Media

Ofcom’s approach to GB News will dilute trust in media – just when we need it most – The Guardian

Ofcom has signalled the start of the 2024 election season by issuing its advice to broadcasters on coverage of the local elections in May. It does this before every election to help its licensees maintain their legal obligation of impartiality. But in our editorial and regulatory experience, stretching back 40 years, there has never been so much cause for confusion and concern about what lies ahead in broadcast coverage of both local and general election campaigns.

Is Ofcom going to allow senior party officials to present election programmes as long as they are not actual candidates? Could a channel host party loyalists from only one side, delivering nightly unchallenged polemics on each day’s campaign news? Will channels with poor compliance records and fewer viewers than the public service broadcasters be given greater flexibility in achieving “due impartiality” on the basis of what Ofcom calls “audience expectations”?

Ofcom says that “pretty soon” it will set out its thinking because in its own words “the stakes are even higher in an election year”. But, based on Ofcom’s existing interpretation of its rules and its recent statements, we fear the answer to all three questions is yes.

The recent rise of what have been called “opinionated” TV channels has stretched Ofcom’s interpretation of what “due” impartiality means to its very limit. Ofcom often cites freedom of expression and audience expectations in allowing much greater flexibility to these news channels in comparison to their public service cousins, which, alongside channels such as Sky News, strive for impartiality. So Ofcom has now created a two-tier impartiality system. The law has never allowed for this – irrespective of audience size or brand reputation.

But the law hasn’t changed – not one comma – and there is no evidence that parliament is seeking to dilute impartiality in broadcasting. In fact, quite the contrary. Proposed new legislation before the Commons seeks to extend the impartiality rules to on-demand services such as Netflix and Prime Video. So why does Ofcom appear to be applying a different set of impartiality rules to the likes of GB News?

When the broadcasting code, which all UK broadcasters must comply with, was first published almost 20 years ago, it was never envisaged that sitting politicians and senior officials from the same political party would present news and current affairs shows day in, day out. If it did happen, then it would certainly raise questions under the impartiality rules. Now presenters give long monologues on no end of controversial matters and frequently go unchallenged. But neither the law, the code nor Ofcom’s published guidance on the code has changed.

It has long been established that the obligation for due impartiality is, in itself, a restriction on freedom of expression. It’s one that’s been accepted as legitimate in a democratic society and upheld in the courts numerous times. The overall rationale being that the public should be exposed to informed debate with competing views and opinions and not fed one line. This is the reason, often cited by Ofcom, why broadcast news is so trusted in this country.

But Ofcom has repeatedly failedto quickly conclude many of its investigations, and is apparently unwilling to uphold impartiality – all in the name of freedom of expression and audience expectations. These failures seem to be compromising its statutory duty to act as an independent regulator and ensure a bias-free broadcast environment.

What Ofcom is dealing with is not unique. Last month, the highest administrative court in France directed the French regulator to properly examine whether a television channel, CNews, was complying with its rules on balanced and independent journalism. A press freedom organisation took the regulator to court over its inaction on what’s become known as “French Fox News”. Ofcom may face the same fate.

Many have watched aghast as Ofcom gives GB News and others the green light to put out highly partial views with no apparent challenge, or fails to investigate alleged conspiracy theories. Often, we don’t even get to see Ofcom’s reasoning in published decisions. Meanwhile, government ministers are interviewed by MPs from their own party. Similar content from the likes of Press TV from Iran, CGTN from China and RT from Moscow was censured by Ofcom, including with six-figure fines.

It is not for Ofcom but parliament to decide whether impartiality rules should be weakened, changed or abandoned. If, after public and parliamentary debate, there’s a view that perhaps impartiality should only apply to public service broadcasters, then so be it. But, at the moment, the rules are being changed by the back door.

For the past two decades, Ofcom has admirably maintained its independence and carried out its regulatory duties without fear or favour. We are proud to have worked there to uphold those values.

If its code is no longer fit for purpose, Ofcom should amend it and make sure its rules, which apply to all UK broadcasters, are upheld. But as the elections loom, Ofcom should not forget that impartiality is the cornerstone upon which trust in our news and current affairs has been built.

-

Stewart Purvis was the chief executive and editor in chief of ITN and a former Ofcom content and standards partner. Chris Banatvala is an independent expert member of the Sky News board and was Ofcom’s founding director of standards responsible for drafting and enforcing its first broadcasting code.

Media

Trump could cash out his DJT stock within weeks. Here’s what happens if he sells

Former President Donald Trump is on the brink of a significant financial decision that could have far-reaching implications for both his personal wealth and the future of his fledgling social media company, Trump Media & Technology Group (TMTG). As the lockup period on his shares in TMTG, which owns Truth Social, nears its end, Trump could soon be free to sell his substantial stake in the company. However, the potential payday, which makes up a large portion of his net worth, comes with considerable risks for Trump and his supporters.

