Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Economy

Posthaste: Recession risk rises as Canadian economy runs out of room to grow – Financial Post

Aggressive interest rate hikes to tackle inflation could ‘tip the economy into recession,’ RBC says

Article content

Good morning!

Advertisement 2

Article content

The risk of a recession in Canada is rising as the economy runs out of room to grow amid high inflation, interest rate hikes and labour shortages, according to the Royal Bank of Canada.

The bank expects GDP growth to slow in Canada, from 4.5 per cent in 2021 to 4.2 per cent in 2022 and down to 1.9 per cent in 2023, said RBC’s latest macroeconomic outlook. Canada isn’t an outlier. Economies all over the world are slowing, and in fact, the United States, Italy and France, saw GDP actually fall in the first quarter of 2021 amid fallout from a fresh wave of COVID-19, supply chain problems and tight labour markets.

Those factors have put pressure on the Canadian economy as well, but it is still expanding. RBC said most of that growth is being driven by two sources: travel and high commodity prices. Canadians have resumed booking vacations, setting the travel industry up for growth through the summer. Meanwhile, higher prices for the commodities Canada exports, such as oil and gas, are padding the revenues of producers. That, along with an expected surge in oil and gas production after the spring maintenance season ends, will help keep GDP moving up.

Advertisement 3

Article content

But that’s where the good news ends, RBC said.

“Beyond that, the scope for any growth above trend is limited — and downside risks are building,” Craig Wright, senior vice-president and chief economist, and Nathan Janzen, senior economist, wrote in the report.

Inflation, and the corresponding interest rate increases from central banks trying to get it under control, are two such risks, RBC said. The rate of inflation climbed to 6.8 per cent in April, and RBC thinks it will keep growing as gas prices tick higher. Escalating prices of oil and fertilizer, supplies of which have been constrained amid Russia’s invasion of Ukraine, will also keep food prices climbing, lifting the overall inflation rate.

That’s where interest rates come in. Central banks the world over are implementing aggressive rate hikes in an effort to slow inflation. The Bank of Canada has already raised rates twice in a row by 50 basis points to bring the interest rate to 1.5 per cent. But it’s still “too low,” RBC said. It forecasts rates will hit 2.75 per cent by October.

Advertisement 4

Article content

However, there’s a chance interest rates could go higher than predicted and have an even greater impact. If expectations of persistent, elevated inflation become “entrenched,” as some fear, it will be harder for the Bank of Canada to bring it under control. That could mean even higher rates ahead, RBC said, because the central bank has made it clear it’s more worried about tackling inflation than keeping the economy growing. And that could set the economy up for a shock.

“The central bank is willing to hike rates higher if necessary, even if that risks pushing the economy into recession,” RBC said.

There are more headwinds slowing the Canadian economy. Labour shortages are also taking a big bite out of growth, RBC said. Job postings are 70 per cent higher than before the pandemic amid the lowest unemployment rate since 1976. If businesses don’t have enough staff, they can’t ramp up production, hitting economic growth.

Advertisement 5

Article content

Meanwhile, though transportation bottlenecks have eased, more supply chain problems are likely ahead if China keeps implementing rolling lockdowns to control the spread of COVID-19. That will also drag on growth.

Add all of it together, and Canada is set for a slowdown, if not an actual recession, said the RBC economists.

“At this point in the economic cycle, there’s limited room for future near-term growth. That means the next surprise in terms of the economic outlook is more likely to be downside than upside. And the most obvious downside risk is that central banks will need to hike interest rates more aggressively than we expect to tame inflation,” RBC said.

But even if the Bank of Canada were to stick to its path of bringing interest rates to “neutral,” between two and three per cent, GDP growth is still expected to slow. Interest rates at that level will soften economic growth by increasing household debt payments, bringing GDP to around one per cent per quarter in the last half of 2023, RBC said.

Advertisement 6

Article content

“Amid these conditions, it would not take a large downside growth surprise or further increase in interest rates to tip the economy into recession.”

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

LÜTKE IN CONTROL Shopify Inc. shareholders approved a new share structure that guarantees chief executive Tobi Lütke retains 40 per cent voting power. The newly created “founder” share would help protect Shopify against an unwanted takeover, explains one expert. The Financial Post’s Barbara Shecter has the details of the vote and what founder’s share means for the company. Photo by Julie Oliver/Postmedia News

Advertisement 7

Article content

___________________________________________________

- Prime Minister Justin Trudeau takes part in the Summit of the Americas in Los Angeles

- Labour Minister Seamus O’Regan attends the 110th Session of the International Labour Conference in Geneva

- Tourism Minister Randy Boissonnault will be in Paris to attend the 2022 Meeting of the Organization for Economic Co-operation and Development Ministerial Council

- Steven Guilbeault, minister of environment and climate change, will hold a press conference on Canada’s Greenhouse Gas Offset Credit System

- Dollarama Annual General Meeting

- Today’s data: U.S. wholesale trade

- Earnings: Bausch + Lomb Corp., Dollarama Inc., Gamestop Corp.

