Investment

Why has Labour U-turned on its green investment pledge?

|

|

The promise was clear. And it was prominent.

At Labour’s 2021 conference, shadow chancellor Rachel Reeves announced her ambition to be the UK’s first “green” chancellor.

To stress her bona fides, she pledged to invest £28bn a year, every year to 2030 to “green” the economy.

Labour’s Green Prosperity Plan was one of its defining policies. It gave the party a clear dividing line with government.

Ms Reeves said there would be “no dither, and no delay” in tackling the climate crisis.

It was also an answer to the government’s “levelling up” pledge.

The borrowed cash would underpin well-paid jobs in every corner of the UK in the energy sector.

So why has Ms Reeves kicked the pledge into the second half of the next Parliament, if Labour wins?

The first reason is obvious.

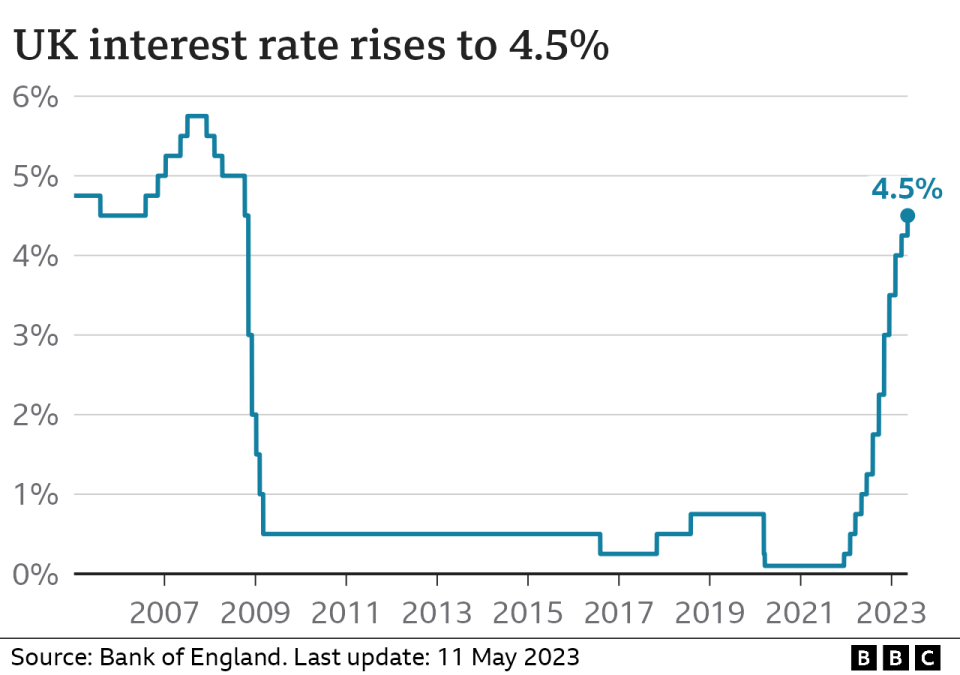

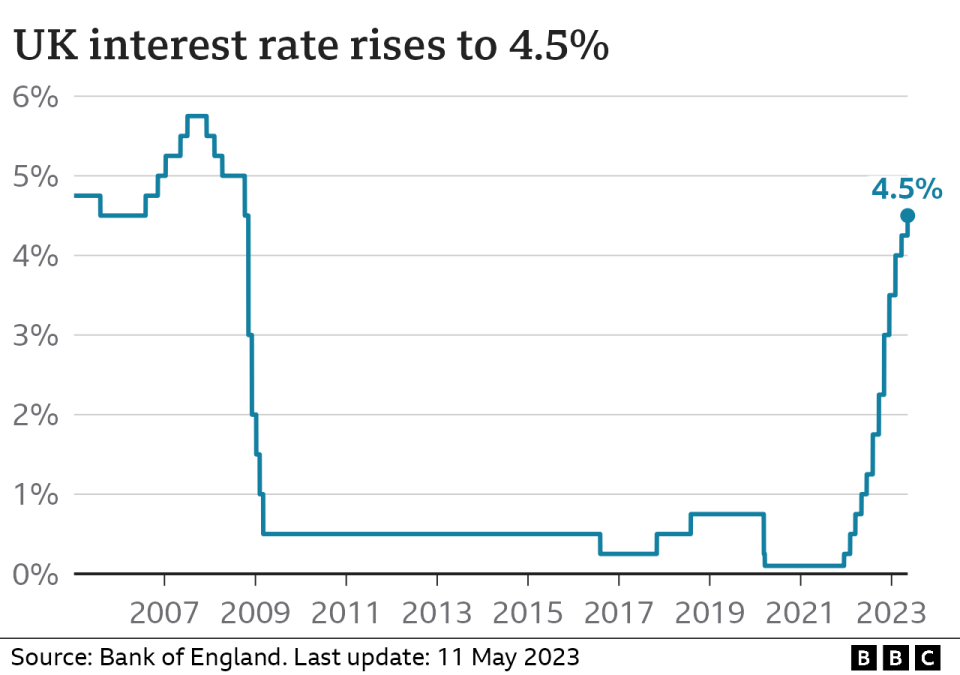

Ms Reeves now says she was “green” – in a different sense of the word – in 2021, in that she hadn’t foreseen what then-Prime Minister Liz Truss would do to the economy.

With interest rates up, the cost of borrowing rises too, making the £28bn pledge more expensive to deliver.

And Ms Reeves wants to emphasise that if any spending commitments clash with her fiscal rules, the rules would win every time.

But did the £28bn green pledge really clash with her rules?

In their own detailed briefing on their fiscal rules, Labour said: “It is essential that for our future prosperity that we retain the ability to borrow for investing in capital projects which over time will pay for themselves.

“And that is why our target for eliminating the deficit excludes investment.”

So borrowing to invest in the future technology and jobs shouldn’t fall foul of that fiscal rule.

But there is another rule which Ms Reeves cited this morning – to have debt falling as a percentage of GDP or Gross Domestic Product, a measure of economic activity.

Meeting that rule may have contributed to putting the £28bn on the backburner – though I remember at the 2021 conference some senior Labour figures questioning the wisdom of borrowing the equivalent of half the defence budget every year even then.

And some senior figures in Labour are far less convinced that £28bn would necessarily bust the debt rule – economic forecasts can change by far greater margins.

One of the other justifications for the change of position is that £28bn shouldn’t be poured in to the economy straight away.

That’s because it will take time to train workers, to create and bolster supply chains. Hence “ramping up” to £28bn.

One shadow minister said that while today’s announcement felt like a bit of a handbrake turn, it was nonetheless inevitable and sensible.

The scale of the ambition remained the same, but pragmatically the shadow chancellor was simply not committing to spending which would be difficult to deliver.

But all this must have been known in 2021, too.

So why announce the U-turn today?

The change of position was discussed within Labour’s Treasury team for some time.

