Municipalities should rezone broadly to allow more density and Canada should temporarily ban foreign buyers to help alleviate the housing affordability crunch faced by residents, the country’s housing minister said on Tuesday.

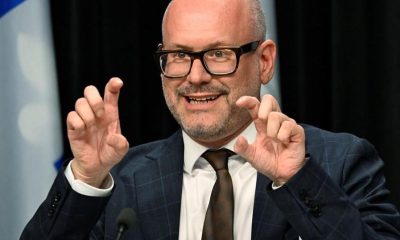

Ahmed Hussen told Reuters in an interview that housing should be for Canadians to live in, not passive foreign investment, and that he backs Canadian cities implementing density measures like those recently rolled out in New Zealand, which allow up to three homes to be built on most single-family lots.

“I support that,” he said. “That’s one of the ways to easily increase housing supply by using the same land for single-family dwelling and creating more units.”

“Any measure that increases the housing supply, that intensifies the use of land, that builds more housing and that frees up more housing on the same amount of land, is a good thing,” he added.

Canada is grappling with a national housing crisis, as surging demand tied to the COVID-19 pandemic has sprawled beyond big cities and into smaller centers, which are unable to keep up with supply.

A typical home in Canada now costs C$780,400 ($603,791), up 25.3% this year and by 81.4% since November 2015, when Prime Minister Justin Trudeau’s Liberals took power. Home price gains in smaller centers have outpaced those in large cities during the pandemic.

Trudeau, who won his third term in September, has promised new measures to improve housing affordability, including a temporary ban on foreign buyers and 1.4 million new or refurbished homes over four years.

Hussen said he supports the foreign buyer ban, but did not provide any details on how and when it would be implemented, deferring to Finance Minister Chrystia Freeland.

Hussen noted a 1% tax on foreign-owned vacant or underused real estate would take effect on Jan. 1 and said the Liberal government is working hard to get other taxes, like an anti-flipping tax, in place as soon as possible.

“This will enable us to reduce the speculative demand in the marketplace. It’ll help cool excessive price growth,” he said.

Canada has limited statistics on foreign ownership of housing. In 2019, 4.3% of homes in Vancouver were owned by non-residents of Canada, jumping to 13.6% for newer condos, official data shows. In Toronto, 7.7% of newer condos are owned by non-residents.

RENT-TO-OWN

Hussen said consultation work has already begun on designing a rent-to-own program, which will help renters buy their first home. The Liberals also promised a tax-free down-payment savings program for first-time buyers.

Those two measures alone will cost taxpayers C$4.2 billion over four years, according to Trudeau’s election platform. They have not been officially budgeted as yet.

But critics worry first-time buyer supports will drive up home prices, unless coupled with measures to tamp down demand. Hussen will study measures like larger down payments for investor owners, but gave no timeline for completing that work.

“This has been dealt with by other countries,” he said. “And it’ll be interesting to see what are some of these measures that they implemented and what results have they had.”

New Zealand tightened mortgage lending requirements for investors this year in an attempt to slow rapid price escalation. In October, the country moved to rezone broadly to allow more housing density.

($1 = 1.2925 Canadian dollars)

(Reporting by Julie Gordon in Ottawa; Editing by Peter Cooney)

Related