___________________________________________________

Advertisement 8

Article content

_______________________________________________________

___________________________________________________

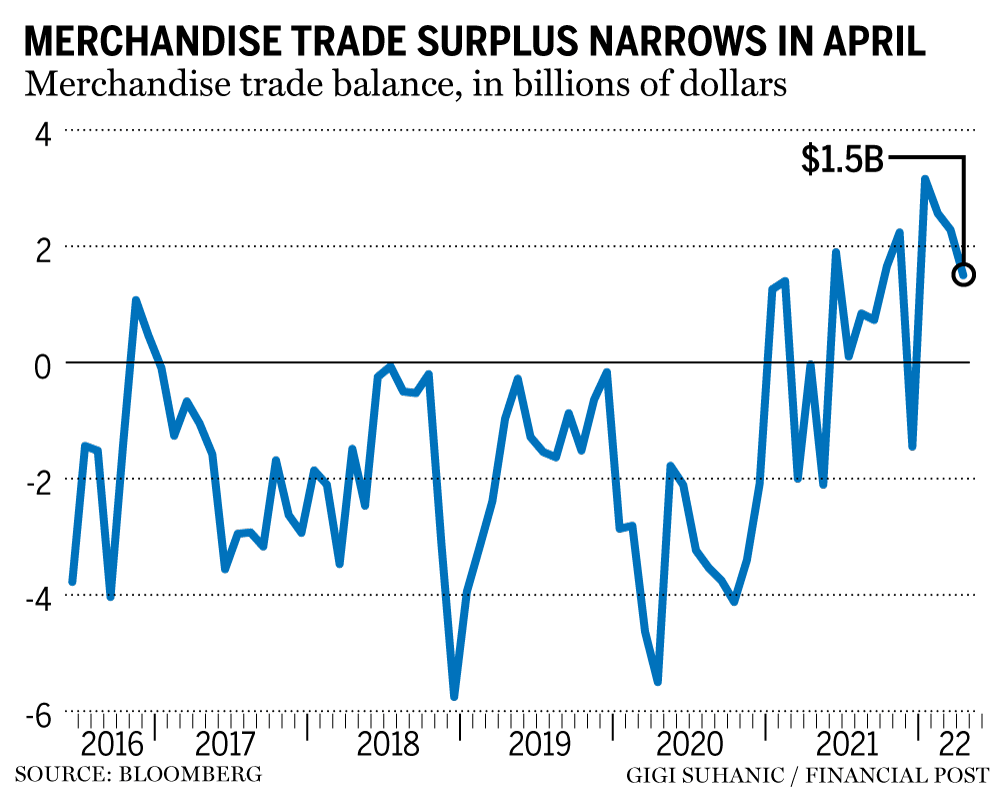

Outflows of crabs and motor vehicles helped boost Canadian exports 0.6 per cent in April, while imports rose 1.9 per cent, Statistics Canada said Tuesday.

Advertisement 9

Article content

Canada’s trade surplus narrowed to $1.50 billion in April from a revised $2.28 billion in March, and came in below analyst forecasts of $2.9 billion.

Energy exports softened last month amid drops in crude oil production amid maintenance shutdowns.

Consumer goods led gains in imports, along with energy products, driven higher by the high cost of gasoline.

____________________________________________________

Up to 10 per cent of homes in Canada are uninsurable because of flooding, one insurance expert says, and the risk of flooding will continue to increase without government intervention.

Our content partner MoneyWise Canada offers some tips for homeowners on what they can do to determine and lower their risk of flooding.

____________________________________________________

Today’s Posthaste was written by Victoria Wells (@vwells80), with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Advertisement

Economy

Canada’s unemployment rate holds steady at 6.5% in October, economy adds 15,000 jobs

OTTAWA – Canada’s unemployment rate held steady at 6.5 per cent last month as hiring remained weak across the economy.

Statistics Canada’s labour force survey on Friday said employment rose by a modest 15,000 jobs in October.

Business, building and support services saw the largest gain in employment.

Meanwhile, finance, insurance, real estate, rental and leasing experienced the largest decline.

Many economists see weakness in the job market continuing in the short term, before the Bank of Canada’s interest rate cuts spark a rebound in economic growth next year.

Despite ongoing softness in the labour market, however, strong wage growth has raged on in Canada. Average hourly wages in October grew 4.9 per cent from a year ago, reaching $35.76.

Friday’s report also shed some light on the financial health of households.

According to the agency, 28.8 per cent of Canadians aged 15 or older were living in a household that had difficulty meeting financial needs – like food and housing – in the previous four weeks.

That was down from 33.1 per cent in October 2023 and 35.5 per cent in October 2022, but still above the 20.4 per cent figure recorded in October 2020.

People living in a rented home were more likely to report difficulty meeting financial needs, with nearly four in 10 reporting that was the case.

That compares with just under a quarter of those living in an owned home by a household member.

Immigrants were also more likely to report facing financial strain last month, with about four out of 10 immigrants who landed in the last year doing so.

That compares with about three in 10 more established immigrants and one in four of people born in Canada.

This report by The Canadian Press was first published Nov. 8, 2024.

The Canadian Press. All rights reserved.

