The economic squall battering the Canadian tech sector landed squarely in Alberta this week with layoffs at one of the city’s marquee software firms.

Economy

Alberta economy in a ‘state of transition’ as layoffs bump up against labour shortages

Benevity announced it will reduce its staff by 14 per cent, cutting 137 out of almost 1,000 jobs — the first major layoffs in the company’s history — as its CEO cited a dramatic change in broader economic conditions.

The same day, the Calgary Construction Association sounded the alarm about an acute shortage of skilled staff for its sector. It estimates more than 3,000 construction jobs in the region are unfilled as demand for commercial buildings and new homes increases, even with rising interest rates and high inflation.

“As we enter 2023, the Alberta economy is in a state of transition,” the Business Council of Alberta declared in a new report issued Thursday.

The transition means Alberta’s economy will cool off from the “blistering pace” seen in 2022 that was fuelled by surging commodity prices, said council president Adam Legge.

“Alberta is best positioned to weather any downturn or recession globally or domestically in Canada, largely because we have so many of the things the world will continue to need,” Legge said, pointing to energy and agricultural products.

“But we won’t be immune. No place is an island, and that includes Alberta.”

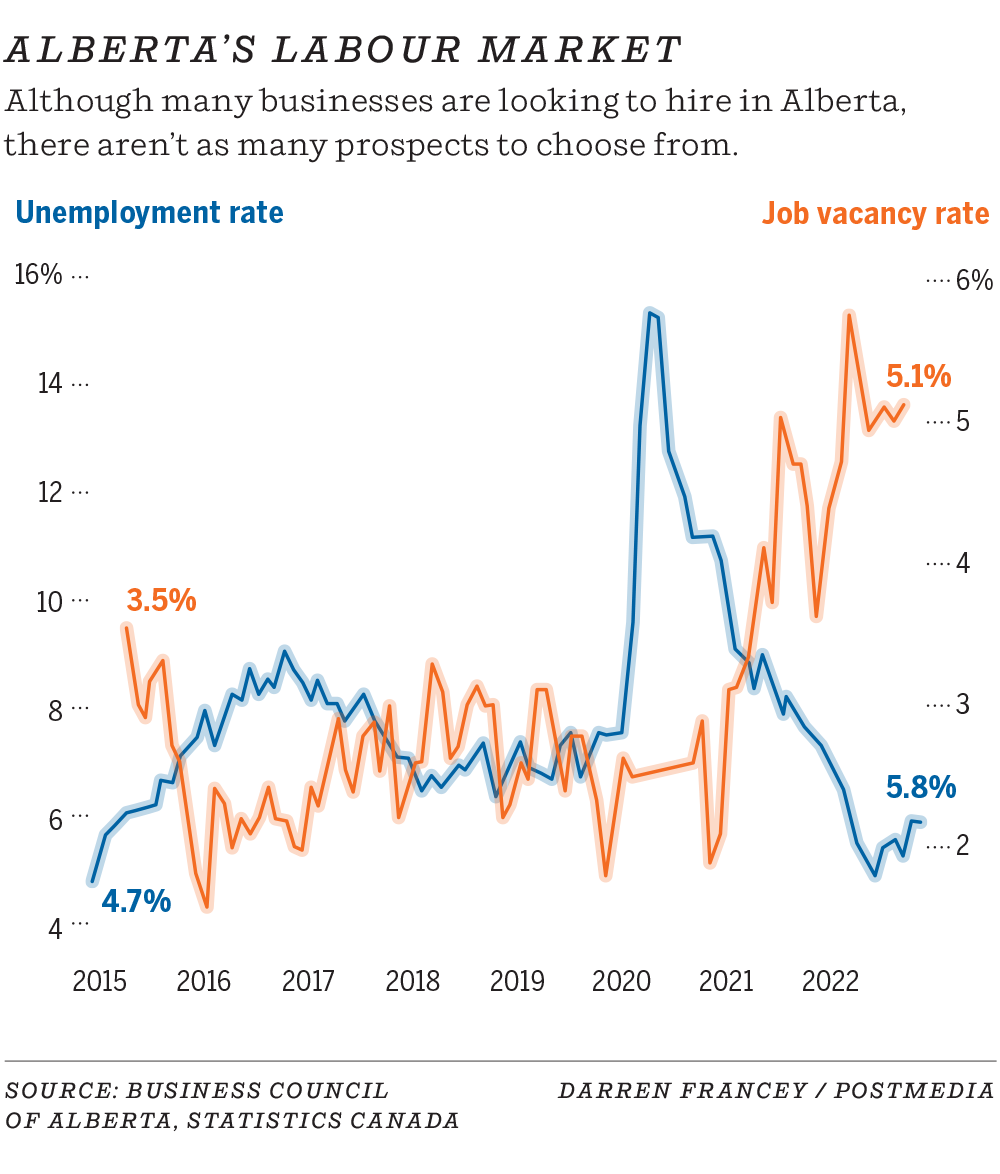

The report noted the labour market is stronger than it has been in years — the jobless rate stood at 5.8 per cent in December — and the recent gap between the provincial and Canadian unemployment levels narrowed over the second half of 2022.

“Alberta’s labour market is the hottest it’s been in years,” it states.

About six in 10 businesses plan on adding staff (according to a survey in November), but with a labour crunch, they will need to attract workers away from existing jobs, the report said.

Staffing shortages are affecting many businesses in industries including hospitality, professional services, and manufacturing. It’s also a challenge for the construction sector as the existing workforce ages and not enough younger people are entering the trades.

Scott White, CEO of Western Electrical Management in Calgary, said as commercial construction increased over the past year, its staffing has increased by 40 per cent.

