Media

Facebook made a major change after years of PR disasters, and news sites are paying the price

Mother Jones CEO Monika Bauerlein has had a front-row seat in recent years to watch Facebook upend the media industry.

Bauerlein, who took over as CEO of the publication nine years ago, remembers when about 5 million users a month visited the Mother Jones website after coming across articles distributed on Facebook. That was in 2017.

But Facebook, now known as Meta, is out of the news business, a move that’s disrupted the traffic flow for many publications — Mother Jones has seen a 99% drop in Facebook referrals since its peak — and had disastrous consequences for some. In September, Meta said it would “deprecate” its Facebook news tab in European countries including the U.K., France and Germany as “part of an ongoing effort to better align our investments to our products and services people value the most.”

The push away from news followed years of public relations disasters for Facebook regarding the company’s handling of misinformation and its decisions on when to cancel accounts and remove posts. Conservative politicians have long accused the company of operating with a liberal bias, while groups on the other side portrayed Facebook as instrumental in the 2016 election of Donald Trump because of how Russian operatives exploited the site to boost his candidacy.

“At this point, it seems pretty clear from the comments that executives at Facebook and Meta made that they have just decided that news is more trouble than it’s worth and that they will show people a fairly minimal amount of it,” Bauerlein said in an interview.

At Mother Jones, a 48-year-old nonprofit magazine specializing in politics and investigations, the implications were dramatic. Though Facebook had generated millions of referrals a month for Mother Jones during its heyday, in November and December it generated just over 58,000 and 67,000 visitors, respectively, for Mother Jones, down from about 172,000 and 228,000 in the same months a year earlier.

An analysis of 1,930 news and media websites from over 370 companies conducted by the analytics firm Chartbeat for CNBC revealed that Facebook accounted for 33% of those publishers’ overall social traffic, measured by page views, as of December, down from 50% a year earlier.

As to all external traffic, which comes from social media and search engines such as Google, Facebook represented 6% of referral volume in December 2023, down from 14% in December 2018 and 12% in December 2022. That decline is mostly due to Facebook, as Google accounted for 38% of external traffic in December, up from 26% five years earlier and 36% in 2022.

Jill Nicholson, chief marketing officer at Chartbeat, said Facebook’s social traffic decline stems from several moves at Meta, including banning Canadian users last year from sharing news on its apps after Canada’s federal government passed the Online News Act, which forced tech companies to pay content fees to domestic media outlets.

Nicholson said a similar ban by Meta in Australia in 2021 ended up “making news less accessible” in general. Facebook eventually reversed that decision after reaching a deal with the Australian government.

Meta CEO Mark Zuckerberg is showing little interest in wading into hot-button issues on politics and global affairs after taking numerous trips to Capitol Hill following the 2016 election. Since changing his company’s name to Meta in late 2021, Zuckerberg has been focused on investing billions of dollars a quarter to develop the futuristic metaverse while trying to fend off competition from TikTok by bolstering Reels, Meta’s short-form video product that’s used by creators.

His strategy is paying off on Wall Street. Meta’s stock closed at a record Friday, as it continues to rally following an almost 200% pop last year.

David Carr, senior insights manager at analytics firm Similarweb, said Meta’s changing approach to news isn’t all about Zuckerberg’s preferences. Users are also tired of all the online bickering.

“One of the things that Facebook has talked about as a justification or a reason why they’re making some changes is that people are happier using the service when they don’t see all that political stuff,” Carr said.

A Meta spokesperson, echoing previous statements from company executives, said the shift away from news has been driven by user behavior.

“We know that people don’t come to Facebook for news and political content — they come to connect with people and discover new opportunities, passions and interests,” the spokesperson said. “We’ve made several changes to better align our investments to our products and services people value the most.”

In de-emphasizing news, Meta hasn’t just minimized contentious political debates. It’s made it harder for publications of all types and sizes to circulate stories to Facebook’s 3 billion monthly users.

Data from Similarweb showed that the top 100 global news publishers saw Facebook referral traffic plummet in 2023 from 2022 following a steady decline over several years.

