Media

Amherstburg man shares EV car experience on social media | CTV News – CTV News Windsor

When Eric Wortley became the new owner of an electric vehicle, the Amherstburg, Ont. resident never planned on documenting what it’s like on social media.

But as Windsor’s auto sector started moving toward electrification, he noticed more of his friends debating the pros and cons of EVs over social media.

“When I got my Tesla, [I decided] to just document everything,” he said. “Show everyone the good, the bad, the ugly — and let people make their own opinions on it.”

Like many others in recent months, Wortley considered going electric for his next vehicle due to rising gas prices. He bought a Jeep Gladiator last year but noticed fuel was starting to cost more than the payments for the truck itself.

In February, Wortley made the switch and bought a fully-electric, pre-owned Tesla vehicle.

He’s also started providing occasional updates on his social media, sharing details such as charging time, distance travelled and money saved compared to driving a gas-powered vehicle.

So far, Wortley’s experience with his electric vehicle has been positive. The biggest benefit, he said, is being able to charge his vehicle overnight at home, eliminating the need for him to stop at gas stations. On the rare occasion, Wortley added, he may plug his EV in at the charging stations at Devonshire Mall.

In one of his social media updates, Wortley recalls a recent drive to Point Pelee which cost him virtually nothing in terms of fuel because the area has free EV charging stations.

From his home to Point Pelee, the distance is about 120 kilometres. Wortley estimates the same drive in his former pickup truck would have cost him about $35 just in gas.

Wortley said he mainly charges his EV at home and rarely plugs into a supercharger, which allows for faster charging at a premium rate. But despite the extra cost, Wortley said it still works out cheaper than filling up a gas-powered vehicle at current prices.

“To plug in and charge at home, it’s $10 a week. If I go to a supercharger, which I did a couple days ago, it still only cost me $18 to charge it from 15 per cent.

While charging his electric vehicle at the mall, Wortley said he paid just a few dollars to increase the charge on his EV battery by about 30 per cent. It took him about two hours, but Wortley said the cost savings is worth it.

“I went shopping. I worked out at the gym,” said Wortley on what he did while his EV was charging at the mall. “I don’t have to worry about having to fill up now. It’s pennies, whereas if I wanted to fill up to drive to Amherstburg, 20 bucks is down the drain.”

Peter Hatges, national automotive sector leader for KPMG Canada, says the extra time needed to charge an electric vehicle can be an issue for some drivers who quickly need to get from place-to-place. (Sanjay Maru/CTV News Windsor)

Peter Hatges, national automotive sector leader for KPMG Canada, says the extra time needed to charge an electric vehicle can be an issue for some drivers who quickly need to get from place-to-place. (Sanjay Maru/CTV News Windsor)

But according to Peter Hatges, national automotive sector leader for KPMG Canada, the extra time it takes for electric vehicles to charge can be an issue for drivers who are very busy or often travel long distances.

“In our surveys and the polls that we’ve done across Canada, most Canadians expect to go and refuel a car in about five to seven minutes. That’s how long it takes for you to go to the gas station. It can take 10 minutes if you’re waiting in line for coffee, but that’s about it,” said Hatges.

In comparison, Hatges said it can take 45 minutes for an electric vehicle to increase the charge in an electric vehicle battery by 80 per cent, even when plugged into a supercharger.

“I think the range anxiety really impacts people that use the vehicles like we do in North America,” he said.

“People aren’t thinking about when and where to charge the battery. They’re thinking about what they got to do next and if they have to travel a long distance,” Hatges added. “That is going to be an impediment to the widespread adoption of electric cars, at least for now.”

But for early adopters like Wortley, the extra wait isn’t too much of an issue for him. On long drives, he said 45 minutes gives him enough to stop for a bathroom break, sit down for a meal and stretch his legs out

Searching for an EV charger isn’t a problem for Wortley either. That’s because his in-car GPS will show him where to find superchargers along his route, after he enters his destination on the centre console.

Take a look at the tweet below to see that feature in action:

Wortley also addressed concerns he’s received from others on his social media updates regarding the battery’s total lifespan and the financial ramifications that could arise if it fails altogether. Wortley said his warranty fully covers any fixes needed to the battery and allows for a full replacement if its total capacity falls below 70 per cent.

But the warranty does not apply if the vehicle has been driven for eight years or has amassed 160,000 kilometres.

Media

Trump could cash out his DJT stock within weeks. Here’s what happens if he sells

Former President Donald Trump is on the brink of a significant financial decision that could have far-reaching implications for both his personal wealth and the future of his fledgling social media company, Trump Media & Technology Group (TMTG). As the lockup period on his shares in TMTG, which owns Truth Social, nears its end, Trump could soon be free to sell his substantial stake in the company. However, the potential payday, which makes up a large portion of his net worth, comes with considerable risks for Trump and his supporters.

