(Bloomberg) — Skyrocketing demand, limited supply, price gouging and monopoly accusations. And a customer willing to pay almost anything.

Economy

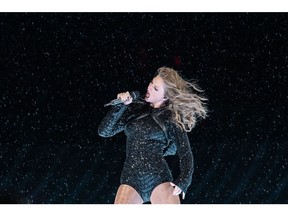

What Taylor Swift Reveals About the US Economy

Swifties, as the popstar’s fans are known, aren’t necessarily your average American, but they capture the current moment in the post-Covid economy. Even as recession looms, many consumers are willing to splurge on what they missed at the height of the pandemic — whether it’s travel or live entertainment.

Swift’s fans represent an extreme version of that turbocharged consumer: millions of mostly Millennials and Gen Zs who waited at least four years to see the superstar live again and emerged from the pandemic with historically high rates of savings.

Read More: Here’s The Real Reason You Can’t Buy Taylor Swift Tickets

Right now, Swift’s “The Eras Tour” tickets are available only on the secondary market and they’re anything but cheap. About 2.4 million were sold last week before Ticketmaster suspended the official pre-sale. The ticketing company’s site crashed under the pressure of some 14 million people trying to get seats.

Among them was Melissa Kearney, an economics professor at the University of Maryland who is now experiencing first-hand the basic laws of supply and demand. The mother of two Swifties, ages 12 and 15, is determined to spend whatever it takes after failing to score tickets.

Gustavo Coutinho, who’s never seen Swift play live, came up with a $2,000 budget after 10 months of savings. The 25-year-old consultant in Boston ended up spending about $1,500 to attend two concerts. “I would pay $3,000 if I had to,” he said.

In the early 2000s, the late economist Alan Krueger came up with the concept of “Rockonomics” to explain the economy through the lens of the music industry. Krueger often used Swift, who released her debut album in 2006 at the age of 16, as an example of someone who played with strategies that boosted concert and product sales, calling her “an economic genius.”

Other artists, including Bruce Springsteen, have proved fans are ready to pay sky-high prices for mega post-Covid live events — recession be damned.

Meanwhile, Swiftonomics is a crash course on another concept: monopoly. Politicians and attorneys general seized on the moment to renew their criticism of Ticketmaster, a dominant player in the live-music industry.

Even before last week, Ticketmaster and parent company Live Nation Entertainment Inc. were at the center of an antitrust investigation by the Department of Justice over whether the platform is abusing its power, according to people familiar with the probe.

Supply Mastermind

Ultimately, the singer is the mastermind behind the supply. She has chosen to play at high-capacity stadiums, and has added new concerts. Still, there’s frenzy around her tours. “Very often you have the sense that scarcity increases demand,” said Pascal Courty, an economist at the University of Victoria in Canada who researches resale markets for tickets.

One of the biggest questions in the broader economy is whether consumers will continue to spend as interest rates and joblessness increase.

Swiftonomics probably won’t help answer. It’s its own economic microcosm, and fans just shake it off.

“I hesitate to read too much into people’s willingness to pay exorbitant amounts for Taylor Swift tickets in terms of what that says about the health of the US economy,” said Kearney, the Swiftie-parent economist. “I’m more inclined to read into it that for the die-hard Taylor Swift fans — of which there are many — the demand for tickets is nearly inelastic.”

—With assistance from Ashley Carman and Reade Pickert.

Economy

B.C.’s debt and deficit forecast to rise as the provincial election nears

VICTORIA – British Columbia is forecasting a record budget deficit and a rising debt of almost $129 billion less than two weeks before the start of a provincial election campaign where economic stability and future progress are expected to be major issues.

Finance Minister Katrine Conroy, who has announced her retirement and will not seek re-election in the Oct. 19 vote, said Tuesday her final budget update as minister predicts a deficit of $8.9 billion, up $1.1 billion from a forecast she made earlier this year.

Conroy said she acknowledges “challenges” facing B.C., including three consecutive deficit budgets, but expected improved economic growth where the province will start to “turn a corner.”

The $8.9 billion deficit forecast for 2024-2025 is followed by annual deficit projections of $6.7 billion and $6.1 billion in 2026-2027, Conroy said at a news conference outlining the government’s first quarterly financial update.

Conroy said lower corporate income tax and natural resource revenues and the increased cost of fighting wildfires have had some of the largest impacts on the budget.

“I want to acknowledge the economic uncertainties,” she said. “While global inflation is showing signs of easing and we’ve seen cuts to the Bank of Canada interest rates, we know that the challenges are not over.”

Conroy said wildfire response costs are expected to total $886 million this year, more than $650 million higher than originally forecast.

Corporate income tax revenue is forecast to be $638 million lower as a result of federal government updates and natural resource revenues are down $299 million due to lower prices for natural gas, lumber and electricity, she said.