Engagement with investors convinced them the government itself may not need to pump in a huge amount of cash straight away – the private sector would provide green jobs without state help.

And while Ms Reeves has ditched the £28bn pledge in the first half of the Parliament, this doesn’t mean that a Labour government would spend nothing on its Green Prosperity Plan.

I understand cash will be prioritised for projects where the private sector would not commit without state assistance – nuclear and hydrogen for example.

But it seems clear that politics and not just economics played a role in today’s announcement.

Tory attacks

There have been grumbles and growls over how the policy has landed over the past two years within Labour’s ranks and internal criticism has increased, not receded.

One concern was that the amount to be borrowed – the £28bn – was better known than what the money would buy – from home insulation and heat pumps to new carbon capture technology.

But it was crystal clear this week that the Conservatives felt that they had seen a vulnerability that could be exploited.

The front page of the Daily Mail blared this week about the alleged dangers of the policy – the extra borrowing would put up interest and therefore mortgage costs.

The independent Institute for Fiscal Studies was also being cited by Conservative ministers.

Its director Paul Johnson had warned that while additional borrowing would pump money in to the economy, it also drives up interest rates.

As Labour has been attacking the Conservatives for their handling of the economy, and the “mortgage premium” they claim the government has caused, it was understandable that they did not want the same attack to be aimed at them, and Ms Reeves this morning sought to eliminate a potential negative.

As one Labour shadow minister put it: “They [the Conservatives] will be pulling their hair out that one of their attack lines has failed.”

Some in Labour’s ranks, though, believe the party should have insulated (no pun intended) itself from attack by making the case more stridently that borrowing to invest is different from borrowing to meet day-to-day spending.

Credibility is key

Labour’s opinion poll lead is wide but pessimists in their ranks fear it is shallow.

Establishing economic credibility is seen as key.

But while it may have been the lesser of two evils, today’s change of tack isn’t cost-free.

The party has committed to achieve a net-zero power system by 2030.

But with potentially significantly less investment, is this target in danger too?

And unlike many of the left-wing commitments that have been ditched – where the leadership don’t really mind the backlash – this was the shadow chancellor watering down her own highest-profile pledge.

That in itself has allowed the Conservatives to shout about Labour’s economic plans being “in tatters”.

As Labour is still committed to its Green Prosperity Plan – just not the original timescale – they will still claim they have clear dividing lines with the government.

