Article content

When economics professor Joel Bruneau heard the news that BHP Group was pumping $7.5 billion into Saskatchewan’s Jansen potash mine one word came to mind — “sweet.”

“It’s a vote of confidence in the potash industry and the future of potash going forward. (BHP) are not going to make this kind of investment when they think this kind of investment is risky.”

When economics professor Joel Bruneau heard the news that BHP Group was pumping $7.5 billion into Saskatchewan’s Jansen potash mine one word came to mind — “sweet.”

“That is unmitigated good news,” said Bruneau, an associate professor and the department head of economics at the University of Saskatchewan.

The province touted the investment on Tuesday with Premier Scott Moe saying Saskatchewan is set to make an extremely strong economic recovery coming out of the global pandemic which will be bolstered by BHP and the province’s potash sector.

The premier said the Australian mining company BHP Group made the decision “while we were all sleeping last night,” to approve capital investment in the mine, with the goal of extracting potash by 2027.

The mine is expected to produce 4.35 million tonnes of potash annually for up to 100 years. Moe said the cumulative investment from BHP is “the largest private economic investment that our province has ever seen.”

Bruneau said this project will have a significant impact on the province and its potash industry, as the significant sum of money seems to indicate a degree of faith in Saskatchewan potash.

“It’s a vote of confidence in the potash industry and the future of potash going forward. (BHP) are not going to make this kind of investment when they think this kind of investment is risky,” said Bruneau.

The mine was first announced in 2010 and already $5.7 billion has been spent on the project, but, there was some hesitation from the company and its shareholders about the future viability of the site. Shortly after the announcement of the mine east of Saskatoon, the company started digging two, 1,000-metre deep shafts as part of the operation.

Bruneau said uncertainty arose from the cost and viability of the product when the mine finally came online. As for other potash producers in Saskatchewan, Bruneau said this will likely be good news for them as well, as the Jansen mine could serve as a rallying moment for foreign potash capital.

“It’s a vote of confidence in the industry itself,” he said.

The premier remarked upon the future of Saskatchewan as a potash producer as the demand grows for the mineral.

“We have the food, the fuel, the fertilizer that the world does need,” said Moe.

“BHP will join Saskatchewan’s other world-class producers — Mosaic, Nutrien, K+S — who have collectively, over the course of the past 15 years, invested over $20 billion in capital projects right here in Saskatchewan.”

During the conference, the premier emphasized that the potash mined in Saskatchewan is “the most sustainable potash that is produced in the world.”

And as the province charts its recovery coming out of the pandemic, Moe said “we will see potash continue to play an outsized role in Saskatchewan growth over the course of the next decade.”

In a statement from the company Mike Henry, BHP CEO, said investment at the Jansen mine is in line with the company’s strategy “of growing our exposure to future facing commodities.”

The statement went on to say the investment gives the company “increased leverage to key global mega-trends, including rising population, changing diets, decarbonisation and improving environmental stewardship.”

One point stressed by the government during its news conference was the stability offered by investing in Saskatchewan versus other potash-rich regions of the world.

Bronwyn Eyre, minister of energy and resources, mentioned potash-rich Belarus and Russia. Both nations have faced sanctions and both nations, according to Bruneau, offer a degree of uncertainty for mining companies.

“That’s going to kill business with them,” said Bruneau.

As construction starts, Moe said the project will employ some 3,500 people each year. And once the mine is operational, more than 600 people will have full-time jobs. BHP will have corporate offices in Saskatoon. The company also said it aims to have gender parity in its workforce and will aim to have 20 per cent Indigenous representation among its workers.

Another significant detail from the news of the day was that BHP is merging its oil and gas assets with an Australian company that will be the majority shareholder.

While BHP isn’t getting out of the oil and gas realm, their focus on potash and, to a degree, taking a backseat on oil and gas shows Bruneau that the company is looking long into the future.

“Oil and gas, I mean, it just has a more uncertain future,” he said.

The news seems to be flying at us faster all the time. From COVID-19 updates to politics and crime and everything in between, it can be hard to keep up. With that in mind, the Regina Leader-Post has created an Afternoon Headlines newsletter that can be delivered daily to your inbox to help make sure you are up to date with the most vital news of the day. Click here to subscribe.

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in base metal and utility stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 103.40 points at 24,542.48.

In New York, the Dow Jones industrial average was up 192.31 points at 42,932.73. The S&P 500 index was up 7.14 points at 5,822.40, while the Nasdaq composite was down 9.03 points at 18,306.56.

The Canadian dollar traded for 72.61 cents US compared with 72.44 cents US on Tuesday.

The November crude oil contract was down 71 cents at US$69.87 per barrel and the November natural gas contract was down eight cents at US$2.42 per mmBTU.

The December gold contract was up US$7.20 at US$2,686.10 an ounce and the December copper contract was up a penny at US$4.35 a pound.

This report by The Canadian Press was first published Oct. 16, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

TORONTO – Canada’s main stock index was up more than 200 points in late-morning trading, while U.S. stock markets were also headed higher.

The S&P/TSX composite index was up 205.86 points at 24,508.12.

In New York, the Dow Jones industrial average was up 336.62 points at 42,790.74. The S&P 500 index was up 34.19 points at 5,814.24, while the Nasdaq composite was up 60.27 points at 18.342.32.

The Canadian dollar traded for 72.61 cents US compared with 72.71 cents US on Thursday.

The November crude oil contract was down 15 cents at US$75.70 per barrel and the November natural gas contract was down two cents at US$2.65 per mmBTU.

The December gold contract was down US$29.60 at US$2,668.90 an ounce and the December copper contract was up four cents at US$4.47 a pound.

This report by The Canadian Press was first published Oct. 11, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

TORONTO – Canada’s main stock index was little changed in late-morning trading as the financial sector fell, but energy and base metal stocks moved higher.

The S&P/TSX composite index was up 0.05 of a point at 24,224.95.

In New York, the Dow Jones industrial average was down 94.31 points at 42,417.69. The S&P 500 index was down 10.91 points at 5,781.13, while the Nasdaq composite was down 29.59 points at 18,262.03.

The Canadian dollar traded for 72.71 cents US compared with 73.05 cents US on Wednesday.

The November crude oil contract was up US$1.69 at US$74.93 per barrel and the November natural gas contract was up a penny at US$2.67 per mmBTU.

The December gold contract was up US$14.70 at US$2,640.70 an ounce and the December copper contract was up two cents at US$4.42 a pound.

This report by The Canadian Press was first published Oct. 10, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Calmer weather helps contain Oakland, California, fire that forced evacuations

BC NDP, Conservatives in tight fight to the finish, with no clear winner in B.C. election |

Harris raises $633 million in the third quarter but spends heavily in final push

Israel says it will target Hezbollah’s financial arm and begins striking Beirut

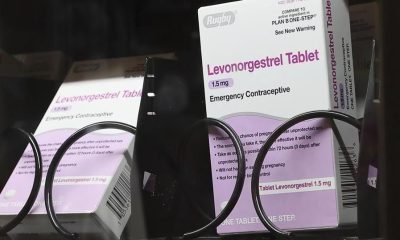

White House says health insurance needs to fully cover condoms, other over-the-counter birth control

Forward Jade Kovacevic is the first player signing announced by Northern Super League

Harris tells Black churchgoers that people must show compassion and respect in their lives

In one portrait, an AP Photographer tells the story of how difficult the job of a miner is