Economy

Where to Look for Signs Financial Turmoil Is Impacting the US Economy

|

|

(Bloomberg) — The key to if — or when — the US economy falls into recession will depend on how the latest turmoil in the banking sector spills over to Main Street.

Less lending and tighter loan standards would make it tougher for people to buy cars and homes, and harder for businesses to expand and invest. Elevated concerns about the banking system and heightened odds of a recession also risk turning households more cautious about spending and businesses wary of beefing up payrolls or pursuing capital investments.

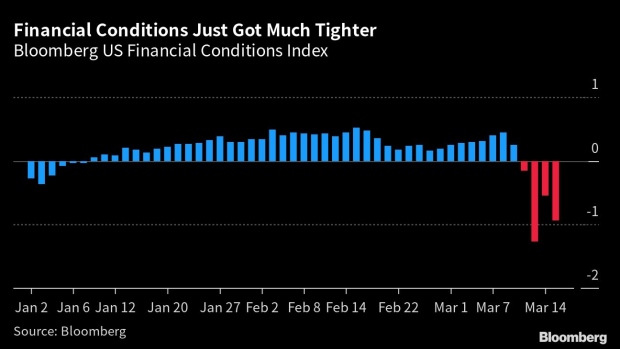

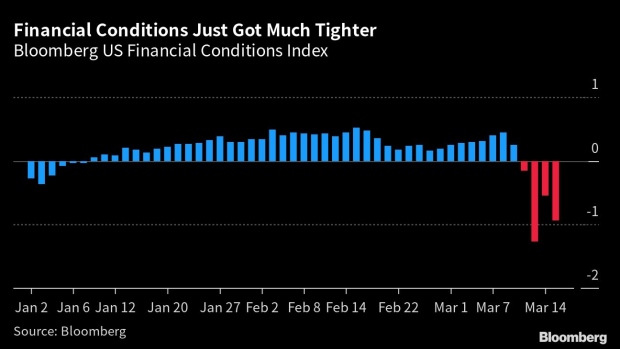

The economy was already showing some cracks from the Federal Reserve’s steep interest-rate hikes to stave off inflation. The failure of three US banks followed by a crisis of confidence in Credit Suisse Group AG spooked investors on concerns about the stability of the financial sector.

With conditions changing by the hour, traditional economic data points — typically released monthly or quarterly with a lag — prove less helpful.

Following are some places to look to gauge the economic fallout from the tumult in the banking sector. It should be noted, though, that some of these indicators have already retreated in recent months which will make deciphering the impact even more challenging:

Bank Lending

Each Friday around 4:15 p.m. in Washington the Fed releases a slew of information on assets and liabilities at the nation’s commercial banks. Statistics on consumer, real estate and commercial loans are all included, as well as broken out into broader categories based on bank size.

The report, known as the H.8, will be closely watched by economists and investors for insight into lending patterns and deposits at both regional banks and the nation’s biggest banks.

The Senior Loan Officer Opinion Survey on Bank Lending Practices is a quarterly survey of up to 80 large domestic banks and 24 US branches of foreign banks that also offers insight into lending standards as well as demand for and loans to businesses and households.

While not a high-frequency measure, the next report will be released in April — an opportune insight in the wake of the turbulence seen in March. Indications of a tightening of bank lending standards may raise concerns about the economy’s prospects.

Consumer Confidence

Consumer confidence is fickle and fragile, and while certainly not perfect, it can at times help signal changes in personal spending.

Early indications are that the upheaval in the banking sector is having an impact. A measure by Penta and CivicScience showed confidence in the US economy fell by the most since June in the two weeks ended March 14.

Results of the University of Michigan’s March survey of consumers, set for release later on Friday, was conducted Feb. 22-March 15 and will likely reflect some impact from the latest market turmoil. The final index, out March 31, will offer a clearer picture of consumers’ initial reaction to the bank failures. The data are released twice a month.

The Conference Board has a similar measure, which is due on March 28.

Credit Card Spending

A key way to assess whether Americans are pulling back on spending is through credit card data.

The Bureau of Economic Analysis estimates spending on a variety of services and merchandise using daily payment card data. Unlike personal spending data that’s released monthly and with a significant lag, BEA generally updates this data weekly.

Several private sources also regularly provide insights into consumer spending patterns, including Bank of America Corp. and Visa Inc.

Business Sentiment

The Census Bureau’s Business Trends and Outlook Survey offers one way to get timely insight into firms across the economy. The survey is sent out to roughly 200,000 businesses every two weeks and includes figures on performance, revenue, employees and hours worked. The next release will include the two weeks ending March 26.

The National Federation of Independent Business, a small-business association, regularly polls its members on questions like hiring plans, capital expenditures, and ease of getting a loan. The NFIB released their latest results earlier this week, so the next reading won’t come for about another month. Reports come out on the second Tuesday of each month.

Household Behavior

The Household Pulse Survey, an experimental Census Bureau survey started in the depths of the pandemic, has become a key source of timely information on topics ranging from employment status to food sufficiency and methods used to meet spending needs. The data are collected in two-week intervals of two-weeks on, two-weeks off.

OpenTable, a booking platform for reservations at restaurants, has daily data on reservations at the national level as well as across a variety of US cities. While it can be volatile, a sustained downturn in reservations could point to Americans pulling back on discretionary spending.

Job Availability

Businesses tend to slow and ultimately freeze hiring when demand wanes in order to limit job cuts. While government data on vacancies is published with a significant lag, many job-search websites offer much more up-to-date figures on the status of labor demand.

