Politics

Wirecard: the scandal spreads to German politics

|

|

In September 2019, Angela Merkel’s top economic adviser, Lars-Hendrik Röller, met a delegation from payments group Wirecard, which at the time was still seen as one of Germany’s most successful tech companies.

One of Mr Röller’s visitors in the chancellery in Berlin was Burkhard Ley, a strategic adviser to Wirecard and its former chief financial officer. A year later, Mr Ley is in police custody, accused of fraud, embezzlement and market manipulation. He denies any wrongdoing.

The get-together highlighted the extraordinary access the payments group enjoyed to Germany’s top decision makers until shortly before its collapse this summer — access which has shone an unforgiving light on the influence of lobbyists over German politics.

Wirecard has gone down as the most spectacular case of financial misconduct in postwar German history. But it is now fast becoming a political scandal too. Earlier this month the Bundestag decided to launch a full parliamentary inquiry into the affair, ensuring that it will continue to capture headlines well into 2021 — a year when Germans go to the polls to elect a new parliament — and potentially cast a shadow over Angela Merkel’s final months as chancellor.

One key area of interest for MPs is why the authorities seemed so slow to recognise the gravity of the situation at Wirecard. The Röller-Ley meeting took place months after whistleblowers had raised serious concerns about fraud at the payments processor that triggered a police probe in Singapore. Members of the German government — including Ms Merkel herself — continued to lobby for Wirecard, despite mounting doubts about its accounting practices.

The scandal has also exposed the weaknesses of Germany’s system of financial regulation, and in particular the toothlessness of its markets watchdog BaFin. Opposition MPs are still incredulous that instead of investigating the substance of the allegations against Wirecard, BaFin and criminal prosecutors in Munich went after the very journalists and short-sellers who had highlighted suspicious activities at the payment provider.

“With the knowledge we have today, this is an utterly hair-raising situation for us,” a senior German official told the Financial Times, conceding that “the level of [alleged] criminality at Wirecard by far exceeded the power of my imagination”. Government bodies as well as private-sector institutions such as auditors had, he said, all failed miserably.

For Germany’s opposition parties, it is the political failures which are particularly egregious. Many MPs single out Olaf Scholz, finance minister and Social Democrat candidate for chancellor in next year’s Bundestag elections, who oversees both BaFin and the Financial Intelligence Unit, Germany’s anti-money laundering agency. The FIU has come under fire for failing to pass on dozens of Wirecard-related suspicious activity reports to the German public prosecutor’s office.

“No government agencies played any role in uncovering the crime — neither BaFin, nor the FIU, nor the public prosecutor,” says Florian Toncar, an MP for the pro business Free Democratic party. “The state made zero contribution to getting to the bottom of the Wirecard affair.”

The Bundestag’s committee of inquiry is not yet constituted, its remit still unclear. But it is already obvious what kind of questions might interest MPs.

Why, for example, did Ms Merkel lobby for Wirecard while on an official trip to China in September last year when her own finance minister was aware of continuing investigations into the company? Why did deputy finance minister Jörg Kukies visit Wirecard boss Markus Braun at his Munich headquarters last November, on the day of the chief executive’s 50th birthday?

Why did BaFin appear so reluctant to investigate a company that had been generating negative headlines for months? Why were BaFin employees able to trade Wirecard shares while the agency was investigating the payments group?

And why did BaFin respond to FT articles alleging accounting fraud by banning investors from betting against the company’s shares for two months, and later filing a criminal complaint against two FT journalists who had authored the reports?

Fabio De Masi, an MP from the hard-left party Die Linke, who was one of the few lawmakers to take an early interest in Wirecard, says the signal Bafin’s actions sent was “just terrible”. “It was a message to all critics of the company that they were spreading malicious rumours,” he says. “And it was a message to German journalists to be very, very careful before you write anything negative about Wirecard.”

‘Fig leaf’ inquiry

Wirecard was once seen as a rare German tech success story. In 2018 it replaced Commerzbank in the prestigious Dax index and a year later dreamt of taking over Deutsche Bank. But that fantasy unravelled in June when it admitted that €1.9bn in cash was missing from its accounts. Within a week Wirecard had collapsed into insolvency, and €13bn in stock market value had been wiped out.

