Uncategorized

Bill with tax credits for ‘North American’ electric vehicles passes in U.S. Senate

WASHINGTON — The new plan to encourage Americans to buy more electric vehicles built in North America, instead of just the United States, has cleared its tallest hurdle.

After a marathon voting session that lasted nearly 24 hours, the U.S. Senate finally approved the new Inflation Reduction Act of 2022.

Vice-President Kamala Harris had to break a 50-50 tie to pass the legislation, a dramatically smaller version of President Joe Biden’s signature $2-trillion climate and social spending package.

The original proposal reserved the richest tax credits for vehicles assembled in the U.S. with union labour — a plan experts say would have kneecapped Canada’s auto industry.

But Senate Majority Leader Chuck Schumer reached a deal with holdout West Virginia Sen. Joe Manchin on a version of the bill that extended the credits to vehicles built in Canada and Mexico.

The bill is expected to win approval in the Democrat-controlled House of Representatives next week before heading to the president’s desk.

“It’s been a long, tough and winding road, but at last, at last we have arrived,” Schumer said Sunday when the outcome was no longer in doubt.

“I am confident the Inflation Reduction Act will endure as one of the defining legislative measures of the 21st century.”

The bill devotes $369 billion to measures to combat climate change, while also capping drug costs for seniors, extending health insurance benefits and lowering the deficit.

The climate measures also include incentives for building clean-energy equipment like solar panels and wind turbines, lowering pollution levels in minority communities and expanding greener factory-farm operations.

Republicans, whose barrage of proposed amendments were swatted down throughout Saturday night and into Sunday, framed their defeat as a win for higher taxes, more inflation and continued dependence on foreign energy.

“Democrats have already robbed American families once through inflation,” said Senate Minority Leader Mitch McConnell. “Now their solution is to rob American families a second time.”

The tax credits — which also require eligible vehicles to have a percentage of North American critical minerals in their batteries — have barely been part of the U.S. debate. Critics say it will be years before consumers can benefit.

But for the Canadian auto industry, the stakes were enormous.

Flavio Volpe, president of the Auto Parts Manufacturers’ Association, was just one part of an all-hands, year-long effort by the industry, the Ontario government and Ottawa to convince U.S. lawmakers and Biden administration officials to stand down.

“It’s a cigar. It’s always a cigar,” Volpe said when asked how he would mark the occasion.

“In trade wars, by the time it’s officially over, everyone else has moved on to the next issue of the day. I’ve had so many quiet cigars it’s become my ritual.”

Manchin, a Senate swing vote from a state where Toyota is a major manufacturer, had long been opposed to the idea of leaving foreign automakers out of the EV incentives — but it wasn’t clear until just last week whether that would pay dividends for Canada.

The surprise agreement he forged with Schumer marked the culmination of an aggressive lobbying effort that began with Prime Minister Justin Trudeau’s visit to the White House back in November.

Federal government officials say it was rivalled in scope only by the 2017-18 NAFTA talks, the high-stakes Trump-era negotiations that forged the diplomatic flood-the-zone strategy now known as the “Team Canada” approach.

It targeted a wide array of U.S. officials and lawmakers, and involved at least one face-to-face meeting in recent months between Manchin and Deputy Prime Minister Chrystia Freeland.

This report by The Canadian Press was first published Aug. 7, 2022.

— With files from The Associated Press

The Canadian Press

Note to readers: This is a corrected story. A previous version pegged the amount devoted to fighting climate change at US$389 billion. It is, in fact, $369 billion.

Uncategorized

The Booming Business of Online Casinos: A Look at Current Trends

Photo: https://unsplash.com/photos/red-playing-cards-kpY9410Ha2s

In the ever-evolving landscape of the gambling industry, online casinos have emerged as a powerhouse, captivating millions of players worldwide. This trend is particularly evident in Canada, where the online casino market has experienced significant growth in recent years. Let’s delve into the latest business news and trends shaping the world of online casinos.

Rise in Demand and Revenue

The online casino business has been on a steady upward trajectory, fueled by the increasing demand for convenient and accessible gambling options. With advancements in technology and the widespread availability of high-speed internet, Canadians are embracing online casinos as a preferred mode of entertainment. This surge in demand has translated into substantial revenue growth for operators, with many reporting record-breaking profits in recent quarters. If you’re interested in checking out what the online casino industry has to offer, check out https://luckycasino.com/en/ to find interesting and innovative ideas in the iGaming industry.

Expansion of the Market

One notable trend in the online casino industry is the expansion of the market to new demographics and regions. Traditionally, online gambling was associated with younger demographics, but there has been a noticeable shift in recent years. Older adults, in particular, are increasingly turning to online casinos for entertainment, contributing to the diversification of the player base. Additionally, with the legalization of online gambling in certain provinces and the growing acceptance of digital currencies like Bitcoin, the market is poised for further expansion.

Technological Advancements

Technology continues to play a pivotal role in shaping the online casino landscape. From state-of-the-art gaming platforms to innovative payment solutions, operators are constantly striving to enhance the user experience. Virtual reality (VR) and augmented reality (AR) technologies are also being integrated into online casinos, offering players a more immersive and interactive gaming experience. These technological advancements not only attract new players but also foster loyalty among existing customers.

