News

Why COVID-19 cases are surging across Canada and what needs to be done – CBC.ca

This is an excerpt from Second Opinion, a weekly roundup of health and medical science news emailed to subscribers every Saturday morning. If you haven’t subscribed yet, you can do that by clicking here.

Six weeks ago, Prime Minister Justin Trudeau said the country was at a “crossroads” in the COVID-19 pandemic.

Now, with cases spiking in regions that were practically untouched by the virus in the first wave, it appears we’ve taken a wrong turn.

There have been more than 100,000 new cases of COVID-19 and over 1,000 more deaths in this country since Trudeau made those comments.

The percentage of COVID-19 tests across the country that have come back positive has also grown by more than 235 per cent — from 1.4 per cent in mid-September to 4.7 per cent in the past week.

So where did Canada go wrong?

Experts say a mix of insufficient public health measures and complacency brought us to where we are today and we need to act quickly to turn things around — or at the very least prevent them from getting worse.

Canada ‘failed’ to follow lessons

South Korea taught us that by building up a robust test, trace and isolate system, it’s possible to control the spread of the coronavirus without subjecting your population to a lockdowns at all.

New Zealand locked down quickly, then shifted to a South Korean model focused on building up testing, tracing and isolating cases.

But Australia learned the hard way in the second wave that, if you let the coronavirus spread unchecked for too long, tough action is needed to keep it under control through further lockdowns and strict public health measures.

“The lesson across all of the world is that the places that do the best are the ones that act hard and early,” said Raywat Deonandan, a global health epidemiologist and an associate professor at the University of Ottawa.

“That’s where we failed.”

Experts say Canada, comparatively, has seemingly not yet learned these lessons.

“In Canada, we never set clear goals and so we opened up without having built a solid test, trace isolate strategy,” said Dr. Irfan Dhalla, vice-president of physician quality at Unity Health in Toronto.

“We didn’t follow the indicators closely enough and now we’re paying the price. The good news is we’re not paying nearly as bad a price as people in some other countries are paying, but it would be a big mistake to compare ourselves to the worst countries in the world.”

Ontario ‘highly unstable’

In Ontario, there are currently almost 150 outbreaks in long-term care homes, the seven-day average of cases has grown to nearly 1,000 and the largest number of COVID-19 deaths in a single day happened this week.

“The situation we find ourselves in right now is highly unstable,” said Dhalla, who is also an associate professor at the University of Toronto who sits on provincial and federal committees related to the COVID-19 response.

“It wouldn’t take much to put us on a path towards the kinds of outcomes we’re seeing in Belgium, Switzerland, the United Kingdom, many American states.”

But with over half of Ontario’s cases with no known link to previous cases and community transmission running rampant, experts say the province doesn’t have a clear enough view of the situation.

“We don’t understand how many people are infected. We know that it’s a lot, but we really don’t know the magnitude,” said Dr. Andrew Morris, a professor of infectious diseases at the University of Toronto and the medical director of the Antimicrobial Stewardship Program at Sinai-University Health Network.

“If this were an iceberg, we don’t know how much is above or below water.”

Despite this, Ontario is moving to ease restrictions on much of the province, even without hitting its full testing capacity and contact tracing and isolation of cases not functioning in hot spots like Toronto due to the sheer volume.

“We know in Ontario that 1,000 cases per day is not a sustainable situation. We have too many outbreaks in hospitals, we have too many outbreaks in long-term care homes,” he said.

“We have to bring the number of cases down from 1,000 a day back down to something like 50 or 100 per day. And when we get back down there, we need to have a test, trace, isolate strategy that works.”

WATCH | Ontario’s restrictions system under fire:

Ontario has announced a new tiered system for triggering COVID-19 restriction, but critics say the sky-high thresholds won’t stop the virus from spreading across the province. 1:59

Manitoba suffered from ‘complacency’

Manitoba went from one of Canada’s shining examples of how to successfully manage the spread of the coronavirus, to facing its single worst outbreak.

“Some of us lost our way, and now COVID is beating us,” Premier Brian Pallister said Monday. “Perhaps we were cursed by our early success.”

It was that early success that caused the province to let its guard down, leaving it vulnerable to a surge in cases when the virus re-entered the community.