Indeed offers a near real-time look at job postings on their site by country, state, city and sector. Vacancies in many sectors were already on the decline before the events of the last week.

Reductions in temporary staffing can also be an indicator of business concerns about the future. The final step is larger layoffs, something that can often be seen in WARN notices — or an advance notice of plant closings and mass layoffs — before government metrics.

–With assistance from Alex Tanzi, Augusta Saraiva and Ben Holland.

Economy

China Wants Everyone to Trade In Their Old Cars, Fridges to Help Save Its Economy – Bloomberg

China’s world-beating electric vehicle industry, at the heart of growing trade tensions with the US and Europe, is set to receive a big boost from the government’s latest effort to accelerate growth.

That’s one takeaway from what Beijing has revealed about its plan for incentives that will encourage Chinese businesses and households to adopt cleaner technologies. It’s widely expected to be one of this year’s main stimulus programs, though question-marks remain — including how much the government will spend.

Economy

German Business Outlook Hits One-Year High as Economy Heals – BNN Bloomberg

(Bloomberg) — German business sentiment improved to its highest level in a year — reinforcing recent signs that Europe’s largest economy is exiting two years of struggles.

An expectations gauge by the Ifo institute rose to 89.9. in April from a revised 87.7 the previous month. That exceeds the 88.9 median forecast in a Bloomberg survey. A measure of current conditions also advanced.

“Sentiment has improved at companies in Germany,” Ifo President Clemens Fuest said. “Companies were more satisfied with their current business. Their expectations also brightened. The economy is stabilizing, especially thanks to service providers.”

A stronger global economy and the prospect of looser monetary policy in the euro zone are helping drag Germany out of the malaise that set in following Russia’s attack on Ukraine. European Central Bank President Christine Lagarde said last week that the country may have “turned the corner,” while Chancellor Olaf Scholz has also expressed optimism, citing record employment and retreating inflation.

There’s been a particular shift in the data in recent weeks, with the Bundesbank now estimating that output rose in the first quarter, having only a month ago foreseen a contraction that would have ushered in a first recession since the pandemic.

Even so, the start of the year “didn’t go great,” according to Fuest.

“What we’re seeing at the moment confirms the forecasts, which are saying that growth will be weak in Germany, but at least it won’t be negative,” he told Bloomberg Television. “So this is the stabilization we expected. It’s not a complete recovery. But at least it’s a start.”

Monthly purchasing managers’ surveys for April brought more cheer this week as Germany returned to expansion for the first time since June 2023. Weak spots remain, however — notably in industry, which is still mired in a slump that’s being offset by a surge in services activity.

“We see an improving worldwide economy,” Fuest said. “But this doesn’t seem to reach German manufacturing, which is puzzling in a way.”

Germany, which was the only Group of Seven economy to shrink last year and has been weighing on the wider region, helped private-sector output in the 20-nation euro area strengthen this month, S&P Global said.

–With assistance from Joel Rinneby, Kristian Siedenburg and Francine Lacqua.

(Updates with more comments from Fuest starting in sixth paragraph.)

©2024 Bloomberg L.P.

Economy

Parallel economy: How Russia is defying the West’s boycott

|

|

When Moscow resident Zoya, 62, was planning a trip to Italy to visit her daughter last August, she saw the perfect opportunity to buy the Apple Watch she had long dreamed of owning.

Officially, Apple does not sell its products in Russia.

The California-based tech giant was one of the first companies to announce it would exit the country in response to Russian President Vladimir Putin’s full-scale invasion of Ukraine on February 24, 2022.

But the week before her trip, Zoya made a surprise discovery while browsing Yandex.Market, one of several Russian answers to Amazon, where she regularly shops.

Not only was the Apple Watch available for sale on the website, it was cheaper than in Italy.

Zoya bought the watch without a moment’s delay.

The serial code on the watch that was delivered to her home confirmed that it was manufactured by Apple in 2022 and intended for sale in the United States.

“In the store, they explained to me that these are genuine Apple products entering Russia through parallel imports,” Zoya, who asked to be only referred to by her first name, told Al Jazeera.

“I thought it was much easier to buy online than searching for a store in an unfamiliar country.”

Nearly 1,400 companies, including many of the most internationally recognisable brands, have since February 2022 announced that they would cease or dial back their operations in Russia in protest of Moscow’s military aggression against Ukraine.

But two years after the invasion, many of these companies’ products are still widely sold in Russia, in many cases in violation of Western-led sanctions, a months-long investigation by Al Jazeera has found.

Aided by the Russian government’s legalisation of parallel imports, Russian businesses have established a network of alternative supply chains to import restricted goods through third countries.

The companies that make the products have been either unwilling or unable to clamp down on these unofficial distribution networks.

-

Health10 hours ago

Health10 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Art16 hours ago

Mayor's youth advisory council seeks submissions for art gala – SooToday

-

Science24 hours ago

Science24 hours ago"Hi, It's Me": NASA's Voyager 1 Phones Home From 15 Billion Miles Away – NDTV

-

Health14 hours ago

Health14 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

News22 hours ago

Some Canadians will be digging out of 25+ cm of snow by Friday – The Weather Network

-

Media21 hours ago

Jon Stewart Slams the Media for Coverage of Trump Trial – The New York Times

-

Investment15 hours ago

Investment15 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

News15 hours ago

Peel police chief met Sri Lankan officer a court says ‘participated’ in torture – Global News