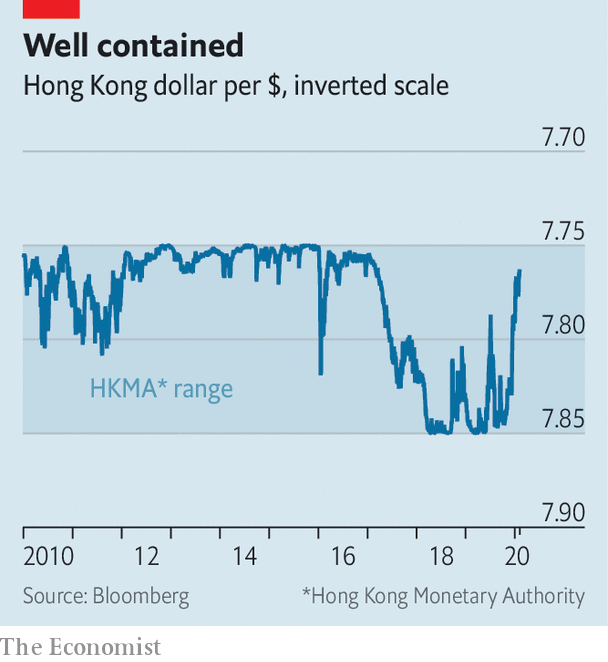

In other economies rocked by the virus, such as mainland China, Thailand and Singapore, the central bank has let the currency depreciate, easing financial conditions. But Hong Kong is different. Its currency has been tied to the American dollar since 1983 and confined to a narrow trading band of HK$7.75–7.85 to the dollar since 2005. If it falls to the weak side, the Hong Kong Monetary Authority (HKMA) is obliged to sell as many American dollars as people want to buy for HK$7.85. That has stopped the currency falling further (see chart).

Economy

Just how stable is Hong Kong’s economy? – The Economist

“I WANTED TRAVELLERS to arrive and know exactly which city they were in,” wrote Andrew Bromberg, an architect, to explain his design for West Kowloon station, where high-speed trains arrive in Hong Kong from mainland China. The platforms are deep underground, but passengers can enjoy the city’s skyline through 4,000 glass panes suspended from the station’s tilted roof. The more adventurous can go up to the rooftop for a better view.

But not anymore. The station and its rooftop are cordoned off. Four of the 21 people in Hong Kong that have been infected with the Wuhan coronavirus arrived in the city by high-speed rail. The station has now been closed, alongside ten of the other 13 entry points from the mainland.

These closures may or may not slow the spread of the disease. But they will certainly hamper an economy already debilitated by months of fierce anti-government protests. Figures released on February 3rd showed that GDP shrank by 2.9% year-on-year in the last quarter of 2019, when the protests reached a peak. Worse may be to come. Analysts at UBS, a bank, expect a fall of over 6% in the first quarter of this year compared with the same period last year.

But will it always do so? Even before the protests erupted or the virus mutated, some observers began to wonder if the peg would endure. According to Hong Kong’s mini-constitution, its autonomy and even the existence of its own currency is guaranteed only until 2047, which is within the duration of a 30-year mortgage. Hong Kong, many fear, is destined to become just another Chinese city—and they do not have their own currencies. Even if it remains semi-detached politically, its economy is increasingly attached to China’s. Why should its financial conditions remain tethered to America’s?

In the forward-looking world of financial markets, that question leads naturally to another: if Hong Kong’s currency regime is destined to change some day, how hard would Hong Kong fight for it today, if the markets tested its will? Such a test is not too hard to envisage. In December, property prices fell by 1.7%, compared with the previous month, and are now almost 5% below their peak. If those falls gained momentum, speculative capital might quit the market and the city. A collapse in property prices would also test the banking system. Its assets are worth 845% of Hong Kong’s GDP (although only 30% of its total loans are spent on Hong Kong property development or home purchases). And many of the deposits on the other side of its balance-sheet are held by non-residents, who might prove flighty in a crisis.

