Article content

Russia’s invasion of Ukraine has sparked unprecedented economic and financial retaliation from western nations which are piling on sanctions in what France has called “all-out economic and financial war.”

Check here for the latest news

Russia’s invasion of Ukraine has sparked unprecedented economic and financial retaliation from western nations which are piling on sanctions in what France has called “all-out economic and financial war.”

But the conflict will have consequences for the whole world as it cuts off crucial energy and crop supplies, disrupts businesses and upsets financial markets, already under extreme stress as central banks prepare to tighten.

There is a lot going on out there so check here for the latest news on how the conflict is affecting markets, businesses and the economy.

Russia’s wealthy are putting their money into luxury jewelry and watches to preserve the value of their savings as sanctions hit, reports Bloomberg.

Sales in Bulgari SpA’s Russian stores have risen in the last few days, the Italian jeweller’s chief executive officer said, after the international response to the nation’s invasion of Ukraine severely restricted the movement of cash.

“In the short term it has probably boosted the business,” Jean-Christophe Babin said in an interview with Bloomberg, describing Bulgari’s jewelry as a “safe investment.”

“How long it will last it is difficult to say, because indeed with the SWIFT measures, fully implemented, it might make it difficult if not impossible to export to Russia,” he said, referring to restrictions on Russian access to the SWIFT financial-messaging system.

Even as consumer brands from Apple Inc. to Nike Inc. and energy giants BP Plc, Shell Plc and Exxon Mobil Corp. pull out of Russia, Europe’s biggest luxury brands are, so far, trying to continue operating in the country.

— Bloomberg

Swedish fashion group H&M is temporarily pausing all sales in Russia, it said on Wednesday, joining a growing list of companies shunning the country since it invaded Ukraine.

The world’s second-biggest fashion retailer said it was deeply concerned about the tragic developments in Ukraine and “stand with all the people who are suffering.”

Russia was H&M’s sixth biggest market with four per cent of group sales in the fourth quarter of 2021. While it has been reducing the number of physical stores in many markets, it has been increasing store count in Russia.

“H&M Group has decided to temporarily pause all sales in Russia,” the company, whose biggest rival is Inditex, said in a statement.

— Reuters

Russian businessman Roman Abramovich has decided to sell Chelsea Football Club, 19 years after buying the London side, and promised to donate money from the sale to help victims of the war in Ukraine.

“I have always taken decisions with the club’s best interest at heart,” Abramovich said in statement published by the reigning European and world soccer champions on their website.

“In the current situation, I have therefore taken the decision to sell the club, as I believe this is in the best interest of the club, the fans, the employees, as well as the club’s sponsors and partners.”

Abramovich said he would not ask for loans he has made to the club — reported to total 1.5 billion pounds (US$2.0 billion) — to be repaid to him and the sale would not be fast-tracked.

He said he had told his aides to set up a charitable foundation which would receive all net proceeds from the sale.

“The foundation will be for the benefit of all victims of the war in Ukraine,” Abramovich said in the statement.

“This includes providing critical funds towards the urgent and immediate needs of victims, as well as supporting the long-term work of recovery.”

— Reuters

The surge of Russians buying cryptocurrencies amid a tumbling ruble has one analyst calling it a moment of crypto returning to its roots.

“Russians buying crypto actually represents a use case of the sort for which crypto was intended,” said George Monaghan, thematic analyst at analytics firm GlobalData, in a report. “Crypto, being decentralized, is less vulnerable to government regulations than FIAT currencies. Sanctions have excluded some Russian banks from SWIFT and Mastercard and VISA have frozen their operations in Russia, but it seems that Russians can still make crypto transactions.”

Monaghan added that while the Russian government refused to open the Moscow exchange, Russians are still able to trade in crypto assets. The Russian government won’t be able to move day-to-day operations into crypto, but it has given citizens a way to preserve some of their wealth, Monaghan noted.

“This activity reminds us what crypto was really meant to be, before the hype and the memecoins and the gains: decentralized and unregulated,” he wrote.

GlobalData made it clear that Russians were not piling into the space because it looked promising or had strong prospects for growth, but because it was more stable compared to the ruble.

The amount traded from the rouble into cryptocurrencies have doubled since the beginning of the Russian invasion into the Ukraine and reached US$60 million a day on Monday, according to data from crypto analytics firm Chainalysis.

— Stephanie Hughes

A broad range of companies, from energy giant BP Plc to Apple Inc. to the world’s largest banks are pulling up stakes and cutting ties with Russia after its attack on Ukraine, leaving billions of dollars in business behind.

The departures come as Western countries, including Canada, the U.S. and much of Europe, have imposed harsh sanctions on Russia in a bid to constrict its economy and compel it to end the invasion.

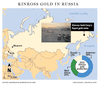

But at least one Canadian company, Toronto-headquartered Kinross Gold Corp., which operates a high-grade underground mine in the far east of Russia, has abstained from criticizing Russia and indicated it plans to continue operating there as long as possible.