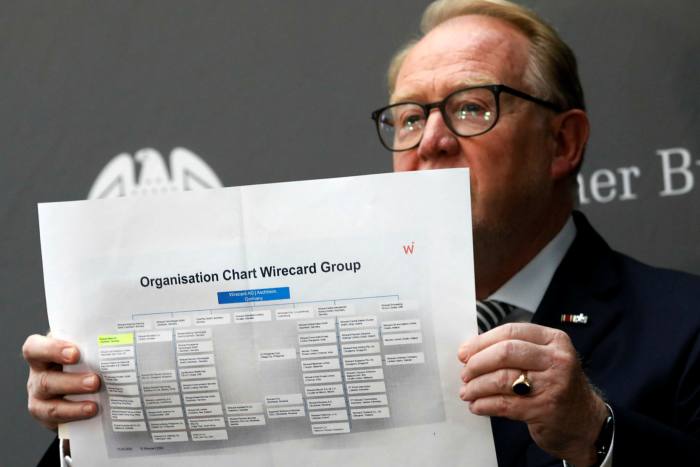

At least seven of its former top managers are suspected of running a criminal racket that defrauded creditors of €3.2bn. Four people are in police custody and Jan Marsalek, Wirecard’s fugitive former second-in-command, is on Interpol’s most wanted list.

For Lisa Paus, MP and finance spokesperson for the opposition Greens, there is a pattern to this. “Wirecard is the latest in a whole series of financial scandals in Germany that BaFin failed to uncover,” she says. “You need a really tough watchdog with proper investigative skills to identify fraud, and that’s the opposite of what we have right now.”

She cited the “Cum-Ex” fraud scheme, the controversial share trades which exploited a design flaw in Germany’s tax code to rob the country’s exchequer of billions of euros in revenues. Then there are the various misconduct scandals at Deutsche Bank, which were unearthed by US and UK regulators, and the Volkswagen diesel affair, which was uncovered not by German authorities but by the US Environmental Protection Agency.

Some suspect that the German authorities were motivated by a desire to shield a national tech champion from external criticism. “You have the impression the regulators said — hey, we have this model German company, . . . it’s a victim of attacks by foreign hedge funds, and the FT is their tool,” says Mr Toncar. “And that was a grave miscalculation.”

Asked by the FT if it was true that the government and BaFin deliberately sought to protect the payments processor, Mr Scholz said there was “no evidence” of that.

He also brushed off the claim that the government could have done more to uncover wrongdoing at Wirecard — implicitly pointing the finger instead at EY, the accounting firm that gave the disgraced tech group unqualified audits for more than a decade.

Mr Scholz drew parallels between the Wirecard debacle and the Enron scandal in the US. There was not only a “gigantic accounting fraud”, but in both cases, “auditors who checked the company every year failed to identify this manipulation”.

That is why, he said, he was pushing for reform of the accounting industry. One finance ministry proposal would force large companies to switch auditors more frequently, and for accountancy firms to better separate their audit units from their consultancy businesses.

BaFin, too, has tried hard to fend off criticism that it failed to act. Felix Hufeld, its president, has argued that German capital markets laws left the agency no alternative but to act as it did. The authority, he told the German parliament, lacked a legal mandate to supervise Wirecard as a whole and instead oversaw only Wirecard Bank, a small subsidiary of the group.

Meanwhile, he argued, under German law BaFin did not itself have the right to launch a special audit of Wirecard’s accounts. All it could do was to turn to a body called the Financial Reporting Enforcement Panel, a private sector organisation which monitors the accounting practices of listed companies on behalf of the government, and ask it to investigate Wirecard. This is what happened in mid-February 2019.

BaFin then hunkered down for a long wait. Under Germany’s so-called “two-tier procedure”, the regulator cannot initiate its own investigation into a company until it has received the results of a Frep probe. Yet Frep, which has only 15 employees and an annual budget of just €6m, is ill-equipped to conduct the kind of forensic investigations required to uncover fraud.

When Wirecard went bust, the Frep probe was still continuing. Only after the company’s insolvency did Frep formally conclude that its financial statements were inadequate, according to a person with first-hand knowledge of the situation.

The slowness of Frep’s work had far-reaching consequences. Over the summer of 2019, Wirecard was able to raise €1.4bn in new debt from external investors. While the cash was partly needed to fund the company’s cash-burning operative business, prosecutors also suspect that hundreds of millions were siphoned out of the group.

In any case, critics dispute the assertion that BaFin’s only option was to request a probe by Frep: they argue that the Wirecard situation was so serious that BaFin should have considered more drastic action — and that it had the option to do so.

“BaFin did not take the allegations seriously,” says Rudolf Hübner, a capital markets lawyer at Quinn Emanuel Urquhart & Sullivan in Hamburg. “Commissioning Frep was just a fig leaf, as that body has neither the remit nor the resources for a forensic audit.” He argues that German law provides BaFin with several options to intervene decisively to uncover accounting fraud. “The problem wasn’t a lack of power,” says Mr Hübner.

