Earlier this year, on the eve of what would have been the 11th birthday of a historic bull market, stocks started rewriting the history books in the opposite direction. As coronavirus fears gripped the world, huge daily declines piled up, leading to a bear market and an end to what some have called a magical decade.

Since then, market indexes have recovered some lost ground, and now—whether it feels like it or not—stocks are in a new bull market based on the rule-of-thumb definition of having risen 20% from their low without another 20% drop.

Clearly, markets are unsettled and may be for some time, which adds even more urgency to the following question: Do you know how risky your mutual funds or exchange-traded funds are?

For many investors, the honest answer is “probably not.”

U.S. markets “had this magical decade, and that’s pretty rare,” says Meb Faber, chief executive and chief investment officer of Cambria Funds. Now, some market veterans worry that many individual investors aren’t familiar enough with measures of risk to understand when they are flashing red.

Investors define risk in different ways. For some, it’s the market gyrations that make them fearful of staying in the market. For others, it’s the prospect of incurring big losses they won’t be able to recoup before they retire, or otherwise failing to accumulate the nest egg they know they need. Still others want to avoid being stuck in a fund that underperforms its peers and leaves them lagging behind the pack.

“We see lists of top-performing funds everywhere,” says Charlotte Beyer, the founder of the Institute for Private Investors, a networking and educational organization. But what really matters “is how much risk [investors] have to take in order to collect those returns,” she says.

Nailing that down is tougher than it seems, even in an investment world awash in metrics. Just ask the veteran Wall Street strategist Byron Wien, who tried to challenge the concept that “absolute performance is king” nearly a quarter-century ago. His attempt to create a metric that would capture risk-adjusted returns in a single, simple percentage figure (based on research done by Leah Modigliani, with whom he worked at

at the time, and her grandfather, Nobel economics laureate Franco Modigliani) never became mainstream.

So, what’s an investor to do? The simplest answer may be to familiarize yourself with some of the main risk-adjusted measurements available, and determine which is most relevant for your purposes.

1. The Sharpe ratio

This gauge of risk is the granddaddy of them all and is relatively simple, perhaps too much so in the eyes of some experts. Named in honor of its architect, Nobel economics laureate William Sharpe, the ratio measures the additional amount of return a fund or portfolio manager provides per unit of increase in risk. It is calculated by subtracting the rate of return of a risk-free asset (such as U.S. Treasury bills) from the average rate of return of a fund’s portfolio. That amount is then divided by the standard deviation of the fund portfolio’s returns, or the degree to which those returns vary from their mean.

The higher the Sharpe ratio, the better the fund’s manager is doing at delivering lower-risk returns, without incurring the swings that make for great headlines. In other words, the ratio is largely about equating risk with volatility.

One factor that has made the Sharpe ratio the most familiar and widely used measure of risk (you’ll find it quoted on many financial data sites, as well as in mutual-fund disclosure documents) is that it’s easy to grasp that volatility is scary, and thus risky. But some experts take issue with the measure.

“We think [using volatility as a synonym for investment risk] is incomplete at best and dangerous at worst,” says Peter Chiappinelli, portfolio strategist on the asset-management team at GMO LLC, a Boston investment manager.

In 2007, volatility measures would have told you that U.S. equity funds had never been safer, on a risk-adjusted basis. Of course, investors who acted on that data would have lost their shirts in the stock-market bloodbath that led up to and followed the financial crisis of 2008.

“I remember funds that had a [very high] Sharpe ratio that blew up during the crisis,” says Eddy Vataru, a fixed-income investor who manages the San Francisco-based Osterweis Total Return Fund.

2. The Sortino ratio

Mr. Vataru says that downside volatility is more important than overall volatility because it captures the risk that investors will lose money and fail to meet their long-term investment objectives.

It is this kind of “downside risk” that tends to have the greatest impact on an investor’s long-term returns. The greater the probability that a fund takes bigger hits when the market falls, the more likely it is that investors (acting out of fear) will sell at precisely the wrong time.

“We have found that investors have an outsize reaction to losses,” says Amy Arnott, a portfolio strategist at Chicago-based fund tracker

Morningstar Inc.

