VANCOUVER – Canada’s labour minister says striking grain terminal workers in Metro Vancouver and their employers have reached a tentative labour deal.

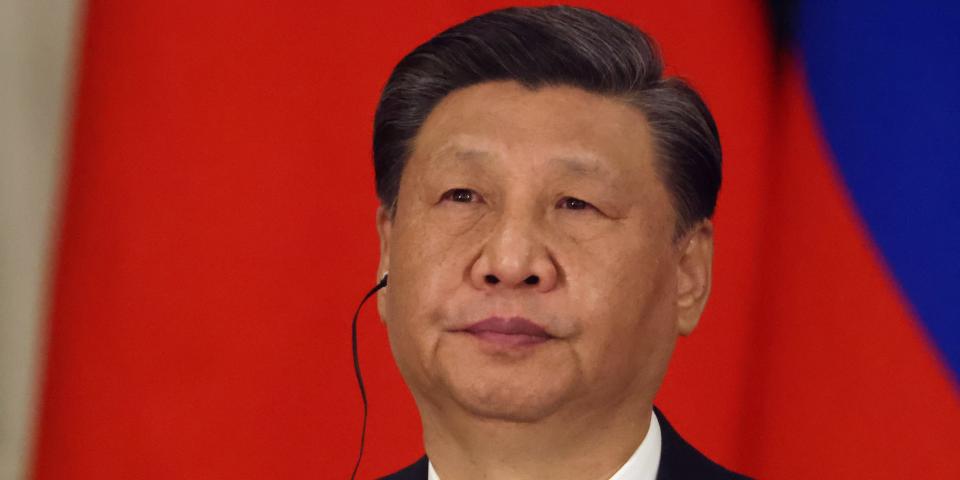

Steven MacKinnon announced the agreement between Grain Workers Union Local 333 and the Vancouver Terminal Elevators’ Association in a post on social media platform X, but provided no other details.

The union confirmed the tentative deal in a statement on Facebook, saying its members will conduct the ratification vote by Oct. 4.

The notification from the union also says picket lines were to be removed Saturday and members will return to work pending ratification, ending the strike that had paralyzed grain shipments from Metro Vancouver’s port.

The dispute had previously led to picket lines going up at six Metro Vancouver grain terminals on Tuesday as about 600 workers went on strike.

Canadian grain producers had urged a resolution in the dispute, noting about 52 per cent of the country’s grains moved through Metro Vancouver terminals last year en route to being exported.

Farmers say the strike, happening during crop harvesting, would result in as much as $35 million per day in lost exports.

The Western Grain Elevator Association said on Friday that talks had stalled after two days of negotiations this week, with the employer saying it had increased its offers to settle “outstanding issues.”

The employers group had said they’ve reached the end of their “financial ability to conclude an agreement that industry can absorb” with the last offer, and it was up to the federally appointed mediator to report the results to MacKinnon for the next steps.

MacKinnon says in his tweet that both parties put in “the work necessary to get a deal done.”

This report by The Canadian Press was first published Sept. 28, 2024.