According to its defenders, Hong Kong’s currency peg is “virtually impregnable”. The HKMA’s foreign-exchange reserves amount to $440bn, twice as much as the money supply, narrowly defined to include banknotes and the banks’ claims on the monetary authority. The banks would run out of Hong Kong dollars before it ran out of American ones.

Why then is it only “virtually” impregnable? For one thing, there are broader definitions of money supply. A war chest of $440bn may be large compared with banks’ deposits at the HKMA. But it is small compared with customers’ deposits with banks (HK$6.9trn, equivalent to $880bn). If every depositor wanted to convert their holdings into American dollars, there would not be enough to go around.

Such conversions would also have broader economic implications. Every Hong Kong dollar sold to the monetary authority disappears. All else equal, it then becomes dearer for the banks to borrow the diminishing number of Hong Kong dollars that remain. These high interest rates make holding the currency more lucrative and short-selling it more costly. But insofar as households and firms still need to borrow in Hong Kong dollars, these high interest rates also hurt the economy. How much pain would Hong Kong be willing to take?

The peg’s downfall may be imaginable. But is it probable? One place to look is the options market, where investors can hedge against the risk of the currency moving outside the band. For about 40% of the period from June 2005 to July 2018, option prices implied that the odds of the peg breaking were above 10%, suggests a recent study by Samuel Drapeau, Tan Wang and Tao Wang of Shanghai Jiao Tong University. But for most of that time markets were betting on the currency strengthening past HK$7.75 to the dollar, not weakening past HK$7.85.

Bearish bets became more popular last year during the worst of the protests. But the speculation was not as fierce as it had been in 2016, after China clumsily devalued the yuan. Capital outflows picked up in the third quarter of last year, diminishing Hong Kong’s foreign-exchange reserves. But reserves have stabilised since, helped by a truce in the trade war between America and China. Hong-Kong dollar deposits are lower than they were six months ago, but still higher than they were a year ago.

Any signs of sustained capital outflows are, then, “embryonic”, says Alicia Garcia Herrero of Natixis, a bank. If capital is leaving, its speed of departure is reminiscent of one of Hong Kong’s quaint trams, not one of its bullet trains.■

This article appeared in the Finance and economics section of the print edition under the headline “Just how stable is Hong Kong’s economy?”

Economy

Liberals announce expansion to mortgage eligibility, draft rights for renters, buyers

OTTAWA – Finance Minister Chrystia Freeland says the government is making some changes to mortgage rules to help more Canadians to purchase their first home.

She says the changes will come into force in December and better reflect the housing market.

The price cap for insured mortgages will be boosted for the first time since 2012, moving to $1.5 million from $1 million, to allow more people to qualify for a mortgage with less than a 20 per cent down payment.

The government will also expand its 30-year mortgage amortization to include first-time homebuyers buying any type of home, as well as anybody buying a newly built home.

On Aug. 1 eligibility for the 30-year amortization was changed to include first-time buyers purchasing a newly-built home.

Justice Minister Arif Virani is also releasing drafts for a bill of rights for renters as well as one for homebuyers, both of which the government promised five months ago.

Virani says the government intends to work with provinces to prevent practices like renovictions, where landowners evict tenants and make minimal renovations and then seek higher rents.

The government touts today’s announced measures as the “boldest mortgage reforms in decades,” and it comes after a year of criticism over high housing costs.

The Liberals have been slumping in the polls for months, including among younger adults who say not being able to afford a house is one of their key concerns.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

Economy

Statistics Canada says manufacturing sales up 1.4% in July at $71B

OTTAWA – Statistics Canada says manufacturing sales rose 1.4 per cent to $71 billion in July, helped by higher sales in the petroleum and coal and chemical product subsectors.

The increase followed a 1.7 per cent decrease in June.