Enter the Sortino ratio, developed by economist Frank Sortino, the managing director of the Pension Research Institute in Menlo Park, Calif. The Sortino ratio also subtracts the rate of return of a risk-free asset from the average return of a riskier asset, but unlike the Sharpe ratio, it divides the resulting amount by the riskier asset’s downside deviation, or the extent to which its returns fall below what is minimally acceptable to an investor.

This allows investors to compare two portfolios with similar returns, to see which does better at managing risk, especially when markets are volatile or falling. A higher Sortino ratio identifies a portfolio that earns more for every unit of risk that it takes.

If a fund doesn’t do well at capturing the upside either, then the math looks pretty grim. Remember, if your portfolio falls 40%, you’ll need it to generate not 40% but 66.66% just to get back to your starting point.

3. Downside capture

“Downside capture” provides a variation on the Sortino ratio in that it calculates a given fund’s risk-adjusted return as a function of its benchmark, such as the S&P 500 or an MSCI or Russell index. More specifically, it shows whether the fund has lost less than a broad market benchmark during periods of market weakness, and if so, how much less.

Stephen Atkins, portfolio strategist at Polen Capital, prefers to emphasize this raw number.

“This helps me more than either volatility measurements or looking at standard deviations does, in isolation,” he says. “It measures more directly how well the manager does compared to the market.”

Downside-capture ratios are calculated by dividing a fund’s monthly return by the benchmark’s return during the periods the benchmark is in the red. A score of less than 100 indicates that a fund lost less than the benchmark during periods of market weakness. (If a fund generates a positive return when its benchmark declines, the score will be negative.)

A score of less than 100 over the long haul in a variety of markets signals that a fund manager is doing a good job of hanging on to more of the investors’ capital.

#g-IF_RISKchrt_AI2-box.ai2html_export

max-width: 700px;

width:100%;

margin: 0 auto;

.g-aiImg

margin-top: -1.2px;

.g-_valign

margin-top: -2px;

div[class^=”g-_textoutline-white”] text-shadow: -1px -1px 0 #fff, 1px -1px 0 #fff, -1px 1px 0 #fff, 1px 1px 0 #fff;

div[class^=”g-_textshadow-white”] text-shadow: 1px 1px 2px #fff;

div[class^=”g-_textoutline-black”] text-shadow: -1px -1px 0 #000, 1px -1px 0 #000, -1px 1px 0 #000, 1px 1px 0 #000;

div[class^=”g-_textshadow-black”] text-shadow: 1px 1px 2px #000;

div[class^=”g-_textoutline-grey”] text-shadow: -1px -1px 0 #dddddd, 1px -1px 0 #dddddd, -1px 1px 0 #dddddd, 1px 1px 0 #dddddd;

div[class^=”g-_textshadow-grey”] text-shadow: 1px 1px 2px #dddddd;

@media all and (max-width: 585px)

.at4units .ai2html_export

max-width: 355px !important;

@media all and (min-width: 586px) and (max-width: 665px)

.at4units #g-IF_RISKchrt_AI2-box.ai2html_export

max-width: 540px !important;

.at8units #wsj-article-wrap .inline .ai2html_export,

.at8units #wsj-article-wrap .offset .ai2html_export,

.at8units #wsj-article-wrap .bleed .ai2html_export

margin: 0 auto;

max-width: 620px;

#g-IF_RISKchrt_AI2-box .g-artboard

margin:0 auto;

#g-IF_RISKchrt_AI2-box p

margin:0;

.g-aiAbs

position:absolute;

.g-aiImg

display:block;

width:100% !important;

.g-aiSymbol

position: absolute;

box-sizing: border-box;

.g-aiPointText p white-space: nowrap;

#g-IF_RISKchrt_AI2-box tspan

position:relative;

overflow:hidden;

#g-IF_RISKchrt_AI2-box tspan p

font-family:Retina,Helvetica,Arial,sans-serif;

font-weight:300;

font-size:15px;

line-height:20px;

filter:alpha(opacity=100);

-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100);

opacity:1;

letter-spacing:0em;

text-align:left;

color:rgb(51.0000007599592,51.0000007599592,51.0000007599592);

text-transform:none;

padding-bottom:0;

padding-top:0;

mix-blend-mode:normal;

font-style:normal;

height:auto;

position:static;

