Business

39 new cases of COVID-19 and one additional death recorded in Alberta – CBC.ca

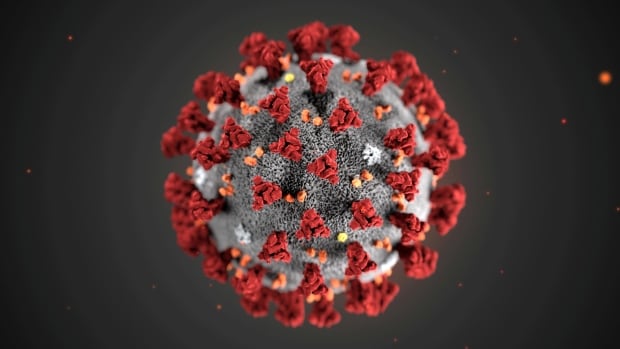

Alberta reported 39 new cases of COVID-19 across the province and one additional death on Monday.

This brings the total number of active cases in Alberta to 1,036, nearly 30 fewer active cases than the province’s last count on Sunday.

The provincial update also said hospitalization rates were still low with just 65 people currently in hospital, nine of them in intensive care. As of Monday, Alberta has seen 6,683 cases of COVID-19 with 5,519 people having recovered from the illness.

The Alberta government reported 3,458 COVID-19 tests were completed in the last 24 hours. As of Monday’s update, 216,536 total tests for the illness have been performed in Alberta.

The latest death was a woman in her 70s at the Intercare Brentwood Care Centre, an assisted living facility in Calgary.

In Alberta’s continuing care facilities, there were 93 active cases of COVID-19 and 596 recovered cases. These facilities have also seen 94 residents die from COVID-19.

There have been a total of 128 deaths in the province from the disease.

A regional breakdown of cases as of Monday shows the impact of COVID-19 in different parts of the province:

- Calgary zone: 836 active, 3,675 recovered

- South zone: 109 active, 1,093 recovered

- Edmonton zone: 58 active cases, 448 recovered

- North zone: 18 active cases, 196 recovered

- Central zone: 10 active cases, 88 recovered

- Unknown: 5 active, 19 recovered

Calgary, which has faced the most cases of COVID-19 in the province since the pandemic began, saw its number of active cases drop by 20 for the second consecutive day of reporting.

The Edmonton, south and central zones also saw slight reductions in active cases in the past 24 hours.

Business

Valero, Chevron Tap Trans Mountain Pipeline for West Coast Crude – OilPrice.com

Valero Energy Corp. and Chevron Corp. have entered the fray of buyers for oil traversing Canada’s expanded Trans Mountain Pipeline system, signaling a potential shift in the West Coast’s oil-sourcing landscape.

Anonymous Bloomberg sources revealed on Friday that these refineries in California are set to receive cargoes of Cold Lake crude, a heavy grade from Canada’s oil sands, loaded onto Aframax tankers out of the Westridge Terminal near Vancouver last June. This development marks the first sales off the expanded pipeline to Western US refiners, following earlier transactions with Asian buyers Sinopec Group and Sinochem Group.

The expanded Trans Mountain Pipeline, slated to commence commercial operations on May 1, has faced a litany of hurdles, including construction delays, cost overruns, and regulatory challenges. Despite yet-to-be-obtained approvals from the Canadian Energy Regulator, the pipeline’s capacity is set to nearly triple to 890,000 bpd, catering to a growing demand for oil transport from Alberta to Canada’s Pacific Coast. This expansion, originally valued at $33 billion, ballooned to $53 billion, reflecting the complexities and uncertainties of large-scale energy infrastructure projects.

While the pipeline expansion promises to open up international markets for Canadian oil producers, tensions have simmered between environmentalists and stakeholders advocating for increased pipeline capacity. The project’s approval sparked protests and political divisions, ultimately prompting the Canadian federal government’s intervention to ensure its realization. However, analysts caution that despite the expanded capacity, rising oil production, particularly from the oil sands, may swiftly fill the available pipeline space, underscoring ongoing challenges in balancing energy demand, environmental concerns, and market dynamics.

Back in February, when Trans Mountain first began filling the expanded pipeline, Canadian crude oil prices jumped to the narrowest discount to WTI since August 2023, eating into what once was cheap Canadian crude oil for U.S. refiners.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Business

Calls for gift cards after Tim Hortons contest mistake | CTV News – CTV News Vancouver

Since moving to B.C. from Colombia to go to university, Marylin Moreno has been a regular at Tim Hortons – and she always scans her app so she can play the iconic Roll Up To Win contest.

