TORONTO and MANCHESTER, England, Feb. 05, 2024 (GLOBE NEWSWIRE) — Onex Corporation (“Onex”) (TSX: ONEX) today announced that Onex Partners V has completed a majority investment in Morson Group (“Morson” or the “Company”), a leading UK engineering and technical staffing and workforce solutions business, with growing operations in the UK, U.S., Italy, Canada and Australia. The investment has been made alongside the founding family CEO Ged Mason and members of the management team. Financial terms were not disclosed.

Investment

Onex Partners to Invest in Morson Group

About Onex

Onex is an investor and asset manager that invests capital on behalf of Onex shareholders and clients across the globe. Formed in 1984, we have a long track record of creating value for our clients and shareholders. Onex’ two primary businesses are Private Equity and Credit. In Private Equity, we raise funds from third-party investors, or limited partners, and invest them, along with Onex’ own investing capital, through the funds of our private equity platforms, Onex Partners and ONCAP. Similarly, in Credit, we raise and invest capital across several private credit, public credit, and public equity strategies. Our investors include a broad range of global clients, including public and private pension plans, sovereign wealth funds, insurance companies and family offices. In total, Onex has US$49.7 billion in assets under management, of which US$8.1 billion is Onex’ own investing capital. With offices in Toronto, New York, New Jersey, Boston and London, Onex and its experienced management teams are collectively the largest investors across Onex’ platforms.

Onex is listed on the Toronto Stock Exchange under the symbol ONEX. For more information on Onex, visit its website at www.onex.com. Onex’ security filings can also be accessed at www.sedarplus.ca.

About Morson Group

Morson Group is a leading provider of complete talent solutions, offering services across contingent workforce, design consultancy, and permanent recruitment through a variety of delivery models. The Company’s proprietary technology underpins managed service provider (MSP) and recruitment process outsourcing (RPO) offerings alongside other service models. Morson employs over 1,500 people in more than 60 locations in the UK, Australia, the United States, and Canada. With revenues in excess of £1.3 billion, Morson is ranked by SIA as the world’s third largest engineering and technical staffing business.

Disclaimers

This press release may contain, without limitation, statements concerning possible or assumed future operations, performance or results preceded by, followed by or that include words such as “believes”, “expects”, “potential”, “anticipates”, “estimates”, “intends”, “plans” and words of similar connotation, which would constitute forward-looking statements. Forward-looking statements are not guarantees. The reader should not place undue reliance on forward-looking statements and information because they involve significant and diverse risks and uncertainties that may cause actual operations, performance, or results to be materially different from those indicated in these forward-looking statements. Except as may be required by Canadian securities law, Onex is under no obligation to update any forward-looking statements contained herein should material facts change due to new information, future events or other factors. These cautionary statements expressly qualify all forward-looking statements in this press release.

For Further Information:

Onex

Jill Homenuk

Managing Director – Shareholder Relations and Communications

JHomenuk@onex.com

+1 416.362.7711

Economy

S&P/TSX composite down more than 200 points, U.S. stock markets also fall

TORONTO – Canada’s main stock index was down more than 200 points in late-morning trading, weighed down by losses in the technology, base metal and energy sectors, while U.S. stock markets also fell.

The S&P/TSX composite index was down 239.24 points at 22,749.04.

In New York, the Dow Jones industrial average was down 312.36 points at 40,443.39. The S&P 500 index was down 80.94 points at 5,422.47, while the Nasdaq composite was down 380.17 points at 16,747.49.

The Canadian dollar traded for 73.80 cents US compared with 74.00 cents US on Thursday.

The October crude oil contract was down US$1.07 at US$68.08 per barrel and the October natural gas contract was up less than a penny at US$2.26 per mmBTU.

The December gold contract was down US$2.10 at US$2,541.00 an ounce and the December copper contract was down four cents at US$4.10 a pound.

This report by The Canadian Press was first published Sept. 6, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX composite up more than 150 points, U.S. stock markets also higher

TORONTO – Canada’s main stock index was up more than 150 points in late-morning trading, helped by strength in technology, financial and energy stocks, while U.S. stock markets also pushed higher.

The S&P/TSX composite index was up 171.41 points at 23,298.39.

In New York, the Dow Jones industrial average was up 278.37 points at 41,369.79. The S&P 500 index was up 38.17 points at 5,630.35, while the Nasdaq composite was up 177.15 points at 17,733.18.

The Canadian dollar traded for 74.19 cents US compared with 74.23 cents US on Wednesday.

The October crude oil contract was up US$1.75 at US$76.27 per barrel and the October natural gas contract was up less than a penny at US$2.10 per mmBTU.

The December gold contract was up US$18.70 at US$2,556.50 an ounce and the December copper contract was down less than a penny at US$4.22 a pound.

This report by The Canadian Press was first published Aug. 29, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Investment

Crypto Market Bloodbath Amid Broader Economic Concerns

-

Sports19 hours ago

Sports19 hours agoArmstrong scores, surging Vancouver Whitecaps beat slumping San Jose Earthquakes 2-0

-

News19 hours ago

News19 hours agoAs plant-based milk becomes more popular, brands look for new ways to compete

-

News15 hours ago

News15 hours agoLabour Minister praises Air Canada, pilots union for avoiding disruptive strike

-

News15 hours ago

News15 hours agoLooking for the next mystery bestseller? This crime bookstore can solve the case

-

News19 hours ago

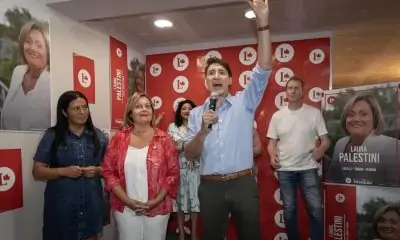

News19 hours agoLiberal candidate in Montreal byelection says campaign is about her — not Trudeau

-

News19 hours ago

News19 hours agoB.C. victim’s family furious at no-fault insurance regime in motor-vehicle death case

-

News19 hours ago

News19 hours agoAir Canada, pilots reach tentative deal, averting work stoppage

-

News19 hours ago

News19 hours agoInflation expected to ease to 2.1%, lowest level since March 2021: economists