Debt-servicing costs are also forecast to be $344 million higher due to the larger debt balance, the current interest rate and accelerated borrowing to ensure services and capital projects are maintained through the province’s election period, said Conroy.

B.C.’s economic growth is expected to strengthen over the next three years, but the timing of a return to a balanced budget will fall to another minister, said Conroy, who was addressing what likely would be her last news conference as Minister of Finance.

The election is expected to be called on Sept. 21, with the vote set for Oct. 19.

“While we are a strong province, people are facing challenges,” she said. “We have never shied away from taking those challenges head on, because we want to keep British Columbians secure and help them build good lives now and for the long term. With the investments we’re making and the actions we’re taking to support people and build a stronger economy, we’ve started to turn a corner.”

Premier David Eby said before the fiscal forecast was released Tuesday that the New Democrat government remains committed to providing services and supports for people in British Columbia and cuts are not on his agenda.

Eby said people have been hurt by high interest costs and the province is facing budget pressures connected to low resource prices, high wildfire costs and struggling global economies.

The premier said that now is not the time to reduce supports and services for people.

Last month’s year-end report for the 2023-2024 budget saw the province post a budget deficit of $5.035 billion, down from the previous forecast of $5.9 billion.

Eby said he expects government financial priorities to become a major issue during the upcoming election, with the NDP pledging to continue to fund services and the B.C. Conservatives looking to make cuts.

This report by The Canadian Press was first published Sept. 10, 2024.

Note to readers: This is a corrected story. A previous version said the debt would be going up to more than $129 billion. In fact, it will be almost $129 billion.

The Canadian Press. All rights reserved.

Economy

Mark Carney mum on carbon-tax advice, future in politics at Liberal retreat

NANAIMO, B.C. – Former Bank of Canada governor Mark Carney says he’ll be advising the Liberal party to flip some the challenges posed by an increasingly divided and dangerous world into an economic opportunity for Canada.

But he won’t say what his specific advice will be on economic issues that are politically divisive in Canada, like the carbon tax.

He presented his vision for the Liberals’ economic policy at the party’s caucus retreat in Nanaimo, B.C. today, after he agreed to help the party prepare for the next election as chair of a Liberal task force on economic growth.

Carney has been touted as a possible leadership contender to replace Justin Trudeau, who has said he has tried to coax Carney into politics for years.

Carney says if the prime minister asks him to do something he will do it to the best of his ability, but won’t elaborate on whether the new adviser role could lead to him adding his name to a ballot in the next election.

Finance Minister Chrystia Freeland says she has been taking advice from Carney for years, and that his new position won’t infringe on her role.

This report by The Canadian Press was first published Sept. 10, 2024.

The Canadian Press. All rights reserved.

Economy

Nova Scotia bill would kick-start offshore wind industry without approval from Ottawa

HALIFAX – The Nova Scotia government has introduced a bill that would kick-start the province’s offshore wind industry without federal approval.

Natural Resources Minister Tory Rushton says amendments within a new omnibus bill introduced today will help ensure Nova Scotia meets its goal of launching a first call for offshore wind bids next year.

The province wants to offer project licences by 2030 to develop a total of five gigawatts of power from offshore wind.

Rushton says normally the province would wait for the federal government to adopt legislation establishing a wind industry off Canada’s East Coast, but that process has been “progressing slowly.”

Federal legislation that would enable the development of offshore wind farms in Nova Scotia and Newfoundland and Labrador has passed through the first and second reading in the Senate, and is currently under consideration in committee.

Rushton says the Nova Scotia bill mirrors the federal legislation and would prevent the province’s offshore wind industry from being held up in Ottawa.

This report by The Canadian Press was first published Sept. 10, 2024.

The Canadian Press. All rights reserved.

-

News19 hours ago

News19 hours agoSingh claps back at Poilievre ahead of House return

-

News19 hours ago

News19 hours agoMore than 67 million people watched Donald Trump and Kamala Harris debate. That’s way up from June

-

News19 hours ago

News19 hours agoTaxi driver suspected in fatal B.C. hit-and-run has left Canada: RCMP

-

News19 hours ago

News19 hours agoThe ancient jar smashed by a 4-year-old is back on display at an Israeli museum after repair

-

News19 hours ago

News19 hours agoMounties say there’s no evidence Lytton, B.C., wildfire was arson; cause unknown

-

News7 hours ago

Local Toronto business story – Events Industry : new national brand, Element Event Solutions

-

News8 hours ago

News8 hours agoReggie Bush was at his LA-area home when 3 male suspects attempted to break in

-

News19 hours ago

News19 hours agoAlberta Premier Smith says she wants Calgary Green Line to proceed as first pitched