“I start to roll to see if I can win something, sometimes I have a coffee or a donut,” said Moreno.

On Wednesday, she got an email from Tim Hortons that stopped her in her tracks. “It said, ‘Congratulations, you’ve won four coffees, one donut, and a boat.’ I was like, a boat! Really?” said Moreno.

The prize was a $55,000 fishing boat and trailer. Shaking, Moreno went to the nearest Tim Hortons.

“And I asked them, is this real? I’m not sure it’s real. And they told me yes, it’s real,” said Moreno, who was told to call customer service and wait for further instructions on claiming her prize.

The let down came in an email hours later. “They said, ‘I’m so sorry, we made a mistake, you didn’t win the boat. Please ignore the email.’ And I went oh, my heart! I can’t believe it,“ said Moreno.

She learned she was among hundreds of Roll Up To Win players across the country who got the same email, congratulating them on winning the boat. In the email explaining the error, Tim Hortons said it was meant to be a simple recap of the contest.

The apology email went on to say: “Unfortunately, some of the prizes that you did not win may have been included in the recap email you received. If this was the case, today’s email does not mean you won those prizes.”

Moreno said she understands humans make mistakes, but pointed out this isn’t the first time. In 2023, some Roll Up To Win players were mistakenly told they won a $10,000 prize.

Lindsey Meredith, an SFU marketing professor emeritus, said the fact it’s now happened twice is troubling.

“If you start to get a bad reputation, collectively it starts to build. It hurts your brand, it hurts your ability to run future promotions, and it certainly can hurt market segments who get really annoyed when that fishing boat just sunk right underneath them,”said Meredith.

Last time, Tims offered $50 gift cards to the customers who were told they won the big prize and didn’t. Moreno said she hasn’t been offered anything.

“I’m waiting for at least something. Make a customer feel better, so OK you make a mistake, at least you give this customer something good, a gift card, something,” Moreno said.

Meredith agrees, saying: “We start to look at what can we do to make that customer happy again, and if that means giving out a lot of coffee cards, get ‘em out, gang. Because you’ve got a problem on your hands, and it’s lot more than a cup of coffee.”

Moreno said she won’t stop going to Tims, and she will continue to play Roll Up To Win, adding “I want to get a free coffee or free donut.”

But if she gets an email saying she won a bigger prize, she won’t get excited. “I don’t trust them,” she said. “It would be hard for me to believe this.”

Business

Bitcoin's latest 'halving' has arrived. Here's what you need to know – Business News – Castanet.net

The “miners” who chisel bitcoins out of complex mathematics are taking a 50% pay cut — effectively reducing new production of the world’s largest cryptocurrency, again.

Bitcoin’s latest “halving” appeared to occur Friday night. Soon after the highly anticipated event, the price of bitcoin held steady at about $63,907.

Now, all eyes are on what will happen down the road. Beyond bitcoin’s long-term price behavior, which relies heavily on other market conditions, experts point to potential impacts on the day-to-day operations of the asset’s miners themselves. But, as with everything in the volatile cryptoverse, the future is hard to predict.

Here’s what you need to know.

WHAT IS BITCOIN HALVING AND WHY DOES IT MATTER?

Bitcoin “halving,” a preprogrammed event that occurs roughly every four years, impacts the production of bitcoin. Miners use farms of noisy, specialized computers to solve convoluted math puzzles; and when they complete one, they get a fixed number of bitcoins as a reward.

Halving does exactly what it sounds like — it cuts that fixed income in half. And when the mining reward falls, so does the number of new bitcoins entering the market. That means the supply of coins available to satisfy demand grows more slowly.

Limited supply is one of bitcoin’s key features. Only 21 million bitcoins will ever exist, and more than 19.5 million of them have already been mined, leaving fewer than 1.5 million left to pull from.

So long as demand remains the same or climbs faster than supply, bitcoin prices should rise as halving limits output. Because of this, some argue that bitcoin can counteract inflation — still, experts stress that future gains are never guaranteed.

HOW OFTEN DOES HALVING OCCUR?

Per bitcoin’s code, halving occurs after the creation of every 210,000 “blocks” — where transactions are recorded — during the mining process.

No calendar dates are set in stone, but that divvies out to roughly once every four years.

WILL HALVING IMPACT BITCOIN’S PRICE?

Only time will tell. Following each of the three previous halvings, the price of bitcoin was mixed in the first few months and wound up significantly higher one year later. But as investors well know, past performance is not an indicator of future results.

“I don’t know how significant we can say halving is just yet,” said Adam Morgan McCarthy, a research analyst at Kaiko. “The sample size of three (previous halvings) isn’t big enough to say ‘It’s going to go up 500% again,’ or something.”