Gold recently pierced a one-year high, reaching US$1,930 per ounce, up eight per cent in the past 30 days, a surge most attribute to the increase in geopolitical tensions as a result of the invasion.

Kinross chief executive J. Paul Rollinson told analysts during the company’s fourth quarter earnings call on Feb. 18, as Russian troops were gathering on the border of Ukraine but had not yet invaded, that the company’s Kupol mine had all the supplies and workforce it needs to continue operating.

“All I can say is we’ve operated there successfully for many years with strong support from the Russian government,” Rollinson said, adding. “We’re good in our communities. We pay our taxes. And we think we’re quite welcome there, and it’s been a great place for us.”

Keep reading the story from the Financial Post’s Gabriel Friedman.

The Bank of Canada raised interest rates by 25 basis points to 0.50 per cent this morning, citing high inflation as one of the main factors behind its decision.

Prices were already rising, but the conflict in Ukraine is adding to inflationary pressures, policy makers said in today’s statement. The bank now expects inflation rates, now at 5.1 per cent, to stay higher for longer.

“Price increases have become more pervasive, and measures of core inflation have all risen. Poor harvests and higher transportation costs have pushed up food prices. The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities. All told, inflation is now expected to be higher in the near term than projected in January,” the statement said.

The bank reiterated its commitment to using its policy tools to bring the inflation rate back down to its 2 per cent target.

— Victoria Wells

Hockey equipment company Canada Cycle and Motor Company Limited (CCM) will drop Alex Ovechkin and other Russian hockey players in their global marketing campaigns.

“Although Mr. Ovechkin is not responsible for the Russian government’s actions, we took the decision to not use him (or any Russian player) on any global CCM communication at this point,” CCM chief executive Marrouane Nabih wrote to TSN in an email.

In the past, Ovechkin has been a vocal supporter of Russian president Vladimir Putin. In 2017, he started a social movement called “PutinTeam.”

— Marisa Coulton

The list of companies exiting or refusing to do business with Russia grows.

Boeing has suspended technical support for Russian airlines and Apple Inc has stopped selling iPhones and other products in Russia.

U.S. energy firm Exxon Mobil said it would exit Russia

North American stocks open higher after a rough week so far as Federal Reserve Chair Jerome Powell signaled the central bank would start raising rates this month despite uncertainties stemming from the Ukraine crisis.

The Dow Jones Industrial Average rose 84.56 points, or 0.25 per cent, at the open to 33,379.51.

The S&P 500 opened higher by 16.30 points, or 0.38 per cent, at 4,322.56, while the Nasdaq Composite gained 65.07 points, or 0.48 per cent, to 13,597.53 at the opening bell.

The Toronto Stock Exchange’s S&P/TSX composite index was up 117.07 points, or 0.56 per cent, at 21,121.58.

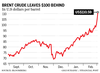

Whoa, oil prices are getting crazy.

Brent crude spiked higher this morning touching $113.02 – its highest since 2014 — and U.S. crude came close to passing its 2013 peak as traders scrambled to find alternatives to Russian oil in an already tight market.

But according to some economists, it’s possible we ain’t seen nothing yet.

If the conflict escalates and Russian exports are choked off altogether, oil could rise to a range of US$120 to US$140, says Capital Economics.

Capital also had a few thoughts on gold, which it expects will climb higher in coming weeks and months because of safe-haven demand. It forecasts that gold will remain firmly above US$2,000 an ounce in the first half of this year, but if there is an escalation in the conflict the yellow metal could soar to US$2,500.

Gold was down this morning, pressured by a higher U.S. dollar and yields, at US$1,924.00 per ounce.

Additional reporting by Reuters and Bloomberg

OTTAWA – Canada’s unemployment rate held steady at 6.5 per cent last month as hiring remained weak across the economy.

Statistics Canada’s labour force survey on Friday said employment rose by a modest 15,000 jobs in October.

Business, building and support services saw the largest gain in employment.

Meanwhile, finance, insurance, real estate, rental and leasing experienced the largest decline.

Many economists see weakness in the job market continuing in the short term, before the Bank of Canada’s interest rate cuts spark a rebound in economic growth next year.

Despite ongoing softness in the labour market, however, strong wage growth has raged on in Canada. Average hourly wages in October grew 4.9 per cent from a year ago, reaching $35.76.

Friday’s report also shed some light on the financial health of households.

According to the agency, 28.8 per cent of Canadians aged 15 or older were living in a household that had difficulty meeting financial needs – like food and housing – in the previous four weeks.

That was down from 33.1 per cent in October 2023 and 35.5 per cent in October 2022, but still above the 20.4 per cent figure recorded in October 2020.

People living in a rented home were more likely to report difficulty meeting financial needs, with nearly four in 10 reporting that was the case.

