Premier John Horgan unveiled Thursday the largest reforms to auto insurance since the creation of the Insurance Corp. of B.C. more than four decades ago, as his government struggles to stop continuing financial losses at ICBC.

Business

B.C. to cut ICBC rates 20 per cent and switch to 'no-fault' insurance – Vancouver Sun

VICTORIA – B.C. motorists are about to see a dramatic change to their auto insurance, as well as a 20 per cent cut to their premiums next year, under a new no-fault system announced by the B.C. government.

Premier John Horgan unveiled Thursday the largest reforms to auto insurance since the creation of the Insurance Corp. of B.C. more than four decades ago, as his government struggles to stop continuing financial losses at ICBC.

No-fault insurance will mean people involved in vehicle crashes can no longer sue each other for damages — except in cases involving court convictions for offences like negligence, street racing, impaired driving, as well as in cases of faulty manufacturing, botched repairs and the over-service of alcohol by a business.

Instead, people will receive benefits, payments for medical treatment and compensation directly from ICBC, using amounts set by the province depending on the type of injury.

“It’s time for change at ICBC,” said Horgan.

“A 20 per cent decrease in rates in the years ahead is a symbol to the people of British Columbia that we are going to wrestle this problem to the ground.”

The switch will upend B.C.’s litigation-based insurance model, in the process saving ICBC an estimated $1.5 billion annually in legal fees that the NDP government pledged will be redirected to cut rates, boost treatment benefits and quicken response times for claims.

“You shouldn’t need a lawyer to access the benefits you’ve paid for,” said Attorney General David Eby.

“The current auto insurance system in British Columbia simply doesn’t work.”

The government will introduce enabling legislation in the spring session of the legislature, which starts next week. But the no-fault system won’t come in until May 1, 2021 – just five months before the scheduled provincial election.

In the meantime, ICBC’s basic rates will not increase in 2020, the government revealed Thursday.

In 2021, when no-fault takes effect, basic and optional rates will be reduced an average of 20 per cent, saving motorists on average $400 a year, said Eby.

Had the government not made the change, rates would have risen 36 per cent over the next five years, adding an average of $650 million to an annual insurance package, according to government estimates.

A B.C. government chart outlining the estimated savings for motorists under the new no-fault insurance system.

The cuts to premiums come after ICBC redesigned its rate risk structure in 2018, leading to savings for some motorists but steep hikes for inexperienced drivers and youth. Government figures appear to show the rate cut in 2021 would save a Burnaby driver with one year’s experience as much as $1,570 annually on basic and optional insurance.

Eby admitted it sounds “too good to be true” that B.C. will move to a model that boosts benefits and cuts premiums. But he pointed to other provinces like Manitoba and Saskatchewan as already operating such systems.

“It’s only because we see it actually being delivered in two other province that we believe we can do it,” he said.

The new no-fault system will boost the maximum lifetime care benefits an injured person could receive from $300,000 to $7.5 million, with the additional promise that more funding will be available for visits to physiotherapists, chiropractors, counsellors and other recovery services.

For example, the amount ICBC will pay in lost wages is set to increase to $1,200 a week under no-fault, compared to $740 a week set in 2019 and only $300 a week before that. People who earn more than that amount can choose to purchase additional optional insurance for extra wage benefits.

A person’s doctor, not ICBC, will decide what recovery treatments are needed and for how long, according to the province.

In another scenario, involving an injured child, ICBC said no-fault would provide new up-front permanent care aides worth $10,000 a month, homemaking costs, missed school compensation of up to $20,000 a year and recreational benefits that would under the current system require a lawsuit and court awarded judgement.

The government says the benefits will be available for as long as a person needs, meaning funding for care aides and supports for more seriously injured victims could be sustained for a person’s entire lifetime and not, under the current system, simply involve a one-time lump sum payment in court that must be rationed by the victim for future years and can’t be re-litigated.

Money for pain and suffering will be eliminated for minor injuries, but for major injuries cash compensation will bet set by categories of benefits with maximum amounts set by ICBC, according to government. Repairs to vehicles will still be handled by auto adjustors with traditional damage assessments.

The model virtually eliminates the role of personal injury lawyers, who typically take one-third of the total amount awarded in a settlement and represent a powerful lobby group that continues to fight government reforms. They have argued a no-fault system would leave the most vulnerable victims, with the most catastrophic injuries, alone to face ICBC without legal help.

The Trial Lawyers Association responded on social media by saying that the change puts the rights of injured and vulnerable British Columbians “at grave risk.”

