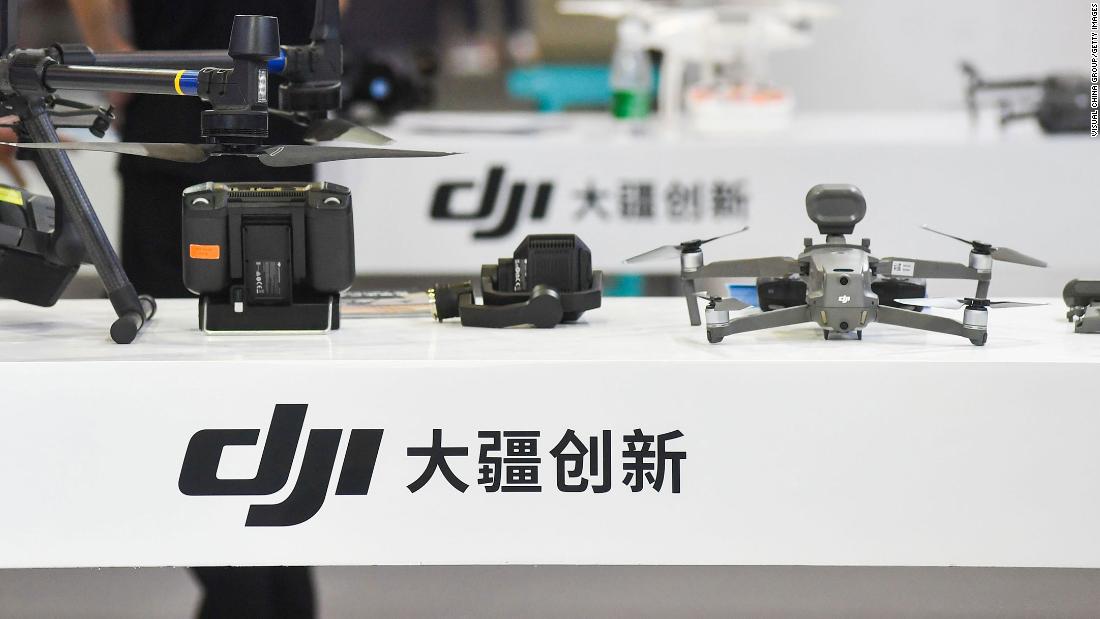

The US Treasury Department announced Thursday

that it has placed investment restrictions on the firms due to their roles in facilitating human rights abuses against China’s Uyghur Muslims in

Xinjiang and other ethnic and religious minorities.

As a result, American investors will be barred from buying or selling shares of the companies.

“Today’s action highlights how private firms in China’s defense and surveillance technology sectors are actively cooperating with the government’s efforts to repress members of ethnic and religious minority groups,” said Brian Nelson, undersecretary for terrorism and financial intelligence. “Treasury remains committed to ensuring that the U.S. financial system and American investors are not supporting these activities.”

DJI and the seven other companies are already on the

US entity list, which means they are barred from buying US products or importing American technology without a special license.

Dozens of Chinese companies and organizations were added to that export blacklist by the US Commerce Department on Thursday, in a bid to limit China’s use of US technologies for military purposes and for alleged human rights violations.

Thursday’s twin announcements came a week after Treasury slapped similar economic sanctions against two Chinese politicians and a Chinese artificial intelligence firm, SenseTime.

The drone maker declined to comment ahead of the US Treasury’s announcement on Wednesday. Instead, it referred CNN Business to a previous statement made in response to earlier restrictions last December, when it said it had “done nothing to justify being placed on the entity list.”

DJI added at the time that it was also “evaluating options to ensure our customers, partners, and suppliers are treated fairly,” without elaborating further. It declined to provide an update or comment on those plans this week.

Washington’s latest clampdown could create financing headaches for the upstart drone maker, which is privately held and headquartered in Shenzhen.

DJI currently counts Silicon Valley heavyweights such as Sequoia Capital China and

Kleiner Perkins as investors. Sequoia Capital China declined to comment and Kleiner Perkins did not respond to a request for comment on whether the restriction would complicate their investments.

But according to a person familiar with the matter, Sequoia’s investment in DJI is handled by Sequoia Capital China, which operates as a separate legal entity from the US firm.

That means it would likely not be impacted by any restriction barring American investment in DJI, the person said.

Turning up the heat

Washington has been piling pressure on Chinese companies recently.

Last Friday, artificial intelligence startup SenseTime

was also hit by the same US Treasury blacklist as DJI, two years after one of its subsidiaries was put on the

entity list in 2019.

Similarly, the Treasury Department said that the decision to block SenseTime was due to the role its technology allegedly played in enabling human rights abuses against the Uyghurs and other Muslim minorities in Xinjiang.

SenseTime has strongly denied the accusations. But on Monday, the company

postponed its stock market debut in Hong Kong, where it was set to start trading as soon as this week.

The firm said the delay was “to safeguard the interests of the potential investors of the company,” and allow them to “consider the potential impact of” the US move on any investments.

Separately, the FT reported earlier this week that US officials were deliberating whether to stiffen rules about selling to one of China’s top chipmakers. No action was taken Thursday, however.

The company, Semiconductor Manufacturing International Corp (SMIC), has been on the US entity list

since last year. But “the decision included a provision that critics said created a loophole that some companies had exploited,” according to the FT.

SMIC did not respond to a request for comment.

However, since it was put on the entity list, “the company has faced tremendous challenges in production and operations,” SMIC’s acting chairman and chief financial officer, Gao Yonggang,

said last month.

Separately, last year the US Department of Defense also added the firm to a list of companies the agency claims are owned or controlled by the Chinese military. That decision means Americans are banned from investing in SMIC.

China’s Foreign Ministry criticized the United States on Wednesday after reports of Washington’s planned crackdown.

At a briefing, spokesperson Zhao Lijian called on the Biden administration to stop “politicizing” technological and economic issues by “generalizing the concept of national security.”

“Stop abusing state power to unreasonably oppress specific sectors and enterprises of China,” Zhao said, warning that sanctions on companies such as DJI would threaten global industrial and supply chains, and undermine international trade rules.

“China will, as always, firmly defend the legitimate rights and interests of Chinese companies,” he added.

— CNN’s Beijing bureau and Jill Disis contributed to this report.