Facebook represented 2.7% of the Daily Mail’s global referral traffic in November 2023, a decline from 6.5% in November 2020 and 3.8% in November 2022, according to Similarweb. For The Independent, Facebook’s contribution dropped to 1.3% of traffic in November from 6.5% three years earlier and 4% in 2022.

Publications have had to adapt, finding other ways to draw in traffic. For some ad-based sites that needed the big Facebook numbers to make money, the change was existential.

BuzzFeed, once known for viral posts and videos, shut down its BuzzFeed News site in April. The company still owns news site HuffPost, but its main site largely contains entertainment content, quizzes and videos.

The company has a market cap of under $35 million — nine years after Comcast-owned NBCUniversal, the parent company of CNBC, invested at a $1.5 billion valuation. BuzzFeed’s estimated Facebook referral traffic was 12% in November 2023, down from 15% a year earlier, according to Similarweb.

Vice Media, which was valued at $5.7 billion in 2017, declared bankruptcy in May.

Some top media brands experienced a bigger drop in Facebook traffic in earlier years as they recognized over time the need to diversify their sources of distribution. Across the media industry, news organizations have been steadily weaning themselves from reliance on Facebook.

Sam Cholke, an audience growth and distribution manager for the Institute for Nonprofit News, cited The Texas Tribune and Montana Free Press as examples of publications that are taking other routes to finding readers. The Texas Tribune, an online nonprofit paper launched in 2009, is leveraging in-person events to attract readers, while the Montana Free Press, started in 2016 by journalist John S. Adams, is running billboard ads in the capital city of Helena.

BuzzFeed CEO Jonah Peretti told analysts on his company’s earnings call in August that he’s “laser-focused” on a new strategy involving the use of artificial intelligence to help generate content in addition to relying more on creators.

“As Facebook and other major tech platforms continue to prioritize vertical video, traffic referrals from these platforms to our content have diminished,” Peretti said on the call.

Jessica Probus, BuzzFeed’s publisher, told CNBC in an interview that BuzzFeed’s “biggest shift” in its Facebook and audience strategy occurred around 2021. While there was a “slow trickle decline for a long time,” the major “turning point,” she said, occurred when Meta began going more directly after TikTok.

BuzzFeed decided to “take an even bigger emphasis on our own properties,” which included its core app and website as well as others such as HuffPost and Tasty.

BuzzFeed is looking for other ways to make money, which includes selling sponsorships, subscriptions and memberships, and a commerce business that’s “monetized through transactions, things that people are buying through our site,” Probus said.

‘Firehose of Facebook traffic’

Because Mother Jones is a nonprofit and relies on donors and subscribers rather than primarily ads, Bauerlein said the publication has been able to weather the social media storm better than others.

“The firehose of Facebook traffic was never going to pay for our journalism, for the majority of our journalism,” Bauerlein said. Regarding the pursuit of traffic by media upstarts, Bauerlein said, “a lot of venture capital was burned in the process.”

Bauerlein said Mother Jones has still managed to attain more Facebook followers than ever before, which she said points to the level of consumer appetite for its stories even if they’re harder to find.

“Now, you’re just not seeing that information that you chose to see,” Bauerlein said. That’s “a real broken promise to the users, especially at a time when the world is incredibly complicated and incredibly hard to understand.”

Cholke said that when it comes to Facebook and news, the writing has been on the wall for years. Last decade, many publishers saw their “social traffic decline pretty dramatically,” with Facebook deprioritizing text-based articles in favor of video content, Cholke said. In 2019, Facebook paid $40 million in a settlement to advertisers who alleged in a lawsuit that the company overinflated its video metrics, resulting in higher-priced video ads.

“For a lot of people, me included, it was one of the first signals that we’ve got to get smart about this,” Cholke said.

The 400-plus North American media outlets associated with the Institute for Nonprofit News are scrambling to find ways to reach readers, Cholke said. Some publishers are doubling down on Google search traffic, a strategy that poses other risks.

Last year, for example, a bug in Google Discover, a personalized news and content feed, caused traffic to decline for a number of publishers.