Trump’s stake in TMTG comprises nearly 59% of the company, amounting to 114,750,000 shares. As of now, this holding is valued at approximately $2.6 billion. These shares are currently under a lockup agreement, a common feature of initial public offerings (IPOs), designed to prevent company insiders from immediately selling their shares and potentially destabilizing the stock. The lockup, which began after TMTG’s merger with a special purpose acquisition company (SPAC), is set to expire on September 25, though it could end earlier if certain conditions are met.

Should Trump decide to sell his shares after the lockup expires, the market could respond in unpredictable ways. The sale of a substantial number of shares by a major stakeholder like Trump could flood the market, potentially driving down the stock price. Daniel Bradley, a finance professor at the University of South Florida, suggests that the market might react negatively to such a large sale, particularly if there aren’t enough buyers to absorb the supply. This could lead to a sharp decline in the stock’s value, impacting both Trump’s personal wealth and the company’s market standing.

Moreover, Trump’s involvement in Truth Social has been a key driver of investor interest. The platform, marketed as a free speech alternative to mainstream social media, has attracted a loyal user base largely due to Trump’s presence. If Trump were to sell his stake, it might signal a lack of confidence in the company, potentially shaking investor confidence and further depressing the stock price.

Trump’s decision is also influenced by his ongoing legal battles, which have already cost him over $100 million in legal fees. Selling his shares could provide a significant financial boost, helping him cover these mounting expenses. However, this move could also have political ramifications, especially as he continues his bid for the Republican nomination in the 2024 presidential race.

Trump Media’s success is closely tied to Trump’s political fortunes. The company’s stock has shown volatility in response to developments in the presidential race, with Trump’s chances of winning having a direct impact on the stock’s value. If Trump sells his stake, it could be interpreted as a lack of confidence in his own political future, potentially undermining both his campaign and the company’s prospects.

Truth Social, the flagship product of TMTG, has faced challenges in generating traffic and advertising revenue, especially compared to established social media giants like X (formerly Twitter) and Facebook. Despite this, the company’s valuation has remained high, fueled by investor speculation on Trump’s political future. If Trump remains in the race and manages to secure the presidency, the value of his shares could increase. Conversely, any missteps on the campaign trail could have the opposite effect, further destabilizing the stock.

As the lockup period comes to an end, Trump faces a critical decision that could shape the future of both his personal finances and Truth Social. Whether he chooses to hold onto his shares or cash out, the outcome will likely have significant consequences for the company, its investors, and Trump’s political aspirations.