#g-IF_RISKchrt_AI2-box tspan .g-pstyle0

font-weight:500;

font-size:18px;

#g-IF_RISKchrt_AI2-box tspan .g-pstyle1

font-weight:500;

#g-IF_RISKchrt_AI2-box tspan .g-pstyle2

font-size:13px;

line-height:16px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle3

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:19px;

height:19px;

text-align:right;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle4

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:19px;

height:19px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle5

font-weight:500;

font-size:13px;

line-height:17px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle6

font-size:13px;

line-height:16px;

height:16px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle7

font-style:italic;

font-size:13px;

line-height:17px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle8

font-style:italic;

font-size:13px;

line-height:16px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle9

font-weight:500;

font-size:13px;

line-height:11px;

height:11px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle10

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

text-align:right;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle11

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle12

font-weight:500;

line-height:19px;

padding-bottom:5px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle13

line-height:19px;

padding-bottom:5px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle14

font-size:13px;

line-height:16px;

height:16px;

text-align:right;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle15

font-size:13px;

line-height:17px;

text-align:center;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle16

font-weight:500;

line-height:16px;

height:16px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle17

line-height:16px;

height:16px;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle18

font-weight:500;

font-size:13px;

line-height:16px;

text-align:center;

color:rgb(0,0,0);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle19

font-weight:500;

font-size:9px;

line-height:19px;

height:19px;

text-align:center;

color:rgb(0,121.00000038743,174.000004827976);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle20

font-style:italic;

font-size:13px;

line-height:8px;

height:8px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle21

font-size:13px;

line-height:17px;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-box tspan .g-pstyle22

font-size:13px;

line-height:17px;

color:rgb(102.000001519918,102.000001519918,102.000001519918);

#g-IF_RISKchrt_AI2-_300px

position:relative;

overflow:hidden;

#g-IF_RISKchrt_AI2-_300px p

font-family:Retina,Helvetica,Arial,sans-serif;

font-weight:300;

font-size:15px;

line-height:19px;

filter:alpha(opacity=100);

-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100);

opacity:1;

padding-bottom:0;

letter-spacing:0em;

text-align:left;

color:rgb(0,0,0);

text-transform:none;

padding-top:0;

mix-blend-mode:normal;

font-style:normal;

height:auto;

position:static;

#g-IF_RISKchrt_AI2-_300px .g-pstyle0

font-weight:500;

line-height:20px;

color:rgb(51.0000007599592,51.0000007599592,51.0000007599592);

#g-IF_RISKchrt_AI2-_300px .g-pstyle1

line-height:20px;

color:rgb(51.0000007599592,51.0000007599592,51.0000007599592);

#g-IF_RISKchrt_AI2-_300px .g-pstyle2

font-size:13px;

line-height:16px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle3

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

height:19px;

text-align:right;

#g-IF_RISKchrt_AI2-_300px .g-pstyle4

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

height:19px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle5

font-weight:500;

font-size:13px;

line-height:17px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle6

font-size:13px;

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle7

font-style:italic;

font-size:13px;

line-height:17px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_300px .g-pstyle8

font-style:italic;

font-size:13px;

line-height:16px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_300px .g-pstyle9

font-weight:500;

font-size:13px;

line-height:11px;

height:11px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle10

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

text-align:right;

#g-IF_RISKchrt_AI2-_300px .g-pstyle11

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle12

font-weight:500;

padding-bottom:5px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle13

padding-bottom:5px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle14

font-size:13px;

line-height:16px;

height:16px;

text-align:right;

#g-IF_RISKchrt_AI2-_300px .g-pstyle15

font-size:13px;

line-height:17px;

text-align:center;

#g-IF_RISKchrt_AI2-_300px .g-pstyle16

font-weight:500;

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle17

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_300px .g-pstyle18

font-weight:500;

font-size:13px;

line-height:16px;

text-align:center;

#g-IF_RISKchrt_AI2-_300px .g-pstyle19

font-weight:500;

font-size:9px;

height:19px;

text-align:center;

color:rgb(0,121.00000038743,174.000004827976);