Trump’s stake in TMTG comprises nearly 59% of the company, amounting to 114,750,000 shares. As of now, this holding is valued at approximately $2.6 billion. These shares are currently under a lockup agreement, a common feature of initial public offerings (IPOs), designed to prevent company insiders from immediately selling their shares and potentially destabilizing the stock. The lockup, which began after TMTG’s merger with a special purpose acquisition company (SPAC), is set to expire on September 25, though it could end earlier if certain conditions are met.

Should Trump decide to sell his shares after the lockup expires, the market could respond in unpredictable ways. The sale of a substantial number of shares by a major stakeholder like Trump could flood the market, potentially driving down the stock price. Daniel Bradley, a finance professor at the University of South Florida, suggests that the market might react negatively to such a large sale, particularly if there aren’t enough buyers to absorb the supply. This could lead to a sharp decline in the stock’s value, impacting both Trump’s personal wealth and the company’s market standing.

Moreover, Trump’s involvement in Truth Social has been a key driver of investor interest. The platform, marketed as a free speech alternative to mainstream social media, has attracted a loyal user base largely due to Trump’s presence. If Trump were to sell his stake, it might signal a lack of confidence in the company, potentially shaking investor confidence and further depressing the stock price.

Trump’s decision is also influenced by his ongoing legal battles, which have already cost him over $100 million in legal fees. Selling his shares could provide a significant financial boost, helping him cover these mounting expenses. However, this move could also have political ramifications, especially as he continues his bid for the Republican nomination in the 2024 presidential race.

Trump Media’s success is closely tied to Trump’s political fortunes. The company’s stock has shown volatility in response to developments in the presidential race, with Trump’s chances of winning having a direct impact on the stock’s value. If Trump sells his stake, it could be interpreted as a lack of confidence in his own political future, potentially undermining both his campaign and the company’s prospects.

Truth Social, the flagship product of TMTG, has faced challenges in generating traffic and advertising revenue, especially compared to established social media giants like X (formerly Twitter) and Facebook. Despite this, the company’s valuation has remained high, fueled by investor speculation on Trump’s political future. If Trump remains in the race and manages to secure the presidency, the value of his shares could increase. Conversely, any missteps on the campaign trail could have the opposite effect, further destabilizing the stock.

As the lockup period comes to an end, Trump faces a critical decision that could shape the future of both his personal finances and Truth Social. Whether he chooses to hold onto his shares or cash out, the outcome will likely have significant consequences for the company, its investors, and Trump’s political aspirations.

