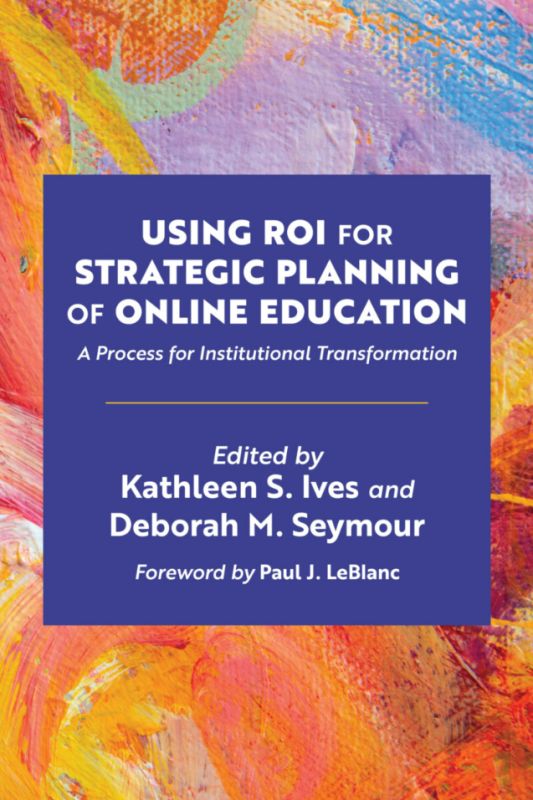

Though higher education has historically been a reliable economic engine for individuals and the economy, college insiders have long failed to convey the industry’s value to students, parents, employers and policy makers who question the investment, Kathleen Ives and Deborah Seymour argue in their new book, Using ROI for Strategic Planning of Online Education. Online learning has potential to provide access and optimal course pacing and content to students with time, geographic or medical constraints. But many continue to view it with a critical eye.

At the same time, the shift from emergency remote teaching in the early pandemic has morphed into innovation and investment in online teaching and learning. Many have since discovered an interest in understanding online learning’s return on investment.

Inside Higher Ed recently asked Ives and Seymour about why analyzing return on investment is uncomfortable for many in higher education, the gap between students’ and college leaders’ understanding of return on investment, and how ed-tech companies are bringing the notion of return on investment into focus for college leaders. What follows is an edited and condensed version of this email conversation.

Q: Kathleen, you argue that implementing a return-on-investment analysis in online higher education will entail making significant cultural, policy and processes changes. What are some of these changes that need to happen, and how will we recognize progress?

Ives: Historically, colleges have seen themselves as mission-driven, which means that measuring return on investment can be culturally uncomfortable. Colleges may fear that a business perspective could undermine their values and turn them into degree mills. At the same time, colleges are facing increased competition from both inside and outside of academe. Reversing this only-mission-driven mind-set will require a cultural shift in which students are treated as customers. Satisfying the customer is critical to survival, or they will go elsewhere.

As higher education costs and student debt mount, policy makers and others are questioning higher education’s role in producing a workforce needed to sustain the economy. At the same time, college enrollments are declining, state governments are offering less support and employers are skeptical that college graduates possess appropriate skill sets. Policy makers could help colleges protect students, promote access and improve both institutional and student return on investment, without introducing regulations that curb innovation, according to the presidents interviewed in our book.

Colleges are navigating complex technological environments with limited resources. They typically have neither the operational infrastructure nor the embedded skill sets to institutionalize return on investment. By reviewing and adapting return-on-investment methodologies to inform decision-making, online college leaders can evaluate initiatives and work toward achieving their financial and social goals.

Online colleges will see progress when they adopt a return-on-investment mind-set. Such a mind-set may be new for many, and some may not be used to digesting or even requesting such analysis. But this book’s contributors argue that they should be brought along on the journey. To make return on investment a cornerstone of initiatives going forward, they need trainings on best practices and terminology. A return-on-investment mind-set will increase engagement in the decision-making process and make it easier for all to see its impact.

