Register now for FREE unlimited access to Reuters.com

LONDON, March 8 (Reuters) – From European banks to the Polish zloty, Moscow’s invasion of Ukraine has triggered massive price falls as well as a number of winners in assets that investors are racing to stock up on.

Commodity prices are soaring, defence stocks are benefiting from higher security spending pledges and emerging market investors are finding refuge in Latin America. With the world still awash with pandemic-era cheap cash, many assets are displaying eye-catching moves.

Below is a list of some of the winners. All price moves are since Feb. 24, the day of Russia’s invasion. Russia calls its actions a “special operation”. read more

COMMODITY SHARES

A 30% jump in oil prices since Moscow sent troops and tanks into Ukraine has turbocharged the shares of energy producers. The SPDR S&P Oil & Gas index has risen 14%, and some individual energy companies have gained far more.

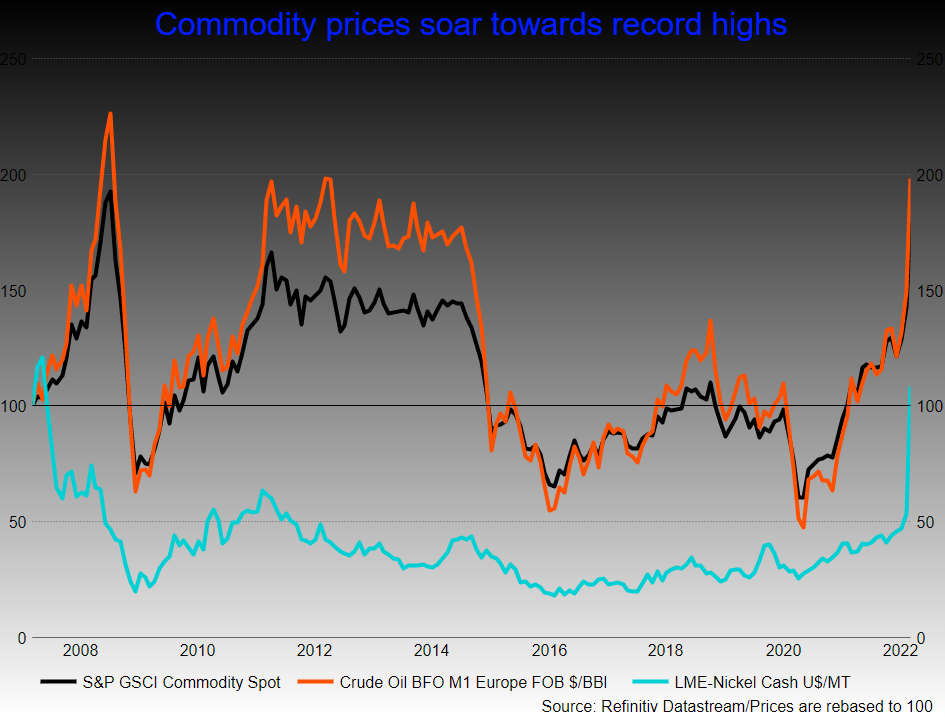

Russia’s large role in metals has driven even bigger jumps in other commodities.

It supplies about 10% of global nickel, and concern about Russian supplies and a short squeeze have sent London three-month nickel prices up four-fold since the invasion to a record above $100,000-a-tonne. That prompted the London Metal Exchange to halt trading on Tuesday. read more

Russia and Ukraine together account for about 29% of global wheat exports, and 19% of corn exports. Chicago wheat futures have jumped 40% to 14-year highs .

The S&P GSCI (.SPGSCI), a composite index of commodity sector returns, has risen 24% since Feb. 24 and stands 9% off record highs hit in 2008.

Commodity trading firms are booming too. Shares in Glencore (GLEN.L) are up 15%, and in Archer-Daniels-Midland 13% higher, while agribusiness Bunge has gained 11%.