Regulatory Challenges and Compliance

Despite its rapid growth, the online casino industry is not without its challenges, particularly in terms of regulation and compliance. As governments around the world grapple with the complexities of online gambling, regulatory frameworks continue to evolve. In Canada, for example, the legality of online gambling varies by province, leading to inconsistencies in regulations and enforcement. Operators must navigate a complex web of laws and regulations to ensure compliance, which can be a daunting task.

The Impact of COVID-19

The COVID-19 pandemic has had a profound impact on the online casino industry, both positively and negatively. On one hand, lockdown measures and social distancing restrictions have driven more people to seek entertainment options online, leading to a surge in demand for online casinos. On the other hand, economic uncertainty and job losses have affected consumer spending, prompting some players to cut back on discretionary expenses like gambling. Overall, the net effect of the pandemic on the online casino business remains to be seen.

Looking Ahead

As we look to the future, the online casino industry shows no signs of slowing down. With continued technological innovations, evolving consumer preferences, and shifting regulatory landscapes, the business of online casinos is poised for further growth and transformation. For players and operators alike, staying abreast of the latest trends and developments will be crucial in navigating this dynamic and ever-changing industry landscape.

In conclusion, the world of online casinos presents a myriad of opportunities and challenges for businesses and players alike. With its growing popularity and profitability, the online casino industry is undoubtedly a force to be reckoned with in the global gambling market.

News

Migrant Justice Organizations and South Asian Diaspora Groups from Across Canada in Support of Permanent Solution for International Students of Indian Origin

Calgary, Edmonton, Montreal, Toronto, Vancouver, Winnipeg, June 20, 2023 – Almost twenty Migrant Justice Organizations and South Asian Diaspora Groups from across Canada urge Immigration, Refugees and Citizenship Minister, Sean Fraser, to put a definite stop to the deportation of scores of international students from India.“These students entered Canada like any other international students and they should not have to bear the burden of proof because of fraud committed by immigration consultants and education recruiters” stated the joint letter. Receiving deportation orders and the precarity of having to live with a constant threat of being separated from their families and uprooted from their communities and the associated struggle and turmoil is a painful process and is punishment in itself.For over two weeks, from May 28, students, their supporters and community members had set up a permanent protest in front of the CBSA headquarters in Mississauga. While this protest now ended with your announcement on June 14 to halt the deportations, students continue to express their concerns over the next steps in this process. Migrant Justice Organizations and South Asian Diaspora Groups stand in solidarity with the students and believe there can be no justice until their demands are met, which are: a permanent solution to the situation, a definitive cancellation of the deportations, and granting them permanent resident status. Nothing short of this is acceptable.These individuals who arrived in Canada as international students call Canada home and have become integral parts of our lives. They are an asset to our communities and should be living here without any hassle or threat of deportation.Deportations are a long standing form of institutional racism, and are manifested in the violent and coercive practices of the state. This situation is yet another example of how the Canadian immigration system and CBSA fail people and produce undocumented migrants. This is why regularization is necessary. Just like Migrant Justice and hundreds of civil society groups across Canada, the signatories of the joint letter call for a comprehensive, inclusive and ongoing regularization program for all people with precarious status. All migrants should be given permanent resident status on arrival. Migrants already here must be granted permanent residency.Close to twenty groups that signed the joint letter urge the minister to take prompt and decisive action to provide a permanent solution, and immediate regularization and permanent resident status for these students and all undocumented people across Canada. Without this, there can be no justice.Status for All, Dignity for All!Signatories of the joint letter:Butterfly (Asian and Migrant Sex Workers Support Network), TorontoCentre sur L’Asie du Sud (CERAS), MontréalImmigrant Workers Centre/Centre Des Travailleurs Et Travailleuses Immigrants (IWC-CTTI), MontréalIndia Civil Watch – International, TorontoMigrante Alberta, EdmontonParkdale Community Legal Services, TorontoProgressive Cultural Association, CalgaryPro-People Arts Project Media Group (Sarokaran Di Awaz), TorontoPunjabi Literary and Cultural Association, WinnipegQuebec Public Interest Research Group – Concordia University (QPIRG), MontréalRang Collective: Arts for Solidarity/Collectif Rang: Les Arts pour la Solidarité, MontréalShaheed Bhagat Singh Book Centre, CalgarySolidarity Across Borders, MontréalSouth Asian Dalit Adivasi Network – Canada, TorontoSouth Asian Diaspora Action Collective (SADAC), MontréalSouth Asian Network for Secularism and Democracy (SANSAD), VancouverSouth Asian Women’s Community Center/Centre Communautaire Des Femmes Sud-Asiatiques (SAWCC-CCFSA), MontréalTeesri Duniya Theatre, MontréalWorkers’ Action Centre, TorontoCC Standing Committee on Citizenship and Immigration:Shafqat Ali, MPAlexis Brunelle-Duceppe, MPSukh Dhaliwal, MPFayçal El-Khoury, MPArielle Kayabaga, MPTom Kmiec, MPJenny Kwan, MPMarie-France Lalonde, MPLarry McGuire, MPHon. Michelle Rempelle Garner, MPBrad Redekopp, MPSalma Zahid, MP

Uncategorized

Federal budget 2022: Highest-earning Canadians face minimum tax rate increase

The federal government is moving to raise the minimum tax rate paid by wealthy Canadians in the budget and narrowing its focus on the highest earners.