But one of their key arguments has been this: With the US pouring subsidies in to domestic green industries, the UK will get left behind if it doesn’t follow suit. And fast.

A delay doesn’t destroy – but it does potentially weaken – the Labour case.

But there is another concern amongst those who are most certainly not on the Corbyn left.

Emphasising competence and fiscal credibility over climate change commitments could leave some target voters cold.

Investment

MOF: Govt to establish high-level facilitation platform to oversee potential, approved strategic investments

|

|

KUALA LUMPUR: A meeting with 70 financial fund investors and corporate members at the recently concluded Joint Investors Meeting in London has touched on the MADANI government’s immediate action to stimulate strategic investment in important technologies, according to the Ministry of Finance (MoF).

In a statement today, it said that the government is serious about making investments a national agenda through the establishment of a high-level investment facilitation platform to ensure the implementation of potential and approved strategic investments through a “Whole of Government” approach.

Minister of Finance II Datuk Seri Amir Hamzah Azizan (pix), who led the Malaysian delegation to the Joint Investors Meeting from April 20 to 22, said that the National Investment Council (MPN) chaired by the Prime Minister is an integrated action that reflects how serious the government is in making Malaysia an investment hub in the region.

Among the immediate actions taken by the government is establishing the National Semiconductor Strategic Committee (NSSTF) to facilitate cooperation between the government, industry players, universities, and relevant stakeholders to place the Malaysian semiconductor industry at the forefront and ensure the continued growth of the electronics & electrical industry, especially the semiconductor sector, as a major contributor to the Malaysian economy.

The government also aims to empower Malaysia as a preferred green investment destination as well as remove barriers and bureaucracy in the provision and accessibility to renewable energy, especially for the new technology industry, including data centres, said Amir Hamzah.

He also said that the country’s investment prospects have reached an extraordinary level, with approved investments surging to RM329.5 billion in 2023 from RM268 billion in 2022.

He said about 74 per cent of manufacturing projects approved between 2021 and 2023 have been completed or are in process.

In addition, Amir Hamzah said the greater initial stage construction work completed in 2023 (RM31.5 billion) and 2022 (RM26.3 billion) shows a positive trend for future investment opportunities.

“From a total of 5,101 investment projects approved in 2023, as many as 81.2 per cent or 4,143 projects are in the services sector, 883 projects in the manufacturing sector, and 75 projects in other related sectors,” he said.

Before this, Amir Hamzah met with international investors in New York and Washington to clarify the direction of the implementation of the MADANI Economic framework to improve investors’ confidence in Malaysia’s economic level and strengthen the perception and investment sentiment of foreign investors towards the country.

Investment

Want $1 Million in Retirement? Invest $15000 in These 3 Stocks

|

|

Compound interest is a thing of magic. It’s also one of your best bets if you’re looking to retire rich.

It might take time and patience but there’s not a whole lot of heavy lifting when it comes to a buy-and-hold investment strategy. What matters most is having decades of time in front of you, which will allow you to maximize the benefits of compounded returns. And, of course, choosing the right investments is equally important.

The magic of compound interest

With a decent return, building a million-dollar portfolio might not be as hard as you think. An initial investment of $15,000, returning 15% annually, would be worth just shy of $1 million in 30 years.

First off, 30 years is a long time, which means you’ll need to be planning your retirement far in advance. However, all it takes is one initial investment of $15,000 and the right stocks to build a $1 million portfolio.

Additionally, it’s important to remain realistic and acknowledge that a stock returning 15% annually is not exactly common. That being said, the TSX certainly has its share of dependable companies with track records of returning far more than just 15% per year.

I’ve put together a list of three Canadian stocks that are perfect for hands-off investors who are looking to retire rich.

Constellation Software

It will require a steep initial investment, but Constellation Software (TSX:CSU) is well worth its nearly $4,000-a-share price tag. When it comes to market-crushing returns, the tech stock has been in a league of its own over the past two decades.

Even as the company is now valued at a massive market cap of close to $80 billion, the impressive returns have continued. Shares are up more than 200% over the past five years. That’s good enough for a compound annual growth rate (CAGR) of 25%.

At a 25% annual return, a $15,000 investment would be worth a whopping $12 million in 30 years.

Descartes Systems

Descartes Systems (TSX:DSG) is another tech stock that’s no stranger to delivering market-beating returns. The company is also only valued at a market cap of $10 billion, leaving plenty of room for growth in the coming decades.

There’s a reason why Descartes Systems is one of the few tech stocks trading near all-time highs today. This stock is a proven winner, with lots of growth left in the tank.