Q: A chapter in your book by Laurie Hillstock suggests that students and college leaders may have different perspectives on return on investment for online learning. Students consider a range of complex factors—including cost, type of degree, faculty-to-student ratios, connections with classmates, job placement and starting salaries. Meanwhile, many college leaders view online course delivery primarily as a means for increasing access to higher education. What steps can leaders take today to help bridge this gap?

A: As a start, leaders can acknowledge that learners differ in many ways. One universal method may not close the gap. Capturing and acting on students’ direct feedback will help. To do this, colleges need to be intentional about building trust and helping students feel heard. Formative assessments that, for example, request feedback may be more effective than online surveys.

Some students may feel more comfortable sharing with faculty, staff, peer mentors or other students than with college leaders. In such cases, be transparent with those with whom students feel most comfortable connecting. Then look for ways to work with and through them to capture authentic student feedback.

Remember, don’t just collect student feedback. Be intentional about acting on the feedback. Share updates with students as well. Building authentic relationships takes time but is necessary for student success.

Q: Deborah, you note that innovative investors and entrepreneurial ventures—such as ed-tech companies, online program managers, venture capital firms and pathway programs—seek to stake a claim in the online higher education ecosystem. How have these institutions and companies brought the notion of return on investment into focus for college leaders and students?

Seymour: More and more, employers are hiring candidates for their technical skill sets rather than for their ability to communicate. Boot-camp training programs at Apple, Microsoft, Google and others, as well as pathway programs, focus on the competencies and skills employers say are necessary to fill existing technical skills gaps. Many students learn to code to get a job instead of pursuing a two- or four-year degree.

As a result, many colleges have been forced to look at their strategy and balance sheets differently. What’s the return on investment for an individual who chooses a degree over technical skills training? That question can no longer be ignored.

Q: The collection of articles in your book makes a strong case that leaders should pay more attention to return-on-investment analysis in online education. But one of the articles by David Schejbal argues that “higher education institutions would be well served to resist the urge to fit online education into a narrow return-on-investment box to justify its worth.” Does a holistic, online higher ed return-on-investment spreadsheet exist that can measure nonfinancial benefits such as an educated populace, research, individual enrichment and community improvement?

A: To our knowledge, no actual spreadsheet exists. But David Schejbal explains why college access is important beyond employment rates and the economy. When more people are educated beyond the secondary level, citizens are more active in public life, crime rates are lower and life expectancy increases.

When a college wishes to offer an online program, return-on-investment planning includes market research to determine concrete, monetary benefits to both the student and the institution. But colleges will also want to align their online programs with their social missions. (This is alluded to in the chapter by Leah Matthews on online education and accreditation.) That means social factors in a campus-based program in, say, nursing, must be included in online nursing programs, as well.

Q: What did you learn about return on investment for online learning from putting together this book that you did not fully understand before you started?

Seymour: When a face-to-face course is originally developed, many colleges do not consider the cost of converting it to an online course that is compliant with the Americans With Disabilities Act. In some cases, these conversion costs are higher than the original cost of development. Also, these costs are often not included in the course design nor the prices that online program managers charge when developing courses for colleges. That means the risk of noncompliance is passed along to the institution. Hidden costs like these on an institution’s balance sheet can produce significant opportunity costs.

Online programs face many external challenges, including doubt about their worth. College leaders may have more success by first addressing their institution’s internal challenges. To do this, they should engage strategy and planning experts to ensure that oversights do not threaten program continuity.

Ives: Return on investment in online higher education has moved beyond the singular metric of student earning potential. It is not solely or even necessarily a performance measure gauging investment efficiency as typically measured by corporations, investors and entrepreneurs. Also, what works for one college’s mission and vision may not work for another institution.

Many methodologies are available to assess return on investment, and many institutional leaders are serious about measuring value as compared to cost, specifically with regard to students and institutional mission. Many are pursuing nuanced return-on-investment analyses, depending on their definitions of success.

Many of the presidents told us the pandemic fast-forwarded some plans to optimize their return-on-investment initiatives. As Keith Miller, president of Greenville Technical College, put it, “ROI may even increase because we have learned so much.”

Source link

Related