On top of the changes at Facebook, that’s led to the question: “What are the other options?” Cholke said.

Chartbeat’s Nicholson said one site that’s being used is YouTube, where “some are branching out into monetizing social video.” But for the most part, she said, publications have to rely more on “their own operated platforms,” where traffic patterns are less volatile.

“When those trends started going downward for social in terms of a referral source, that is where people really got into the business of diversification, investing more into newsletters and apps,” Nicholson said.

Longtime media columnist Mathew Ingram, a chief digital writer at the Columbia Journalism Review, said Facebook was “never a good place” for news, because it “focused on emotion and sharing for other purposes” rather than on seeking the truth.

That was true even when Facebook focused on news. But when the platform began pushing news stories down, the economics stopped working.

“In order to keep your traffic and all your numbers where they were, you just try three times as hard, and then eventually, you’re sort of blowing all this time and resources for a diminishing return,” Ingram said.

Data from the Pew Research Center shows that TikTok is taking some market share when it comes to where consumers get their news.

In a study published in November, Pew found that the percentage of U.S. adults who say they regularly turn to TikTok for news has more than quadrupled since 2020 to 14% from 3%. Elisa Shearer, a senior researcher at Pew, told CNBC that over that stretch the portion of Facebook users who said they regularly get news on the site has dropped to 43% from 54%.

But the way people access news on TikTok is different. Rather than seeing links to stories from outside publications, the news tends to be delivered by influencers in short videos. That makes it a particularly poor source of traffic for media outlets.

Still, Bauerlein said Mother Jones is building a bigger presence on TikTok as well as Instagram because the publication wants to find consumers where they are and “serve people who are looking for trustworthy information,” she said.

“If we all end up finding news in the metaverse, then you’ll be finding Mother Jones in the metaverse,” she said. What Mother Jones won’t do, she said, is “bet everything on one platform, because that never works out.”

Media

Trump could cash out his DJT stock within weeks. Here’s what happens if he sells

Former President Donald Trump is on the brink of a significant financial decision that could have far-reaching implications for both his personal wealth and the future of his fledgling social media company, Trump Media & Technology Group (TMTG). As the lockup period on his shares in TMTG, which owns Truth Social, nears its end, Trump could soon be free to sell his substantial stake in the company. However, the potential payday, which makes up a large portion of his net worth, comes with considerable risks for Trump and his supporters.

Trump’s stake in TMTG comprises nearly 59% of the company, amounting to 114,750,000 shares. As of now, this holding is valued at approximately $2.6 billion. These shares are currently under a lockup agreement, a common feature of initial public offerings (IPOs), designed to prevent company insiders from immediately selling their shares and potentially destabilizing the stock. The lockup, which began after TMTG’s merger with a special purpose acquisition company (SPAC), is set to expire on September 25, though it could end earlier if certain conditions are met.

Should Trump decide to sell his shares after the lockup expires, the market could respond in unpredictable ways. The sale of a substantial number of shares by a major stakeholder like Trump could flood the market, potentially driving down the stock price. Daniel Bradley, a finance professor at the University of South Florida, suggests that the market might react negatively to such a large sale, particularly if there aren’t enough buyers to absorb the supply. This could lead to a sharp decline in the stock’s value, impacting both Trump’s personal wealth and the company’s market standing.

Moreover, Trump’s involvement in Truth Social has been a key driver of investor interest. The platform, marketed as a free speech alternative to mainstream social media, has attracted a loyal user base largely due to Trump’s presence. If Trump were to sell his stake, it might signal a lack of confidence in the company, potentially shaking investor confidence and further depressing the stock price.

Trump’s decision is also influenced by his ongoing legal battles, which have already cost him over $100 million in legal fees. Selling his shares could provide a significant financial boost, helping him cover these mounting expenses. However, this move could also have political ramifications, especially as he continues his bid for the Republican nomination in the 2024 presidential race.