Over the past five years, the stock has had a CAGR just shy of 20%.

goeasy

The last pick on my list is a beaten-down growth stock that’s trading at a serious discount.

The consumer-facing financial services provider has been hit by short-term headwinds from sky-high interest rates. With potential rate cuts around the corner though, now could be an excellent time to be loading up on goeasy (TSX:GSY).

Even with shares down 25% from all-time highs, the stock is still nearing a return of 300% over the past five years.

goeasy was crushing the market’s returns before the recent spike in interest rates, and there’s no reason to believe why the company won’t continue to do so for years to come.

Investment

FLAGSHIP COMMUNITIES REAL ESTATE INVESTMENT TRUST ANNOUNCES CLOSING OF APPROXIMATELY US

|

|

TORONTO, April 24, 2024 /CNW/ – Flagship Communities Real Estate Investment Trust (the “REIT” or “Flagship“) (TSX: MHC.U) (TSX: MHC.UN) announced today that it has completed its previously announced public offering (the “Offering“) of 3,910,000 trust units (the “Units“) on a bought deal basis at a price of US$15.35 per Unit for total gross proceeds to the REIT of approximately US$60 million.

The Offering was completed through a syndicate of underwriters co-led by BMO Capital Markets and Canaccord Genuity Corp.

ADVERTISEMENT

The REIT intends to use the net proceeds from the Offering to fund a portion of the approximately US$93 million aggregate purchase price for the REIT’s previously announced acquisition of seven manufactured housing communities comprising 1,253 lots (the “Acquisitions“) and for general business purposes. In the event the REIT is unable to consummate one or both of the Acquisitions, the REIT intends to use the net proceeds of the Offering to fund future acquisitions and for general business purposes.

The REIT has also granted the underwriters an over-allotment option to purchase up to an additional 586,500 Units on the same terms and conditions, exercisable at any time, in whole or in part, up to 30 days after the date hereof.

About Flagship Communities Real Estate Investment Trust

Flagship Communities Real Estate Investment Trust is a leading operator of affordable residential Manufactured Housing Communities primarily serving working families seeking affordable home ownership. The REIT owns and operates exceptional residential living experiences and investment opportunities in family-oriented communities in Kentucky, Indiana, Ohio, Tennessee, Arkansas, Missouri, and Illinois. To learn more about Flagship, visit www.flagshipcommunities.com.

Forward-Looking Statements

This press release contains statements that include forward-looking information (within the meaning of applicable Canadian securities laws). Forward-looking statements are identified by words such as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”, “will”, “may”, “can”, “could”, “would”, “must”, “estimate”, “target”, “objective”, and other similar expressions, or negative versions thereof, and include statements herein concerning the use of the net proceeds of the Offering.

These forward-looking statements are based on the REIT’s expectations, estimates, forecasts and projections, as well as assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies that could cause actual results to differ materially from those that are disclosed in such forward-looking statements. While considered reasonable by management of the REIT as at the date of this news release, any of these expectations, estimates, forecasts, projections, or assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those expectations, estimates, forecasts, projections, or assumptions could be incorrect. Material factors and assumptions used by management of the REIT to develop the forward-looking information in this news release include, but are not limited to, that the conditions to closing of the Acquisitions will be met or waived in a timely manner and that both of the Acquisitions will be completed on the current agreed upon terms.

When relying on forward-looking statements to make decisions, the REIT cautions readers not to place undue reliance on these statements, as they are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors, many of which are beyond the REIT’s control, could cause actual results to differ materially from the results discussed in the forward-looking statements, such as the risks identified in the REIT’s management’s discussion and analysis for the year ended December 31, 2023 available on the REIT’s profile on SEDAR+ at www.sedarplus.com, including, but not limited to, the factors discussed under the heading “Risks and Uncertainties” therein and the risk of the REIT’s plans with respect to debt bridge financing for the Acquisitions not being achieved as anticipated. There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Forward-looking statements are made as of the date of this press release and, except as expressly required by applicable Canadian securities laws, the REIT assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

-

Health19 hours ago

Health19 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Health23 hours ago

Health23 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

News15 hours ago

Amid concerns over ‘collateral damage’ Trudeau, Freeland defend capital gains tax change

-

Art19 hours ago

Random: We’re In Awe of Metaphor: ReFantazio’s Box Art

-

Investment23 hours ago

Investment23 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

News24 hours ago

Peel police chief met Sri Lankan officer a court says ‘participated’ in torture – Global News

-

Art13 hours ago

The unmissable events taking place during London’s Digital Art Week

-

Media18 hours ago

Vaughn Palmer: B.C. premier gives social media giants another chance