Business

Live news: Loblaw to build more than 40 new stores, create 7,500 jobs in $2-billion expansion – Financial Post

The latest business news as it happens

Article content

Top story

Loblaw to build more than 40 new stores in $2-billion expansion

Advertisement 2

Article content

Loblaw Cos. Ltd. says it will build more than 40 new stores as part of a record investment plan of more than $2 billion.

The parent company of Loblaws and Shoppers Drug Mart said it will also expand or relocate another 10 locations.

It will renovate more than 700 others.

Loblaw said the company’s capital investments this year are expected to create more than 7,500 jobs in Canada.

The company has a network of 2,500 stores across the country.

In addition to Loblaws and Shoppers Drug Mart, the company’s banners include No Frills, Real Canadian Superstore and T&T.

— The Canadian Press

1:14 p.m.

Brookfield explores new infrastructure fund months after record close

Brookfield Asset Management Ltd. is beginning early-stage discussions about its next infrastructure product, two months after it closed a record fund that it’s deploying into transportation, telecom and other hard assets.

The world’s second-largest alternative asset manager has started informal talks with investors for the sixth vintage of the flagship Brookfield Infrastructure Fund, aiming to launch next year, according to people familiar with the matter who asked not to be identified because the matter is private. The timing is subject to change, one person said.

Article content

Advertisement 3

Article content

Brookfield received US$30 billion in commitments for its infrastructure strategy in a process that closed in late 2023 — US$28 billion for the fund and US$2 billion for related co-investment vehicles. A representative for the firm declined to comment.

The Toronto-based manager has US$154 billion of fee-paying assets across its infrastructure, renewables and climate-transition businesses, accounting for one-third of the US$457 billion in capital from which it draws fees.

Brookfield’s infrastructure unit pitches the funds as a way for investors to play major trends shaping the global economy, including the clean-energy transition, digitization and artificial intelligence. Like rival Blackstone Inc., it has poured money into data centres to capitalize on growing interest in AI.

— Bloomberg

Noon

TSX seesaws, U.S. stocks fall

Canada’s main stock index seesawed between narrow gains and losses on Tuesday, while U.S. stocks were lower after markets in both countries were closed Monday for a holiday.

The S&P/TSX composite index was down 0.03 per cent at 21,248.45.

Advertisement 4

Article content

In New York, the Dow Jones industrial average was down 0.36 per cent at 38,485.80. The S&P 500 index was down 0.64 per cent at 4,973.58, while the Nasdaq composite was down 1.5 per cent points at 15,540.54.

The Canadian dollar traded down 0.20 per cent at 73.94 cents US compared with 74.16 cents US on Friday.

The April crude oil contract was down 0.42 per cent from Friday at US$78.86 per barrel, while the March natural gas contract was down less than a penny at US$1.61 per mmBTU.

The April gold contract was up 0.71 per cent from Friday at US$2,038.40 an ounce and the March copper contract was up a penny at US$3.85 a pound.

— The Canadian Press

11:41 a.m.

Ford cuts prices Mustang EV models

Ford Motor Co. cut the price of its electric Mustang Mach-E by as much as US$8,100 after its sales tumbled 51 per cent in January when the automaker had to stop offering tax incentives on the plug-in model.

The automaker lowered prices on multiple versions of the 2023 model Mach-E by a range of US$3,100 to US$8,100, according to an emailed statement Tuesday. The battery-powered crossover SUV that Ford makes in Mexico now starts at US$39,895, down from US$42,995. The biggest discount is offered on several versions, including the high-end premium model with an extended range battery, which now starts at US$45,895.

Advertisement 5

Article content

Amid an industry-wide slowdown in demand for electric vehicles, Ford’s EV sales fell 11 per cent in January. On Jan. 1, the Mach-E lost its eligibility for a US$3,750 US tax credit as the Biden administration tightened rules on stimulus measures to prevent EV makers from sourcing battery materials from China and other foreign adversaries. Ford also is cutting production of the Mach-E and the F-150 Lightning plug-in pickup truck.

“We are adjusting pricing for 2023 models as we continue to adapt to the market to achieve the optimal mix of sales growth and customer value,” Ford said in the statement.

— Bloomberg

10:25 a.m.

Stocks in U.S., Canada down to start shortened trading week

Stocks fell on Wall Street in morning trading on Tuesday to kick off a holiday-shortened week.

