Left the Building' After Turning It Into an Art Café – PEOPLE