In the world of mutual funds, many investors consider any period exceeding five years as the benchmark for long-term commitment. On the other hand, retail investors engaged in direct equity trading may perceive anything beyond a year as a long-term horizon. Nonetheless, it is the most discerning of equity investors who recognize that the long term is essentially a sh

The importance of long-term investing in achieving investment success is now widely acknowledged. Many investors attribute this significance primarily to the power of compounding, a well-established catalyst for wealth accumulation. However, what often goes unnoticed is that long-term investing is not just about compounding but also plays a pivotal role in managing risk and mitigating potential downsides.

In fact, the concept of long-term investing is intricately linked to effective risk management, and this risk mitigation aspect is equally vital in the pursuit of long-term wealth creation.

In the realm of investing, risk takes various forms and sizes, but for the purpose of this discussion, we’re focusing on volatility as a representation of total risk to an investment. The ability to comprehend and effectively manage volatility is a crucial factor in achieving investment success. Volatility, in essence, is not an adversary but a valuable ally.

Volatility represents the non-linear fluctuations in returns that have the potential to generate significant gains for investors. Yet, it’s essential to recognize that this same volatility can also trigger impulsive actions that lead to unwarranted investment decisions. This propensity to act in response to volatility often results in investors prioritizing short-term loss avoidance at the expense of long-term wealth creation.

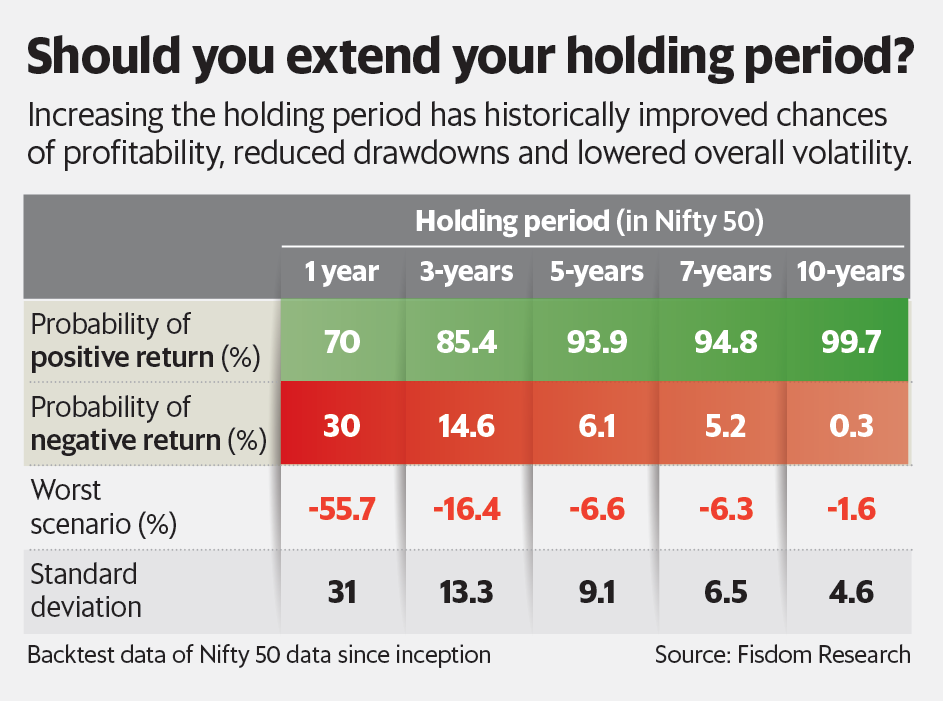

To illustrate this perspective, we’ve prepared a table (see graphic). In this analysis, Fisdom Research conducted a backtest to examine the returns that investors would have achieved by investing in the Nifty 50 index at various points in time and holding their investments for different time periods. This study encompasses all instances since the inception date of the index.

The above illustration clearly demonstrates a significant trend: as an investor’s holding period extends from 1 year to a longer tenure of 10 years, the likelihood of exiting with a profit approaches nearly one hundred percent. Furthermore, when examining instances where investors do incur losses, it becomes evident that the magnitude of those losses decreases as the investment horizon extends.

Standard deviation here serves as a measure of volatility. Consequently, as the investment horizon lengthens, the degree of volatility diminishes. A straightforward way to visualize this concept is to compare the Nifty 50 chart for a specific day with the same day on a longer chart, such as a 5-year chart. Doing so will reveal that while the daily chart may appear highly volatile, on the 5-year chart, the same day is a mere blip on a considerably smoother, less volatile curve.

While patience is often cited as the key virtue needed to navigate through periods of volatility, it’s actually conviction that defines resilience through volatile times.

Volatility serves as a litmus test for one’s conviction in their investment strategy. Once conviction is established, it becomes far easier to maintain the patience required to see investments through turbulence. Patience is a behavioural trait while conviction is intellectual one. Patience, when not supported by conviction, could lead to inaction and consequently ineffective investment management. However, conviction can be tested from an objective standpoint, periodically.

It is important for investors to realise that investment success is defined within oneself first and then impacted by externalities. Have good reason to believe and once there is, stick to it till the reason is proven inadequate or irrelevant.

Nirav Karkera is head of research at Fisdom.