Source: Tesla

Source: TeslaBusiness

GM and Ford to use Tesla’s plug, all but killing CCS in North America

Source: Tesla

Source: TeslaRival auto manufacturers GM and Ford have signed on to use Tesla’s NACS charging connector for their future electric cars in North America, a decision that has effectively signed the death certificate for the competing CCS1 charging connector standard.

We’re still in the early days of electric vehicles, but the rate of adoption is rapidly increasing as more manufacturers produce EVs in different shapes and sizes and prices, and as customers buy them up with vigor. And so there is a lot of jockeying happening not just for buyers, but for infrastructure to support them. The most interesting bifurcation has happened in charging standards with the division led primarily by Tesla.

Back in 2012 when Tesla unveiled its all-electric Model S sedan it did so with a new charging connector. At the time it was a proprietary connector, but it was already much more impressive and elegant than the highly engineered J1772 standard connector or almost comically bulky CCS1 and CHAdeMO standards that also offered DC charging. Tesla’s connector did all of that in a fraction of the footprint, with far less complexity in design or use. Yet, for the past decade, Tesla’s been trucking along with their own connector in North American markets while all other manufacturers remained committed to CCS1.

(Tesla was mandated by law to use the Type 2 IEC 60309 and CCS2 connectors for cars sold in Europe, and the GB/T connector in China)

Tesla accounts for more than half of DC fast chargers in the USA — surely a selling point for Ford and GM

This led to the bifurcation of the US EV market, with Tesla leading in electric car sales ever since their first cars went on sale, and leading in the deployment of chargers with their expansive but exclusive Supercharger network. Tesla’s head start in charger installation gets us to where we are today, with Tesla’s Superchargers accounting for more than half of the DC fast chargers installed in the USA.

That’s all started to change. It began with the relatively quiet November 2022 announcement from Tesla that they were opening up the Tesla charging connector to other manufacturers as the NACS — the North American Charging Standard. But the big news arrived late last month with Ford switching to the Tesla NCAS connector in 2025. And now today, chief American rival GM revealed they are also adopting NACS. Both plan to make adapters for the existing CCS-equipped chargers, and Tesla already sells their own CSS adapter, and also has equipped a handful of its own Tesla-plugged charging stations with adapters to support CCS vehicles.

Source: Tesla

Source: TeslaTesla, Ford, and GM today account for roughly 3/4 of all EV sales in the USA and the top three sales spots. This is a tipping point for EVs in the USA and thus North America — in the span of a few months Tesla’s NACS connector went from proprietary to the winning option. There are still other EV manufacturers that remain publicly committed to the CCS connector, including VW, Mercedes, Kia, and Rivian. Ford and GM are huge swings for NACS and will almost certainly lead to other companies adapting the standard.

Certainly, charging companies like Electrify America and ChargePoint are also going to race to install NACS connectors in the next two years so that the fleets of differently receptacled EVs can utilize their currently CCS-only chargers. Tesla will also have to invest in upgrading their existing charger stations with longer cables, though, since they’re basically the only manufacturer placing their charging port at the corner of the car. Charging a Ford F-150 at one of those adapter-equipped stations didn’t go so well because of the short Supercharger cables.

GM’s adoption of NACS signals the end of the line for CCS1. The standards body made some angry noises when Ford jumped ship, but the loss of GM means they no longer have America’s largest auto manufacturer and popular and well-known brands like Chevrolet, GMC, Ram, Buick, and Cadillac. Alas, CCS1, few people even knew your clunkiness. NACS will reign supreme from here on out.

Business

Transat AT reports $39.9M Q3 loss compared with $57.3M profit a year earlier

MONTREAL – Travel company Transat AT Inc. reported a loss in its latest quarter compared with a profit a year earlier as its revenue edged lower.

The parent company of Air Transat says it lost $39.9 million or $1.03 per diluted share in its quarter ended July 31.

The result compared with a profit of $57.3 million or $1.49 per diluted share a year earlier.

Revenue in what was the company’s third quarter totalled $736.2 million, down from $746.3 million in the same quarter last year.

On an adjusted basis, Transat says it lost $1.10 per share in its latest quarter compared with an adjusted profit of $1.10 per share a year earlier.

Transat chief executive Annick Guérard says demand for leisure travel remains healthy, as evidenced by higher traffic, but consumers are increasingly price conscious given the current economic uncertainty.

This report by The Canadian Press was first published Sept. 12, 2024.

Companies in this story: (TSX:TRZ)

The Canadian Press. All rights reserved.

Business

Dollarama keeping an eye on competitors as Loblaw launches new ultra-discount chain

Dollarama Inc.’s food aisles may have expanded far beyond sweet treats or piles of gum by the checkout counter in recent years, but its chief executive maintains his company is “not in the grocery business,” even if it’s keeping an eye on the sector.

“It’s just one small part of our store,” Neil Rossy told analysts on a Wednesday call, where he was questioned about the company’s food merchandise and rivals playing in the same space.

“We will keep an eye on all retailers — like all retailers keep an eye on us — to make sure that we’re competitive and we understand what’s out there.”

Over the last decade and as consumers have more recently sought deals, Dollarama’s food merchandise has expanded to include bread and pantry staples like cereal, rice and pasta sold at prices on par or below supermarkets.

However, the competition in the discount segment of the market Dollarama operates in intensified recently when the country’s biggest grocery chain began piloting a new ultra-discount store.