COMMODITY CURRENCIES

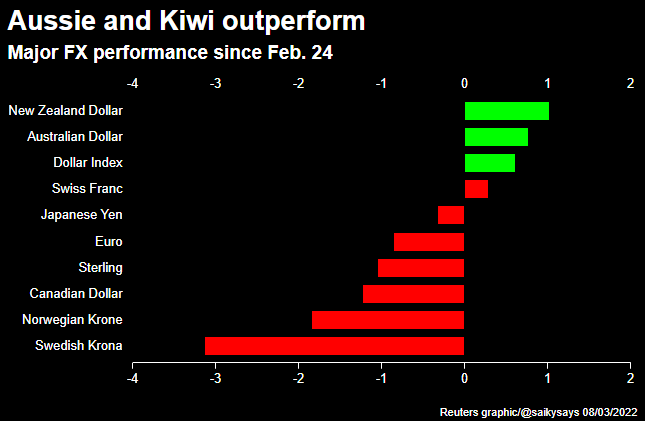

Currencies of commodity-exporting nations are outperforming.

The Australian and the New Zealand dollars are up nearly 1% since the invasion.

Those moves are striking because both currencies typically struggle when global market sentiment deteriorates and traders tend to scramble for safer assets, such as the Swiss franc and U.S. dollar, which are also strong.

The Norwegian crown , lifted by rising prices of Norway’s major export, oil, has risen 2.7% versus the euro.

Emerging market currencies tend to weaken in the face of a robust dollar, but those of resource-rich South Africa and Brazil have also performed well. ,

SUN AND WIND

The S&P Global Clean Energy Index (.SPGTCLEN) has gained 14.6% since the invasion on a bet Western countries will push harder to wean themselves off fossil fuels.

Wind energy suppliers Nordex (NDXG.DE) and Vestas Wind (VWS.CO) have risen around 50%. Citi reckons many European companies could see sharp revenue upgrades if Germany meets its wind energy expansion plans.

Invesco’s Solar ETF (TAN.P) has climbed 31%.

DEFENCE AND CYBER

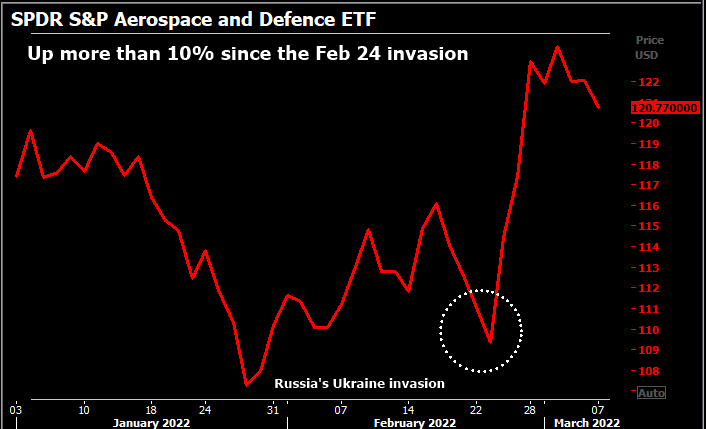

Manufacturers of jets, missiles and radar are big gainers after several European countries, notably Germany, pledged to spend more on defence. read more

Since Feb. 24, arms companies dominate the list of the top-performers in the MSCI World index, led by 60%-80% gains for German military sensor maker Hensoldt (HAGG.DE) and armoured vehicle manufacturer Rheinmetall .

U.S. firm Raytheon (RTX.N) – the manufacturer of Stinger missiles that Western allies are dispatching to Ukraine – is up around 15%.

The SPDR S&P Aerospace and Defence ETF (XAR.P) is 11% higher.

The Global X Cybersecurity ETF (BUG.O), which includes Check Point Software Technologies (CHKP.O) and Palo Alto Networks , has gained 9%.

“Cyber is one of our preferred long-term themes and that’s been borne out further with this crisis,” said Kiran Ganesh, at UBS Global Wealth Management.

He said many sustainably-focused investors usually exclude defence shares but “it’s a debate the industry needs to have… many would argue that security is a social good too.”