Trump Media’s success is closely tied to Trump’s political fortunes. The company’s stock has shown volatility in response to developments in the presidential race, with Trump’s chances of winning having a direct impact on the stock’s value. If Trump sells his stake, it could be interpreted as a lack of confidence in his own political future, potentially undermining both his campaign and the company’s prospects.

Truth Social, the flagship product of TMTG, has faced challenges in generating traffic and advertising revenue, especially compared to established social media giants like X (formerly Twitter) and Facebook. Despite this, the company’s valuation has remained high, fueled by investor speculation on Trump’s political future. If Trump remains in the race and manages to secure the presidency, the value of his shares could increase. Conversely, any missteps on the campaign trail could have the opposite effect, further destabilizing the stock.

As the lockup period comes to an end, Trump faces a critical decision that could shape the future of both his personal finances and Truth Social. Whether he chooses to hold onto his shares or cash out, the outcome will likely have significant consequences for the company, its investors, and Trump’s political aspirations.

Media

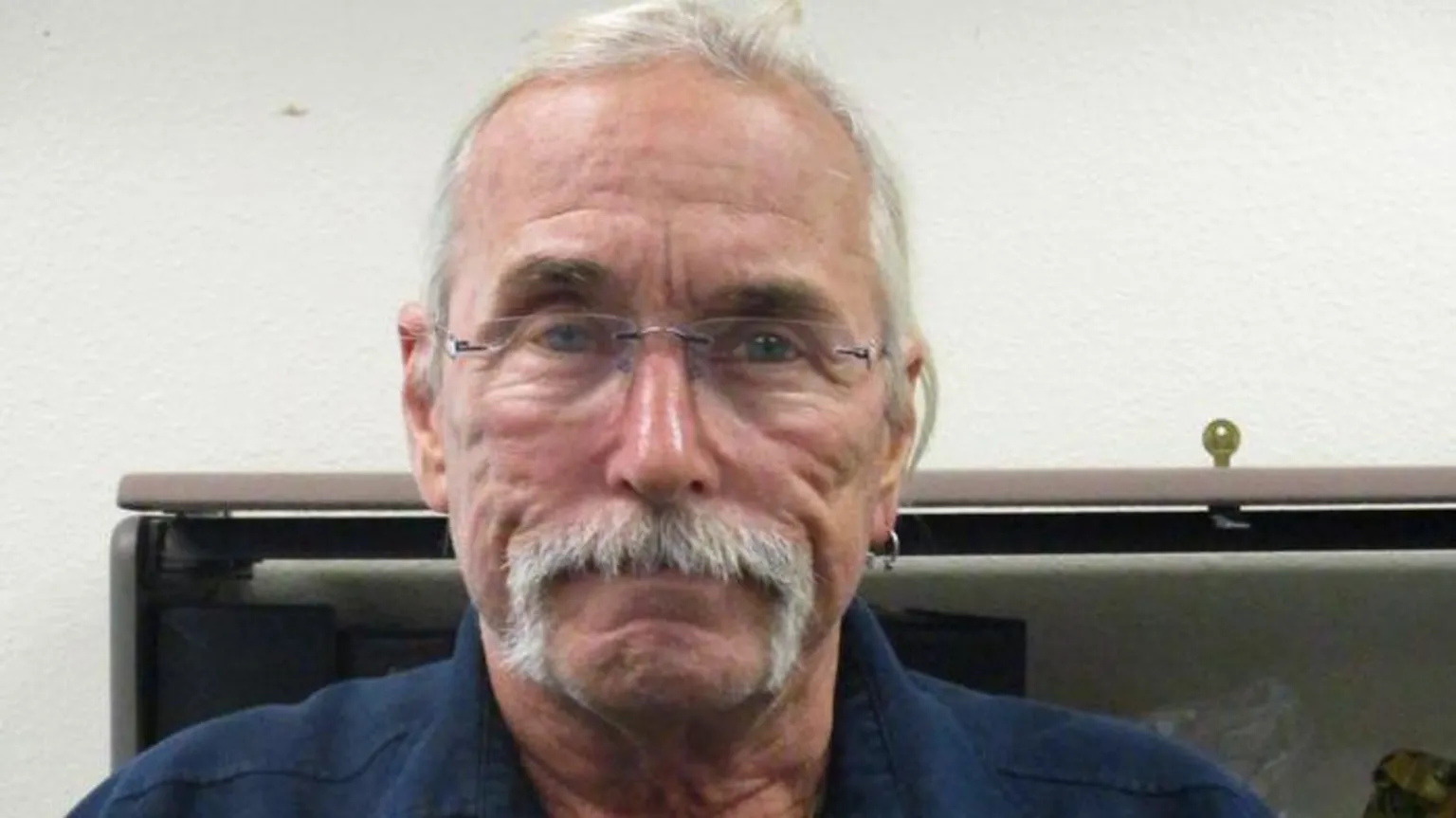

Arizona man accused of social media threats to Trump is arrested

Cochise County, AZ — Law enforcement officials in Arizona have apprehended Ronald Lee Syvrud, a 66-year-old resident of Cochise County, after a manhunt was launched following alleged death threats he made against former President Donald Trump. The threats reportedly surfaced in social media posts over the past two weeks, as Trump visited the US-Mexico border in Cochise County on Thursday.

Syvrud, who hails from Benson, Arizona, located about 50 miles southeast of Tucson, was captured by the Cochise County Sheriff’s Office on Thursday afternoon. The Sheriff’s Office confirmed his arrest, stating, “This subject has been taken into custody without incident.”

In addition to the alleged threats against Trump, Syvrud is wanted for multiple offences, including failure to register as a sex offender. He also faces several warrants in both Wisconsin and Arizona, including charges for driving under the influence and a felony hit-and-run.

The timing of the arrest coincided with Trump’s visit to Cochise County, where he toured the US-Mexico border. During his visit, Trump addressed the ongoing border issues and criticized his political rival, Democratic presidential nominee Kamala Harris, for what he described as lax immigration policies. When asked by reporters about the ongoing manhunt for Syvrud, Trump responded, “No, I have not heard that, but I am not that surprised and the reason is because I want to do things that are very bad for the bad guys.”