Media

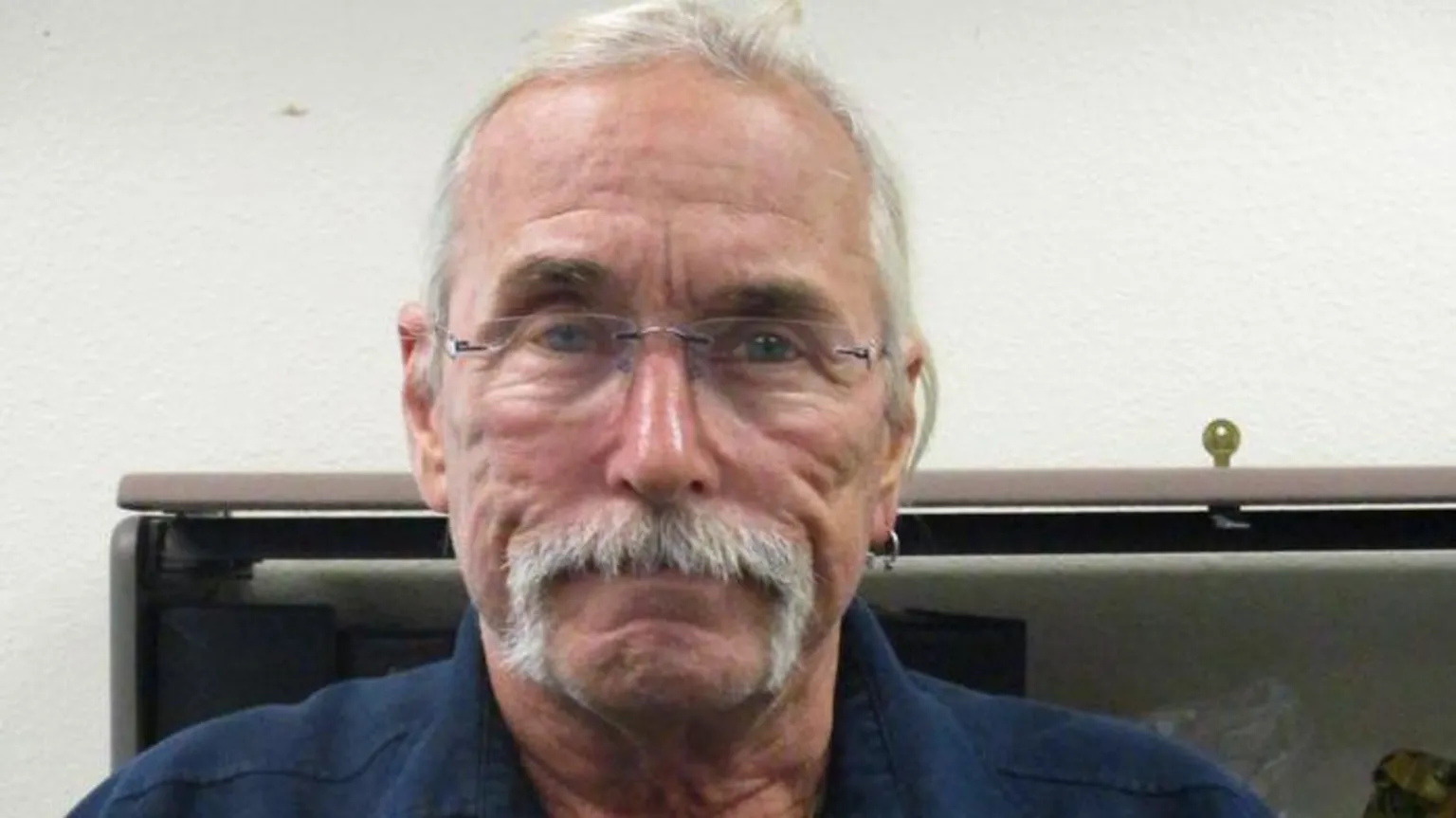

Arizona man accused of social media threats to Trump is arrested

Cochise County, AZ — Law enforcement officials in Arizona have apprehended Ronald Lee Syvrud, a 66-year-old resident of Cochise County, after a manhunt was launched following alleged death threats he made against former President Donald Trump. The threats reportedly surfaced in social media posts over the past two weeks, as Trump visited the US-Mexico border in Cochise County on Thursday.

Syvrud, who hails from Benson, Arizona, located about 50 miles southeast of Tucson, was captured by the Cochise County Sheriff’s Office on Thursday afternoon. The Sheriff’s Office confirmed his arrest, stating, “This subject has been taken into custody without incident.”

In addition to the alleged threats against Trump, Syvrud is wanted for multiple offences, including failure to register as a sex offender. He also faces several warrants in both Wisconsin and Arizona, including charges for driving under the influence and a felony hit-and-run.

The timing of the arrest coincided with Trump’s visit to Cochise County, where he toured the US-Mexico border. During his visit, Trump addressed the ongoing border issues and criticized his political rival, Democratic presidential nominee Kamala Harris, for what he described as lax immigration policies. When asked by reporters about the ongoing manhunt for Syvrud, Trump responded, “No, I have not heard that, but I am not that surprised and the reason is because I want to do things that are very bad for the bad guys.”

This incident marks the latest in a series of threats against political figures during the current election cycle. Just earlier this month, a 66-year-old Virginia man was arrested on suspicion of making death threats against Vice President Kamala Harris and other public officials.

Media

Trump Media & Technology Group Faces Declining Stock Amid Financial Struggles and Increased Competition

Trump Media & Technology Group’s stock has taken a significant hit, dropping more than 11% this week following a disappointing earnings report and the return of former U.S. President Donald Trump to the rival social media platform X, formerly known as Twitter. This decline is part of a broader downward trend for the parent company of Truth Social, with the stock plummeting nearly 43% since mid-July. Despite the sharp decline, some investors remain unfazed, expressing continued optimism for the company’s financial future or standing by their investment as a show of political support for Trump.

One such investor, Todd Schlanger, an interior designer from West Palm Beach, explained his commitment to the stock, stating, “I’m a Republican, so I supported him. When I found out about the stock, I got involved because I support the company and believe in free speech.” Schlanger, who owns around 1,000 shares, is a regular user of Truth Social and is excited about the company’s future, particularly its plans to expand its streaming services. He believes Truth Social has the potential to be as strong as Facebook or X, despite the stock’s recent struggles.

However, Truth Social’s stock performance is deeply tied to Trump’s political influence and the company’s ability to generate sustainable revenue, which has proven challenging. An earnings report released last Friday showed the company lost over $16 million in the three-month period ending in June. Revenue dropped by 30%, down to approximately $836,000 compared to $1.2 million during the same period last year.