INTO LATAM

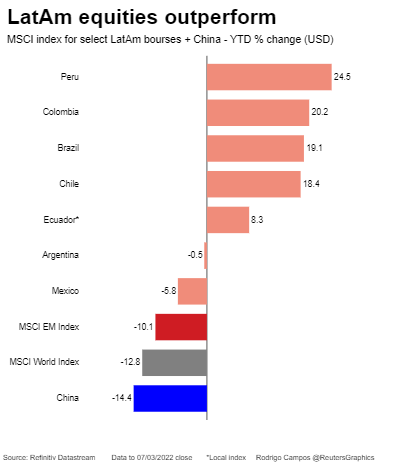

Investors are heading into Latin American markets, commodity-heavy and more insulated from the Russian fallout than other emerging markets.

Data from the Institute of International Finance shows Latin American markets received $8.7 billion of investment inflows and Asian emerging economies took in $6.8 billion over February.

The MSCI Latin America index (.MILA00000PUS) is higher versus pre-invasion levels, while its materials sub-index has jumped (.MILA0MT00PUS) 16% since Feb. 24.

“The commodity factor – whether agri commods or metals is supporting capital flows to LatAm,” said Jeremy Schwartz, chief investment officer at asset manager WisdomTree.

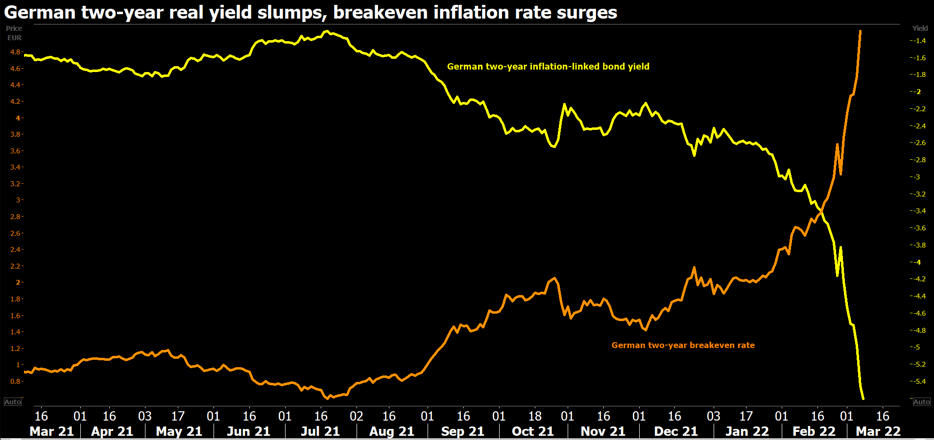

INFLATION PROTECTION

As the commodity surge threatens to lift inflation even further, inflation-linked bonds have proved a winner, especially in the euro zone where they have returned 7% since the invasion, BofA’s index shows.

The rally is most dramatic in short-dated ‘linkers’ with the yield on Germany’s two-year issue down 190 basis points since the invasion.

Additional reporting by Eileen Soreng and Yoruk Bahceli; editing by Barbara Lewis

Our Standards: The Thomson Reuters Trust Principles.

TORONTO – TD Bank Group, which is mired in a money laundering scandal in the U.S., says chief executive Bharat Masrani will retire next year.

Masrani, who will retire officially on April 10, 2025, says the bank’s, “anti-money laundering challenges,” took place on his watch and he takes full responsibility.

The bank named Raymond Chun, TD’s group head, Canadian personal banking, as his successor.

As part of a transition plan, Chun will become chief operating officer on Nov. 1 before taking over the top job when Masrani steps down at the bank’s annual meeting next year.

TD also announced that Riaz Ahmed, group head, wholesale banking and president and CEO of TD Securities, will retire at the end of January 2025.

TD has taken billions in charges related to ongoing U.S. investigations into the failure of its anti-money laundering program.

This report by The Canadian Press was first published Sept. 19, 2024.

Companies in this story: (TSX:TD)

The Canadian Press. All rights reserved.

File this column under “for what it’s worth.”

“Communication is one of the most important skills you require for a successful life.” — Catherine Pulsifer, author.

I’m one hundred percent in agreement with Pulsifer, which is why my evaluation of candidates begins with their writing skills. If a candidate’s writing skills and verbal communication skills, which I’ll assess when interviewing, aren’t well above average, I’ll pass on them regardless of their skills and experience.

Why?

