Investment

Investing in AI: how to avoid the hype

LONDON, May 26(Reuters) – Experienced tech investors are hunting for undervalued opportunities in an over-valued space.

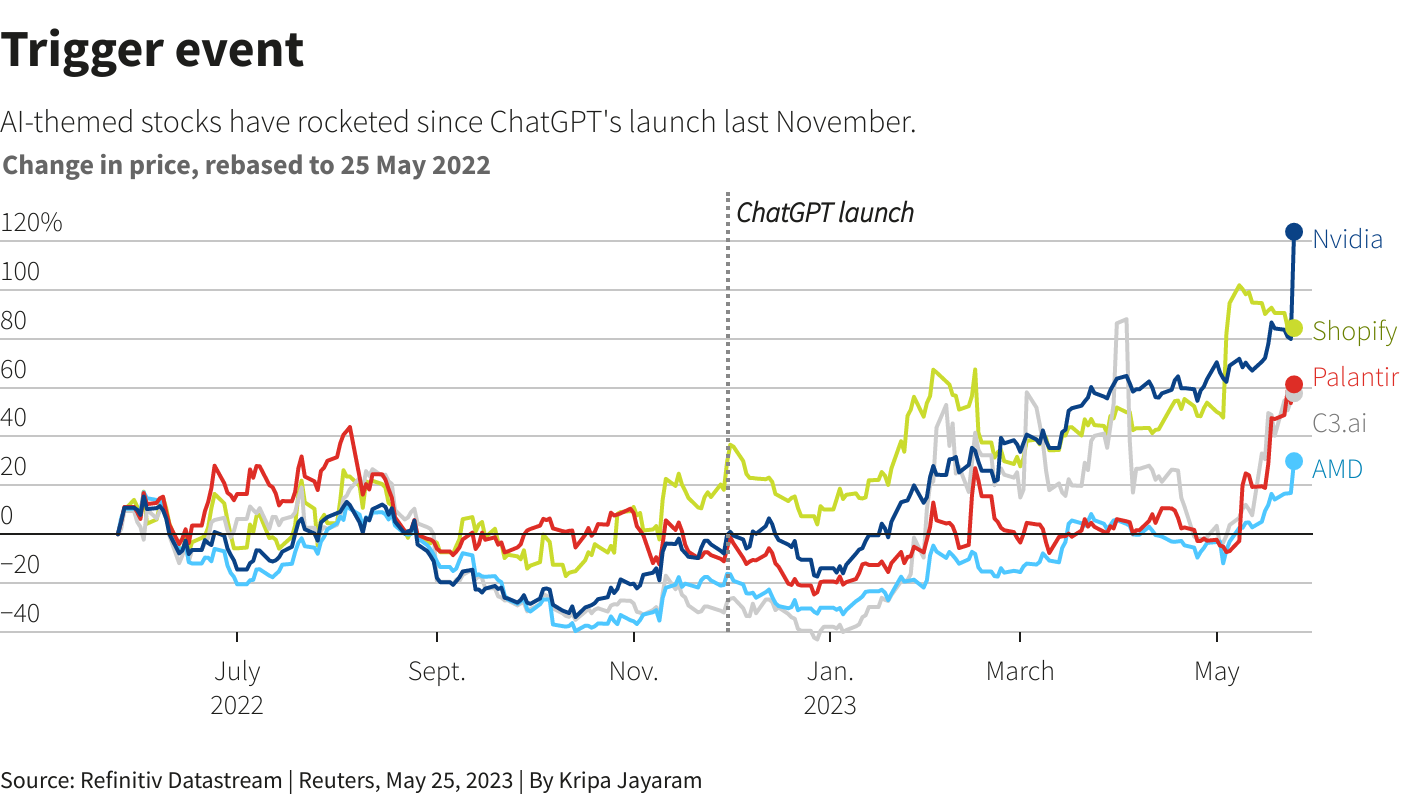

At stake is how best to invest in the potential of Artificial Intelligence (AI), which took a leap forward in November when Microsoft-backed OpenAI released its ChatGPT bot, without buying into a bubble.

Shares in Nvidia (NVDA.O), which makes computer chips that train AI systems, have almost doubled since ChatGPT’s launch. The company’s stock market value at roughly $940 billion is more than double that of Europe’s Nestle (NESN.S). Nvidia surged some 25% on Thursday alone after forecasting a sales jump.

Shares in loss-making AI software company C3.AI, which grabbed the stock ticker , have risen 149% this year and Palantir Technologies (PLTR.N), which has launched its own AI platform, is up 91% year-to-date.

Investors are chasing exposure to generative AI, the technology run by ChatGPT that learns from analysing vast datasets to generate text, images and computer code. Businesses are trying to use generative AI to speed up video editing, recruitment and even legal work.

Consultancy PwC sees AI-related productivity savings and investments generating $15.7 trillion worth of global economic output by 2030, almost equivalent to the gross domestic product of China.

The question for investors is whether to jump on the AI train now, or exercise caution, especially given mounting concern amongst regulators about the technology’s potentially disruptive impact.

“There are clearly going to be winners in all this,” said Niall O’Sullivan, chief investment officer of multi-asset for EMEA, at Neuberger Berman. “It’s just that that’s very hard to be true for the entire market.”

STILL EARLY

Instead of backing hot start-ups or rushing into highly valued AI-themed businesses that might fail, seasoned investors are taking a lateral view to back already proven technology companies that might benefit from the longer-term trend.