Large developments in the province are moving ahead, such as the company’s work on the convention centre expansion in Calgary, and construction in the city’s downtown has picked up.

“Since April, we’ve probably hired 140 guys and it’s been very difficult finding people,” White said.

“There are a lot of things coming down the pipe and, to be honest, I’m not sure where they are going to find all the people.”

Other areas of the economy will be affected by a broader slowdown and the squeeze coming from rising interest rates.

One sector already facing challenges across North America is the technology industry, with large-scale layoffs announced at giants such as Microsoft and Amazon, while Canadian firms such as Hootsuite, Clearco, Lightspeed Commerce and Clutch have cut staff.

Nic Beique, CEO of Calgary-based online payment firm Helcim, said the startup is still growing but has slowed some of its hiring plans for the year — it has about 150 staff — and noted the industry is growing more cautious given the economic uncertainty.

“We’re just preparing ourselves that we might see a slowdown; we’re not seeing it yet in the numbers,” he said. “Prudence is the word of 2023 when it comes to tech.”

This past week also saw Calgary-based cleantech firm Summit Nanotech close a $67-million fundraising round as it grows its workforce and expands its business to extract lithium from brine.

Benevity, one of the city’s first startups to gain a billion-dollar valuation, has been a Calgary tech-sector leader, providing customers such as Visa and UPS with employee-engagement software, which enables workplace giving programs and employee volunteering.

The Calgary-based firm, founded in 2008, had 989 employees before this week’s announcement, including 527 in the city.

“All parts of the organization have been impacted, not just those within our Calgary office,” CEO Kelly Schmitt said Thursday in a statement.

“Many companies are tightening budgets in response to the macro-economic environment, but we believe the longer-term appetite for companies to make a social impact is still strong.”

However, its announcement is another signal of the turbulence ahead.

Jim Gibson, a veteran of Calgary’s tech sector and now chief catalyst at the Southern Alberta Institute of Technology (SAIT), said organizations across the industry are responding to investor pressure and shifting away from the “growth-at-all cost” mantra.

“It is part of a shift that’s happening across the world and Calgary is not immune to it,” he said.

“We will feel it, but . . . we weren’t overbuilt, so we won’t see the same level.”

Chris Varcoe is a Calgary Herald columnist.

Economy

S&P/TSX composite gains almost 100 points, U.S. stock markets also higher

TORONTO – Strength in the base metal and technology sectors helped Canada’s main stock index gain almost 100 points on Friday, while U.S. stock markets also climbed higher.

The S&P/TSX composite index closed up 93.51 points at 23,568.65.

In New York, the Dow Jones industrial average was up 297.01 points at 41,393.78. The S&P 500 index was up 30.26 points at 5,626.02, while the Nasdaq composite was up 114.30 points at 17,683.98.

The Canadian dollar traded for 73.61 cents US compared with 73.58 cents US on Thursday.

The October crude oil contract was down 32 cents at US$68.65 per barrel and the October natural gas contract was down five cents at US$2.31 per mmBTU.

The December gold contract was up US$30.10 at US$2,610.70 an ounce and the December copper contract was up four cents US$4.24 a pound.

This report by The Canadian Press was first published Sept. 13, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

Statistics Canada reports wholesale sales higher in July

OTTAWA – Statistics Canada says wholesale sales, excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain, rose 0.4 per cent to $82.7 billion in July.

The increase came as sales in the miscellaneous subsector gained three per cent to reach $10.5 billion in July, helped by strength in the agriculture supplies industry group, which rose 9.2 per cent.

The food, beverage and tobacco subsector added 1.7 per cent to total $15 billion in July.

The personal and household goods subsector fell 2.5 per cent to $12.1 billion.

In volume terms, overall wholesale sales rose 0.5 per cent in July.

Statistics Canada started including oilseed and grain as well as the petroleum and petroleum products subsector as part of wholesale trade last year, but is excluding the data from monthly analysis until there is enough historical data.

This report by The Canadian Press was first published Sept. 13, 2024.

The Canadian Press. All rights reserved.

Economy

S&P/TSX composite up more than 150 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 150 points in late-morning trading, helped by strength in the base metal and energy sectors, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 172.18 points at 23,383.35.

In New York, the Dow Jones industrial average was down 34.99 points at 40,826.72. The S&P 500 index was up 10.56 points at 5,564.69, while the Nasdaq composite was up 74.84 points at 17,470.37.

The Canadian dollar traded for 73.55 cents US compared with 73.59 cents US on Wednesday.

The October crude oil contract was up $2.00 at US$69.31 per barrel and the October natural gas contract was up five cents at US$2.32 per mmBTU.

The December gold contract was up US$40.00 at US$2,582.40 an ounce and the December copper contract was up six cents at US$4.20 a pound.

This report by The Canadian Press was first published Sept. 12, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

Sports17 hours ago

Sports17 hours agoArmstrong scores, surging Vancouver Whitecaps beat slumping San Jose Earthquakes 2-0

-

News17 hours ago

News17 hours agoAs plant-based milk becomes more popular, brands look for new ways to compete

-

News24 hours ago

News24 hours agoCF Montreal finds its groove with 2-1 win over Charlotte

-

News24 hours ago

News24 hours agoToronto FC downs Austin FC to pick up three much-needed points in MLS playoff push

-

News14 hours ago

News14 hours agoLabour Minister praises Air Canada, pilots union for avoiding disruptive strike

-

News14 hours ago

News14 hours agoLooking for the next mystery bestseller? This crime bookstore can solve the case

-

News17 hours ago

News17 hours agoLiberal candidate in Montreal byelection says campaign is about her — not Trudeau

-

News17 hours ago

News17 hours agoB.C. victim’s family furious at no-fault insurance regime in motor-vehicle death case