AI can’t physically build a home. It can’t lay the brick, install the light fixtures, or get your couch up the stairs. But behind the scenes, a number of emerging technologies including AI, computer vision and machine learning are transforming the fragmented pipeline powering our “built environment.”

It’s the answer to a persistent problem in the real estate and proptech world. While the process of buying and selling has vastly improved, areas like construction, architecture, project management and design have lagged. The result is lopsided advancement and a fragmented, inefficient ecosystem.

But that’s about to change.

AI fueled by data will become the base layer that unlocks efficiency and speed. AI has the potential to smooth out many links in the real estate production chain and create a cascade that will close the productivity gap. This essay reveals what’s on the way and how founders can seize this opportunity.

The Lopsided Effect

Proptech has accelerated at a tremendous pace, but critical parts of it are lagging.

Where we see advancement: Companies like Trulia, Zillow, and LoopNet leveraged the search paradigm to empower consumers to become their own property hunters. The rise of SaaS created best-in-class software for property management or brokerage activities (RealPage, AppFolio). Since then, other companies have smoothed out the transaction process (Lev) or introduced new and more accessible pathways to home ownership.

Where we see stagnation: Construction, for example, has been one of the slowest industries to digitize. The average mega-project runs about 20 months behind schedule, and 98 percent of projects overshoot costs or timelines. $1.63 Trillion in value is lost each year due to construction inefficiencies.

Consider that you can now conduct most of your home search and financing process totally online and very quickly. But if one piece of construction equipment is overbooked, or a remodeling plan contains a single flaw, or weather strikes, or skilled labor is unavailable, then a whole building project can end up months behind. Because of the interdependent nature of this industry (it’s all centered around a core asset – the buildings where we live, work and play or the infrastructure that supports them) the whole pipeline gets jammed.

This is not a new problem. The “back-end” to Zillow and Co-Star’s “front end” has been slow to adopt technology, and high capital expenditure in construction and complex local regulatory structures have made digitization hard and seemingly not worth the effort.

AI is changing that, and now is the time.

While there is a commercial imperative around driving productivity, there is also a societal imperative. The operation of buildings contributes 30% of global final energy consumption, and 26 percent of global energy-related emissions. The current inefficiencies in our buildings is well recognized as a contributor to climate change, in step with industries like manufacturing and transport. And this is only likely to become more important with the rise of extreme temperatures.

As investors, we always look at startup timing and we believe there is a clear economic impetus, enabling technologies and cultural acceptance that are going to propel adoption.

