Article content

Competition is one of the most important aspects of a properly functioning market economy. Without competition, you will have stagnation, deteriorating quality and a lack of innovation, progress and growth.

Competition is the best tool for ensuring that customers get a better-quality product or service at a better price

Competition is one of the most important aspects of a properly functioning market economy. Without competition, you will have stagnation, deteriorating quality and a lack of innovation, progress and growth.

Back in the late 1980s, when Mikhail Gorbachev was introducing a number of wide-ranging economic reforms in the Soviet Union, my company became the first manufacturer in North America to open a facility behind the Iron Curtain. On one of my visits there, a senior Communist party official invited me to tour some Soviet automotive factories and assembly plants.

After seeing the various factories, filled with antiquated equipment and assembly lines that looked like they hadn’t changed since the days of Henry Ford, the minister asked me what I thought. I told him that I didn’t think they could make quality cars at the right price, and they couldn’t make enough of them to satisfy the needs of their people. And then I said: “You know why your country always does so well at the Olympics? It’s because you’ve got competition. If there was only one runner in a race, time wouldn’t mean anything. Even a slow guy could win.”

Competition was a deeply held principle at Magna International, the auto parts I company I founded. One of the hallmarks of how we operated as a company was that every factory was an independent business unit. Our manufacturing divisions were so decentralized and independent, they even competed against each other.

For example, back in the early ’90s, we had one division that made running boards for trucks. Traditionally, this was a metal-stamped component. But one of our plastics divisions began experimenting in its R&D unit and came up with a lighter-weight plastic running board that was stronger and cheaper. It ended up capturing the business from the other Magna division.

I always encouraged our people to be at the forefront of change, rather than being forced to play catch-up with the rest of the industry. Some people thought it was crazy that we’d allow our own factories to compete against each other. But when push came to shove, I would sooner lose business to one of our own product groups than to an outside competitor. That’s one of the main reasons why we became known as one of the most innovative companies in the automotive industry.

Evolution and change are inevitable and relentless: just as the small, stainless steel trim pieces we made in Magna’s early years gave way to aluminum trim and then to plastic, technological innovations and new competitors force companies to continually change. But this would never happen without competition — it’s the force that drives individuals and organizations and countries to be better, to go faster, farther and higher.

I learned that powerful lesson on a business trip to Japan back in the late ’70s, when companies such as Honda and Toyota were quickly but quietly emerging as serious competitors to the Big Three carmakers in Detroit, which had grown fat and inefficient.

During my travels throughout the country, I had an opportunity to visit a traditional Japanese silk farm. I was amazed to see the silkworms feeding on mulberry bushes and spinning the spectacular strands of silk used to make fine clothing and other materials.

My guide explained that the operation was going to shut down because it could no longer compete against the synthetic silk producers that were grabbing a larger and larger share of the market. Human ingenuity being what it is, someone had figured out a way to make a product as good or better than nature, at a much lower cost.

It was a vivid example of how entire industries can be wiped out overnight by technological advances or sudden changes in the economic landscape — changes that only happen when there is free and unfettered competition.

That’s the reason why monopolies, whether they are government-run or privately operated, are always bad for society. I believe one way to constrain the inevitable drift toward market concentration is to enact a law that no company can have more than 30 per cent market share in any industry and that there must be a minimum of four competitors operating in each industry — everything from packaged goods and phones, to internet search engines and automobiles.

Wherever they exist, monopolies lead to poor service, lower quality and higher prices. At the end of the day, competition is the best tool for ensuring that customers get a better-quality product or service at a better price.

National Post

OTTAWA – Statistics Canada says real gross domestic product grew 0.2 per cent in July, following essentially no change in June, helped by strength in the retail trade sector.

The agency says the growth came as services-producing industries grew 0.2 per cent for the month.

The retail trade sector was the largest contributor to overall growth in July as it gained one per cent, helped by the motor vehicles and parts dealers subsector which gained 2.8 per cent.

The public sector aggregate, which includes the educational services, health care and social assistance, and public administration sectors, gained 0.3 per cent, while the finance and insurance sector rose 0.5 per cent.

Meanwhile, goods-producing industries gained 0.1 per cent in July as the utilities sector rose 1.3 per cent and the manufacturing sector grew 0.3 per cent.

Statistics Canada’s early estimate for August suggests real GDP for the month was essentially unchanged, as increases in oil and gas extraction and the public sector were offset by decreases in manufacturing and transportation and warehousing.

This report by The Canadian Press was first published Sept. 27, 2024.