This incident marks the latest in a series of threats against political figures during the current election cycle. Just earlier this month, a 66-year-old Virginia man was arrested on suspicion of making death threats against Vice President Kamala Harris and other public officials.

Media

Trump Media & Technology Group Faces Declining Stock Amid Financial Struggles and Increased Competition

Trump Media & Technology Group’s stock has taken a significant hit, dropping more than 11% this week following a disappointing earnings report and the return of former U.S. President Donald Trump to the rival social media platform X, formerly known as Twitter. This decline is part of a broader downward trend for the parent company of Truth Social, with the stock plummeting nearly 43% since mid-July. Despite the sharp decline, some investors remain unfazed, expressing continued optimism for the company’s financial future or standing by their investment as a show of political support for Trump.

One such investor, Todd Schlanger, an interior designer from West Palm Beach, explained his commitment to the stock, stating, “I’m a Republican, so I supported him. When I found out about the stock, I got involved because I support the company and believe in free speech.” Schlanger, who owns around 1,000 shares, is a regular user of Truth Social and is excited about the company’s future, particularly its plans to expand its streaming services. He believes Truth Social has the potential to be as strong as Facebook or X, despite the stock’s recent struggles.

However, Truth Social’s stock performance is deeply tied to Trump’s political influence and the company’s ability to generate sustainable revenue, which has proven challenging. An earnings report released last Friday showed the company lost over $16 million in the three-month period ending in June. Revenue dropped by 30%, down to approximately $836,000 compared to $1.2 million during the same period last year.

In response to the earnings report, Truth Social CEO Devin Nunes emphasized the company’s strong cash position, highlighting $344 million in cash reserves and no debt. He also reiterated the company’s commitment to free speech, stating, “From the beginning, it was our intention to make Truth Social an impenetrable beachhead of free speech, and by taking extraordinary steps to minimize our reliance on Big Tech, that is exactly what we are doing.”