“We had a very good proactive response in early spring. We shut things down very quickly, everybody seemed to be quite on board and cases receded,” said Jason Kindrachuk, an assistant professor of viral pathogenesis at the University of Manitoba in Winnipeg and Canada Research Chair of emerging viruses.

“And that, probably, in some ways, fed a complacency across all levels.”

Kindrachuk said that because Manitoba didn’t bear the brunt of COVID-19 that other regions of the country had, it lost focus on the need to prepare for the future.

“Then everything hit at the perfect time — we had exponential growth, we had community transmission, we likely had superspreading events, we had outbreaks that occurred in long-term care facilities,” he said.

“The worst of the worst that could have happened, did happen.”

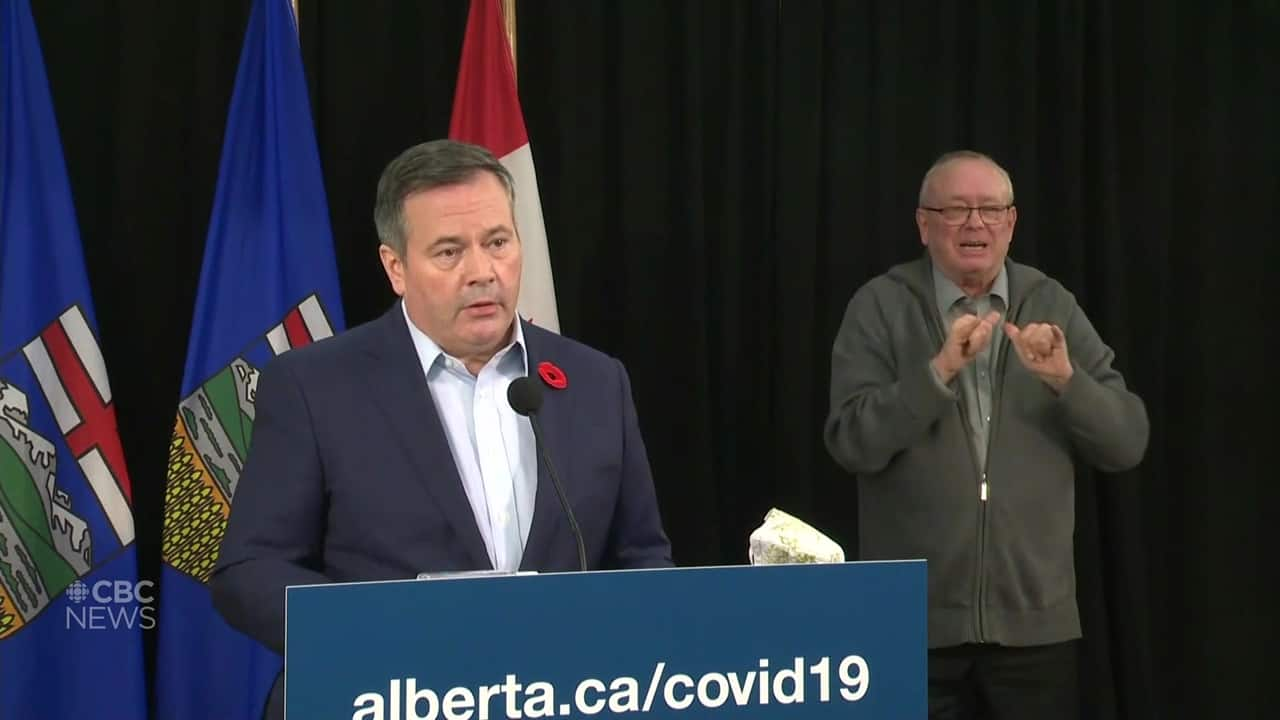

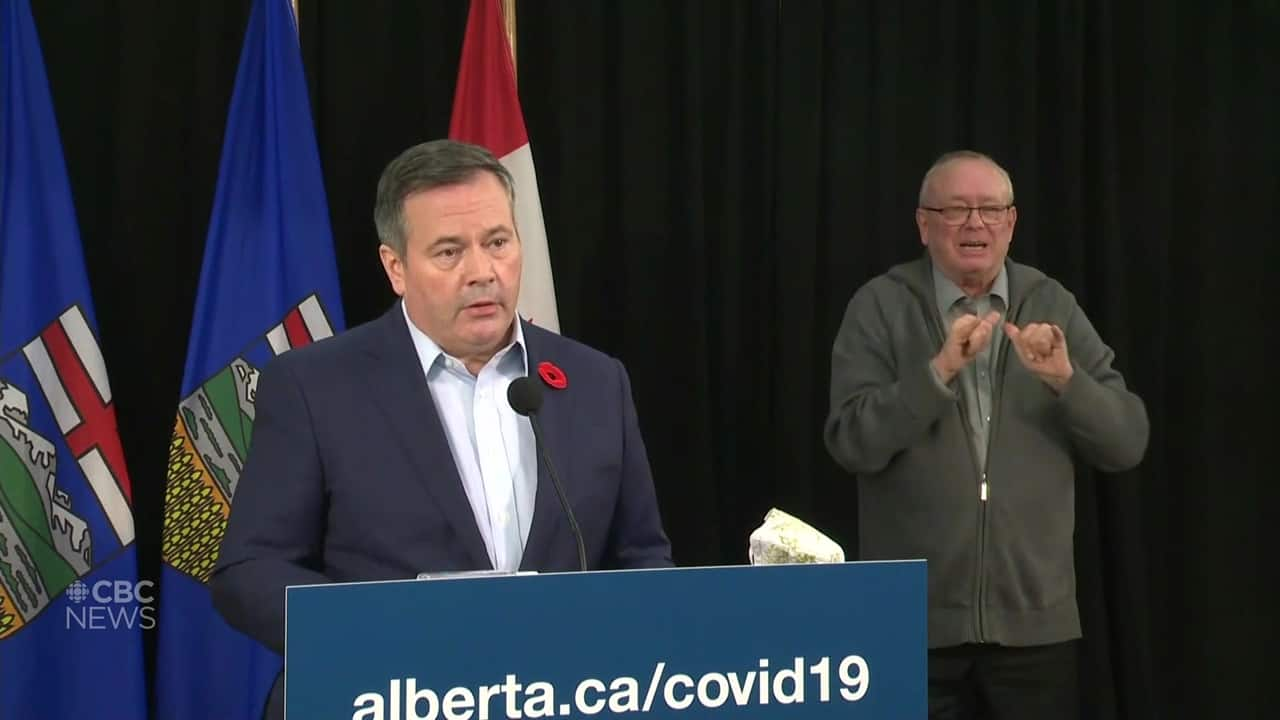

Alberta faces ‘tipping point’

Alberta shattered COVID-19 records on Thursday, recording what health officials described as “about 800” new cases after specific numbers were unavailable due to technical problems with the province’s reporting system.

It’s another province that saw low case numbers slowly rise after a lull in the summer, but waited to act on imposing stricter restrictions and now faces the prospect of a worsening second wave.

Dr. Lynora Saxinger, an infectious diseases specialist and an associate professor at the University of Alberta’s faculty of medicine, called the situation “profoundly disturbing.”

“You can have things simmering along, and then it just starts to boil over — there’s a tipping point, and it starts to change,” she said.

“And when that happens, what we’ve seen across the world, is the actions in that early phase make a really big difference.”

Alberta Premier Jason Kenney rejected the call for stricter public health restrictions this week, the same time a record 171 people were hospitalized with COVID-19, 33 of them in ICU, and nine more people died.

“We’ve seen other jurisdictions implement sweeping lockdowns, indiscriminately violating people’s rights and destroying livelihoods,” Kenney said Friday, rejecting the call for further measures to curb the spread of the virus.

“Nobody wants that to happen here in Alberta.”

Saxinger said Alberta should look at emulating a “circuit breaker” model of controlling the virus from the U.K., focused on brief lockdowns that can interrupt transmission and reverse rising case numbers quickly if rolled out successfully.

WATCH | Stop gatherings in homes, Kenney urges Albertans:

Premier Jason Kenney is calling on Albertans to not host parties or large family dinners and is expanding the 15-person limit on social gatherings to all communities on the province’s COVID-19 watch list. 2:42

“There’s a certain part of the population that’s just not really paying attention as much anymore,” she said. “So you might need to have that short, sharp, lockdown that’s visible to actually really get the whole population re-engaged.”

