Article content

(Bloomberg) — The world’s third largest economy recovered to its pre-pandemic size in the second quarter, as consumer spending picked up following the end of coronavirus curbs on businesses.

The world’s third largest economy recovered to its pre-pandemic size in the second quarter, as consumer spending picked up following the end of coronavirus curbs on businesses.

(Bloomberg) — The world’s third largest economy recovered to its pre-pandemic size in the second quarter, as consumer spending picked up following the end of coronavirus curbs on businesses.

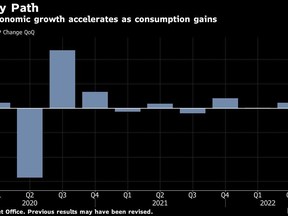

Gross domestic product grew at an annualized pace of 2.2% in the second quarter of this year, coming in below the median estimate of 2.6%, Cabinet Office data showed Monday. That lifted the size of the economy to 542.1 trillion yen ($4.1 trillion), above what it was at the end of 2019. First quarter GDP was revised to an expansion from a prior contraction.

“The economy managed to return to its pre-pandemic size, but its recovery pace has been slower than other nations,” said economist Takeshi Minami at Norinchukin Research Institute. “I expect growth to continue in the third quarter too, but it will likely be losing momentum down the road.”

The end of pandemic restrictions on businesses in late March helped spur the economy. Consumer spending, which accounts for more than half of Japan’s economic output, led the growth, as did capital expenditure. The relaxing of Covid rules resulted in increased spending at restaurants and hotels, as well as on clothes, according to the Cabinet Office.

Still, the gains were more limited than expected a few months ago, showing that pent-up demand among consumers has been moderate.

What Bloomberg Economics Says…

“Going forward, we expect growth to slow in 3Q. Persistent cost-push inflation and a surge in new Covid-19 cases point to downside risks to the recovery. These will probably outweigh any boost from inventory rebuilding.”

— Yuki Masujima, economist

For the full report, click here.

While the economy regained its pre-pandemic size, economists expect the central bank to stick to its current easing policy, and the government to continue providing support for households hit by both the pandemic and rising prices. Other developed economies are doing the opposite by raising interest rates to cool demand and rampant inflation.

Japan’s milestone also comes behind the US’s, which recovered its pre-pandemic economy size a year ago, while much of Europe regained it at the end of 2021.

The report came out as downside risks mount at home and abroad. Japan has been reporting record Covid infection cases with daily numbers continuing to top 200,000 this month. The government has so far kept economic activity as normal as possible without bringing back restrictions. But high-frequency data suggest people’s mobility is falling.

In Japan’s key trading partners, growth is slowing as the US and Europe fight inflation and China sticks to its zero-Covid policy. The war in Ukraine continues to disrupt food and energy supplies while the crisis in Taiwan is adding to geopolitical risks.

Inflation remains relatively moderate in Japan, but consumption may cool with prices rising faster than wages. After factoring in inflation, paychecks in Japan have been falling for three months in a row through June.

Prime Minister Fumio Kishida reshuffled his cabinet last week but signaled that the core parts of his policies will remain the same. Kishida also suggested he’ll remain flexible on fiscal support, although he’ll focus on spending existing reserve funds first before reaching for additional debt issuance.

Japan Kishida Orders Continued Wheat Prices Cap, More Grants (1)

Kishida ordered Monday another set of measures to contain inflation by early September, with a boost in funding for regional governments and a continued cap on imported wheat prices. He emphasized that wage gains need to be sustained, while saying that the additional support measures will concentrate on food, regional grants and energy.

For now, the measures will be supported by existing reserve funds, though Kishida said he’ll remain flexible in his approach.

“Inflation can cool consumption, although oil prices may stabilize with the global economy slowing down,” said Norinchukin’s Minami. “As downside risks mount in the world economy, there’s a risk that Japan’s economy could contract at some stage toward the end of the year.”

Bank of Japan Governor Haruhiko Kuroda has repeatedly said that the central bank must retain its easing program to support the economy until inflation becomes sustainable. He’s still seeking healthy wage gains, and price rises that go beyond a boom in commodities.

So far, economists expect growth in Japan to remain moderate for the rest of the year, slowing as the months progress. For the third quarter, analysts expect annualized gains of 3.2%.

(Updates with more details on additional price relief measures)

TORONTO – Strength in the base metal and technology sectors helped Canada’s main stock index gain almost 100 points on Friday, while U.S. stock markets also climbed higher.

The S&P/TSX composite index closed up 93.51 points at 23,568.65.

In New York, the Dow Jones industrial average was up 297.01 points at 41,393.78. The S&P 500 index was up 30.26 points at 5,626.02, while the Nasdaq composite was up 114.30 points at 17,683.98.

The Canadian dollar traded for 73.61 cents US compared with 73.58 cents US on Thursday.

The October crude oil contract was down 32 cents at US$68.65 per barrel and the October natural gas contract was down five cents at US$2.31 per mmBTU.

The December gold contract was up US$30.10 at US$2,610.70 an ounce and the December copper contract was up four cents US$4.24 a pound.

This report by The Canadian Press was first published Sept. 13, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

OTTAWA – Statistics Canada says wholesale sales, excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain, rose 0.4 per cent to $82.7 billion in July.

The increase came as sales in the miscellaneous subsector gained three per cent to reach $10.5 billion in July, helped by strength in the agriculture supplies industry group, which rose 9.2 per cent.

The food, beverage and tobacco subsector added 1.7 per cent to total $15 billion in July.

The personal and household goods subsector fell 2.5 per cent to $12.1 billion.

In volume terms, overall wholesale sales rose 0.5 per cent in July.

Statistics Canada started including oilseed and grain as well as the petroleum and petroleum products subsector as part of wholesale trade last year, but is excluding the data from monthly analysis until there is enough historical data.

This report by The Canadian Press was first published Sept. 13, 2024.

The Canadian Press. All rights reserved.

TORONTO – Canada’s main stock index was up more than 150 points in late-morning trading, helped by strength in the base metal and energy sectors, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 172.18 points at 23,383.35.

In New York, the Dow Jones industrial average was down 34.99 points at 40,826.72. The S&P 500 index was up 10.56 points at 5,564.69, while the Nasdaq composite was up 74.84 points at 17,470.37.

The Canadian dollar traded for 73.55 cents US compared with 73.59 cents US on Wednesday.

The October crude oil contract was up $2.00 at US$69.31 per barrel and the October natural gas contract was up five cents at US$2.32 per mmBTU.

The December gold contract was up US$40.00 at US$2,582.40 an ounce and the December copper contract was up six cents at US$4.20 a pound.

This report by The Canadian Press was first published Sept. 12, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Armstrong scores, surging Vancouver Whitecaps beat slumping San Jose Earthquakes 2-0

As plant-based milk becomes more popular, brands look for new ways to compete

Looking for the next mystery bestseller? This crime bookstore can solve the case

Labour Minister praises Air Canada, pilots union for avoiding disruptive strike

CF Montreal finds its groove with 2-1 win over Charlotte

Toronto FC downs Austin FC to pick up three much-needed points in MLS playoff push

Liberal candidate in Montreal byelection says campaign is about her — not Trudeau

Inflation expected to ease to 2.1%, lowest level since March 2021: economists