This fall looks like it will present investors with another high-potential opportunity to buy TSX stocks. With all the uncertainty lately, and the second wave of coronavirus looking like it’s hitting the globe harder than the first wave, there is a serious possibility of a second financial crisis.

This is important, because it gives investors another opportunity to buy the highest-quality TSX stocks while they trade for dirt-cheap prices.

There’s no question that the best time to buy stocks is during a market crash. So, investors need to be prepared for whatever comes next. That way, you can take full advantage of the opportunities that arise.

However, it will be crucial that investors can distinguish between a great deal and a value trap. With that in mind, here is a TSX stock you’ll want to make sure to avoid.

TSX stock to avoid

Avoiding certain stocks is crucial for investors for a few reasons. You don’t want to make a bad investment and lose money. In addition, you don’t want to tie up your cash in an underperformer. You’d be missing out on other potentially massive gains.

That’s why I’d caution investors to avoid Rogers (TSX:RCI.B)(NYSE:RCI) for now. There isn’t anything necessarily wrong with Rogers, and a long-term investment will likely still earn you money; it’s just that there are much better choices in the sector.

In fact, of the four major telecom stocks on the TSX, Rogers is the worst choice in the current environment, which is why I would avoid the stock.

In this market environment, it’s crucial investors own only the best of the best. This means leaving behind companies that still have some work to do, such as Rogers.

If it’s stability that you are looking for, then BCE’s massive size and diversification is likely a better choice for you. If it’s growth you’re after, then there’s no better stock to pick in the sector than Shaw Communications. Investors who are looking for a good mix of both should consider Telus.

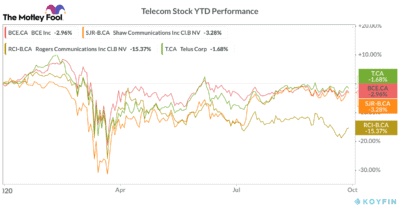

Back in March, I’d cautioned investors to avoid the stock. Since then, it’s the only telecom that’s negative and, on a year-to-date basis, is underperforming its competitors.

As you can see, Rogers has clearly been outperformed by its peers, down over 15% year to date. This is evidence that the market sees more potential out of the other telecom stocks for now.

However, if Rogers does turn it around eventually, look for it to become a great undervalued opportunity. For now, though, I’d avoid the stock.

TSX stock to buy

While Rogers is a stock that’s in a great long-term industry, because it’s not one of the top businesses in that industry at the moment, it’s not worth an investment.

Conversely, companies that may operate in a struggling industry but are leaders in that industry could be worth an investment. This all depends on what the issues are affecting the sector.

If it’s a temporary headwind, such as the coronavirus pandemic, the sector is likely worth an investment. However, if it’s a maturing industry, like newspapers, for example, then it would be best to forgo an investment.

One TSX stock that’s a leader in its struggling industry is Canadian Tire (TSX:CTC.A). Canadian Tire is a diverse retailer in an industry that’s been severely impacted by the pandemic. Even before that, however, many smaller merchandisers have been struggling with the competition from online shopping.

Canadian Tire investors don’t have to worry about that, though. Not only does the company have a fantastic e-commerce platform itself, but many of the goods it sells, consumers prefer to buy in person instead.

Plus, its diverse brands and businesses all complement each other well, and it has helped the company perform relatively well so far, throughout 2020.

Canadian Tire’s quality is the main reason the stock has recovered rapidly. However, if you buy today, you can still lock in its attractive 3.35% dividend, to go along with all the long-term growth potential.

Bottom line

It’s just as important that investors avoid poor TSX stocks as it is to buy the best stocks. So, make sure you do your homework; you wouldn’t want to invest in a dud.

Here is one TSX stocks that’s sure to be a huge winner…

This Tiny TSX Stock Could Be the Next Shopify

One little-known Canadian IPO has doubled in value in a matter of months, and renowned Canadian stock picker Iain Butler sees a potential millionaire-maker in waiting…

Because he thinks this fast-growing company looks a lot like Shopify, a stock Iain officially recommended 3 years ago – before it skyrocketed by 1,211%!

Iain and his team just published a detailed report on this tiny TSX stock. Find out how you can access the NEXT Shopify today!

Click here to discover how!