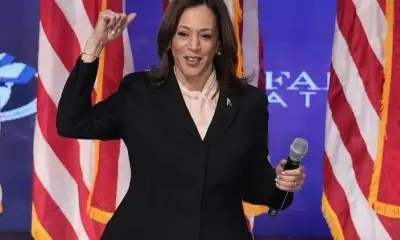

Gov. Ron DeSantis wins second term in Florida, bashes woke culture Governor Ron DeSantis won a second term in Florida as he bashed “woke culture,” telling supporters “we’ve got so much more to do.”

The acronym for environmental, social, governance principles isn’t widely known outside investment circles but is fast becoming a popular GOP talking point in the run-up to the 2024 presidential election.

The GOP says the nation’s top money managers are pursuing an ideological agenda at the expense of financial returns in violation of their fiduciary duty.

In an effort to stop public pension funds from using ESG as a consideration when making investment decisions, red states from Texas to West Virginia have pulled billions from BlackRock and other money managers despite concerns that doing so may hurt financially.

They’ve also launched investigations into the influence of big money managers on everything from reducing emissions to racial justice.

“As worthy as those goals may be, they are not goals that may be entirely motivated by value maximization and they do not align with the views of many Americans who invest with those asset managers,” Vivek Ramaswamy, author of “Woke, Inc.: Inside Corporate America’s Social Justice Scam” and co-founder of a new investment firm Strive Asset Management, told USA TODAY.

Big money managers disagree. “We have one bias,” BlackRock Senior Managing Director Dalia Blass said at a hearing held last week before the Texas Senate’s Committee on State Affairs, “and that’s to get the best risk-adjusted returns for our clients.”

What does ESG stand for?

ESG is shorthand for environmental, social, governance principles.

What is ESG investing?

ESG is an investing strategy that takes into account environmental, social and corporate governance factors in addition to financial analysis.

Money managers like BlackRock are signatories of the United Nations Principles for Responsible Investing. They increasingly use environmental, social and governance factors when making investment decisions

Who are the key players in ESG?

The top three investment firms are BlackRock, Vanguard and State Street. They collectively manage $22 trillion in assets.

Why is ESG controversial?

For years now, BlackRock, the nation’s largest asset manager, and its CEO Larry Fink, have championed ESG investment strategies. Today, a growing number of money managers are calling on companies to calculate environmental and social risks such as climate change and board diversity.

“Companies must ask themselves: What role do we play in the community? How are we managing our impact on the environment? Are we working to create a diverse workforce?” Fink wrote in his annual letter to CEOs in 2018.

Republican lawmakers across the country accuse BlackRock and other asset managers of using their influence to push liberal policies and put undue pressure on companies to reduce emissions or hire more diverse boards.

Fink denies any political motivation. “Stakeholder capitalism is not about politics. It is not a social or ideological agenda. It is not ‘woke,’” he wrote to CEOs in January.

It’s not just the political right. Money managers are caught in the political crossfire.

Democrats and environmentalists have taken swings at BlackRock for not doing enough on the ESG front and for maintaining large stakes in fossil fuel companies and gun manufacturers.

ESG backlash building over oil, gas

This latest front in the culture wars is intensifying as the GOP prepares to take over the House. ESG is seen as a threat to the oil, gas and coal industries as red states fight the transition from fossil fuels.

The Securities and Exchange Commission has proposed requiring businesses to disclose the risks climate change poses to their operations when they file regulatory statements.

Corporate environmental efforts often include reducing carbon footprints and divesting from fossil fuels. Investors now consider these efforts when deciding which companies to invest in and that trend is gaining momentum.

What does Exxon Mobil have to do with it?

In 2021, big money managers sided with an activist investor, Engine No. 1, to win seats on the board of Exxon Mobil, part of a proxy campaign to get the oil giant to better prepare for the financial realities of climate change.

The Exxon vote showed the GOP how much influence the top three money managers – BlackRock, Vanguard, and State Street – have over public companies.

Former Vice President Mike Pence criticized putting “left-wing” goals over the interests of businesses and their employees during an energy policy speech in Houston in May.

Bills and boycotts: How GOP is taking on ESG

A group of 19 state attorneys general is investigating the role of banks in a coalition to cut greenhouse gas emissions. They say banks are favoring companies that follow a “woke climate agenda.”

Republicans are advancing bills in a number of states to boycott companies that embrace sustainability. And House Republicans say they plan to investigate ESG in congressional hearings next year.

Florida, DeSantis lead fight against ESG

A leader in the anti-ESG movement is Florida Gov. Ron DeSantis, a likely 2024 GOP presidential contender who has scored political points by waging a war against corporate “wokeness,” from legislation curbing how private employers offer diversity training to feuding with Walt Disney over its opposition to state legislation banning classroom discussion of gender identity and sexual orientation.

Once a rallying cry for systemic racism and injustice, “wokeness” has been co-opted by conservatives to decry “political correctness” and progressive talking points.

Earlier this month, Florida pulled $2 billion worth of state assets managed by BlackRock.

Florida is considering sweeping legislation and pulling more state funds from BlackRock next year, the state’s chief financial officer Jimmy Patronis and state Representative Bob Rommel told Bloomberg last week.

Is Republican pressure working?

Money manager Vanguard recently withdrew from an investment industry initiative on climate change. The Net Zero Asset Managers coalition is made up of firms that have committed to their portfolios reaching net-zero emissions by 2050.

A white paper from Republicans on the Senate Committee on Banking, Housing and Urban Affairs took issue with BlackRock, Vanguard and State Street’s involvement in the coalition.

“Climate change, and the ongoing global response, will have far-reaching economic consequences for companies, financial markets, and investors, presenting a clear example of a material and multifaceted financial risk,” Vanguard said in a statement.

Vanguard said it is pulling out of the coalition to “make clear that Vanguard speaks independently on matters of importance to our investors.”

It was excused from last week’s grilling of finance executives at the hearing on ESG practices in Texas. BlackRock and State Street were not.

What do voters think of ESG?

So far, ESG isn’t resonating with voters on either side of the aisle, albeit for different reasons, according to a survey from Penn State’s Center for the Business of Sustainability and communications firm ROKK Solutions.

Some 63% of voters surveyed said the government should not set limits on ESG investments, Democrats because ESG investments are a social good and Republicans because doing so would interfere with free markets.

“Our research found that neither Republican nor Democratic voters support policymakers’ potential legislative efforts to curb ESG initiatives,” researchers found. “The consensus among voters surveyed was that companies should be able to exercise discretion to invest in ESG initiatives that benefit society without government interference.”

Source link

Related