That compares with just under a quarter of those living in an owned home by a household member.

Immigrants were also more likely to report facing financial strain last month, with about four out of 10 immigrants who landed in the last year doing so.

That compares with about three in 10 more established immigrants and one in four of people born in Canada.

This report by The Canadian Press was first published Nov. 8, 2024.

The Canadian Press. All rights reserved.

The Canadian Institute for Health Information says health-care spending in Canada is projected to reach a new high in 2024.

The annual report released Thursday says total health spending is expected to hit $372 billion, or $9,054 per Canadian.

CIHI’s national analysis predicts expenditures will rise by 5.7 per cent in 2024, compared to 4.5 per cent in 2023 and 1.7 per cent in 2022.

This year’s health spending is estimated to represent 12.4 per cent of Canada’s gross domestic product. Excluding two years of the pandemic, it would be the highest ratio in the country’s history.

While it’s not unusual for health expenditures to outpace economic growth, the report says this could be the case for the next several years due to Canada’s growing population and its aging demographic.

Canada’s per capita spending on health care in 2022 was among the highest in the world, but still less than countries such as the United States and Sweden.

The report notes that the Canadian dental and pharmacare plans could push health-care spending even further as more people who previously couldn’t afford these services start using them.

This report by The Canadian Press was first published Nov. 7, 2024.

Canadian Press health coverage receives support through a partnership with the Canadian Medical Association. CP is solely responsible for this content.

The Canadian Press. All rights reserved.

As Canadians wake up to news that Donald Trump will return to the White House, the president-elect’s protectionist stance is casting a spotlight on what effect his second term will have on Canada-U.S. economic ties.

Some Canadian business leaders have expressed worry over Trump’s promise to introduce a universal 10 per cent tariff on all American imports.

A Canadian Chamber of Commerce report released last month suggested those tariffs would shrink the Canadian economy, resulting in around $30 billion per year in economic costs.

More than 77 per cent of Canadian exports go to the U.S.

Canada’s manufacturing sector faces the biggest risk should Trump push forward on imposing broad tariffs, said Canadian Manufacturers and Exporters president and CEO Dennis Darby. He said the sector is the “most trade-exposed” within Canada.

“It’s in the U.S.’s best interest, it’s in our best interest, but most importantly for consumers across North America, that we’re able to trade goods, materials, ingredients, as we have under the trade agreements,” Darby said in an interview.

“It’s a more complex or complicated outcome than it would have been with the Democrats, but we’ve had to deal with this before and we’re going to do our best to deal with it again.”

American economists have also warned Trump’s plan could cause inflation and possibly a recession, which could have ripple effects in Canada.

It’s consumers who will ultimately feel the burden of any inflationary effect caused by broad tariffs, said Darby.

“A tariff tends to raise costs, and it ultimately raises prices, so that’s something that we have to be prepared for,” he said.

“It could tilt production mandates. A tariff makes goods more expensive, but on the same token, it also will make inputs for the U.S. more expensive.”

A report last month by TD economist Marc Ercolao said research shows a full-scale implementation of Trump’s tariff plan could lead to a near-five per cent reduction in Canadian export volumes to the U.S. by early-2027, relative to current baseline forecasts.

Retaliation by Canada would also increase costs for domestic producers, and push import volumes lower in the process.

“Slowing import activity mitigates some of the negative net trade impact on total GDP enough to avoid a technical recession, but still produces a period of extended stagnation through 2025 and 2026,” Ercolao said.

Since the Canada-United States-Mexico Agreement came into effect in 2020, trade between Canada and the U.S. has surged by 46 per cent, according to the Toronto Region Board of Trade.

With that deal is up for review in 2026, Canadian Chamber of Commerce president and CEO Candace Laing said the Canadian government “must collaborate effectively with the Trump administration to preserve and strengthen our bilateral economic partnership.”

“With an impressive $3.6 billion in daily trade, Canada and the United States are each other’s closest international partners. The secure and efficient flow of goods and people across our border … remains essential for the economies of both countries,” she said in a statement.

“By resisting tariffs and trade barriers that will only raise prices and hurt consumers in both countries, Canada and the United States can strengthen resilient cross-border supply chains that enhance our shared economic security.”

This report by The Canadian Press was first published Nov. 6, 2024.

The Canadian Press. All rights reserved.

‘Do the work’: Ottawa urges both sides in B.C. port dispute to restart talks

Man facing 1st-degree murder in partner’s killing had allegedly threatened her before

‘I get goosebumps’: Canadians across the country mark Remembrance Day

Surrey police transition deal still in works, less than three weeks before handover

From transmission to symptoms, what to know about avian flu after B.C. case

Bitcoin has topped $87,000 for a new record high. What to know about crypto’s post-election rally

Wisconsin Supreme Court grapples with whether state’s 175-year-old abortion ban is valid

Twin port shutdowns risk more damage to Canadian economy: business groups