Just days after Wirecard filed for insolvency, the government announced sweeping changes to the way accounting is policed in Germany. It terminated its contract with Frep and promised to give BaFin more investigative and forensic powers.

“[BaFin] used the powers that it had at the time [when it commissioned a Frep probe] — but they weren’t enough,” Mr Scholz tells the FT. “That’s why we now want to give [it] the capabilities it needs to act with more bite.”

Chinese move

It is not only Mr Scholz and the finance ministry who have come under scrutiny over the Wirecard affair. Ms Merkel, too, is in the spotlight.

On September 3 last year she received a visit from a former colleague, Karl-Theodor zu Guttenberg, according to a timeline of contacts provided by the chancellery. He had once served as German defence minister, but was forced to resign in 2011 over a scandal about plagiarism in his doctoral thesis. He now works for an advisory firm, Spitzberg Partners: one of its clients was Wirecard.

Mr zu Guttenberg brought up Wirecard in his chat with the chancellor and shortly afterwards emailed her adviser Mr Röller to say Wirecard was planning to enter the Chinese market by acquiring a Chinese payments company, the Beijing-based AllScore Financial, and needed the approval of the regulator, the People’s Bank of China.

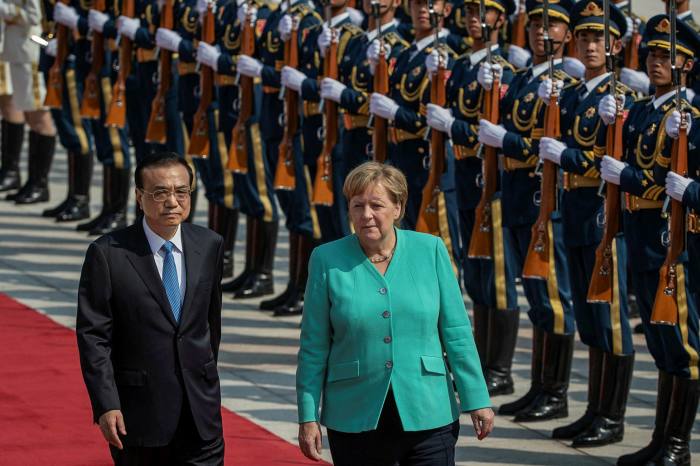

A couple of days later, Ms Merkel flew off on a state visit to China, and, while there, brought up Wirecard and the planned acquisition. After the trip, Mr Röller wrote to Mr zu Guttenberg promising “further political support”, according to the chancellery’s timeline. Wirecard announced the acquisition of AllScore, which came with a price tag of up to €109m, in early November 2019.

Ms Merkel has defended her lobbying for Wirecard. “It’s common practice, not only in Germany, to bring up the concerns of companies on foreign trips,” she said in August. Wirecard was, after all, a “Dax 30 company”, and at the time of the China trip she had “no knowledge” of irregularities at the payments provider.

But that argument does not wash with the opposition. “She essentially did her former cabinet colleague zu Guttenberg a favour by bringing up Wirecard during the China trip,” says Mr Toncar. “And she did it without checking what was happening at the company.”

Some are now calling for a sweeping reform of lobbying in Germany. “The question is: who has access to the chancellor?” says Ms Paus, the Green MP. “There doesn’t seem to be any sensible criteria. No one is checking who knocks on the door and who’s let in.”

Mr zu Guttenberg was not the only ex-government member lobbying for Wirecard. On September 11, Klaus-Dieter Fritsche, a former chancellery official who co-ordinated the work of the German intelligence services, introduced Mr Röller to Wirecard’s current and former CFOs — Alexander von Knoop and Burkhard Ley. According to the chancellery timeline, the meeting was a “getting-to-know-you session” and a chance for Wirecard to inform Mr Röller about its “business activities in the Far East”.

Others were more circumspect when it came to the payments company. Mr zu Guttenberg approached the German embassy in Beijing in late 2019, asking it to help Wirecard win Chinese regulatory approval for the AllScore acquisition.

But in November of that year a financial attaché at the embassy emailed the ambassador, Clemens von Goetze, warning him not to support Wirecard “at the present time”. He said it would be better to wait until the accusations of accounting fraud had been “cleared up unreservedly”, according to a copy of the email seen by the FT.

“[The attaché] clearly had a better sense of what was up at Wirecard than almost everyone who was dealing with the issue at BaFin,” says Mr Toncar.