Eliminating costly legal fees is key to driving down the premiums, said Eby, though he acknowledged the change will be aggressively challenged by trial lawyers.

The only time an injured person will still be able to sue for compensation under the new no-fault model will be if the at-fault driver is convicted of intoxication, dangerous driving or other criminal negligence.

Disputes on settlements will be handled by the civil resolution tribunal, a retooled ICBC fairness commissioner and the provincial ombudsperson, though drivers can also go to court for a judicial review of decisions.

Although the system is called no-fault insurance, government officials who briefed the media Thursday said ICBC will continue to determine fault in crashes for the purpose of penalizing the at-fault driver with higher insurance premiums based on their crash history. However, everyone involved in a crash, regardless of fault, will have access to the same medical benefits – which for an at-fault driver means new care for things like permanent impairment.

Drivers will still be able to choose their deductible levels under no-fault, and purchase additional optional insurance from either ICBC or private providers — though optional insurance will mainly cover the areas of collision, comprehensive and travel outside of B.C.

Despite having a monopoly on basic rates, ICBC lost $2.5 billion over the past two years and is struggling to return to break-even status this year. It has blamed rising claims costs, as well as legal fees that amount to $700 million annually or one-quarter of all its expenditures.

B.C. had for years been the last province in the country to allow a purely litigation-based insurance model, called the tort system. It took a step toward reform last year with a $5,500 cap on pain and suffering costs in minor injury cases that is currently being challenged in court by the Trial Lawyers Association.

B.C.’s new no-fault system appears to align most closely with the structure of Manitoba, but with a more lucrative benefit maximum that compares to Saskatchewan’s levels.

In Manitoba, the Crown automobile insurer with control of compulsory basic insurance has had no-fault in place since 1993. Manitoba’s auto insurance premiums have risen 24 per cent since 2001, compared to more than 60 per cent in B.C. during the same time. Manitoba is dropping rates by almost one per cent in 2020.

In Saskatchewan, rates have not increased during the past five years and the province recorded the lowest number of road fatalities in its history in 2019.

However, B.C. did not copy Saskatchewan’s hybrid model for no-fault, in which motorists can opt-out and pay to the retain the right to sue. It also chose not to follow Ontario’s partial no-fault system, in which legal action is still allowed if your injuries are severe — a loss of a limb, spinal cord damage, blindness, and traumatic brain injury, among others. Ontario also has a fully private marketplace, with no government role in selling insurance.

Although the announcement of a new no-fault system took up much of Thursday’s announcement, Eby also revealed the province has retooled its efforts to cut down the number of expert reports used in court cases before the no-fault system comes into effect in 2021. Its first attempt to set caps on reports last year was overturned by the BC Supreme Court as an inappropriate infringement on judicial independence.

The government will amend the Evidence Act to set a limit of three medical expert reports per case, though leave it up to judicial discretion whether to allow more. The amount ICBC will pay per report will also be capped at $3,000 and no more than five per cent of the total settlement disbursement.

Some of those expert report case limits will apply to the 90,000 claims still on books at ICBC from before 2018’s minor injury cap, which accounts for as much as $10 billion in unsettled liabilities.

Business

Roots sees room for expansion in activewear, reports $5.2M Q2 loss and sales drop

TORONTO – Roots Corp. may have built its brand on all things comfy and cosy, but its CEO says activewear is now “really becoming a core part” of the brand.

The category, which at Roots spans leggings, tracksuits, sports bras and bike shorts, has seen such sustained double-digit growth that Meghan Roach plans to make it a key part of the business’ future.

“It’s an area … you will see us continue to expand upon,” she told analysts on a Friday call.

The Toronto-based retailer’s push into activewear has taken shape over many years and included several turns as the official designer and supplier of Team Canada’s Olympic uniform.

But consumers have had plenty of choice when it comes to workout gear and other apparel suited to their sporting needs. On top of the slew of athletic brands like Nike and Adidas, shoppers have also gravitated toward Lululemon Athletica Inc., Alo and Vuori, ramping up competition in the activewear category.

Roach feels Roots’ toehold in the category stems from the fit, feel and following its merchandise has cultivated.

“Our product really resonates with (shoppers) because you can wear it through multiple different use cases and occasions,” she said.

“We’ve been seeing customers come back again and again for some of these core products in our activewear collection.”

Her remarks came the same day as Roots revealed it lost $5.2 million in its latest quarter compared with a loss of $5.3 million in the same quarter last year.

The company said the second-quarter loss amounted to 13 cents per diluted share for the quarter ended Aug. 3, the same as a year earlier.