The S&P 500 slipped 0.6 per cent and is coming off only its second losing week in the last 16. The benchmark index is sitting below the record high it reached last week.

The Dow Jones industrial average fell 30 points, or 0.1 per cent. The Nasdaq composite fell 1.2 per cent.

Markets were closed in the United States on Monday for Presidents Day.

Advertisement 6

Article content

In Toronto, the S&P/TSX composite index was down 0.04 per cent after being closed on Monday for Family Day in Ontario.

— Bloomberg, Financial Post

8:30 a.m.

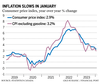

Inflation cools to 2.9% in January

Canada’s rate of inflation slowed to 2.9 per cent in January, down from 3.4 per cent in December, according to Statistics Canada’s monthly consumer price index data.

Statistics Canada said the headline deceleration was mainly due to a year-over-year decline in gasoline prices, which fell four per cent in January from 1.4 per cent the prior month.

Excluding gasoline, headline CPI slowed to 3.2 per cent in January, down from the 3.5 per cent growth in December, it said.

— Denise Paglinawan, Financial Post

7:15 a.m.

Stock markets before the opening bell

United States equity futures declined amid growing conviction that the U.S. Federal Reserve will hold interest rates higher for longer to curb a resilient economy — with some investors even starting to speculate that the next move may be up.

Futures on the S&P 500 and Nasdaq 100 were pointing to a down day when Wall Street reopens after Monday’s public holiday. Nvidia Corp. declined in pre-market trading ahead of its widely anticipated earnings report due Wednesday. Discover Financial Services surged after Capital One Financial Corp. agreed to buy the credit card issuer. Capital One dropped. The 10-year Treasury yield and the dollar were steady.

Advertisement 7

Article content

Traders have in recent weeks moved rate-cut expectation out to June, from March, as a phalanx of Federal Reserve officials warned against over-exuberant expectations of policy easing, and economic data continued to surprise to the upside. Former U.S. Treasury Secretary Lawrence Summers said on Friday “there’s a meaningful chance” the next move is up.

The S&P/TSX composite index closed up 0.16 per vent on Friday.

— Bloomberg

What to watch today

Innovation Minister François-Philippe Champagne will take part in discussions with players from the mining and critical minerals sector at an event in Rouyn-Noranda, Que.

Deputy Prime Minister Chrystia Freeland will deliver remarks and participate in a fireside conversation at the Association quebecoise de la production d’energie renouvelable 2024 symposium, in Quebec City.

Statistics Canada releases the consumer price index for January this morning.

Companies reporting earnings today include First Quantum Minerals Ltd., Walmart Inc., The Home Depot Inc. and Barclays PLC.

Recommended from Editorial

Need a refresher on Friday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Business

Dollarama keeping an eye on competitors as Loblaw launches new ultra-discount chain

Dollarama Inc.’s food aisles may have expanded far beyond sweet treats or piles of gum by the checkout counter in recent years, but its chief executive maintains his company is “not in the grocery business,” even if it’s keeping an eye on the sector.

“It’s just one small part of our store,” Neil Rossy told analysts on a Wednesday call, where he was questioned about the company’s food merchandise and rivals playing in the same space.

“We will keep an eye on all retailers — like all retailers keep an eye on us — to make sure that we’re competitive and we understand what’s out there.”

Over the last decade and as consumers have more recently sought deals, Dollarama’s food merchandise has expanded to include bread and pantry staples like cereal, rice and pasta sold at prices on par or below supermarkets.

However, the competition in the discount segment of the market Dollarama operates in intensified recently when the country’s biggest grocery chain began piloting a new ultra-discount store.

The No Name stores being tested by Loblaw Cos. Ltd. in Windsor, St. Catharines and Brockville, Ont., are billed as 20 per cent cheaper than discount retail competitors including No Frills. The grocery giant is able to offer such cost savings by relying on a smaller store footprint, fewer chilled products and a hearty range of No Name merchandise.

Though Rossy brushed off notions that his company is a supermarket challenger, grocers aren’t off his radar.

“All retailers in Canada are realistic about the fact that everyone is everyone’s competition on any given item or category,” he said.

Rossy declined to reveal how much of the chain’s sales would overlap with Loblaw or the food category, arguing the vast variety of items Dollarama sells is its strength rather than its grocery products alone.