Beefing up BaFin

Since early September, an army of experts from Roland Berger, a management consultancy, has been sweeping through BaFin’s headquarters in Bonn.

Commissioned by the finance ministry in Berlin, they have been asked to figure out the lessons that Germany’s financial watchdog needs to learn from the Wirecard affair.

Critics say BaFin was asleep at the wheel, targeting short-sellers and journalists who raised concerns about Wirecard rather than investigating the substance of the allegations they made.

One thing that is already clear is that in any future reform, BaFin will be given the power to launch its own investigations into potential balance sheet manipulations by any listed company in Germany.

However, according to people familiar with the discussions, it is increasingly unlikely that the country’s two-tier regulatory system, in which Frep, the private-sector institution, played a semi-official role, will be abolished completely. Frep is likely to negotiate new arrangements, though its role will be limited to conducting routine checks of corporate annual reports to ensure they are in line with legal requirements and accounting standards.

The big change is that BaFin will have greater freedom to launch its own forensic audit of a company at any time without being required to wait for the outcome of any Frep investigation.

In addition, BaFin is considering the creation of a new internal unit better able to identify unsound banks and insurance companies. This would pay special attention to institutions that have particularly risky clients, have grown extremely fast over a short period of time or are part of a larger, complex group that faces allegations of accounting fraud.

A third focus of reform is possible changes to the way BaFin deals with information from whistleblowers. People familiar with the matter say that the authority needs to improve its capacity to analyse data and connect the dots between separate pieces of information provided by different whistleblowers.

The German finance ministry is already making progress on another key reform — restricting BaFin employees from trading in shares of companies they supervise. The revelation that many of them had been dealing in Wirecard shares in the months leading up its downfall has only added to the political scandal around the company.

Source: – Financial Times

Politics

Quebec employers group worried 'political' immigration debate will hurt jobs – CBC News

The latest spat between Quebec and Ottawa over immigration is based on politics and not the reality of the labour market, says the head of a major employers group.

“In some ways, it’s deplorable,” said Karl Blackburn, president and CEO of the Conseil du patronat du Québec.

His comments come as Quebec Premier François Legault is threatening to hold a “referendum” on immigration if the federal government doesn’t take rapid action to stem the rising number of temporary immigrants, which include foreign workers, international students and refugee claimants.

“The majority of Quebecers think that 560,000 temporary immigrants is too much,” Legault said last week. “It’s hurting our health-care system. We don’t have enough teachers, we don’t have enough housing.”

Provincial Immigration Minister Christine Fréchette said the province’s demands include stronger French-language requirements in immigration programs managed by the federal government and a reduction in the number of asylum seekers and temporary workers.

While Prime Minister Justin Trudeau rejected the province’s bid for full control over immigration — currently a shared responsibility — Legault said in March that his federal counterpart had shown openness to some of the province’s demands, and agreed with him on the need to reduce temporary immigrants.

Businesses affected by visa cuts

Blackburn, however, disagrees that there are too many temporary workers, who he said are “working in our businesses producing goods and services.” Their numbers, he added, reflect the needs of the labour market and of an aging society.

He said he supports the Legault government’s call to reduce the number of asylum seekers in the province because Quebec has received a disproportionate share in recent years. But he denounced the federal government’s “improvised” decision to suddenly reimpose visas on some Mexican nationals earlier this year, a measure Quebec had pushed for as a way of reducing asylum claims.

He said that’s already having “direct effects” on businesses by restricting their ability to bring in workers. Any subsequent measures to reduce the number of temporary workers will further hurt Quebec’s economy as well as consumers who will no longer have access to the same goods and services, he said.

“It’s as if our governments knowingly agreed to cause companies to lose contracts for reasons of political partisanship and not based on economic growth, which is nonsensical in a way,” Blackburn said.

Politicians are unfairly blaming immigrants for shortages of housing, daycare spaces and teachers, when the real problem is government failure to invest in those areas, he added.

The long-running debate between Quebec and Ottawa has flared in recent months. Earlier this year, the premier wrote to Trudeau about the influx of asylum seekers entering Quebec, which has welcomed more than 65,000 of the 144,000 would-be refugees who came to Canada last year.

Quebec has demanded Ottawa reimburse the province $1 billion — the amount Quebec says it has cost to care for asylum seekers over the last three years.

Federal Immigration Minister Marc Miller said this week that no country would ever give up total control over immigration. But he said he and his provincial counterpart are having good discussions and agree on many matters, including limiting visas to Mexicans and protecting French.