In presenting the results, Roach reminded analysts that the first half of the year is usually “seasonally small,” representing just 30 per cent of the company’s annual sales.

Sales for the second quarter totalled $47.7 million, down from $49.4 million in the same quarter last year.

The move lower came as direct-to-consumer sales amounted to $36.4 million, down from $37.1 million a year earlier, as comparable sales edged down 0.2 per cent.

The numbers reflect the fact that Roots continued to grapple with inventory challenges in the company’s Cooper fleece line that first cropped up in its previous quarter.

Roots recently began to use artificial intelligence to assist with daily inventory replenishments and said more tools helping with allocation will go live in the next quarter.

Beyond that time period, the company intends to keep exploring AI and renovate more of its stores.

It will also re-evaluate its design ranks.

Roots announced Friday that chief product officer Karuna Scheinfeld has stepped down.

Rather than fill the role, the company plans to hire senior level design talent with international experience in the outdoor and activewear sectors who will take on tasks previously done by the chief product officer.

This report by The Canadian Press was first published Sept. 13, 2024.

Companies in this story: (TSX:ROOT)

The Canadian Press. All rights reserved.

Business

Talks on today over HandyDART strike affecting vulnerable people in Metro Vancouver

VANCOUVER – Mediated talks between the union representing HandyDART workers in Metro Vancouver and its employer, Transdev, are set to resume today as a strike that has stopped most services drags into a second week.

No timeline has been set for the length of the negotiations, but Joe McCann, president of the Amalgamated Transit Union Local 1724, says they are willing to stay there as long as it takes, even if talks drag on all night.

About 600 employees of the door-to-door transit service for people unable to navigate the conventional transit system have been on strike since last Tuesday, pausing service for all but essential medical trips.

Hundreds of drivers rallied outside TransLink’s head office earlier this week, calling for the transportation provider to intervene in the dispute with Transdev, which was contracted to oversee HandyDART service.

Transdev said earlier this week that it will provide a reply to the union’s latest proposal on Thursday.

A statement from the company said it “strongly believes” that their employees deserve fair wages, and that a fair contract “must balance the needs of their employees, clients and taxpayers.”

This report by The Canadian Press was first published Sept. 12, 2024.

The Canadian Press. All rights reserved.

Business

Transat AT reports $39.9M Q3 loss compared with $57.3M profit a year earlier

MONTREAL – Travel company Transat AT Inc. reported a loss in its latest quarter compared with a profit a year earlier as its revenue edged lower.

The parent company of Air Transat says it lost $39.9 million or $1.03 per diluted share in its quarter ended July 31.

The result compared with a profit of $57.3 million or $1.49 per diluted share a year earlier.

Revenue in what was the company’s third quarter totalled $736.2 million, down from $746.3 million in the same quarter last year.

On an adjusted basis, Transat says it lost $1.10 per share in its latest quarter compared with an adjusted profit of $1.10 per share a year earlier.

Transat chief executive Annick Guérard says demand for leisure travel remains healthy, as evidenced by higher traffic, but consumers are increasingly price conscious given the current economic uncertainty.

This report by The Canadian Press was first published Sept. 12, 2024.

Companies in this story: (TSX:TRZ)

The Canadian Press. All rights reserved.

-

Sports23 hours ago

Sports23 hours agoDolphins will bring in another quarterback, while Tagovailoa deals with concussion

-

Sports24 hours ago

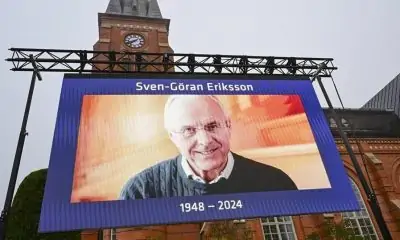

Sports24 hours agoDavid Beckham among soccer dignitaries attending ex-England coach Sven-Goran Eriksson’s funeral

-

News24 hours ago

News24 hours agoVancouver Whitecaps cautious of lowly San Jose Earthquakes

-

Sports18 hours ago

Sports18 hours agoEdmonton Oilers sign defenceman Travis Dermott to professional tryout

-

News24 hours ago

News24 hours agoAlberta town adopts new resident code of conduct to address staff safety

-

Sports17 hours ago

Sports17 hours agoCanada’s Sarah Mitton captures shot put gold at Diamond League in Brussels

-

Tech20 hours ago

Tech20 hours agoUnited Airlines will offer free internet on flights using service from Elon Musk’s SpaceX

-

News23 hours ago

News23 hours agoUnifor says workers at Walmart warehouse in Mississauga, Ont., vote to join union