The Canadian Press. All rights reserved.

TORONTO – Canada’s main stock index closed above 24,000 for the first time Thursday as strength in base metals and other sectors outweighed losses in energy, while U.S. markets also rose and the S&P 500 notched another record as well.

“Another day, another record,” said Angelo Kourkafas, senior investment strategist at Edward Jones.

“The path of least resistance continues to be higher.”

The S&P/TSX composite index closed up 127.95 points at 24,033.83.

In New York, the Dow Jones industrial average was up 260.36 points at 42,175.11. The S&P 500 index was up 23.11 points at 5,745.37, while the Nasdaq composite was up 108.09 points at 18,190.29.

Markets continue to be optimistic about an economic soft landing, said Kourkafas, after the U.S. Federal Reserve last week announced an outsized cut to its key interest rate following months of speculation about when it would start easing policy.

Economic data Thursday added to the story that the U.S. economy remains resilient despite higher rates, said Kourkafas.

The U.S. economy grew at a three-per-cent annual rate in the second quarter, one report said, picking up from the first quarter of the year. Another report showed fewer U.S. workers applied for unemployment benefits last week.

The data shows “the economy remains on strong footing while the Fed is pivoting now in a decisive way towards an easier policy,” said Kourkafas.

The Fed’s decisive move gave investors more reason to believe that a soft landing is still the “base case scenario,” he said, “and likely reduces the downside risks for a recession by having the Fed moving too late or falling behind the curve.”

North of the border, the TSX usually gets a boost from Wall St. strength, said Kourkafas, but on Thursday the index also reflected some optimism of its own as the Bank of Canada has already cut rates three times to address weakening in the economy.

“The Bank of Canada likely now will be emboldened by the Fed,” he said.

“They didn’t want to move too far ahead of the Fed, and now that the Fed moved in a bigger-than-expected way, that provides more room for the Bank of Canada to cut as aggressively as needed to support the economy, given that inflation is within the target range.”

The TSX has also been benefiting from strength in materials after China’s central bank announced several measures meant to support the company’s economy, said Kourkafas.

However, energy stocks dragged on the Canadian index as oil prices fell Thursday following a report that Saudi Arabia was preparing to abandon its unofficial US$100-per-barrel price target for crude as it prepares to increase its output.

The Canadian dollar traded for 74.22 cents US compared with 74.28 cents US on Wednesday.

The November crude oil contract was down US$2.02 at US$67.67 per barrel and the November natural gas contract was down seven cents at US$2.75 per mmBTU.

The December gold contract was up US$10.20 at US$2,694.90 an ounce and the December copper contract was up 15 cents at US$4.64 a pound.

— With files from The Associated Press

This report by The Canadian Press was first published Sept. 26, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in the base metal sector, while U.S. stock markets were also higher.

The S&P/TSX composite index was 143.00 points at 24,048.88.

In New York, the Dow Jones industrial average was up 174.22 points at 42,088.97. The S&P 500 index was up 10.23 points at 5,732.49, while the Nasdaq composite was up 30.02 points at 18,112.23.

The Canadian dollar traded for 74.23 cents US compared with 74.28 cents US on Wednesday.

The November crude oil contract was down US$1.68 at US$68.01 per barrel and the November natural gas contract was down six cents at US$2.75 per mmBTU.

The December gold contract was up US$4.40 at US$2,689.10 an ounce and the December copper contract was up 13 cents at US$4.62 a pound.

This report by The Canadian Press was first published Sept. 26, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Dak Prescott throws 2 TD passes and Cowboys win 7th straight over Giants, 20-15

Maggie Smith, scene-stealing actor famed for Harry Potter and ‘Downton Abbey,’ dies at 89

Canada’s Leylah Fernandez knocked out of China Open

Israel-Hamas war latest: Israel carries out attacks in Beirut on Hezbollah targets

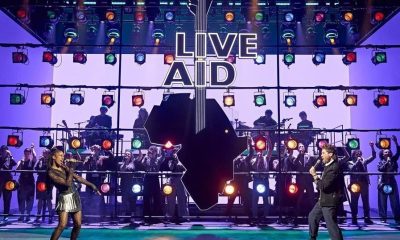

Bob Geldof hopes Live Aid musical inspires younger generation to take action

Netanyahu, at UN, vows that Israel will keep ‘degrading Hezbollah’ until its objectives are met

Montreal Hosts an International Decolonial Conference from September 27 to 29, 2024

Nebraska to become last Big Ten school to sell alcohol at football games in 2025 if regents give OK