#g-IF_RISKchrt_AI2-_300px .g-pstyle20

font-style:italic;

font-size:13px;

line-height:8px;

height:8px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_540px

position:relative;

overflow:hidden;

#g-IF_RISKchrt_AI2-_540px p

font-family:Retina,Helvetica,Arial,sans-serif;

font-weight:300;

font-size:15px;

line-height:19px;

filter:alpha(opacity=100);

-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100);

opacity:1;

padding-bottom:0;

letter-spacing:0em;

text-align:left;

color:rgb(0,0,0);

text-transform:none;

padding-top:0;

mix-blend-mode:normal;

font-style:normal;

height:auto;

position:static;

#g-IF_RISKchrt_AI2-_540px .g-pstyle0

font-weight:500;

line-height:20px;

color:rgb(51.0000007599592,51.0000007599592,51.0000007599592);

#g-IF_RISKchrt_AI2-_540px .g-pstyle1

line-height:20px;

color:rgb(51.0000007599592,51.0000007599592,51.0000007599592);

#g-IF_RISKchrt_AI2-_540px .g-pstyle2

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

height:19px;

text-align:right;

#g-IF_RISKchrt_AI2-_540px .g-pstyle3

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

height:19px;

#g-IF_RISKchrt_AI2-_540px .g-pstyle4

font-size:13px;

line-height:16px;

height:16px;

text-align:right;

#g-IF_RISKchrt_AI2-_540px .g-pstyle5

font-weight:500;

font-size:13px;

line-height:17px;

height:17px;

#g-IF_RISKchrt_AI2-_540px .g-pstyle6

font-size:13px;

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_540px .g-pstyle7

font-style:italic;

font-size:13px;

line-height:8px;

height:8px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_540px .g-pstyle8

font-style:italic;

font-size:13px;

line-height:16px;

height:16px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_540px .g-pstyle9

font-weight:500;

font-size:13px;

line-height:11px;

height:11px;

#g-IF_RISKchrt_AI2-_540px .g-pstyle10

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

text-align:right;

#g-IF_RISKchrt_AI2-_540px .g-pstyle11

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

#g-IF_RISKchrt_AI2-_540px .g-pstyle12

font-weight:500;

padding-bottom:5px;

#g-IF_RISKchrt_AI2-_540px .g-pstyle13

padding-bottom:5px;

#g-IF_RISKchrt_AI2-_540px .g-pstyle14

font-size:13px;

line-height:16px;

height:16px;

text-align:center;

#g-IF_RISKchrt_AI2-_540px .g-pstyle15

font-weight:500;

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_540px .g-pstyle16

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_620px

position:relative;

overflow:hidden;

#g-IF_RISKchrt_AI2-_620px p

font-family:Retina,Helvetica,Arial,sans-serif;

font-weight:300;

font-size:15px;

line-height:19px;

filter:alpha(opacity=100);

-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100);

opacity:1;

padding-bottom:0;

letter-spacing:0em;

text-align:left;

color:rgb(0,0,0);

text-transform:none;

padding-top:0;

mix-blend-mode:normal;

font-style:normal;

height:auto;

position:static;

#g-IF_RISKchrt_AI2-_620px .g-pstyle0

font-weight:500;

line-height:20px;

color:rgb(51.0000007599592,51.0000007599592,51.0000007599592);

#g-IF_RISKchrt_AI2-_620px .g-pstyle1

line-height:20px;

color:rgb(51.0000007599592,51.0000007599592,51.0000007599592);

#g-IF_RISKchrt_AI2-_620px .g-pstyle2

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

height:19px;

text-align:right;

#g-IF_RISKchrt_AI2-_620px .g-pstyle3

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

height:19px;

#g-IF_RISKchrt_AI2-_620px .g-pstyle4

font-size:13px;

line-height:16px;

height:16px;

text-align:right;

#g-IF_RISKchrt_AI2-_620px .g-pstyle5

font-weight:500;

font-size:13px;

line-height:17px;

height:17px;

#g-IF_RISKchrt_AI2-_620px .g-pstyle6

font-size:13px;