A Productivity Cascade

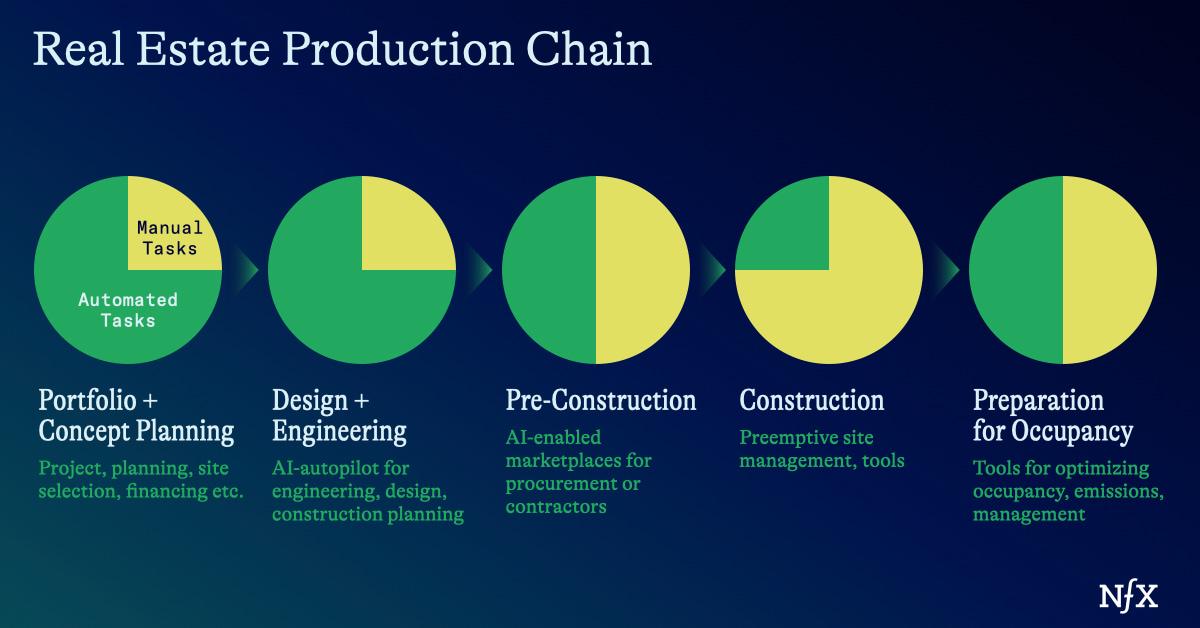

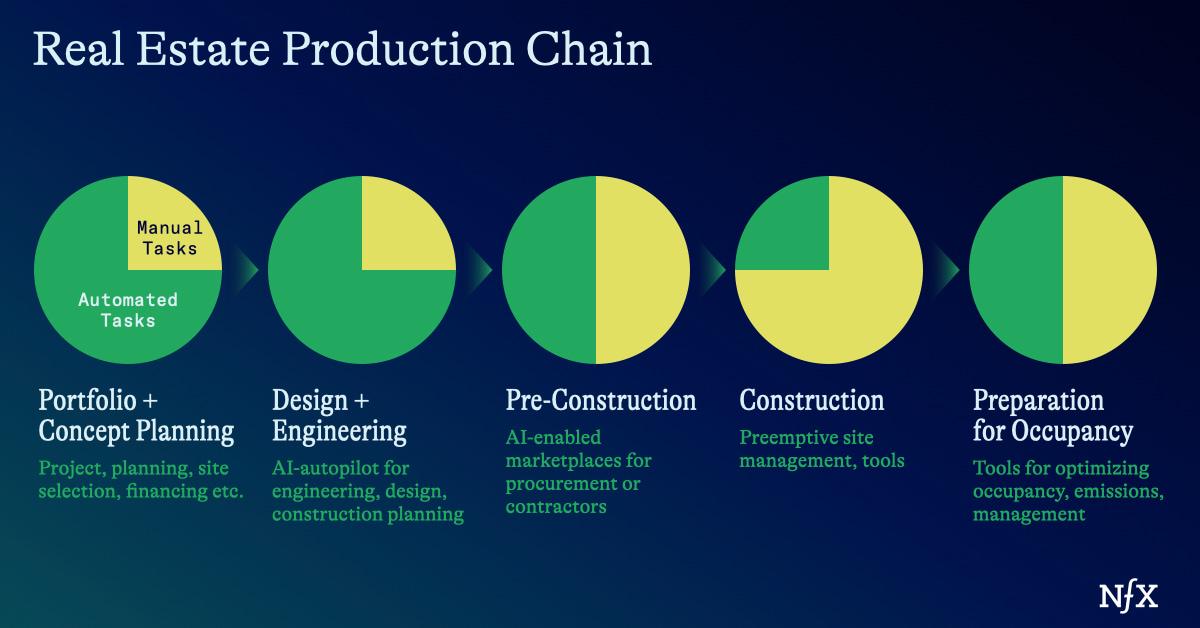

Think of the real estate world like a chain. Every project must move from one link to the other. From site selection to architecture to design to preconstruction, to construction, to buying/selling, to financing, property management, and real estate office activities.

It’s a highly interconnected network. And it is in dire need of streamlining.

This chain is composed of third parties who manage each link. That makes sense. These are specialized tasks that require domain expertise. But it also creates a system where any inefficiency within a link can be easily missed and passed to the next link. Over time, these problems snowball and lead to major delays.

It can take between 2-4 months to complete a plan and permitting process. 1-4 weeks (if all goes perfectly) to purchase a lot. 2 weeks to choose a designer. Months to solidify the plans. A month to choose a contractor… and that’s before the actual construction work even begins. That’s for a single family house, for anything else it’s significantly longer.

Here is where we see opportunity for startups: Each link along this chain can be optimized with AI, creating a productivity cascade along the whole chain.

First: AI will optimize the individual links of the real estate production chain, creating faster processes with fewer mistakes.

These links are primed for AI disruption because many of them contain large corpuses of visual, numerical, or language data. Blueprints, zoning laws, emissions data…new AI models allow us to tap into these data sources and improve each process significantly.

This will begin with AI-copilots, but move towards AI autopilots as models improve and trust in them builds (think: working with architects on pre-construction, permitting, environmental impact etc..)

Second: This will enable firms to bundle tasks together that once demanded the resources of an entire firm. Companies will use software to enhance labor productivity and improve on cost/efficiency of materials.

Third: Bundling of tasks will mean that companies manage necessary handoffs at the right time. The choreography of tasks will become dynamic, and streamlined.

Fourth: This will enable a foundation which will lead to ongoing digitization of the management of properties to ensure increased operating efficiency. These digital tools, armed with physical sensing technologies, will be used to reduce emissions, or operating costs, completing the full streamlining of the building life cycle.