Because business is fundamentally about getting other people to do things—getting employees to be productive, getting customers to buy your products or services, and getting vendors to agree to a counteroffer price. In business, as in life in general, you can’t make anything happen without effective communication; this is especially true when job searching when your writing is often an employer’s first impression of you.

Think of all the writing you engage in during a job search (resumes, cover letters, emails, texts) and all your other writing (LinkedIn profile, as well as posts and comments, blogs, articles, tweets, etc.) employers will read when they Google you to determine if you’re interview-worthy.

With so much of our communication today taking place via writing (email, text, collaboration platforms such as Microsoft Teams, Slack, ClickUp, WhatsApp and Rocket.Chat), the importance of proficient writing skills can’t be overstated.

When assessing a candidate’s writing skills, you probably think I’m looking for grammar and spelling errors. Although error-free writing is important—it shows professionalism and attention to detail—it’s not the primary reason I look at a candidate’s writing skills.

The way someone writes reveals how they think.

Effective writing isn’t about using sophisticated vocabulary. Hemingway demonstrated that deceptively simple, stripped-down prose can captivate readers. Effective writing takes intricate thoughts and presents them in a way that makes the reader think, “Damn! Why didn’t I see it that way?” A good writer is a dead giveaway for a good thinker. More than ever, the business world needs “good thinkers.”

Therefore, when I come across a candidate who’s a good writer, hence a good thinker, I know they’re likely to be able to write:

Now, let’s talk about the elephant in the room: AI, which job seekers are using en masse. Earlier this year, I wrote that AI’s ability to hyper-increase an employee’s productivity—AI is still in its infancy; we’ve seen nothing yet—in certain professions, such as writing, sales and marketing, computer programming, office and admin, and customer service, makes it a “fewer employees needed” tool, which understandably greatly appeals to employers. In my opinion, the recent layoffs aren’t related to the economy; they’re due to employers adopting AI. Additionally, companies are trying to balance investing in AI with cost-cutting measures. CEOs who’ve previously said, “Our people are everything,” have arguably created today’s job market by obsessively focusing on AI to gain competitive advantages and reduce their largest expense, their payroll.

It wouldn’t be a stretch to assume that most AI usage involves generating written content, content that’s obvious to me, and likely to you as well, to have been written by AI. However, here’s the twist: I don’t particularly care.

Why?

Because the fundamental skill I’m looking for is the ability to organize thoughts and communicate effectively. What I care about is whether the candidate can take AI-generated content and transform it into something uniquely valuable. If they can, they’re demonstrating the skills of being a good thinker and communicator. It’s like being a great DJ; anyone can push play, but it takes skill to read a room and mix music that gets people pumped.

Using AI requires prompting effectively, which requires good writing skills to write clear and precise instructions that guide the AI to produce desired outcomes. Prompting AI effectively requires understanding structure, flow and impact. You need to know how to shape raw information, such as milestones throughout your career when you achieved quantitative results, into a compelling narrative.

So, what’s the best way to gain and enhance your writing skills? As with any skill, you’ve got to work at it.

Two rules guide my writing:

Don’t just string words together; learn to organize your thoughts, think critically, and communicate clearly. Solid writing skills will significantly set you apart from your competition, giving you an advantage in your job search and career.

_____________________________________________________________________

Nick Kossovan, a well-seasoned veteran of the corporate landscape, offers “unsweetened” job search advice. You can send Nick your questions to artoffindingwork@gmail.com.

MONTREAL – Politics, public opinion and salary hikes south of the border helped push Air Canada toward a deal that secures major pay gains for pilots, experts say.

Hammered out over the weekend, the would-be agreement includes a cumulative wage hike of nearly 42 per cent over four years — an enormous bump by historical standards — according to one source who was not authorized to speak publicly on the matter. The previous 10-year contract granted increases of just two per cent annually.

The federal government’s stated unwillingness to step in paved the way for a deal, noted John Gradek, after Prime Minister Justin Trudeau made it plain the two sides should hash one out themselves.

“Public opinion basically pressed the federal cabinet, including the prime minister, to keep their hands clear of negotiations and looking at imposing a settlement,” said Gradek, who teaches aviation management at McGill University.