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_620px .g-pstyle7

font-style:italic;

font-size:13px;

line-height:8px;

height:8px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_620px .g-pstyle8

font-style:italic;

font-size:13px;

line-height:16px;

height:16px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_620px .g-pstyle9

font-weight:500;

font-size:13px;

line-height:11px;

height:11px;

#g-IF_RISKchrt_AI2-_620px .g-pstyle10

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

text-align:right;

#g-IF_RISKchrt_AI2-_620px .g-pstyle11

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

#g-IF_RISKchrt_AI2-_620px .g-pstyle12

font-weight:500;

padding-bottom:5px;

#g-IF_RISKchrt_AI2-_620px .g-pstyle13

padding-bottom:5px;

#g-IF_RISKchrt_AI2-_620px .g-pstyle14

font-size:13px;

line-height:16px;

height:16px;

text-align:center;

#g-IF_RISKchrt_AI2-_620px .g-pstyle15

font-weight:500;

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_620px .g-pstyle16

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_700px

position:relative;

overflow:hidden;

#g-IF_RISKchrt_AI2-_700px p

font-family:Retina,Helvetica,Arial,sans-serif;

font-weight:300;

font-size:15px;

line-height:19px;

filter:alpha(opacity=100);

-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100);

opacity:1;

padding-bottom:0;

letter-spacing:0em;

text-align:left;

color:rgb(0,0,0);

text-transform:none;

padding-top:0;

mix-blend-mode:normal;

font-style:normal;

height:auto;

position:static;

#g-IF_RISKchrt_AI2-_700px .g-pstyle0

font-weight:500;

line-height:20px;

color:rgb(51.0000007599592,51.0000007599592,51.0000007599592);

#g-IF_RISKchrt_AI2-_700px .g-pstyle1

line-height:20px;

color:rgb(51.0000007599592,51.0000007599592,51.0000007599592);

#g-IF_RISKchrt_AI2-_700px .g-pstyle2

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

height:19px;

text-align:right;

#g-IF_RISKchrt_AI2-_700px .g-pstyle3

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

height:19px;

#g-IF_RISKchrt_AI2-_700px .g-pstyle4

line-height:16px;

height:16px;

text-align:right;

#g-IF_RISKchrt_AI2-_700px .g-pstyle5

font-weight:500;

line-height:17px;

height:17px;

#g-IF_RISKchrt_AI2-_700px .g-pstyle6

line-height:16px;

height:16px;

#g-IF_RISKchrt_AI2-_700px .g-pstyle7

font-style:italic;

font-size:13px;

line-height:8px;

height:8px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_700px .g-pstyle8

font-weight:500;

font-style:italic;

padding-bottom:5px;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_700px .g-pstyle9

font-weight:500;

line-height:11px;

height:11px;

#g-IF_RISKchrt_AI2-_700px .g-pstyle10

font-style:italic;

font-size:13px;

line-height:16px;

height:16px;

text-align:center;

color:rgb(114.000000804663,114.000000804663,114.000000804663);

#g-IF_RISKchrt_AI2-_700px .g-pstyle11

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

text-align:right;

#g-IF_RISKchrt_AI2-_700px .g-pstyle12

font-family:”Retina Narrow”,Helvetica,Arial,sans-serif;

font-size:13px;

line-height:17px;

height:17px;

#g-IF_RISKchrt_AI2-_700px .g-pstyle13

font-weight:500;

padding-bottom:5px;

#g-IF_RISKchrt_AI2-_700px .g-pstyle14

padding-bottom:5px;

#g-IF_RISKchrt_AI2-_700px .g-pstyle15

line-height:16px;

height:16px;

text-align:center;

#g-IF_RISKchrt_AI2-_700px .g-pstyle16

font-weight:500;

line-height:16px;

height:16px;

