The economy is slowing. Housing prices are in free fall. Many fear a recession next year. Consumer price growth is easing. Yet the Bank of Canada is still raising interest rates aggressively, with last week’s half-point hike the sixth successive outsized move. Average people are wondering if it’s necessary, whether prior rate increases were enough. Why the heavy foot on the brake pedal?

Economy

Why the Bank of Canada’s Interest rate hike is exactly what the economy needs

It tastes awful, but it works. Let’s just hope the side effects are minimal

I’m part of a dying species — the generation that actually experienced our last inflationary bout. As kids in grade school, we talked about sky-high oil prices, food shortages, running out of this and that, out-of-control inflation and leaders madly scrambling for solutions. The 1970s spilled into the 1980s, and despite much effort, the inflation beast remained untamed.

Initially, central banks waved it off, expecting that bottlenecks would be temporary and that prices would soon calm down. Clearly, that didn’t happen. In fact, as the weeks passed, inflation’s reach rapidly spread to a much wider range of goods and services; it was no longer just the volatile, non-core elements of the price indexes that were misbehaving. It gets particularly complicated when goods that are used in just about everything are in short supply. Back in the 70s, the high intensity of oil use in the economy saw energy price increases spread everywhere. Intensity is much lower now, so oil isn’t as influential as before. But what about semiconductors? They may be a small part of the cost of final products, but they are in just about everything. Cut off the supply, and suddenly shortages are widespread.

It doesn’t stop here. With prices riding well ahead of wages, employees at all levels get antsy — especially at annual review time. Given record-low unemployment and our current paucity of skilled workers, businesses aren’t in a strong bargaining position. Fail to meet expectations, and turnover could soar. Meet expectations, and you could be out of business. One way or another, a jump in wage growth is almost impossible to resist. That’s when demand-pull inflation turns into cost-push inflation — a much harder beast to tame, as wage-price spirals can set in.

The dynamics of pricing haven’t changed over time. But we haven’t seen them for so long that we likely forgot how they work: that it’s not so much prices, but price expectations, that matter. And that reining them in requires heavy monetary medicine. It tastes awful, but it works. Let’s just hope the side effects are minimal.

Peter Hall is chief executive of Econosphere Inc. and a former chief economist at Export Development Canada.

Economy

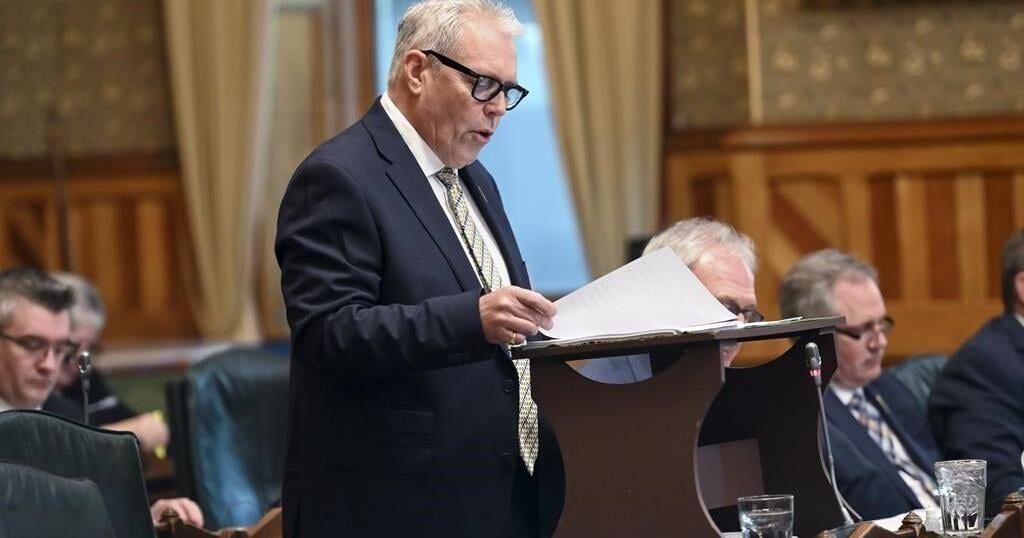

Federal money and sales taxes help pump up New Brunswick budget surplus

FREDERICTON – New Brunswick‘s finance minister says the province recorded a surplus of $500.8 million for the fiscal year that ended in March.