In response to the earnings report, Truth Social CEO Devin Nunes emphasized the company’s strong cash position, highlighting $344 million in cash reserves and no debt. He also reiterated the company’s commitment to free speech, stating, “From the beginning, it was our intention to make Truth Social an impenetrable beachhead of free speech, and by taking extraordinary steps to minimize our reliance on Big Tech, that is exactly what we are doing.”

Despite these assurances, investors reacted negatively to the quarterly report, leading to a steep drop in stock price. The situation was further complicated by Trump’s return to X, where he posted for the first time in a year. Trump’s exclusivity agreement with Trump Media & Technology Group mandates that he posts personal content first on Truth Social. However, he is allowed to make politically related posts on other social media platforms, which he did earlier this week, potentially drawing users away from Truth Social.

For investors like Teri Lynn Roberson, who purchased shares near the company’s peak after it went public in March, the decline in stock value has been disheartening. However, Roberson remains unbothered by the poor performance, saying her investment was more about supporting Trump than making money. “I’m way at a loss, but I am OK with that. I am just watching it for fun,” Roberson said, adding that she sees Trump’s return to X as a positive move that could expand his reach beyond Truth Social’s “echo chamber.”

The stock’s performance holds significant financial implications for Trump himself, as he owns a 65% stake in Trump Media & Technology Group. According to Fortune, this stake represents a substantial portion of his net worth, which could be vulnerable if the company continues to struggle financially.

Analysts have described Truth Social as a “meme stock,” similar to companies like GameStop and AMC that saw their stock prices driven by ideological investments rather than business fundamentals. Tyler Richey, an analyst at Sevens Report Research, noted that the stock has ebbed and flowed based on sentiment toward Trump. He pointed out that the recent decline coincided with the rise of U.S. Vice President Kamala Harris as the Democratic presidential nominee, which may have dampened perceptions of Trump’s 2024 election prospects.

Jay Ritter, a finance professor at the University of Florida, offered a grim long-term outlook for Truth Social, suggesting that the stock would likely remain volatile, but with an overall downward trend. “What’s lacking for the true believer in the company story is, ‘OK, where is the business strategy that will be generating revenue?'” Ritter said, highlighting the company’s struggle to produce a sustainable business model.

Still, for some investors, like Michael Rogers, a masonry company owner in North Carolina, their support for Trump Media & Technology Group is unwavering. Rogers, who owns over 10,000 shares, said he invested in the company both as a show of support for Trump and because of his belief in the company’s financial future. Despite concerns about the company’s revenue challenges, Rogers expressed confidence in the business, stating, “I’m in it for the long haul.”

Not all investors are as confident. Mitchell Standley, who made a significant return on his investment earlier this year by capitalizing on the hype surrounding Trump Media’s planned merger with Digital World Acquisition Corporation, has since moved on. “It was basically just a pump and dump,” Standley told ABC News. “I knew that once they merged, all of his supporters were going to dump a bunch of money into it and buy it up.” Now, Standley is staying away from the company, citing the lack of business fundamentals as the reason for his exit.

Truth Social’s future remains uncertain as it continues to struggle with financial losses and faces stiff competition from established social media platforms. While its user base and investor sentiment are bolstered by Trump’s political following, the company’s long-term viability will depend on its ability to create a sustainable revenue stream and maintain relevance in a crowded digital landscape.

As the company seeks to stabilize, the question remains whether its appeal to Trump’s supporters can translate into financial success or whether it will remain a volatile stock driven more by ideology than business fundamentals.

-

Sports18 hours ago

Sports18 hours agoLawyer says Chinese doping case handled ‘reasonably’ but calls WADA’s lack of action “curious”

-

Sports3 hours ago

Sports3 hours agoDolphins will bring in another quarterback, while Tagovailoa deals with concussion

-

News17 hours ago

News17 hours agoB.C. to scrap consumer carbon tax if federal government drops legal requirement: Eby

-

News19 hours ago

News19 hours agoRCMP say 3 dead, suspects at large in targeted attack at home in Lloydminster, Sask.

-

Sports4 hours ago

Sports4 hours agoDavid Beckham among soccer dignitaries attending ex-England coach Sven-Goran Eriksson’s funeral

-

News18 hours ago

News18 hours agoCeiling high for Vancouver Whitecaps midfielder Ahmed: Canada coach

-

News17 hours ago

News17 hours agoA linebacker at West Virginia State is fatally shot on the eve of a game against his old school

-

News18 hours ago

News18 hours agoShapovalov, Auger-Aliassime lift Canada over Finland 3-0 in Davis Cup tie