After late-night talks at a hotel near Toronto’s Pearson airport, the country’s biggest airline and the union representing 5,200-plus aviators announced early Sunday morning they had reached a tentative agreement, averting a strike that would have grounded flights and affected some 110,000 passengers daily.

The relative precariousness of the Liberal minority government as well as a push to appear more pro-labour underlay the prime minister’s hands-off approach to the negotiations.

Trudeau said Friday the government would not step in to fix the impasse — unlike during a massive railway work stoppage last month and a strike by WestJet mechanics over the Canada Day long weekend that workers claimed road roughshod over their constitutional right to collective bargaining. Trudeau said the government respects the right to strike and would only intervene if it became apparent no negotiated deal was possible.

“They felt that they really didn’t want to try for a third attempt at intervention and basically said, ‘Let’s let the airline decide how they want to deal with this one,'” said Gradek.

“Air Canada ran out of support as the week wore on, and by the time they got to Friday night, Saturday morning, there was nothing left for them to do but to basically try to get a deal set up and accepted by ALPA (Air Line Pilots Association).”

Trudeau’s government was also unlikely to consider back-to-work legislation after the NDP tore up its agreement to support the Liberal minority in Parliament, Gradek said. Conservative Leader Pierre Poilievre, whose party has traditionally toed a more pro-business line, also said last week that Tories “stand with the pilots” and swore off “pre-empting” the negotiations.

Air Canada CEO Michael Rousseau had asked Ottawa on Thursday to impose binding arbitration pre-emptively — “before any travel disruption starts” — if talks failed. Backed by business leaders, he’d hoped for an effective repeat of the Conservatives’ move to head off a strike in 2012 by legislating Air Canada pilots and ground crew to stick to their posts before any work stoppage could start.

The request may have fallen flat, however. Gradek said he believes there was less anxiety over the fallout from an airline strike than from the countrywide railway shutdown.

He also speculated that public frustration over thousands of cancelled flights would have flowed toward Air Canada rather than Ottawa, prompting the carrier to concede to a deal yielding “unheard of” gains for employees.

“It really was a total collapse of the Air Canada bargaining position,” he said.

Pilots are slated to vote in the coming weeks on the four-year contract.

Last year, pilots at Delta Air Lines, United Airlines and American Airlines secured agreements that included four-year pay boosts ranging from 34 per cent to 40 per cent, ramping up pressure on other carriers to raise wages.

After more than a year of bargaining, Air Canada put forward an offer in August centred around a 30 per cent wage hike over four years.

But the final deal, should union members approve it, grants a 26 per cent increase in the first year alone, retroactive to September 2023, according to the source. Three wage bumps of four per cent would follow in 2024 through 2026.

Passengers may wind up shouldering some of that financial load, one expert noted.

“At the end of the day, it’s all us consumers who are paying,” said Barry Prentice, who heads the University of Manitoba’s transport institute.

Higher fares may be mitigated by the persistence of budget carrier Flair Airlines and the rapid expansion of Porter Airlines — a growing Air Canada rival — as well as waning demand for leisure trips. Corporate travel also remains below pre-COVID-19 levels.

Air Canada said Sunday the tentative contract “recognizes the contributions and professionalism of Air Canada’s pilot group, while providing a framework for the future growth of the airline.”

The union issued a statement saying that, if ratified, the agreement will generate about $1.9 billion of additional value for Air Canada pilots over the course of the deal.

Meanwhile, labour tension with cabin crew looms on the horizon. Air Canada is poised to kick off negotiations with the union representing more than 10,000 flight attendants this year before the contract expires on March 31.

This report by The Canadian Press was first published Sept. 16, 2024.

Companies in this story: (TSX:AC)

Alberta Premier Smith aims to help fund private school construction

Sutherland House Experts Book Publishing Launches To Empower Quiet Experts

Quebec won’t fund graphite mine project tied to Pentagon; locals claim ‘victory’

Nurse-patient ratios at B.C. hospitals set to expand in fall, says health minister

N.B. election: Parties’ answers on treaty rights, taxes, Indigenous participation

Nova Scotia NDP accuse government of prioritizing landlord profits over renters

Health Minister Mark Holland appeals to Senate not to amend pharmacare bill

Second-half goals lift defending MLS champion Columbus past Toronto FC