Economy

Health-care spending expected to outpace economy and reach $372 billion in 2024: CIHI

The Canadian Institute for Health Information says health-care spending in Canada is projected to reach a new high in 2024.

The annual report released Thursday says total health spending is expected to hit $372 billion, or $9,054 per Canadian.

CIHI’s national analysis predicts expenditures will rise by 5.7 per cent in 2024, compared to 4.5 per cent in 2023 and 1.7 per cent in 2022.

This year’s health spending is estimated to represent 12.4 per cent of Canada’s gross domestic product. Excluding two years of the pandemic, it would be the highest ratio in the country’s history.

While it’s not unusual for health expenditures to outpace economic growth, the report says this could be the case for the next several years due to Canada’s growing population and its aging demographic.

Canada’s per capita spending on health care in 2022 was among the highest in the world, but still less than countries such as the United States and Sweden.

The report notes that the Canadian dental and pharmacare plans could push health-care spending even further as more people who previously couldn’t afford these services start using them.

This report by The Canadian Press was first published Nov. 7, 2024.

Canadian Press health coverage receives support through a partnership with the Canadian Medical Association. CP is solely responsible for this content.

The Canadian Press. All rights reserved.

Economy

Trump’s victory sparks concerns over ripple effect on Canadian economy

As Canadians wake up to news that Donald Trump will return to the White House, the president-elect’s protectionist stance is casting a spotlight on what effect his second term will have on Canada-U.S. economic ties.

Some Canadian business leaders have expressed worry over Trump’s promise to introduce a universal 10 per cent tariff on all American imports.

A Canadian Chamber of Commerce report released last month suggested those tariffs would shrink the Canadian economy, resulting in around $30 billion per year in economic costs.

More than 77 per cent of Canadian exports go to the U.S.

Canada’s manufacturing sector faces the biggest risk should Trump push forward on imposing broad tariffs, said Canadian Manufacturers and Exporters president and CEO Dennis Darby. He said the sector is the “most trade-exposed” within Canada.

“It’s in the U.S.’s best interest, it’s in our best interest, but most importantly for consumers across North America, that we’re able to trade goods, materials, ingredients, as we have under the trade agreements,” Darby said in an interview.

“It’s a more complex or complicated outcome than it would have been with the Democrats, but we’ve had to deal with this before and we’re going to do our best to deal with it again.”

American economists have also warned Trump’s plan could cause inflation and possibly a recession, which could have ripple effects in Canada.

It’s consumers who will ultimately feel the burden of any inflationary effect caused by broad tariffs, said Darby.

“A tariff tends to raise costs, and it ultimately raises prices, so that’s something that we have to be prepared for,” he said.

“It could tilt production mandates. A tariff makes goods more expensive, but on the same token, it also will make inputs for the U.S. more expensive.”

A report last month by TD economist Marc Ercolao said research shows a full-scale implementation of Trump’s tariff plan could lead to a near-five per cent reduction in Canadian export volumes to the U.S. by early-2027, relative to current baseline forecasts.

Retaliation by Canada would also increase costs for domestic producers, and push import volumes lower in the process.

“Slowing import activity mitigates some of the negative net trade impact on total GDP enough to avoid a technical recession, but still produces a period of extended stagnation through 2025 and 2026,” Ercolao said.

Since the Canada-United States-Mexico Agreement came into effect in 2020, trade between Canada and the U.S. has surged by 46 per cent, according to the Toronto Region Board of Trade.

With that deal is up for review in 2026, Canadian Chamber of Commerce president and CEO Candace Laing said the Canadian government “must collaborate effectively with the Trump administration to preserve and strengthen our bilateral economic partnership.”

“With an impressive $3.6 billion in daily trade, Canada and the United States are each other’s closest international partners. The secure and efficient flow of goods and people across our border … remains essential for the economies of both countries,” she said in a statement.

“By resisting tariffs and trade barriers that will only raise prices and hurt consumers in both countries, Canada and the United States can strengthen resilient cross-border supply chains that enhance our shared economic security.”

This report by The Canadian Press was first published Nov. 6, 2024.

The Canadian Press. All rights reserved.

-

News22 hours ago

News22 hours agoSatellite images and documents indicate China working on nuclear propulsion for new aircraft carrier

-

News22 hours ago

News22 hours agoTraumatized by war, hundreds of Lebanon’s children struggle with wounds both physical and emotional

-

News5 hours ago

News5 hours agoMan facing 1st-degree murder in partner’s killing had allegedly threatened her before

-

News5 hours ago

News5 hours ago‘Do the work’: Ottawa urges both sides in B.C. port dispute to restart talks

-

News22 hours ago

News22 hours agoResearch reveals China has built prototype nuclear reactor to power aircraft carrier

-

News22 hours ago

News22 hours agoLeBron James gets 2nd straight triple-double as Lakers dunk Raptors 123-103

-

News22 hours ago

News22 hours agoNHL roundup: Kurashev’s OT goal lifts Blackhawks over Wild 2-1

-

News22 hours ago

News22 hours agoWisconsin’s high court to hear oral arguments on whether an 1849 abortion ban remains valid