“What makes Dollarama Dollarama is a very wide assortment of different departments that somewhat represent the old five-and-dime local convenience store,” he said.

The breadth of Dollarama’s offerings helped carry the company to a second-quarter profit of $285.9 million, up from $245.8 million in the same quarter last year as its sales rose 7.4 per cent.

The retailer said Wednesday the profit amounted to $1.02 per diluted share for the 13-week period ended July 28, up from 86 cents per diluted share a year earlier.

The period the quarter covers includes the start of summer, when Rossy said the weather was “terrible.”

“The weather got slightly better towards the end of the summer and our sales certainly increased, but not enough to make up for the season’s horrible start,” he said.

Sales totalled $1.56 billion for the quarter, up from $1.46 billion in the same quarter last year.

Comparable store sales, a key metric for retailers, increased 4.7 per cent, while the average transaction was down2.2 per cent and traffic was up seven per cent, RBC analyst Irene Nattel pointed out.

She told investors in a note that the numbers reflect “solid demand as cautious consumers focus on core consumables and everyday essentials.”

Analysts have attributed such behaviour to interest rates that have been slow to drop and high prices of key consumer goods, which are weighing on household budgets.

To cope, many Canadians have spent more time seeking deals, trading down to more affordable brands and forgoing small luxuries they would treat themselves to in better economic times.

“When people feel squeezed, they tend to shy away from discretionary, focus on the basics,” Rossy said. “When people are feeling good about their wallet, they tend to be more lax about the basics and more willing to spend on discretionary.”

The current economic situation has drawn in not just the average Canadian looking to save a buck or two, but also wealthier consumers.

“When the entire economy is feeling slightly squeezed, we get more consumers who might not have to or want to shop at a Dollarama generally or who enjoy shopping at a Dollarama but have the luxury of not having to worry about the price in some other store that they happen to be standing in that has those goods,” Rossy said.

“Well, when times are tougher, they’ll consider the extra five minutes to go to the store next door.”

This report by The Canadian Press was first published Sept. 11, 2024.

Companies in this story: (TSX:DOL)

Business

U.S. regulator fines TD Bank US$28M for faulty consumer reports

TORONTO – The U.S. Consumer Financial Protection Bureau has ordered TD Bank Group to pay US$28 million for repeatedly sharing inaccurate, negative information about its customers to consumer reporting companies.

The agency says TD has to pay US$7.76 million in total to tens of thousands of victims of its illegal actions, along with a US$20 million civil penalty.

It says TD shared information that contained systemic errors about credit card and bank deposit accounts to consumer reporting companies, which can include credit reports as well as screening reports for tenants and employees and other background checks.

CFPB director Rohit Chopra says in a statement that TD threatened the consumer reports of customers with fraudulent information then “barely lifted a finger to fix it,” and that regulators will need to “focus major attention” on TD Bank to change its course.

TD says in a statement it self-identified these issues and proactively worked to improve its practices, and that it is committed to delivering on its responsibilities to its customers.

The bank also faces scrutiny in the U.S. over its anti-money laundering program where it expects to pay more than US$3 billion in monetary penalties to resolve.

This report by The Canadian Press was first published Sept. 11, 2024.

Companies in this story: (TSX:TD)

The Canadian Press. All rights reserved.

Business

Amazon rejects plea to stop selling taxi roof signs as cab scam spreads across Canada

After a long day at a work event in July, Kathryn Kozody was relieved when she spotted a car with a lit-up taxi sign.

She thought it was odd when the driver told her she’d have to pay her fare with a debit card. Still, a tired Kozody hopped in the car.

“I was like, ‘Fine, it’s kind of weird, but let’s go home,'” said Kozody, who lives in Calgary.

Nothing else seemed off — until the next day when she discovered that almost $2,000 was missing from her bank account. On top of that, her debit card had someone else’s name on it.

Kozody concluded that the taxi driver was a fraudster who, during the debit card transaction, recorded her PIN, stole her card and handed her back a fake.

“I started freaking out,” she said. “It’s terrifying when they have your debit card.”

It took Kozody about two weeks to get her money back from her bank, and she’s still rattled by the experience.

“It really felt like an invasion of privacy and a violation to be a victim of this scam,” she said. “I really don’t want it to happen to anybody else.”

The taxi scam isn’t new; Toronto and Montreal have been seeing it for years. But the crime is becoming more widespread.