Saxinger said she’s worried Alberta is past the point of “targeted” restrictions due to rising community transmission and inadequate contact tracing and is being “surged under” by new cases and hospitalizations.

“I’m really afraid that it could take off in a really bad way,” she said. “A lot of us are very anxious right now and the hospitals are already stressed.”

Record numbers in B.C.

British Columbia was praised for its vigorous test, trace and isolate approach and became a global model for how to effectively control the spread of the virus, but could risk jeopardizing the progress it’s made if it doesn’t regain control of a surge in cases.

The province hit a record high COVID-19 case numbers two days in a row this week, with 425 on Thursday and 589 on Friday adding to the 3,741 active cases in the province currently.

Unlike Quebec, which saw its cases surge a month after school started and has been struggling to regain control, B.C. has largely seen outbreaks in community settings.

“Most of the transmissions are through gatherings … superspreader-type events that happen with lots of people in a room,” said Dr. Srinivas Murthy, an infectious disease specialist and clinical associate professor in pediatrics at the University of British Columbia.

“I think our lack of attention to that, and how we can target where we know those large-scale transmission events happen, was probably not as rigorous as it could have been.”

Murthy said new public health restrictions focused on limiting the size of gatherings, mandating masks in health-care facilities and threatening businesses with closures for not following guidelines will hopefully drive down the numbers and avoid lockdowns — but it will take time.

“So far we’ve been able to, with pretty rigorous data collection, follow up and trace and isolate most of the cases in the superspreading events that have happened,” he said.

“But if there is an increased, unlinked case number in the community that’s unable to be traced and isolated — then obviously large-scale social distancing would be probably the next step.”

Atlantic bubble needs vigilance

The Atlantic bubble, a success story for curbing COVID-19 spread, is another model that other parts of the country can learn from.

The four Atlantic provinces imposed tight restrictions on points of entry, moved quickly to clamp down on new outbreaks of COVID-19 and focused on aggressive contact tracing and isolating.

But epidemiologist Susan Kirkland said the recent surge in cases in parts of Canada that weren’t hit as hard in the first wave is a stark reminder of the need for the region to avoid letting its guard down.

“We have to be constantly vigilant,” said Kirkland, head of public health and epidemiology at Dalhousie University in Halifax. “As long as COVID isn’t introduced, we’re OK. But the minute it is, the environment is rife for it to spread very, very quickly.”

The Atlantic provinces have so far avoided rampant community spread of the virus with unknown origins, but Kirkland says rising numbers across the country show it could happen anywhere — even the North.

Nunavut confirmed its first case of COVID-19 on Friday and while health officials say contact tracing is currently underway in the community, the territory’s rapid response team is “on standby to help manage the situation should it become necessary.”

WATCH | No sign of bubble bursting:

Like an extended family, the four Atlantic provinces have walled themselves in, creating measures to restrict outsiders and COVID-19 cases. So far, it’s worked and there doesn’t seem to be much of a rush to burst the Atlantic bubble. 5:09

Kirkland said Atlantic Canada has much more in common with the North than it does with more populous provinces like Ontario and both regions face an uncertain future.

“Part of the reason that we’ve done so well is because we are isolated,” she said, adding that they have also benefited from strong public health messaging and a compliant public.

“But the minute we have community spread, we’re again in that situation where we’re putting ourselves at big risk. So it’s hard to be complacent.”

To read the entire Second Opinion newsletter every Saturday morning, subscribe by clicking here.

News

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

More money will land in the pockets of Canadian families on Friday for the latest Canada Child Benefit (CCB) installment.

The federal government program helps low and middle-income families struggling with the soaring cost of raising a child.

Canadian citizens, permanent residents, or refugees who are the primary caregivers for children under 18 years old are eligible for the program, introduced in 2016.

The non-taxable monthly payments are based on a family’s net income and how many children they have. Families that have an adjusted net income under $34,863 will receive the maximum amount per child.

For a child under six years old, an applicant can annually receive up to $7,437 per child, and up to $6,275 per child for kids between the ages of six through 17.