The result: AI-powered real estate and proptech platforms will be able to conduct many aspects of the real estate process under one roof, as opposed to the many different systems that are deployed right now. (Some companies are already doing this).

It will lead to fewer errors, better results, the closing of the productivity gap, and greater operational efficiency. This is a change that we’ve seen most clearly in software, will eventually leak into the manual tasks associated with real estate (building, moving materials, upkeep) through sensing technologies and robotics.

Examples of AI x Real Estate

Here are a few examples of where we see real estate-powered AI companies initiating the productivity cascade.

AI-optimized Design, Permitting, Environmental Impact, Architecture

The concept and design phase of any building project is a key step in reducing losses down the line. It’s also one of the best fits for AI in the real estate / construction tech industry.

AI excels at pattern recognition, and optimization provided it is trained on high quality datasets. In fields like zoning, or architecture there are corpses of work that can be used to train AI models to act as co-pilots to human architects, and engineers. Zoning and permitting codes are enormously complex in the US and AI can do a great job of understanding at a base level what is possible and to speed up the permitting process. Also, the large and sprawling 2022 Inflation Reduction Act puts incentives for commercial buildings to lower emissions, acting as a catalyst for companies to understand their emissions footprint and improve environmental efficiency.

As a result, some companies have developed AI engines trained on data like zoning laws, demographics, and financial information to aid with site selection. Others are trained to reduce climate impact of buildings via architectural optimization.

We also see potential in technologies like digital twins, which allow us to integrate a variety of datasets from siloed sources into one, living replica. These models will allow us to run endless scenarios, and optimize each piece of the chain from construction to operation. (There are already predictions that digital twins of entire cities will become a backbone for urban planning and infrastructure in coming years).

Other companies operate further along the chain. NFX-backed Tailorbird, for example, speeds up the process of multi-family capex, renovations, and redevelopment. TailorBird is capable of analyzing all sorts of publicly available visual data, and without a site walk, able to turn it into architectural quality as-built drawings. From there, designers and architects can set design and scope, and immediately take those plans to a marketplace to obtain hard bids.

Ultimately, a month-long process becomes a two-week long process. That means landlords can fill buildings faster, make more money, and keep buildings in better condition for tenants.

Predictive Analytics + AI-assisted Project Management

Construction delays and mismanagement are large contributors to the productivity gap. We’re already seeing AI-powered predictive analytics smooth out this process and identify problems before they arise.

For example, NFX-backed Crews by Core has developed a field execution platform for construction teams. The crews software can automatically create work schedules, line up crews, and list tasks for each person to perform via chat. Critically, the system is also able to monitor site health and predict future issues.

For example, the Crews by Core AI engine can flag when bad weather might delay a project, when too many activities are scheduled with the same equipment at once, or a scheduled subcontractor has a history of missing deadlines.

Simply by keeping those trains on the tracks, the system can save Superintendents up to 16 hours in their workweek, and prevent unforced errors that impact the future of the project.

The Digital Incumbent Advantage

While we are excited about the emerging opportunities for new startups, incumbents with access to large amounts of data, engineers and distribution hold the initial advantage.

The large digital residential marketplaces (e.g. Trulia, Zillow) and large mortgage origination platforms, commercial data platforms and construction software tools (who are not asleep at the wheel) will benefit tremendously from these new technologies. They have robust databases and distribution already in place. Because of this, improvements in AI are likely to make their platforms incrementally better on the front end and more efficient behind the scenes. You will likely see AI led innovations incorporated into these platforms over the coming quarters.

But the key word here is incremental. For B2B startups, there are still opportunities if you go beyond incremental change and deliver a complete solution. Don’t be a co-pilot. Be an autopilot.

EvenUp (an NFX backed legal tech company), for example, sells software capable of generating an entire personal demand letter – not just a tool to help personal injury lawyers write those letters faster. NFX company TailorBird instantly generates entire as-built plans. These are extremely high value propositions because they truly eliminate the need for certain processes.

Proptech companies looking to use AI to deliver complete solutions are likely to gain an advantage over incumbents, who may be looking to graft AI on to existing services. These companies aren’t structured to totally recreate (if not eliminate) the workflows they helped build).

That said, a key challenge for these companies (other than distribution) is having access to all the data and a single platform to fully understand the market, the customer needs, and the way that each constituent works. These are the key ingredients needed to create that truly transformative AI autopilot – and deliver that complete solution.

That challenge exists because many traditional companies in the industry have typically embraced a “best in class” approach in selecting vendors bringing on board a number of partners and point solutions. While this made sense at the time, the fragmented data silos inhibit the ability to deliver new breakthrough product experiences and customer insights.