The No Name stores being tested by Loblaw Cos. Ltd. in Windsor, St. Catharines and Brockville, Ont., are billed as 20 per cent cheaper than discount retail competitors including No Frills. The grocery giant is able to offer such cost savings by relying on a smaller store footprint, fewer chilled products and a hearty range of No Name merchandise.

Though Rossy brushed off notions that his company is a supermarket challenger, grocers aren’t off his radar.

“All retailers in Canada are realistic about the fact that everyone is everyone’s competition on any given item or category,” he said.

Rossy declined to reveal how much of the chain’s sales would overlap with Loblaw or the food category, arguing the vast variety of items Dollarama sells is its strength rather than its grocery products alone.

“What makes Dollarama Dollarama is a very wide assortment of different departments that somewhat represent the old five-and-dime local convenience store,” he said.

The breadth of Dollarama’s offerings helped carry the company to a second-quarter profit of $285.9 million, up from $245.8 million in the same quarter last year as its sales rose 7.4 per cent.

The retailer said Wednesday the profit amounted to $1.02 per diluted share for the 13-week period ended July 28, up from 86 cents per diluted share a year earlier.

The period the quarter covers includes the start of summer, when Rossy said the weather was “terrible.”

“The weather got slightly better towards the end of the summer and our sales certainly increased, but not enough to make up for the season’s horrible start,” he said.

Sales totalled $1.56 billion for the quarter, up from $1.46 billion in the same quarter last year.

Comparable store sales, a key metric for retailers, increased 4.7 per cent, while the average transaction was down2.2 per cent and traffic was up seven per cent, RBC analyst Irene Nattel pointed out.

She told investors in a note that the numbers reflect “solid demand as cautious consumers focus on core consumables and everyday essentials.”

Analysts have attributed such behaviour to interest rates that have been slow to drop and high prices of key consumer goods, which are weighing on household budgets.

To cope, many Canadians have spent more time seeking deals, trading down to more affordable brands and forgoing small luxuries they would treat themselves to in better economic times.

“When people feel squeezed, they tend to shy away from discretionary, focus on the basics,” Rossy said. “When people are feeling good about their wallet, they tend to be more lax about the basics and more willing to spend on discretionary.”

The current economic situation has drawn in not just the average Canadian looking to save a buck or two, but also wealthier consumers.

“When the entire economy is feeling slightly squeezed, we get more consumers who might not have to or want to shop at a Dollarama generally or who enjoy shopping at a Dollarama but have the luxury of not having to worry about the price in some other store that they happen to be standing in that has those goods,” Rossy said.

“Well, when times are tougher, they’ll consider the extra five minutes to go to the store next door.”

This report by The Canadian Press was first published Sept. 11, 2024.

Companies in this story: (TSX:DOL)

Business

U.S. regulator fines TD Bank US$28M for faulty consumer reports

TORONTO – The U.S. Consumer Financial Protection Bureau has ordered TD Bank Group to pay US$28 million for repeatedly sharing inaccurate, negative information about its customers to consumer reporting companies.

The agency says TD has to pay US$7.76 million in total to tens of thousands of victims of its illegal actions, along with a US$20 million civil penalty.

It says TD shared information that contained systemic errors about credit card and bank deposit accounts to consumer reporting companies, which can include credit reports as well as screening reports for tenants and employees and other background checks.

CFPB director Rohit Chopra says in a statement that TD threatened the consumer reports of customers with fraudulent information then “barely lifted a finger to fix it,” and that regulators will need to “focus major attention” on TD Bank to change its course.

TD says in a statement it self-identified these issues and proactively worked to improve its practices, and that it is committed to delivering on its responsibilities to its customers.

The bank also faces scrutiny in the U.S. over its anti-money laundering program where it expects to pay more than US$3 billion in monetary penalties to resolve.

This report by The Canadian Press was first published Sept. 11, 2024.

Companies in this story: (TSX:TD)

The Canadian Press. All rights reserved.

-

Sports24 hours ago

Sports24 hours agoCanada’s Stakusic, partner Savinykh lose in doubles quarterfinals at Guadalajara Open

-

News4 hours ago

News4 hours agoRCMP say 3 dead, suspects at large in targeted attack at home in Lloydminster, Sask.

-

News24 hours ago

News24 hours agoSouthern Baptist trustees back agency president but warn against needless controversy

-

News4 hours ago

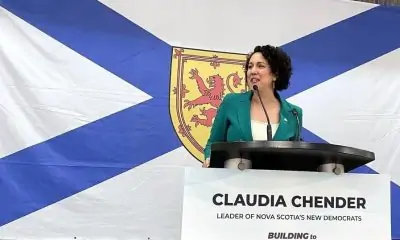

News4 hours agoNova Scotia adopts bill declaring domestic violence in the province an epidemic

-

News14 hours ago

News14 hours agoCanadanewsmedia news September 12, 2024: Air Canada pilot strike looms, BC transit strike talks resume

-

News3 hours ago

News3 hours agoHall of Famer Joe Schmidt, who helped Detroit Lions win 2 NFL titles, dies at 92

-

News13 hours ago

Local Toronto business story – Events Industry : new national brand, Element Event Solutions

-

News3 hours ago

News3 hours agoB.C. to scrap consumer carbon tax if federal government drops legal requirement: Eby