The News cycle has centred upon issues of inflation, the cost of living, transportation and housing costs. Are we living far beyond our financial capabilities? Are our expectations too demanding?

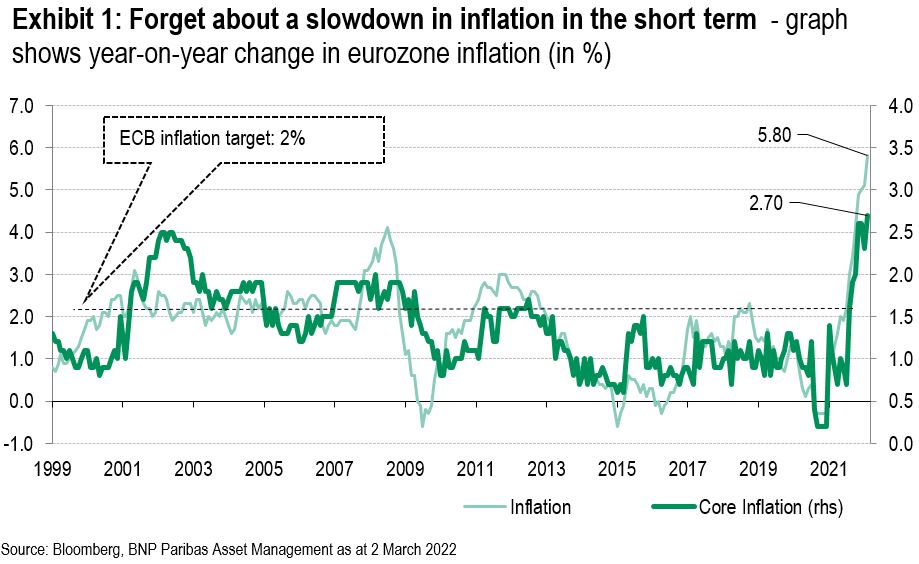

The true inflation levels are nearing 8.9-10%, something our governments tried to hide in an effort to bring our attention to levels they wish to achieve, nearing 2-3%. Gas has reached levels never seen in our nation. Housing, both rental or owned is out of reach for most citizens. Everything from the food we eat, to what clothes us or entertains us has risen drastically.

Our expectations have brought upon us a feared financial apocalypse, and we need to revise our expectations and lifestyles if we are to survive and possibly prosper.

Energy costs demand that we stop driving gas guzzlers, and move to smaller vehicles or perhaps even electric vehicles. Has the time an average person can afford to drive a sports car or large SUV ended?

Can we move away from costly food items towards local nourishing foods that are less costly? Steak and lobster can be perhaps substituted with poultry, shrimp and pork. Eating healthier while saving on your costs works for me. Purchase intelligently, communicating with the grocer what you want and what you are willing to pay. They can be persuaded to compete more effectively.

Housing has been a magnet drawing many of our friends into costly mortgages and excessive debt. Perhaps it is time that we strive for less costly options like renting. In many large urban centers, you can find people who have been renting happily for decades. The problem is finding rental units. Is it not time for you to pressure public officials to move their revenue expectations from large housing units toward townhomes, well-built apartment buildings and large building lofts. If you make it known that that is what is needed, some developers will build them. And when you rent or buy such a unit don’t play the blind bidding game but strive to pay what the product is truly worth. Make the housing game yours, not the real estate agents and developers.*** 1 in 5 house owners in B.C. say they will have to sell if interest rates escalate further.

***Even our governments may need to review the public’s expectations and bring their spending under control. An assessment of what is truly needed vs what the public would like to see.

The time of passive immediate purchasing must end. Your expectations need to mature and evolve, just as you do daily. It can be said we have entered a period of recession, and depending on what the World Economic Czars do about it, can develop into a horrid situation for many of us. Think 2009 but worse and perhaps lasting longer. Yeah the horror, the horror.

Do you have a grandma or grandpa who lived through the Great Depression? There is a source of inspiration and advice you can tape. Make things last longer, and learn how to repair, reuse and recycle. As long as your car works, use it, and conserve gas by not wasting your fuel. Manage your time, expenses and expectations that would make your elders proud. Vacation locally, and don’t go to the airport to travel far away, it is a place of stagnation, stress and anger, especially Toronto International Airport 🙁

“Well done, is better than well said. The more I expect, the more unhappy I am going to be”(Ben Franklin). The stress you are all feeling, going to work for pay while paying more to go there, and your payroll remains the same. This is a feeling that will be with you for a long time, unfortunately. We are not going forward financially, but rather hopefully remaining where we previously were, only to fall into debt and despair. Two feet forward, three feet back.

The only way you can change your predicament is by changing your ways. Expect less, but expect better. Look for quality over quantity and revise your expectations.

Steven Kaszab

Bradford, Ontario

skaszab@yahoo.ca

Related