That translates to up to $619.75 per month for the younger cohort and $522.91 per month for the older group.

The benefit is recalculated every July and most recently increased 6.3 per cent in order to adjust to the rate of inflation, and cost of living.

To apply, an applicant can submit through a child’s birth registration, complete an online form or mail in an application to a tax centre.

The next payment date will take place on May 17.

News

Capital gains tax change draws ire from some Canadian entrepreneurs worried it will worsen brain drain – CBC.ca

A chorus of Canadian entrepreneurs and investors is blasting the federal government’s budget for expanding a tax on the rich. They say it will lead to brain drain and further degrade Canada’s already poor productivity.

In the 2024 budget unveiled Tuesday, Finance Minister Chrystia Freeland said the government would increase the inclusion rate of the capital gains tax from 50 per cent to 67 per cent for businesses and trusts, generating an estimated $19 billion in new revenue.

Capital gains are the profits that individuals or businesses make from selling an asset — like a stock or a second home. Individuals are subject to the new changes on any profits over $250,000.

The government estimates that the changes would impact 40,000 individuals (or 0.13 per cent of Canadians in any given year) and 307,000 companies in Canada.

However, some members of the business community say that expanding the taxable amount will devastate productivity, investment and entrepreneurship in Canada, and might even compel some of the country’s talent and startups to take their business elsewhere.

Finance Minister Chrystia Freeland unveiled the government’s 2024 federal budget, with spending targeted at young voters and a plan to raise capital gains taxes for some of the wealthiest Canadians.

Benjamin Bergen, president of the Council of Canadian Innovators (CCI), said the capital gains tax has overshadowed parts of the federal budget that the business community would otherwise be excited about.

“There were definitely some other stars in the budget that were interesting,” he said. “However, the … capital gains piece really is the sun, and it’s daylight. So this is really the only thing that innovators can see.”

The CCI has written and is circulating an open letter signed by more than 1,000 people in the Canadian business community to Trudeau’s government asking it to scrap the tax change.

Shopify CEO Tobi Lütke and president Harley Finkelstein also weighed in on the proposed hike on X, formerly known as Twitter.

We need to be doing everything we can to turn Canada into the best place for entrepreneurs to build 🇨🇦<br><br>What’s proposed in the federal budget will do the complete opposite. Innovators and entrepreneurs will suffer and their success will be penalized — this is not a wealth tax,…

—@harleyf

Former finance minister Bill Morneau said his successor’s budget disincentivizes businesses from investing in the country’s innovation sector: “It’s probably very troubling for many investors.”

Canada’s productivity — a measure that compares economic output to hours worked — has been relatively poor for decades. It underperforms against the OECD average and against several other G7 countries, including the U.S., Germany, U.K. and Japan, on the measure.

Bank of Canada senior deputy governor Carolyn Rogers sounded the alarm on Canada’s lagging productivity in a speech last month, saying the country’s need to increase the rate had reached emergency levels, following one of the weakest years for the economy in recent memory.

The government said it was proposing the tax change to make life more affordable for younger generations and fund efforts to boost housing supply — and that it would support productivity growth.

A challenge for investors, founders and workers

The change could have a chilling effect for several reasons, with companies already struggling to access funding in a high interest rate environment, said Bergen.

He questioned whether investors will want to fund Canadian companies if the government’s taxation policies make it difficult for those firms to grow — and whether founders might just pack up.

The expanded inclusion rate “is just one of the other potential concerns that firms are going to have as they’re looking to grow their companies.”

He said the rejigged tax is also an affront to high-skilled workers from low-innovation sectors who might have taken the risk of joining a startup for the opportunity, even taking a lower wage on the chance that a firm’s stock options grow in value.

But Lindsay Tedds, an associate economics professor at the University of Calgary, said the tax change is one of the most misunderstood parts of the federal budget — and that its impact on the country’s talent has been overstated.

“This is not a major innovation-biting tax change treatment,” Tedds said. “In fact, when you talk to real grassroots entrepreneurs that are setting up businesses, tax rates do not come into their decision.”

As for productivity, Tedds said Canadians might see improvements in the long run “to the degree that some of our productivity problems are driven by stresses like housing affordability, access to child care, things like that.”

