Canada’s office real estate markets have coped well with the huge shifts in demand brought about by short-term shocks due to the pandemic lockdowns and the long-term changes in corporate culture resulting from hybrid-work environments.

Real eState

Aging labour force, hybrid work among challenges facing office real estate

The future of office real estate relies on how companies adapt to this changing work culture, the growth and aging of the labour force, and the shift in where workers live and how they commute.

The short-term forces are cyclical in nature: job growth will be slower with an economic recession on the horizon and there is a large influx of new office supply coming online at the same time.

The more significant challenge is the structural shift in the economy, given that working from home has resulted in evolving hybrid-work models that allow employees to operate remotely for some days or even some weeks of the month. The rapidly aging workforce presents the other structural shift.

Working from home is not as prevalent as it was at the peak of the pandemic, when two out of five workers reported operating from home or remotely, but it still affects millions of employees, albeit only partially in many cases. These trends have resulted in a relatively slower increase in the demand for office space.

Even when the labour market resumes growth after the impending recession, it may not necessarily result in a commensurate increase in office space demand because of these hybrid-work environments.

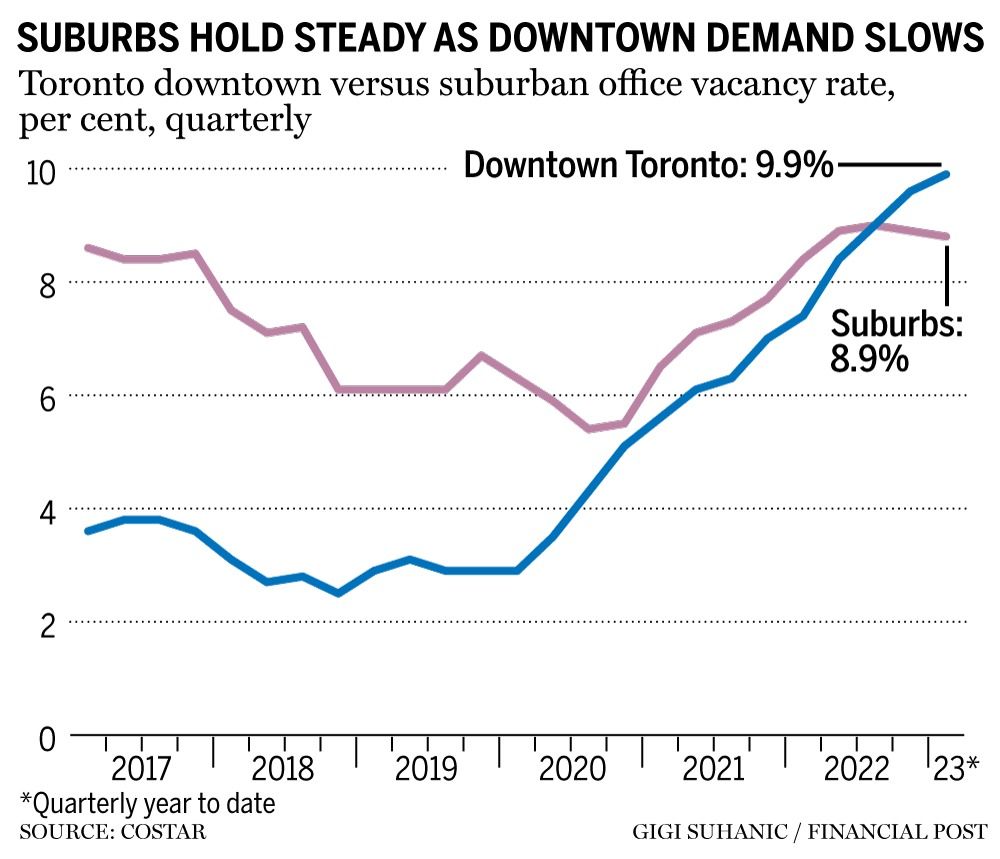

The urban-suburban divide in office real estate resilience is another factor. Office vacancy rates in Toronto show a sustained and faster increase in downtown vacancy rates and they are now higher than in the suburbs. The increase in new office supply in the urban core has contributed to the growth in vacancy rates.

The tech sector, which accounted for a noticeable recent increase in office space demand, is also pulling back. In Vancouver, where the tech sector enjoys a relatively large office space footprint, a slowdown in tech will have a much more noticeable impact than in other cities.

An unexpected, and undesirable, outcome of the growth in office space at a time of slowing demand is that the new supply will likely entice tenants from older buildings, which may not be suitable for hybrid work in a post-pandemic economic recovery.

The design of floor plates, the quality and quantity of elevators, and modern heating, ventilation and air conditioning systems to cope with any future outbreaks are some reasons why tenants may switch to newer buildings.

The hybrid-work culture is also encouraging many tenants to sublease surplus space. Given that office leases are a multi-year commitment, subleasing allows tenants to rightsize the floor space they need, and there has been a noticeable increase in subleasing in large office markets.