The agency says sales in the petroleum and coal product subsector gained 6.7 per cent to total $8.6 billion in July as most refineries sold more, helped by higher prices and demand.

Chemical product sales rose 5.3 per cent to $5.6 billion in July, boosted by increased sales of pharmaceutical and medicine products.

Sales of wood products fell 4.8 per cent for the month to $2.9 billion, the lowest level since May 2023.

In constant dollar terms, overall manufacturing sales rose 0.9 per cent in July.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

Economy

S&P/TSX gains almost 100 points, U.S. markets also higher ahead of rate decision

TORONTO – Strength in the base metal and technology sectors helped Canada’s main stock index gain almost 100 points on Friday, while U.S. stock markets climbed to their best week of the year.

“It’s been almost a complete opposite or retracement of what we saw last week,” said Philip Petursson, chief investment strategist at IG Wealth Management.

In New York, the Dow Jones industrial average was up 297.01 points at 41,393.78. The S&P 500 index was up 30.26 points at 5,626.02, while the Nasdaq composite was up 114.30 points at 17,683.98.

The S&P/TSX composite index closed up 93.51 points at 23,568.65.

While last week saw a “healthy” pullback on weaker economic data, this week investors appeared to be buying the dip and hoping the central bank “comes to the rescue,” said Petursson.

Next week, the U.S. Federal Reserve is widely expected to cut its key interest rate for the first time in several years after it significantly hiked it to fight inflation.

But the magnitude of that first cut has been the subject of debate, and the market appears split on whether the cut will be a quarter of a percentage point or a larger half-point reduction.

Petursson thinks it’s clear the smaller cut is coming. Economic data recently hasn’t been great, but it hasn’t been that bad either, he said — and inflation may have come down significantly, but it’s not defeated just yet.

“I think they’re going to be very steady,” he said, with one small cut at each of their three decisions scheduled for the rest of 2024, and more into 2025.

“I don’t think there’s a sense of urgency on the part of the Fed that they have to do something immediately.

A larger cut could also send the wrong message to the markets, added Petursson: that the Fed made a mistake in waiting this long to cut, or that it’s seeing concerning signs in the economy.

It would also be “counter to what they’ve signaled,” he said.

More important than the cut — other than the new tone it sets — will be what Fed chair Jerome Powell has to say, according to Petursson.

“That’s going to be more important than the size of the cut itself,” he said.

In Canada, where the central bank has already cut three times, Petursson expects two more before the year is through.

“Here, the labour situation is worse than what we see in the United States,” he said.

The Canadian dollar traded for 73.61 cents US compared with 73.58 cents US on Thursday.

The October crude oil contract was down 32 cents at US$68.65 per barrel and the October natural gas contract was down five cents at US$2.31 per mmBTU.

The December gold contract was up US$30.10 at US$2,610.70 an ounce and the December copper contract was up four cents US$4.24 a pound.

— With files from The Associated Press

This report by The Canadian Press was first published Sept. 13, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

Sports51 mins ago

Sports51 mins agoPenguins re-sign Crosby to two-year extension that runs through 2026-27 season

-

Politics4 hours ago

Politics4 hours agoNext phase of federal foreign interference inquiry to begin today in Ottawa

-

News4 hours ago

News4 hours agoOntario considers further expanding pharmacists’ scope to include more minor ailments

-

News4 hours ago

News4 hours agoFeds wary of back-to-work legislation despite employer demands: labour experts

-

News4 hours ago

News4 hours agoVoters head to the polls for byelections in Montreal and Winnipeg

-

Economy3 hours ago

Economy3 hours agoStatistics Canada says manufacturing sales up 1.4% in July at $71B

-

Real eState4 hours ago

Real eState4 hours agoNational housing market in ‘holding pattern’ as buyers patient for lower rates: CREA

-

Sports12 hours ago

Sports12 hours agoSlovenia’s Tadej Pogacar wins Grand Prix Cycliste de Montreal