In its budget Tuesday, Ottawa is raising the alternative minimum tax rate and imposing new limits on many of the exemptions, deductions and credits that apply under the system starting in 2024.

“We’re making sure the very wealthy and our biggest corporations pay their fair share of taxes, so we can afford to keep taxes low for middle-class families,” Finance Minister Chrystia Freeland said in the prepared text of her remarks.

The alternative minimum tax (AMT) introduced in 1986 is a parallel income tax calculation that allows fewer deductions, exemptions and tax credits than the ordinary tax rules for the country’s highest earners. Wealthy Canadians pay the alternative minimum or regular tax, whichever is higher.

The government announced in the budget that it is increasing the alternative minimum rate to 20.5 per cent from 15 per cent starting in 2024.

To help ensure lower- and middle-income Canadians don’t get caught up in the increase, Ottawa is also proposing to increase the exemption to the start of the fourth federal tax bracket from $40,000. For 2024, it expects the exemption would be about $173,000 and be indexed annually to inflation.

The government estimates that under the new rules about 32,000 Canadians will be covered by alternative minimum tax in 2024, compared with about 70,000 if it did not make the changes.

However, the higher rate and revamping of the allowable deductions and credits mean Ottawa expects to take in an additional $150 million in 2023-24 and an additional $625 million in 2024-25.

Bruce Ball, vice-president for tax at CPA Canada, said there is a broader range of things that will go into the alternative minimum tax calculation, but the good news for most taxpayers is that the threshold will be much higher.

“That should exclude a lot of people even if they have more add-backs than they would have under the old system, so there’s some good news and bad news I guess, depending on your situation,” Ball said.

“If you’re higher income you may end up paying more; if you’re lower income you may not be subject to AMT.”

While the richest Canadians face the possibility of higher taxes, the budget also includes a one-time payment for those who receive the goods and services tax credit to help offset the rising cost of living.

“We all know that our most vulnerable friends and neighbours are still feeling the bite of higher prices. And that is why our budget delivers targeted inflation relieve to those who need it most,” Freeland said.

Under the proposal billed as a grocery rebate, Canadians who are eligible will receive an additional amount equal to twice the GST tax credit amount for January. For couples with two children the amount could be up to $467, while a single Canadian without children could receive up to an extra $234.

Student budgets will also see a boost from the budget as the government increases the Canada Student Grants compared with pre-pandemic levels and raises the interest-free Canada Student Loan limit.

The changes increase the total federal aid available to a full-time student based on financial need to $14,400 for 2023, up from $13,160 for 2022 and $10,140 in 2019 before the pandemic.

The government is also moving to cap the increase on alcohol excise duties to two per cent for one year. Ordinarily, the rates are indexed to the consumer price index and were previously set to rise by 6.3 per cent.

However, Canadians looking to take a flight next year will face an increase in the air travellers security charge paid by those flying in Canada starting on May 1, 2024. The charges, which are paid by passengers when they buy an airline ticket, help pay for the air travel security system and were last increased in 2010.

The charge for a domestic round trip will rise to $19.87, from its current rate of $14.96. The charge for a transborder flight to the U.S. will rise to $16.89 from $12.71, while for departing international flights travellers will pay $34.42, up from $25.91.

This report by The Canadian Press was first published March 28, 2023.

-

News16 hours ago

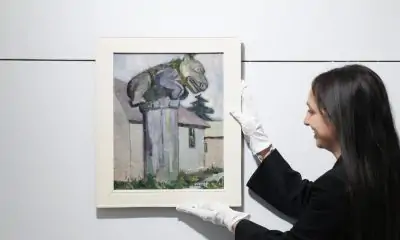

News16 hours agoEstate sale Emily Carr painting bought for US$50 nets C$290,000 at Toronto auction

-

News16 hours ago

News16 hours agoCanada’s Hadwin enters RSM Classic to try new swing before end of PGA Tour season

-

News17 hours ago

News17 hours agoAll premiers aligned on push for Canada to have bilateral trade deal with U.S.: Ford

-

News16 hours ago

News16 hours agoClass action lawsuit on AI-related discrimination reaches final settlement

-

News16 hours ago

News16 hours agoComcast to spin off cable networks that were once the entertainment giant’s star performers

-

News16 hours ago

News16 hours agoWhat to know about Transgender Day of Remembrance and violence against trans people

-

News24 hours ago

News24 hours agoCompetition Bureau investigating Leon’s, The Brick for alleged deceptive marketing

-

News16 hours ago

News16 hours agoGorilla at Calgary zoo died from head injury after worker closed wrong door