Measuring Risk

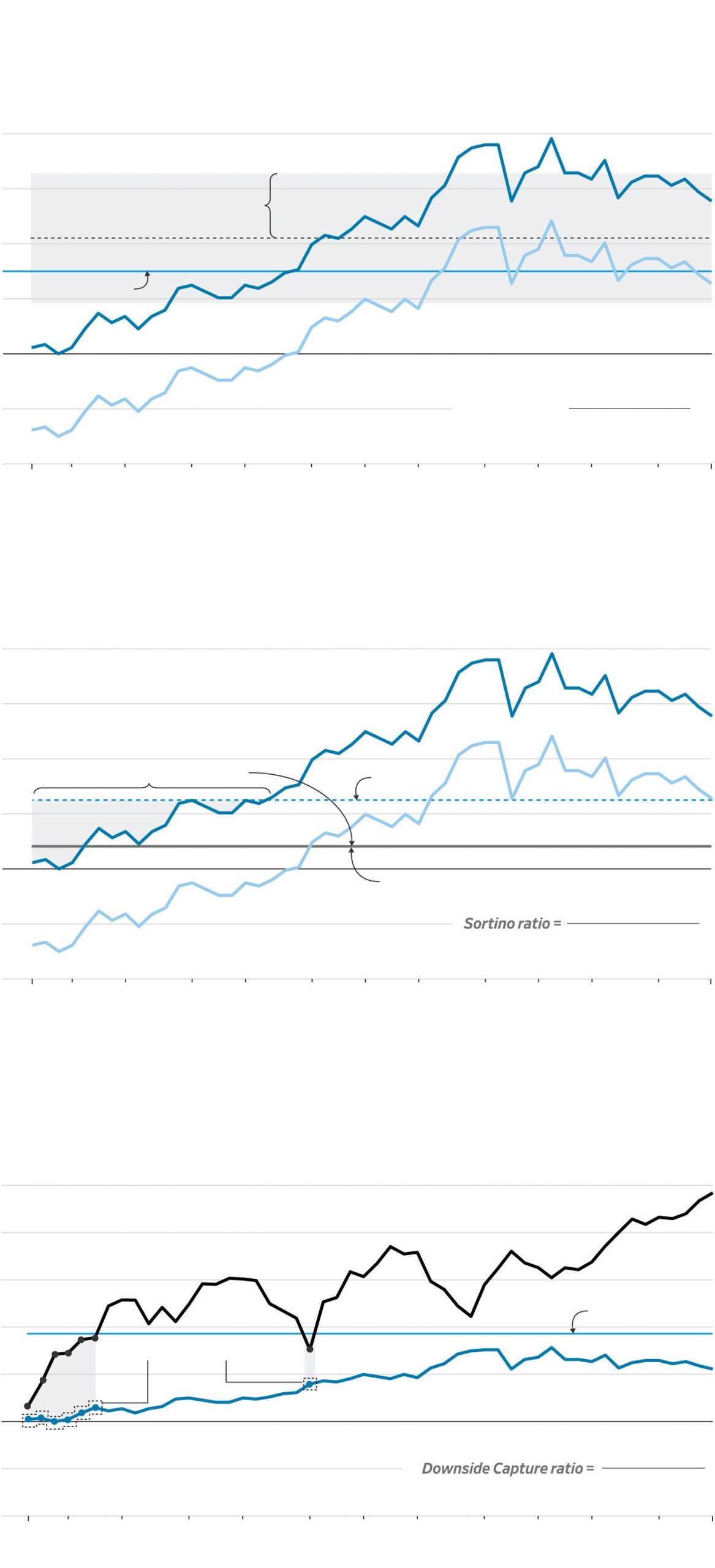

Returns are typcially the primary thing investors look at in an investment. However, risk is another important aspect to consider when investing. But how to calculate risk and what does it show? Below are three main tools (or measures) that investors use to assess risk.

Sharpe Ratio

This measure uses an asset’s volatility to gauge risk. That volatility is expressed in the asset’s standard deviation—a value that describes an average high and low for an asset. The Sharpe ratio then compares the standard deviation with an adjusted return, derived by subtracting a ‘risk-free’ asset like Treasury bonds from the return.

8

%

Pimco Total Return ESG Institutional (PTSAX)

6

Standard deviation

4

Treasury

2

0

Adjusted returns

–2

Sharpe ratio =

Adjusted returns

Standard deviation

–4

Jan.

’20

Jan.