This is going to change. Forward thinking companies are realizing the power that a single system of record (rather than siloed vendors) unlocks. An early example of a company in this space is NFX-backed Radius. Radius helps agents source talent, manage transactions, run marketing operations, draft contracts, and manage in-house teams. Behind the scenes, the company has created one single source of truth for the entire process.

This opens up potential for more powerful AI solutions in the future.

Data is the lifeblood behind AI experiences. We expect to see new data platforms as well as increased attractiveness of verticalized solutions and ecosystems.

4 Considerations for Founders

This is still a developing ecosystem. But we’re beginning to notice several things that founders should keep in mind as they build in this field.

- Don’t stay a feature

AI has the potential to optimize each link of the real estate production chain, but Founders should beware thinking too small. It can be relatively easy to build a new AI tool that is immediately attractive, but don’t stop there – you need to fully understand the value chain.

When you build a vertical SaaS solution, you’re thinking about all the different ways to add value to a certain workflow. Maybe you can understand the environmental impact, interface with customers, or help brokers decide when to follow up on leads. Some of these activities hold more inherent value than others – they’re control points.

These valuable “control points”are the best places to begin building your company. They are the “need to haves.” Control points also typically do more than just save time, but facilitate the transaction (we will discuss the power of the saving time v.s. creating value distinction more below).

Many tasks are helpful, but not true control points. For example, many companies are capable of analyzing floorplans using AI, but is this a wedge or entry point that opens up the biggest opportunity to scale into a large company?

Consider whether you are more likely to be grafted onto an existing service or, over time if you could begin to expand your own product. You could imagine an upstream AI-optimized design tool creating a carbon reduction workflow, for example. Be sure that you’re the bigger idea, not the feature.

This will be a challenge for startups because you need to get to distribution (the incumbent advantage) faster than incumbents can innovate (i.e. graft you onto their platform).

Ultimately AI will make it possible to bundle together specialized tasks under one workflow. It’s ok to start with an incredibly valuable feature, but don’t stay so specialized that you’re bundled away. Avoid falling into this trap by identifying the true control points in your industry, and building around them.

2. Recognize where 3rd party status holds value

There will be fewer handoffs between disparate parties in an AI-powered real estate industry. But there are still some aspects of the process where 3rd party status is a feature, not a bug.

For example: accreditation, property valuations, or auditing are all tasks that must be performed by outside parties. These are areas that will be harder to graft on to upstream services.

3. Get paid for the work that you do: deliver true value, don’t just save time.

The killer proposition in the generative AI world isn’t about maximizing efficiency through time saving automation. It’s about using that maximized efficiency – unlocking value to drive growth.

Selling time-saving solutions may not be the best way to monetize the service. You could use this technology to create a breakthrough product experience or to monetize in some downstream activities. For example, can you incorporate a marketplace or embedded fintech to capture more value beyond a simple time saving tool.

Where we see the most exciting opportunities are where AI enables a breakthrough proposition that enables companies to participate in the transaction and get paid for the value they unlock.

The companies that strongly connect the dots between increased efficiency and growth are in the best position to succeed.

4. The compliance autopilot

Real estate remains a highly regulated industry. There’s a lot of value to be gained in helping people navigate those opportunities, especially by flagging small administrative mistakes before they snowball into bigger problems. Again, this will begin with co-piloting but move towards auto-piloting.

The transition is happening in high stakes industries. One of the earliest examples of AI co-piloting, for example, was in radiology. AI was used to help detect abnormalities in mammograms (in some cases, better than trained radiologists), and, increasingly, has begun to be seen as a key player in the future of the radiology field. Eventually, as trust builds and technology improves, it may eventually be seen as necessary.

That pattern is likely to repeat. Whenever there’s a routine compliance task (as there are across the real estate industry chain) that’s an opportunity for the co-piloting to auto-piloting transition to occur.

An Overlooked Opportunity: AI in the Physical World

We see many companies pursuing office activities, creative work, or digital-first applications of AI. Many incumbents see AI as the newest way to pursue office process automation. But AI’s impact on the physical world is already here, and it’s only going to get more central.

Architecture, engineering and construction is one of the top industries likely to be impacted by AI in the future, per an April Goldman Sachs report. As we’ve covered, we’re seeing it on the software side. But it’s here on the physical side too – through robotics, sensing, and emergent IoT technologies – that will be an even larger leap.

Real estate and proptech are an entry point. It’s one of the first places we are starting to see AI’s fingerprints in the physical world. It’s an enormous opportunity.

The first step is to close that $1.63 trillion global productivity gap.

If you are an early stage founder building a startup at the intersection of real estate and AI, then come talk to us.