Ernie Steeves says the amount — more than 10 times higher than the province’s original $40.3-million budget projection for the 2023-24 fiscal year — was largely the result of a strong economy and population growth.

The report of a big surplus comes as the province prepares for an election campaign, which will officially start on Thursday and end with a vote on Oct. 21.

Steeves says growth of the surplus was fed by revenue from the Harmonized Sales Tax and federal money, especially for health-care funding.

Progressive Conservative Premier Blaine Higgs has promised to reduce the HST by two percentage points to 13 per cent if the party is elected to govern next month.

Meanwhile, the province’s net debt, according to the audited consolidated financial statements, has dropped from $12.3 billion in 2022-23 to $11.8 billion in the most recent fiscal year.

Liberal critic René Legacy says having a stronger balance sheet does not eliminate issues in health care, housing and education.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

Economy

Liberals announce expansion to mortgage eligibility, draft rights for renters, buyers

OTTAWA – Finance Minister Chrystia Freeland says the government is making some changes to mortgage rules to help more Canadians to purchase their first home.

She says the changes will come into force in December and better reflect the housing market.

The price cap for insured mortgages will be boosted for the first time since 2012, moving to $1.5 million from $1 million, to allow more people to qualify for a mortgage with less than a 20 per cent down payment.

The government will also expand its 30-year mortgage amortization to include first-time homebuyers buying any type of home, as well as anybody buying a newly built home.

On Aug. 1 eligibility for the 30-year amortization was changed to include first-time buyers purchasing a newly-built home.

Justice Minister Arif Virani is also releasing drafts for a bill of rights for renters as well as one for homebuyers, both of which the government promised five months ago.

Virani says the government intends to work with provinces to prevent practices like renovictions, where landowners evict tenants and make minimal renovations and then seek higher rents.

The government touts today’s announced measures as the “boldest mortgage reforms in decades,” and it comes after a year of criticism over high housing costs.

The Liberals have been slumping in the polls for months, including among younger adults who say not being able to afford a house is one of their key concerns.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

Economy

Statistics Canada says manufacturing sales up 1.4% in July at $71B

OTTAWA – Statistics Canada says manufacturing sales rose 1.4 per cent to $71 billion in July, helped by higher sales in the petroleum and coal and chemical product subsectors.

The increase followed a 1.7 per cent decrease in June.

The agency says sales in the petroleum and coal product subsector gained 6.7 per cent to total $8.6 billion in July as most refineries sold more, helped by higher prices and demand.

Chemical product sales rose 5.3 per cent to $5.6 billion in July, boosted by increased sales of pharmaceutical and medicine products.

Sales of wood products fell 4.8 per cent for the month to $2.9 billion, the lowest level since May 2023.

In constant dollar terms, overall manufacturing sales rose 0.9 per cent in July.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

-

Politics23 hours ago

Politics23 hours agoNext phase of federal foreign interference inquiry to begin today in Ottawa

-

News23 hours ago

News23 hours agoVoters head to the polls for byelections in Montreal and Winnipeg

-

News7 hours ago

News7 hours agoWorld Junior Girls Golf Championship coming to Toronto-area golf course

-

Economy21 hours ago

Economy21 hours agoLiberals announce expansion to mortgage eligibility, draft rights for renters, buyers

-

News23 hours ago

News23 hours agoVerdict expected in rape trial for former military leader Haydn Edmundson

-

Sports19 hours ago

Sports19 hours agoPenguins re-sign Crosby to two-year extension that runs through 2026-27 season

-

News23 hours ago

News23 hours agoFeds wary of back-to-work legislation despite employer demands: labour experts

-

Business8 hours ago

Business8 hours agoPolitics likely pushed Air Canada toward deal with ‘unheard of’ gains for pilots