Media

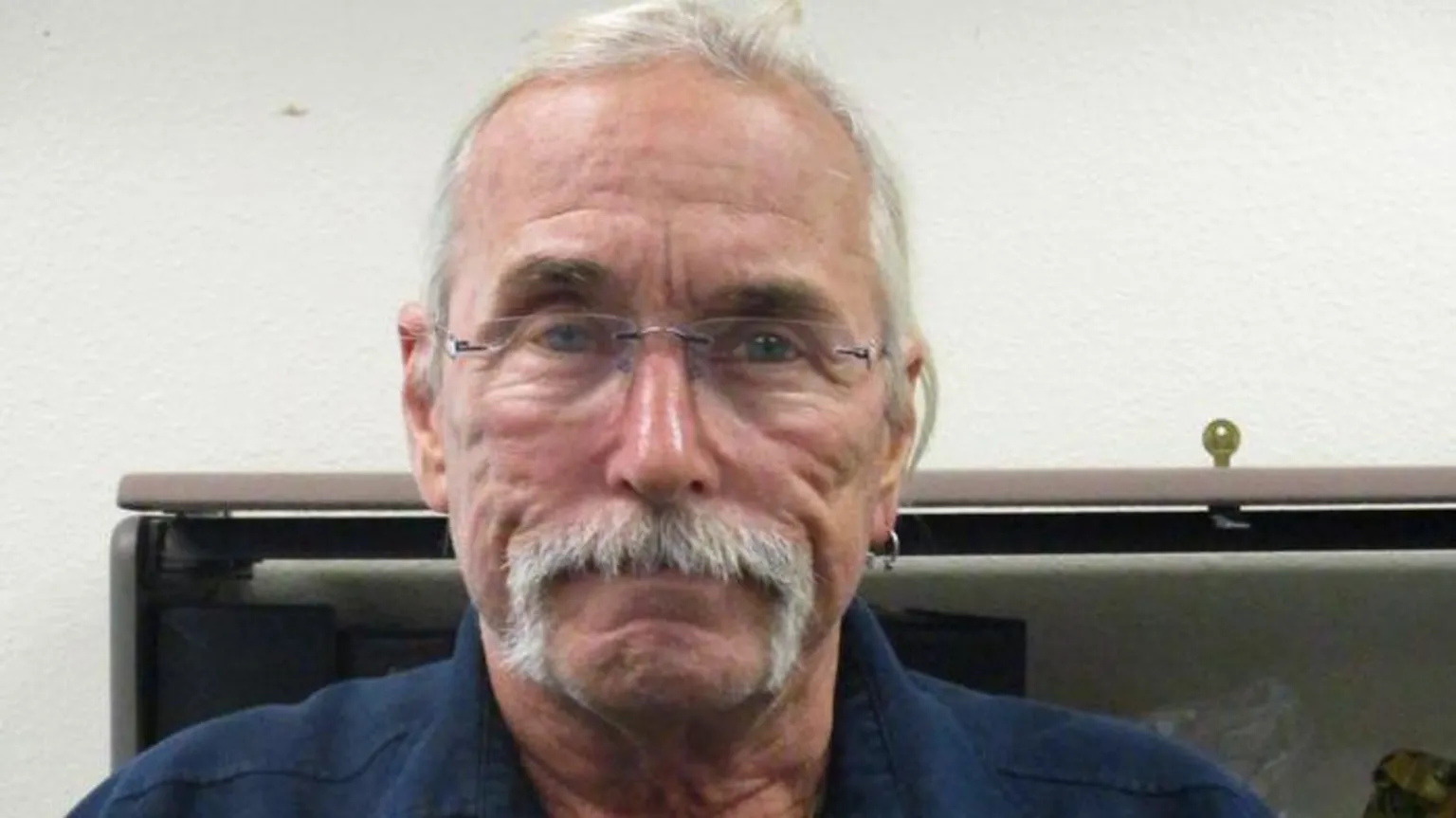

Arizona man accused of social media threats to Trump is arrested

Cochise County, AZ — Law enforcement officials in Arizona have apprehended Ronald Lee Syvrud, a 66-year-old resident of Cochise County, after a manhunt was launched following alleged death threats he made against former President Donald Trump. The threats reportedly surfaced in social media posts over the past two weeks, as Trump visited the US-Mexico border in Cochise County on Thursday.

Syvrud, who hails from Benson, Arizona, located about 50 miles southeast of Tucson, was captured by the Cochise County Sheriff’s Office on Thursday afternoon. The Sheriff’s Office confirmed his arrest, stating, “This subject has been taken into custody without incident.”

In addition to the alleged threats against Trump, Syvrud is wanted for multiple offences, including failure to register as a sex offender. He also faces several warrants in both Wisconsin and Arizona, including charges for driving under the influence and a felony hit-and-run.

The timing of the arrest coincided with Trump’s visit to Cochise County, where he toured the US-Mexico border. During his visit, Trump addressed the ongoing border issues and criticized his political rival, Democratic presidential nominee Kamala Harris, for what he described as lax immigration policies. When asked by reporters about the ongoing manhunt for Syvrud, Trump responded, “No, I have not heard that, but I am not that surprised and the reason is because I want to do things that are very bad for the bad guys.”

This incident marks the latest in a series of threats against political figures during the current election cycle. Just earlier this month, a 66-year-old Virginia man was arrested on suspicion of making death threats against Vice President Kamala Harris and other public officials.

Media

Trump Media & Technology Group Faces Declining Stock Amid Financial Struggles and Increased Competition

Trump Media & Technology Group’s stock has taken a significant hit, dropping more than 11% this week following a disappointing earnings report and the return of former U.S. President Donald Trump to the rival social media platform X, formerly known as Twitter. This decline is part of a broader downward trend for the parent company of Truth Social, with the stock plummeting nearly 43% since mid-July. Despite the sharp decline, some investors remain unfazed, expressing continued optimism for the company’s financial future or standing by their investment as a show of political support for Trump.

One such investor, Todd Schlanger, an interior designer from West Palm Beach, explained his commitment to the stock, stating, “I’m a Republican, so I supported him. When I found out about the stock, I got involved because I support the company and believe in free speech.” Schlanger, who owns around 1,000 shares, is a regular user of Truth Social and is excited about the company’s future, particularly its plans to expand its streaming services. He believes Truth Social has the potential to be as strong as Facebook or X, despite the stock’s recent struggles.

However, Truth Social’s stock performance is deeply tied to Trump’s political influence and the company’s ability to generate sustainable revenue, which has proven challenging. An earnings report released last Friday showed the company lost over $16 million in the three-month period ending in June. Revenue dropped by 30%, down to approximately $836,000 compared to $1.2 million during the same period last year.