2019

Sortino Ratio

Like the Sharpe ratio, the Sortino ratio uses an adjusted return as part of the equation. It differs from the Sharpe ratio in that it uses the downside deviation instead of the standard deviation. The downside deviation is calculated from the asset’s returns that fall below a minimum acceptable return (MAR).

8

%

PTSAX

6

4

Returns that fall below MAR

MAR

2

0

Downside deviation

Adjusted returns

–2

Downside deviation

Adjusted returns

–4

Jan.

’20

Jan.

2019

Downside Capture

Some investors feel using downside caption is a better assessment of an asset’s risk. With this measure, the investor looks at the points a benchmark (a comparable index) fell below a minimum acceptable return. Using those data points, the investor analyses the corresponding returns for the asset.

25

%

20

DJIA

15

MAR

10

Downside capture

5

0

Downside capture

–5

Index returns

–10

Jan.

’20

Jan.

2019

Sharpe Ratio

This measure uses an asset’s volatility to gauge risk. That volatility is expressed in the asset’s standard deviation—a value that describes an average high and low for an asset. The Sharpe ratio then compares the standard deviation with an adjusted return, derived by subtracting a ‘risk-free’ asset like Treasury bonds from the return.

8

%

Pimco Total Return ESG Institutional (PTSAX)

6

Standard deviation

4

Treasury

2

0

Adjusted returns

–2

Standard deviation

Adjusted returns

–4

Jan.

’20

Jan.

2019

Sortino Ratio

Like the Sharpe ratio, the Sortino ratio uses an adjusted return as part of the equation. It differs from the Sharpe ratio in that it uses the downside deviation instead of the standard deviation. The downside deviation is calculated from the asset’s returns that fall below a minimum acceptable return (MAR).

8

%

PTSAX

6

4

Returns that fall below MAR

MAR

2

0

Downside deviation

Adjusted returns

–2

Downside deviation

Adjusted returns

–4

Jan.

’20

Jan.

2019

Downside Capture

Some investors feel using downside caption is a better assessment of an asset’s risk. With this measure, the investor looks at the points a benchmark (a comparable index) fell below a minimum acceptable return. Using those data points, the investor analyses the corresponding returns for the asset.

25

%

20

DJIA

15

MAR

10

Downside capture

5

0

Downside capture

–5

Index returns

–10

Jan.

’20

Jan.

2019

Sharpe Ratio

This measure uses an asset’s volatility to gauge risk. That volatility is expressed in the asset’s standard deviation—a value that describes an average high and low for an asset. The Sharpe ratio then compares the standard deviation with an adjusted return, derived by subtracting a ‘risk-free’ asset like Treasury bonds from the return.

8

%

Pimco Total Return ESG Institutional (PTSAX)

6

Standard deviation

4

Treasury

2

0

Adjusted returns

–2

Standard deviation

Adjusted returns

–4

Jan.

’20

Jan.

2019

Sortino Ratio

Like the Sharpe ratio, the Sortino ratio uses an adjusted return as part of the equation. It differs from the Sharpe ratio in that it uses the downside deviation instead of the standard deviation. The downside deviation is calculated from the asset’s returns that fall below a minimum acceptable return (MAR).

8

%

PTSAX

6

4

Returns that fall below MAR

MAR

2

0

Downside deviation

Adjusted returns

–2

Downside deviation

Adjusted returns

–4

Jan.

’20

Jan.

2019

Downside Capture

Some investors feel using downside caption is a better assessment of an asset’s risk. With this measure, the investor looks at the points a benchmark (a comparable index) fell below a minimum acceptable return. Using those data points, the investor analyses the corresponding returns for the asset.

25

%

20

DJIA

15

MAR

10

Downside capture

5

0

Downside capture

–5

Index returns

–10

Jan.

’20

Jan.

2019

Sharpe Ratio

This measure uses an asset’s volatility to gauge risk. That volatility is expressed in the asset’s standard deviation—a value that describes an average high and low for an asset. The Sharpe ratio then compares the standard deviation with an adjusted return, derived by subtracting a ‘risk-free’ asset like Treasury bonds from the return.

Pimco Total Return ESG Institutional (PTSAX)

8

%

6

Standard deviation

4

Treasury

2

0

Adjusted returns

–2

Standard deviation

Adjusted returns

–4

Jan.