“It’s going to be as transformative as the internet, as the mobile internet, as the mainframe computer was,” said Alison Porter, a tech fund manager at Janus Henderson, whose funds have positions in Nvidia, with Microsoft as their largest holding.

However, Porter also cautions that “we are still very early on the use cases for AI.”

She favours big tech groups like Microsoft (MSFT.O) and Alphabet (GOOGL.O) because they have “strong balance sheets”, that make them “able to invest in many different technology advances”, including their recent focus on AI.

BEWARE, THE HYPE

Dizzying valuations have made some investors wary of the technology hype cycle. This concept, popularised by consultancy Gartner, starts with a trigger, such as the launch of ChatGPT, followed by inflated expectations and then disillusionment. Even if a technology moves to mass adoption, many early stage innovators can fail along the way.

“There’s a question about where we are in that curve with AI, where the hype is so visible,” said Mark Hawtin, investment director at GAM Investments. “There are ways to get exposure to the (AI) theme without picking something that is highly valued.”

PICKS, SHOVELS

Janus’ Porter recommended backing proven companies that may be “big beneficiaries in terms of providing infrastructure,” for future trends in generative AI that, as of now, are unclear.

GAM’s Hawtin said he has also hunted out companies that provide the “picks and shovels,” necessary for enabling new AI technology.

For example, AI systems require huge volumes of data to analyse and learn from, but just 1% of global data is currently being captured, stored and used, according to Bank of America.

Hawtin’s funds hold Seagate Technology (STX.O), which makes hard drives and data storage products, and chipmaker Marvell Technology for this reason, he said.

Jon Guinness, tech portfolio manager at Fidelity International, said management consultancy Accenture is in his portfolio because as businesses consider how to use AI, “I strongly think you call in the experts.”

STICKING TO BIG TECH

Trevor Greetham, head of multi-asset at Royal London Investment Management, said he was “overweight” in dominant tech stocks in part because AI supported their valuations, but he cautioned against AI-themed stocks.

“There will be an awful lot of losing lottery tickets,” he said, recalling the dotcom crash of the early 2000s.

Also sticking with big tech, Fidelity’s Guinness said his funds hold Amazon, partly because of its efforts to make AI less expensive for businesses. Amazon’s Bedrock service, for example, lets companies customise generative AI models rather than invest in developing them themselves.

“The big benefits of AI,” Janus’ Porter said, “are going to happen over the long term.”

“Investors want to invest in AI now and they expect things to happen now,” she added. “But we would never blindly buy into AI and we don’t do things at any price.”

Our Standards: The Thomson Reuters Trust Principles.

Economy

S&P/TSX composite down more than 200 points, U.S. stock markets also fall

TORONTO – Canada’s main stock index was down more than 200 points in late-morning trading, weighed down by losses in the technology, base metal and energy sectors, while U.S. stock markets also fell.

The S&P/TSX composite index was down 239.24 points at 22,749.04.

In New York, the Dow Jones industrial average was down 312.36 points at 40,443.39. The S&P 500 index was down 80.94 points at 5,422.47, while the Nasdaq composite was down 380.17 points at 16,747.49.

The Canadian dollar traded for 73.80 cents US compared with 74.00 cents US on Thursday.

The October crude oil contract was down US$1.07 at US$68.08 per barrel and the October natural gas contract was up less than a penny at US$2.26 per mmBTU.

The December gold contract was down US$2.10 at US$2,541.00 an ounce and the December copper contract was down four cents at US$4.10 a pound.

This report by The Canadian Press was first published Sept. 6, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX composite up more than 150 points, U.S. stock markets also higher

TORONTO – Canada’s main stock index was up more than 150 points in late-morning trading, helped by strength in technology, financial and energy stocks, while U.S. stock markets also pushed higher.

The S&P/TSX composite index was up 171.41 points at 23,298.39.

In New York, the Dow Jones industrial average was up 278.37 points at 41,369.79. The S&P 500 index was up 38.17 points at 5,630.35, while the Nasdaq composite was up 177.15 points at 17,733.18.

The Canadian dollar traded for 74.19 cents US compared with 74.23 cents US on Wednesday.

The October crude oil contract was up US$1.75 at US$76.27 per barrel and the October natural gas contract was up less than a penny at US$2.10 per mmBTU.

The December gold contract was up US$18.70 at US$2,556.50 an ounce and the December copper contract was down less than a penny at US$4.22 a pound.

This report by The Canadian Press was first published Aug. 29, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Investment

Crypto Market Bloodbath Amid Broader Economic Concerns

-

Sports15 hours ago

Sports15 hours agoDolphins will bring in another quarterback, while Tagovailoa deals with concussion

-

Sports16 hours ago

Sports16 hours agoDavid Beckham among soccer dignitaries attending ex-England coach Sven-Goran Eriksson’s funeral

-

News16 hours ago

News16 hours agoVancouver Whitecaps cautious of lowly San Jose Earthquakes

-

Sports24 hours ago

Sports24 hours agoCanada’s Marina Stakusic advances to quarterfinals at Guadalajara Open

-

Sports10 hours ago

Sports10 hours agoEdmonton Oilers sign defenceman Travis Dermott to professional tryout

-

News16 hours ago

News16 hours agoAlberta town adopts new resident code of conduct to address staff safety

-

Sports24 hours ago

Sports24 hours agoDavid Lipsky shoots 65 to take 1st-round lead at Silverado in FedEx Cup Fall opener

-

Tech13 hours ago

Tech13 hours agoUnited Airlines will offer free internet on flights using service from Elon Musk’s SpaceX