While Legault has blamed the federal government for the “exploding” number of newcomers, the director of a research institute and co-author of a recent study on temporary immigrants says both Ottawa and Quebec have brought in measures in recent years to facilitate their arrival.

Multiple factors driving immigration surge

Emna Braham says the surge in temporary immigrants is due to a combination of factors, including a tight labour market, post-secondary institutions recruiting internationally, and programs by both Ottawa and Quebec to allow companies to bring in more workers.

She said numbers have now climbed higher than either level of government expected, likely because temporary immigration is administered through a series of programs that are separate from one another.

“We had a set of measures that could be justified individually, but there was no reflection on what the impact will be of all these cumulative measures on the flow of immigrants that Quebec and Canada accept,” she said in a phone interview.

Both Braham and Blackburn point out that the high number of temporary workers in Quebec is also a result of the province’s decision to cap the number of new permanent residents it accepts each year to around 50,000, creating a bottleneck of people awaiting permanent status.

“If the government of Quebec had set its thresholds at the level they should be to meet the needs of the labour market, we wouldn’t be in this situation where [there] is a significant increase in temporary workers,” Blackburn said.

Braham said the moment is right for provinces and the federal government to develop a co-ordinated approach to immigration, and to ensure a system is put in place to ensure both long- and short-term needs are met.

Politics

Liz Truss: The world was safer under Trump – BBC.com

Former PM Liz Truss says she hopes Donald Trump wins the next US election.

The UK’s shortest-serving prime minster said the world was “on the cusp of very, very strong conflict” and needed “a strong America more than ever”.

The full interview between Chris Mason and Liz Truss on Newscast is here on iPlayer and BBC Sounds.

Politics

Quebec employers group urges governments to base immigration on labour needs, not politics – CityNews Montreal

As Quebec and Canada continue to go back and forth about immigration powers, one employers group in Quebec says the problem has more to do with politics than immigration.

The Conseil du patronat du Québec, which represents the interests of employers in the province, says governments needs to stop playing politics with this issue and simply make decisions based on the numbers and the needs of the market.

With an aging population on the rise and over 150,000 vacant job positions across the province, the organization says temporary immigration is needed to fill those spots.

This comes after Quebec Premier François Legault threatened the idea of holding a “referendum” on immigration if the federal government doesn’t act fast to control the increasing number of temporary immigrants. Legault claims the number of immigrants is straining Quebec’s healthcare, education, and housing systems.

But Melissa Claisse from the Welcome Collective says that temporary immigration is not the issue, instead it’s the government’s lack of political will to improve the system, including access to employment support.

“We’re pretty alarmed by the insistence of the provincial government to make immigrant scapegoats for problems that existed a long time, in some cases decades,” said Claisse.

Adding, “We would love to see funding for refugee claimants to have support for finding a job, to connect employers who really need workers to a workforce that’s desperately looking for jobs.”

On Monday, newcomer Henri Libondelo, was outside a Services Québec office in Montreal, waiting to apply for a work permit.

Libondelo, who arrived four months ago from the Republic of the Congo, says somedays, the line outside the office wraps around the building.

“The office opens at 8:30 a.m., but people arrive here sometimes at six in the morning to stand in line, the line gets very long,” said Libondelo.

Libondelo believes that it’s not the number of newcomers that’s the issue, but rather it’s a matter of organization.

“For the moment, the difficulty that I have is looking for a job. Finding a job has been hard since I’ve arrived here,” said Libondelo.

“It’s really dangerous for refugees to have to face this type of rhetoric from our elected officials,” said Claisse.

-With files from The Canadian Press

-

Media21 hours ago

DJT Stock Plunges After Trump Media Files to Issue Shares

-

Business19 hours ago

FFAW, ASP Pleased With Resumption of Crab Fishery – VOCM

-

Media20 hours ago

Marjorie Taylor Greene won’t say what happened to her Trump Media stock

-

Business21 hours ago

Javier Blas 10 Things Oil Traders Need to Know About Iran's Attack on Israel – OilPrice.com

-

Art22 hours ago

It’s Time to Remove Father Rupnik’s Art – National Catholic Register

-

Media19 hours ago

Trump Media stock slides again to bring it nearly 60% below its peak as euphoria fades – National Post

-

Politics20 hours ago

Politics20 hours agoIn cutting out politics, A24 movie 'Civil War' fails viewers – Los Angeles Times

-

Investment21 hours ago

A Once-in-a-Generation Investment Opportunity: 1 Top Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April … – Yahoo Finance