This summer, police in Calgary, Edmonton and at least five cities in southern Ontario, including Kingston and Ottawa, posted warnings online that they had received multiple reports of the scam.

Police and the Canadian Taxi Association say the fraudsters have a helping hand: with the click of a button, they can purchase a generic — but official looking — taxi roof sign on e-commerce sites like Amazon.

The taxi association has asked Amazon, by far Canada’s most popular online shopping site, to stop making the roof signs so easily available.

“They do have a moral responsibility to at least sell the signs to individuals that are properly licensed,” said association president Marc André Way.

However, the U.S.-based company continues to sell the product to all customers.

“These lights are legal to sell in Canada,” Amazon told CBC News in an email.

‘Eye-popping’ numbers

The taxi scam has several variations but typically ends the same way: the victim pays with a debit card, then the scammer secretly steals it and hands the victim a similar but fake card. Shortly thereafter, money disappears from the victim’s account.

Ron Hansen, deputy chief of police in Sarnia, Ont., said his department received 12 reports of the scam in July, with one victim losing $9,900.

Toronto police report that since June 2023 the department has received 919 reports of the taxi scam, totalling $1.7 million in losses.

The numbers are “eye-popping,” said Toronto police detective David Coffey.

“When they do get a victim, they are quick to go right into the bank accounts. They’re quick to empty them out.”

Jessica Chin King of Toronto said just 15 minutes after a recent cab ride, she got a suspicious activity alert from her bank. Turns out, $600 had been withdrawn from her account.

“I was like, ‘Wow, I can’t believe that just happened.’ I was in shock,” said Chin King, whose bank later reimbursed the cash.

She said she too was fooled by the taxi sign atop the car.

“I was in the car with somebody who wasn’t a taxi driver. Anything could have happened,” she said. “I was thankful that it was only my bank [account] that was compromised.”

Taxi light for $35 on Amazon

CBC News bought a taxi sign from Amazon for $35. It has a magnetic strip on the bottom, so it easily sticks to the top of a car.

To power the light, an attached wire can be run through the driver’s window and plugged into the car’s auxiliary power outlet, also known as the cigarette lighter outlet.

The taxi association says licensed taxi drivers typically get their roof signs from speciality suppliers, and they are hardwired to the car — not powered via the cigarette lighter.

“When you see that … it’s obvious that it’s not a legitimate taxi,” said Way, the association president.

Last month, Way sent Amazon a letter on behalf of the Canadian Taxi Association, asking it to stop selling the product.

“This is not a safe, practical way to distribute the trusted ‘Taxi’ signs,” he wrote.

But Amazon told Way — and CBC News — the signs will remain on its site, because the company isn’t breaking any rules.

“It’s going to be quite difficult, I think, for anyone to stop Amazon from selling a product that is perfectly legal to sell,” said Toronto criminal lawyer, Daniel Goldbloom. “It’s true that these taxi signs can be used to commit scams, but kitchen knives can be used to commit murder — and we don’t stop retailers from selling those.”

But Way isn’t giving up hope.

He says the taxi association also plans to ask other online retailers, such as Temu and eBay, to stop selling the taxi signs and will lobby provincial governments for legislation that regulates the sale of the product.

However, Coffey said he believes the best way to fight the taxi scam is to educate people about it.

“Never, never give another person control of your debit card,” the detective said.

Victims Chin King and Kozody also want to spread the word.

“The more people know, the less likely it is to happen again to somebody else,” Kozody said.

-

News20 hours ago

News20 hours agoSingh claps back at Poilievre ahead of House return

-

News20 hours ago

News20 hours agoMore than 67 million people watched Donald Trump and Kamala Harris debate. That’s way up from June

-

News20 hours ago

News20 hours agoTaxi driver suspected in fatal B.C. hit-and-run has left Canada: RCMP

-

News20 hours ago

News20 hours agoMounties say there’s no evidence Lytton, B.C., wildfire was arson; cause unknown

-

News20 hours ago

News20 hours agoThe ancient jar smashed by a 4-year-old is back on display at an Israeli museum after repair

-

Sports19 hours ago

Sports19 hours agoCanada’s Stakusic, partner Savinykh lose in doubles quarterfinals at Guadalajara Open

-

News19 hours ago

News19 hours agoSouthern Baptist trustees back agency president but warn against needless controversy

-

News8 hours ago

Local Toronto business story – Events Industry : new national brand, Element Event Solutions

Comments