Despite these assurances, investors reacted negatively to the quarterly report, leading to a steep drop in stock price. The situation was further complicated by Trump’s return to X, where he posted for the first time in a year. Trump’s exclusivity agreement with Trump Media & Technology Group mandates that he posts personal content first on Truth Social. However, he is allowed to make politically related posts on other social media platforms, which he did earlier this week, potentially drawing users away from Truth Social.

For investors like Teri Lynn Roberson, who purchased shares near the company’s peak after it went public in March, the decline in stock value has been disheartening. However, Roberson remains unbothered by the poor performance, saying her investment was more about supporting Trump than making money. “I’m way at a loss, but I am OK with that. I am just watching it for fun,” Roberson said, adding that she sees Trump’s return to X as a positive move that could expand his reach beyond Truth Social’s “echo chamber.”

The stock’s performance holds significant financial implications for Trump himself, as he owns a 65% stake in Trump Media & Technology Group. According to Fortune, this stake represents a substantial portion of his net worth, which could be vulnerable if the company continues to struggle financially.

Analysts have described Truth Social as a “meme stock,” similar to companies like GameStop and AMC that saw their stock prices driven by ideological investments rather than business fundamentals. Tyler Richey, an analyst at Sevens Report Research, noted that the stock has ebbed and flowed based on sentiment toward Trump. He pointed out that the recent decline coincided with the rise of U.S. Vice President Kamala Harris as the Democratic presidential nominee, which may have dampened perceptions of Trump’s 2024 election prospects.

Jay Ritter, a finance professor at the University of Florida, offered a grim long-term outlook for Truth Social, suggesting that the stock would likely remain volatile, but with an overall downward trend. “What’s lacking for the true believer in the company story is, ‘OK, where is the business strategy that will be generating revenue?'” Ritter said, highlighting the company’s struggle to produce a sustainable business model.

Still, for some investors, like Michael Rogers, a masonry company owner in North Carolina, their support for Trump Media & Technology Group is unwavering. Rogers, who owns over 10,000 shares, said he invested in the company both as a show of support for Trump and because of his belief in the company’s financial future. Despite concerns about the company’s revenue challenges, Rogers expressed confidence in the business, stating, “I’m in it for the long haul.”

Not all investors are as confident. Mitchell Standley, who made a significant return on his investment earlier this year by capitalizing on the hype surrounding Trump Media’s planned merger with Digital World Acquisition Corporation, has since moved on. “It was basically just a pump and dump,” Standley told ABC News. “I knew that once they merged, all of his supporters were going to dump a bunch of money into it and buy it up.” Now, Standley is staying away from the company, citing the lack of business fundamentals as the reason for his exit.

Truth Social’s future remains uncertain as it continues to struggle with financial losses and faces stiff competition from established social media platforms. While its user base and investor sentiment are bolstered by Trump’s political following, the company’s long-term viability will depend on its ability to create a sustainable revenue stream and maintain relevance in a crowded digital landscape.

As the company seeks to stabilize, the question remains whether its appeal to Trump’s supporters can translate into financial success or whether it will remain a volatile stock driven more by ideology than business fundamentals.

-

News6 hours ago

News6 hours agoRCMP say 3 dead, suspects at large in targeted attack at home in Lloydminster, Sask.

-

Sports6 hours ago

Sports6 hours agoLawyer says Chinese doping case handled ‘reasonably’ but calls WADA’s lack of action “curious”

-

News5 hours ago

News5 hours agoHall of Famer Joe Schmidt, who helped Detroit Lions win 2 NFL titles, dies at 92

-

News16 hours ago

News16 hours agoRBC names Katherine Gibson as permanent chief financial officer

-

News6 hours ago

News6 hours agoNova Scotia adopts bill declaring domestic violence in the province an epidemic

-

News16 hours ago

News16 hours agoCanadanewsmedia news September 12, 2024: Air Canada pilot strike looms, BC transit strike talks resume

-

News5 hours ago

News5 hours agoB.C. to scrap consumer carbon tax if federal government drops legal requirement: Eby

-

News14 hours ago

Local Toronto business story – Events Industry : new national brand, Element Event Solutions