‘One foot on the gas, one foot on the brake’

Some say the government is sending mixed messages to entrepreneurs by touting tailored tax breaks — like the Canada Entrepreneurs’ Incentive, which reduces the capital gains inclusion rate to 33 per cent on a lifetime maximum of $2 million — while introducing measures they say would dampen investment and innovation.

“They seem to have one foot on the gas, one foot on the brake on the very same file,” said Dan Kelly, president of the Canadian Federation of Independent Business.

Some business groups are worried that new capital gains tax changes could hurt economic growth. But according to Small Business Minister Rechie Valdez, most Canadians won’t be impacted by that change — and it’s a move to create fairness.

A founder may be able to sell their successful company with a lower capital gains treatment than otherwise possible, he said.

“At the same time, though, big chunks of it may be subject to a higher rate of capital gains inclusion.”

Selling a company can fund an individual’s retirement, he said, which is why it’s one of the first things founders consider when they think about capital gains.

Mainstreet NS7:03Ottawa is proposing a hike to capital gains tax. What does that mean?

Tuesday’s federal budget includes nearly $53 billion in new spending over the next five years with a clear focus on affordability and housing. To help pay for some of that new spending, Ottawa is proposing a hike to the capital gains tax. Moshe Lander, an economics lecturer at Concordia University, joins host Jeff Douglas to explain.

Dennis Darby, president and CEO of Canadian Manufacturers & Exporters, says he was disappointed by the change — and that it sends the wrong message to Canadian industries like his own.

He wants to see the government commit to more tax credit proposals like the Canada Carbon Rebate for Small Businesses, which he said would incentivize business owners to stay and help make Canada competitive with the U.S.

“We’ve had a lot of difficulties attracting investment over the years. I don’t think this will make it any better.”

Tech titan says change will only impact richest of the rich

Toronto tech entrepreneur Ali Asaria will be one of those subject to the expanded capital gains inclusion rate — but he says it’s only fair.

“It’s going to really affect the richest of the rich people,” Asaria, CEO of open source platform Transformer Lab and founder of well.ca, told CBC News.

“The capital gains exemption is probably the largest tax break that I’ve ever received in my life,” he said. “So I know a lot about what that benefit can look like, but I’ve also always felt like it was probably one of the most unfair parts of the tax code today.”

While Asaria said Canada needs to continue encouraging talent to take risks and build companies in the country, taxation policies aren’t the most major problem.

“I think that the biggest central issue to the reason why people will leave Canada is bigger issues, like housing,” he said.

“How do we make it easier to live in Canada so that we can all invest in ourselves and invest in our companies? That’s a more important question than, ‘How do we help the top 0.13 per cent of Canadians make more money?'”

News

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

More money will land in the pockets of Canadian families on Friday for the latest Canada Child Benefit (CCB) installment.

The federal government program helps low and middle-income families struggling with the soaring cost of raising a child.

Canadian citizens, permanent residents, or refugees who are the primary caregivers for children under 18 years old are eligible for the program, introduced in 2016.

The non-taxable monthly payments are based on a family’s net income and how many children they have. Families that have an adjusted net income under $34,863 will receive the maximum amount per child.

For a child under six years old, an applicant can annually receive up to $7,437 per child, and up to $6,275 per child for kids between the ages of six through 17.

That translates to up to $619.75 per month for the younger cohort and $522.91 per month for the older group.

The benefit is recalculated every July and most recently increased 6.3 per cent in order to adjust to the rate of inflation, and cost of living.

To apply, an applicant can submit through a child’s birth registration, complete an online form or mail in an application to a tax centre.

The next payment date will take place on May 17.

-

Media15 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media17 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment15 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Sports20 hours ago

Sports20 hours ago2024 Stanley Cup Playoffs 1st-round schedule – NHL.com

-

Real eState7 hours ago

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

-

Business16 hours ago

Gas prices see 'largest single-day jump since early 2022': En-Pro International – Yahoo Canada Finance

-

Art19 hours ago

Enter the uncanny valley: New exhibition mixes AI and art photography – Euronews

-

Tech18 hours ago

Tech18 hours agoOur Guide To The Best Inflatable Hot Tubs In Canada In 2024 (And Where To Get Them) – CTV News