The Transform Technology Summits start October 13th with Low-Code/No Code: Enabling Enterprise Agility. Register now!

IT and workplace decision makers are prioritizing technology solutions that enhance employee experience and engagement despite ongoing budget constraints, according to new research from Teem by iOFFICE.

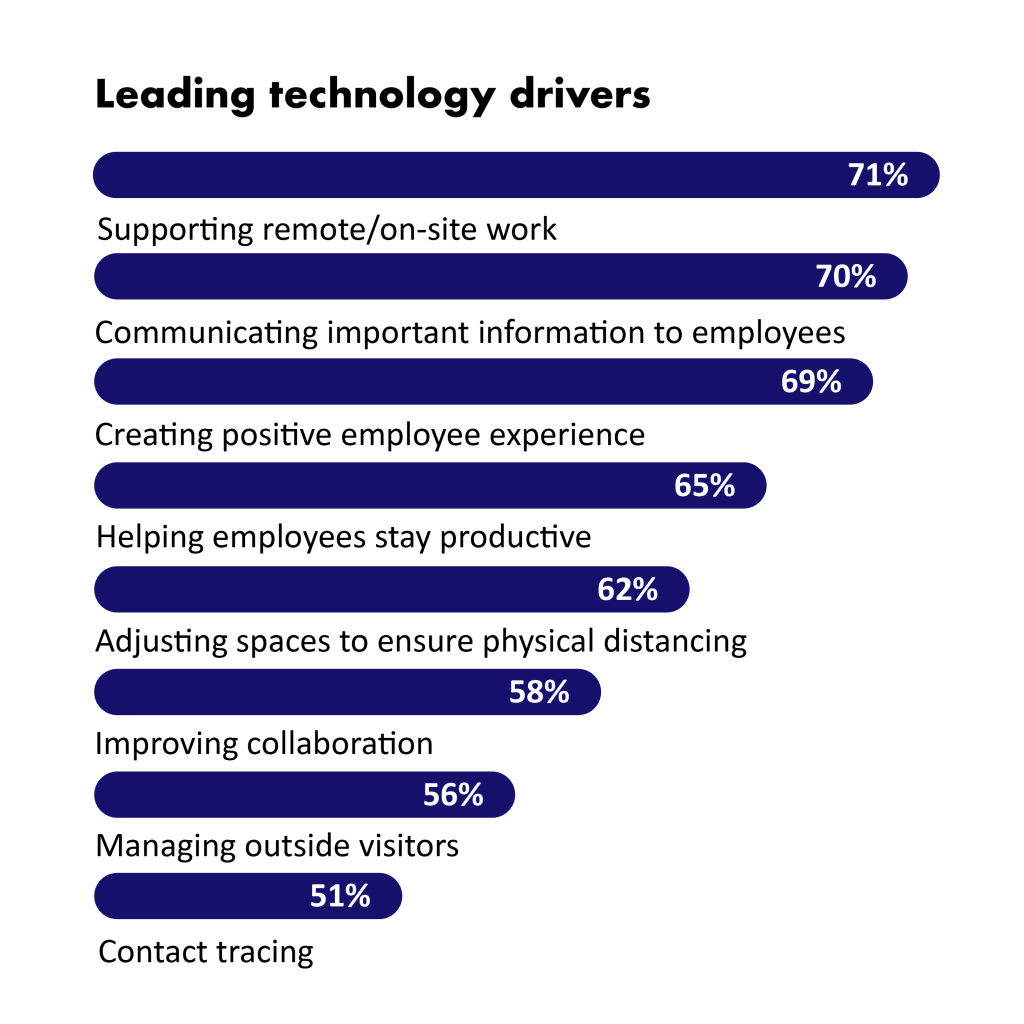

“The State of Workplace Tech” report, which summarizes survey responses from 300 U.S. IT professionals, HR managers, and workplace experience leaders, found that two in three respondents view creating a positive employee experience (69%) and helping employees stay productive (62%) as top technology drivers. Additionally, almost half (42%) reported that they are considering existing or emerging technology to support employee engagement.

The pandemic has brought attention to glaring gaps in workplace experience infrastructure, leading many organizations to accelerate related initiatives and investments. However, 42% of respondents cited cost as a barrier to implementing new workplace technology, while 16% reported a lack of buy-in within their organizations.

Managing an agile work environment, reconfiguring workspaces, and keeping within budget were the top aims cited for evaluating new systems. Above all, businesses indicated that their top criterion for investing in new technology is that it is easy to use.

Unsurprisingly, more than one in three leaders also cited supporting remote/on-site work (71%) and communicating important information to employees (70%) as top drivers for workplace technology investment. Other drivers favored by half of participants included improving employee collaboration and productivity, adjusting spaces to ensure physical distancing, and managing outside visitors.

Workplace leaders also want new solutions that are easy for them to set up and manage. Solutions that require extensive IT hardware, do not integrate well with existing technology, or are difficult to scale can quickly become cumbersome within a growing organization.

When asked what they would most like to change about their existing technology, 30% said they wish it was easier for their people to use. Another 30% wished for better integration with existing software.

The most common themes raised as a result of the pandemic, included network connectivity issues, keeping employees healthy and meeting their needs, onboarding new employees and being short-staffed.

Chad Smith, VP of product strategy at iOFFICE, said: “At such a challenging time, IT leaders continue to face budget limitations, yet they are in a unique position to lead their organizations into the future with technology solutions that improve productivity and collaboration. Learning of the specific challenges they face right now has enabled us to share fresh recommendations to help IT and workplace leaders evaluate workplace technology, justify cost, and demonstrate return on investment.”

Read the full report by iOFFICE.

VentureBeat

VentureBeat’s mission is to be a digital town square for technical decision-makers to gain knowledge about transformative technology and transact.

Our site delivers essential information on data technologies and strategies to guide you as you lead your organizations. We invite you to become a member of our community, to access:

- up-to-date information on the subjects of interest to you

- our newsletters

- gated thought-leader content and discounted access to our prized events, such as Transform 2021: Learn More

- networking features, and more

.article-content .boilerplate-after

background-color: #F5F8FF;

padding: 30px;

border-left: 4px solid #000E31;

line-height: 2em;

margin-top: 20px;

margin-bottom: 20px;

.article-content .membership-link

background-color: #000E31;

color: white;

padding: 10px 30px;

font-family: Roboto, sans-serif;

text-decoration: none;

font-weight: 700;

font-size: 18px;

display: inline-block;

.article-content .membership-link:hover

color: white;

background-color: #0B1A42;

.article-content .boilerplate-after h3

margin-top: 0;

font-weight: 700;

.article-content .boilerplate-after ul li

margin-bottom: 10px;

@media (max-width: 500px)

.article-content .boilerplate-after

padding: 20px;