In response to the earnings report, Truth Social CEO Devin Nunes emphasized the company’s strong cash position, highlighting $344 million in cash reserves and no debt. He also reiterated the company’s commitment to free speech, stating, “From the beginning, it was our intention to make Truth Social an impenetrable beachhead of free speech, and by taking extraordinary steps to minimize our reliance on Big Tech, that is exactly what we are doing.”

Despite these assurances, investors reacted negatively to the quarterly report, leading to a steep drop in stock price. The situation was further complicated by Trump’s return to X, where he posted for the first time in a year. Trump’s exclusivity agreement with Trump Media & Technology Group mandates that he posts personal content first on Truth Social. However, he is allowed to make politically related posts on other social media platforms, which he did earlier this week, potentially drawing users away from Truth Social.

For investors like Teri Lynn Roberson, who purchased shares near the company’s peak after it went public in March, the decline in stock value has been disheartening. However, Roberson remains unbothered by the poor performance, saying her investment was more about supporting Trump than making money. “I’m way at a loss, but I am OK with that. I am just watching it for fun,” Roberson said, adding that she sees Trump’s return to X as a positive move that could expand his reach beyond Truth Social’s “echo chamber.”

The stock’s performance holds significant financial implications for Trump himself, as he owns a 65% stake in Trump Media & Technology Group. According to Fortune, this stake represents a substantial portion of his net worth, which could be vulnerable if the company continues to struggle financially.

Analysts have described Truth Social as a “meme stock,” similar to companies like GameStop and AMC that saw their stock prices driven by ideological investments rather than business fundamentals. Tyler Richey, an analyst at Sevens Report Research, noted that the stock has ebbed and flowed based on sentiment toward Trump. He pointed out that the recent decline coincided with the rise of U.S. Vice President Kamala Harris as the Democratic presidential nominee, which may have dampened perceptions of Trump’s 2024 election prospects.

Jay Ritter, a finance professor at the University of Florida, offered a grim long-term outlook for Truth Social, suggesting that the stock would likely remain volatile, but with an overall downward trend. “What’s lacking for the true believer in the company story is, ‘OK, where is the business strategy that will be generating revenue?'” Ritter said, highlighting the company’s struggle to produce a sustainable business model.

Still, for some investors, like Michael Rogers, a masonry company owner in North Carolina, their support for Trump Media & Technology Group is unwavering. Rogers, who owns over 10,000 shares, said he invested in the company both as a show of support for Trump and because of his belief in the company’s financial future. Despite concerns about the company’s revenue challenges, Rogers expressed confidence in the business, stating, “I’m in it for the long haul.”

Not all investors are as confident. Mitchell Standley, who made a significant return on his investment earlier this year by capitalizing on the hype surrounding Trump Media’s planned merger with Digital World Acquisition Corporation, has since moved on. “It was basically just a pump and dump,” Standley told ABC News. “I knew that once they merged, all of his supporters were going to dump a bunch of money into it and buy it up.” Now, Standley is staying away from the company, citing the lack of business fundamentals as the reason for his exit.

Truth Social’s future remains uncertain as it continues to struggle with financial losses and faces stiff competition from established social media platforms. While its user base and investor sentiment are bolstered by Trump’s political following, the company’s long-term viability will depend on its ability to create a sustainable revenue stream and maintain relevance in a crowded digital landscape.

As the company seeks to stabilize, the question remains whether its appeal to Trump’s supporters can translate into financial success or whether it will remain a volatile stock driven more by ideology than business fundamentals.

-

News8 hours ago

News8 hours agoB.C. to scrap consumer carbon tax if federal government drops legal requirement: Eby

-

News8 hours ago

News8 hours agoA linebacker at West Virginia State is fatally shot on the eve of a game against his old school

-

Sports9 hours ago

Sports9 hours agoLawyer says Chinese doping case handled ‘reasonably’ but calls WADA’s lack of action “curious”

-

News19 hours ago

News19 hours agoReggie Bush was at his LA-area home when 3 male suspects attempted to break in

-

News9 hours ago

News9 hours agoRCMP say 3 dead, suspects at large in targeted attack at home in Lloydminster, Sask.

-

Sports3 hours ago

Sports3 hours agoCanada’s Marina Stakusic advances to quarterfinals at Guadalajara Open

-

News8 hours ago

News8 hours agoHall of Famer Joe Schmidt, who helped Detroit Lions win 2 NFL titles, dies at 92

-

News9 hours ago

News9 hours agoBad weather and boat modifications led to capsizing off Haida Gwaii, TSB says