At the time of the last halving in May 2020, for example, bitcoin’s price stood at around $8,602, according to CoinMarketCap — and climbed almost seven-fold to nearly $56,705 by May 2021. Bitcoin prices nearly quadrupled a year after July 2016’s halving and shot up by almost 80 times one year out from bitcoin’s first halving in November 2012. Experts like McCarthy stress that other bullish market conditions contributed to those returns.

Friday’s halving also arrives after a year of steep increases for bitcoin. As of Friday night, bitcoin’s price stood at $63,907 per CoinMarketCap. That’s down from the all-time-high of about $73,750 hit last month, but still double the asset’s price from a year ago.

Much of the credit for bitcoin’s recent rally is given to the early success of a new way to invest in the asset — spot bitcoin ETFs, which were only approved by U.S. regulators in January. A research report from crypto fund manager Bitwise found that these spot ETFs, short for exchange-traded funds, saw $12.1 billion in inflows during the first quarter.

Bitwise senior crypto research analyst Ryan Rasmussen said persistent or growing ETF demand, when paired with the “supply shock” resulting from the coming halving, could help propel bitcoin’s price further.

“We would expect the price of Bitcoin to have a strong performance over the next 12 months,” he said. Rasmussen notes that he’s seen some predict gains reaching as high as $400,000, but the more “consensus estimate” is closer to the $100,000-$175,000 range.

Other experts stress caution, pointing to the possibility the gains have already been realized.

In a Wednesday research note, JPMorgan analysts maintained that they don’t expect to see post-halving price increases because the event “has already been already priced in” — noting that the market is still in overbought conditions per their analysis of bitcoin futures.

WHAT ABOUT MINERS?

Miners, meanwhile, will be challenged with compensating for the reduction in rewards while also keeping operating costs down.

“Even if there’s a slight increase in bitcoin price, (halving) can really impact a miner’s ability to pay bills,” Andrew W. Balthazor, a Miami-based attorney who specializes in digital assets at Holland & Knight, said. “You can’t assume that bitcoin is just going to go to the moon. As your business model, you have to plan for extreme volatility.”

Better-prepared miners have likely laid the groundwork ahead of time, perhaps by increasing energy efficiency or raising new capital. But cracks may arise for less-efficient, struggling firms.

One likely outcome: Consolidation. That’s become increasingly common in the bitcoin mining industry, particularly following a major crypto crash in 2022.

In its recent research report, Bitwise found that total miner revenue slumped one month after each of the three previous halvings. But those figures had rebounded significantly after a full year — thanks to spikes in the price of bitcoin as well as larger miners expanding their operations.

Time will tell how mining companies fare following this latest halving. But Rasmussen is betting that big players will continue to expand and utilize the industry’s technology advances to make operations more efficient.

WHAT ABOUT THE ENVIRONMENT?

Pinpointing definitive data on the environmental impacts directly tied to bitcoin halving is still a bit of a question mark. But it’s no secret that crypto mining consumes a lot of energy overall — and operations relying on pollutive sources have drawn particular concern over the years.

Recent research published by the United Nations University and Earth’s Future journal found that the carbon footprint of 2020-2021 bitcoin mining across 76 nations was equivalent to emissions of burning 84 billion pounds of coal or running 190 natural gas-fired power plants. Coal satisfied the bulk of bitcoin’s electricity demands (45%), followed by natural gas (21%) and hydropower (16%).

Environmental impacts of bitcoin mining boil largely down to the energy source used. Industry analysts have maintained that pushes towards the use of more clean energy have increased in recent years, coinciding with rising calls for climate protections from regulators around the world.

Production pressures could result in miners looking to cut costs. Ahead of the latest halving, JPMorgan cautioned that some bitcoin mining firms may “look to diversify into low energy cost regions” to deploy inefficient mining rigs.

-

Media22 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Investment23 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Real eState15 hours ago

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

-

News21 hours ago

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

-

Business23 hours ago

Gas prices see 'largest single-day jump since early 2022': En-Pro International – Yahoo Canada Finance

-

Business15 hours ago

Dow Jones Rises But S&P, Nasdaq Fall; Nvidia, SMCI Flash Sell Signals As Bitcoin's Fourth Halving Arrives – Investor's Business Daily

-

Media23 hours ago

Three drones downed after explosions heard in Iran’s Isfahan: State media – Al Jazeera English

-

Science20 hours ago

Science20 hours agoMarine plankton could act as alert in mass extinction event: UVic researcher – Langley Advance Times