For example, the sublease space in Vancouver during the fourth quarter of 2022 grew by 59 per cent from the previous year, and 23 per cent in Toronto during the same period.

Rents have remained relatively stable as office vacancy rates increase to double digits from almost zero in many urban core markets. But this may not be a cause for celebration.

The flux in office space demand and supply also makes it difficult to generate reasonable valuations. This is not helped by a lack of sufficient comparable transactions for appraisals since the pandemic. The good news is that downtown office real estate is often owned by pension funds and others well-positioned to weather any downturn.

The future of office real estate will be defined by the willingness of industry leaders to adapt. Nathalie Palladitcheff, chief executive of Ivanhoé Cambridge Inc., has been asking the industry to adapt and adjust to the new environment of hybrid work and a recession. The new spatial equilibrium in real estate markets requires fresh thinking rather than hopes of returning to the pre-pandemic world.

Murtaza Haider is a professor of real estate management and director of the Urban Analytics Institute at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. They can be reached at the Haider-Moranis Bulletin website, www.hmbulletin.com.

Real eState

Mortgage rule changes will help spark demand, but supply is ‘core’ issue: economist

TORONTO – One expert predicts Ottawa‘s changes to mortgage rules will help spur demand among potential homebuyers but says policies aimed at driving new supply are needed to address the “core issues” facing the market.

The federal government’s changes, set to come into force mid-December, include a higher price cap for insured mortgages to allow more people to qualify for a mortgage with less than a 20 per cent down payment.

The government will also expand its 30-year mortgage amortization to include first-time homebuyers buying any type of home, as well as anybody buying a newly built home.

CIBC Capital Markets deputy chief economist Benjamin Tal calls it a “significant” move likely to accelerate the recovery of the housing market, a process already underway as interest rates have begun to fall.

However, he says in a note that policymakers should aim to “prevent that from becoming too much of a good thing” through policies geared toward the supply side.

Tal says the main issue is the lack of supply available to respond to Canada’s rapidly increasing population, particularly in major cities.

This report by The Canadian Press was first published Sept. 17,2024.

The Canadian Press. All rights reserved.

Real eState

National housing market in ‘holding pattern’ as buyers patient for lower rates: CREA

OTTAWA – The Canadian Real Estate Association says the number of homes sold in August fell compared with a year ago as the market remained largely stuck in a holding pattern despite borrowing costs beginning to come down.

The association says the number of homes sold in August fell 2.1 per cent compared with the same month last year.

On a seasonally adjusted month-over-month basis, national home sales edged up 1.3 per cent from July.

CREA senior economist Shaun Cathcart says that with forecasts of lower interest rates throughout the rest of this year and into 2025, “it makes sense that prospective buyers might continue to hold off for improved affordability, especially since prices are still well behaved in most of the country.”

The national average sale price for August amounted to $649,100, a 0.1 per cent increase compared with a year earlier.

The number of newly listed properties was up 1.1 per cent month-over-month.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

Real eState

Two Quebec real estate brokers suspended for using fake bids to drive up prices

MONTREAL – Two Quebec real estate brokers are facing fines and years-long suspensions for submitting bogus offers on homes to drive up prices during the COVID-19 pandemic.

Christine Girouard has been suspended for 14 years and her business partner, Jonathan Dauphinais-Fortin, has been suspended for nine years after Quebec’s authority of real estate brokerage found they used fake bids to get buyers to raise their offers.

Girouard is a well-known broker who previously starred on a Quebec reality show that follows top real estate agents in the province.

She is facing a fine of $50,000, while Dauphinais-Fortin has been fined $10,000.

The two brokers were suspended in May 2023 after La Presse published an article about their practices.

One buyer ended up paying $40,000 more than his initial offer in 2022 after Girouard and Dauphinais-Fortin concocted a second bid on the house he wanted to buy.

This report by The Canadian Press was first published Sept. 11, 2024.

The Canadian Press. All rights reserved.

-

Politics14 hours ago

Politics14 hours agoNew Brunswick Premier Blaine Higgs expected to call provincial election today

-

Sports9 hours ago

Sports9 hours agoArch Manning to get first start for No. 1 Texas as Ewers continues recovery from abdomen strain

-

Media13 hours ago

Sutherland House Experts Book Publishing Launches To Empower Quiet Experts

-

Investment12 hours ago

Investment12 hours agoCanada’s Probate Laws: What You Need to Know about Estate Planning in 2024

-

Sports9 hours ago

Sports9 hours agoFormer Canada captain Atiba Hutchinson tells his story in ‘The Beautiful Dream”

-

Politics8 hours ago

Politics8 hours agoNew Brunswick election candidate profile: Green Party Leader David Coon

-

Politics12 hours ago

Politics12 hours agoNew Brunswick Premier Blaine Higgs kicks off provincial election campaign

-

News14 hours ago

News14 hours agoQuebec won’t fund graphite mine project tied to Pentagon; locals claim ‘victory’