’20

Jan.

2019

Sortino Ratio

Like the Sharpe ratio, the Sortino ratio uses an adjusted return as part of the equation. It differs from the Sharpe ratio in that it uses the downside deviation instead of the standard deviation. The downside deviation is calculated from the asset’s returns that fall below a minimum acceptable return (MAR).

8

%

PTSAX

6

4

Returns that fall below MAR

2

MAR

Downside deviation

0

Adjusted returns

–2

Downside deviation

Adjusted returns

–4

Jan.

’20

Jan.

2019

Downside Capture

Some investors feel using downside caption is a better assessment of an asset’s risk. With this measure, the investor looks at the points a benchmark (a comparable index) fell below a minimum acceptable return. Using those data points, the investor analyses the corresponding returns for the asset.

25

%

20

DJIA

15

MAR

10

Downside capture

5

0

l

Downside capture

–5

Index returns

–10

Jan.

’20

Jan.

2019

Source: FactSet

John Gould/THE WALL STREET JOURNAL

4. Morningstar risk ratings

While many risk-adjusted returns are quantitative (you end up with a number or ratio, in absolute or relative terms), Morningstar emphasizes other aspects of risk that can’t easily be reduced to a quantitative figure. Yes, Morningstar boils down its results to a rating (from 1 to 5, with 5 being the best), but it also emphasizes whether a fund is “low risk” or “below average” (those that score in the bottom deciles).

Morningstar’s methodology emphasizes the risk that a fund will underperform its benchmark, but goes a step further by comparing how well the fund has fared in volatile or bear markets versus its peers in its category. So, an above-average rating should tell a prospective investor that a particular large-cap growth fund has done a good job of addressing risk relative to, say, the S&P 500, as well as other actively managed large-cap growth funds.

“A lot of risk measures are kind of abstract and hard to visualize,” says Morningstar’s Ms. Arnott. She says Morningstar studies a fund’s underlying holdings and asset allocation, which helps to address some of the flaws in purely quantitative risk-adjusted-return calculations. “You may have a fund that looks like it’s low risk and just hasn’t encountered a bear market,” she says. “Looking at historic trends can be a good starting point, especially if a fund has a longer track record, but it’s really hard to get a complete picture without digging into the portfolio.”

The bottom line, Ms. Arnott says, is to try to find a way to analyze the “underappreciated” risks and their potential impact on returns.

These and other metrics—increasingly easy to locate—can give investors insight into how to balance impressive historic returns against the risk that those gains will evaporate in a bear market or in the midst of turbulence caused by a trade war or fears of a global pandemic. But most market veterans insist that emphasizing any single one in isolation could be just as troublesome as trying to evaluate a single fund or stock in isolation.

“Most investors should primarily be concerned about overall portfolio risk,” says PJ Marinelli, president of RiverGlades Family Offices LLC, a boutique investment adviser in Naples, Fla. For instance, an international fund might look risky when compared with most U.S.-stock funds, given the foreign funds’ relative levels of volatility, but adding a sliver to your portfolio mutes the overall impact of that volatility (and thus the risk) of the individual investment.

It is also important to evaluate risk-adjusted returns during specific historic time periods, such as the financial crisis of 2007 to 2009. Downside-capture calculations can help with this, but given that many funds may not have a 10-year track record, that data may be less readily available. Simply turning to price charts helps, says Mr. Marinelli.

“I’ll look at a fund’s performance during periods when the S&P 500 pulled back to see whether it consistently lost less than the index,” he says. “If it lost more, well, that may warrant more concern or investigation.”

Of course, no measure of risk-adjusted returns can answer the most important question of all: precisely how and when a rally or bull market will come to a screeching halt. But the current market upheaval does provide a great opportunity to talk about the multidimensional nature of risk-adjusted returns.

“Sadly, the easiest way to learn to focus on risk is a correction,” says Mr. Vataru. “You learn from experience rather than education.”

Ms. McGee is a writer in New England. She can be reached at reports@wsj.com.

Share Your Thoughts

How do you think about risk when investing? Join the conversation below.

Copyright ©2019 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8