(Bloomberg) — The economy of the world’s biggest energy exporter is heading for its deepest slump in more than 10 years due to the fallout from the coronavirus. A bigger crisis may be just around the corner.

Analysts at the Kremlin-funded Skolkovo Energy Center warned this month that the nation faces years of economic stagnation as demand for its carbon-heavy exports gradually drops. If Russia doesn’t adapt, budget receipts will “decline drastically” and growth may be limited to less than 0.8% a year for the next two decades, less than a third of what the Economy Ministry is targeting.

President Vladimir Putin has relied on high oil prices as a backstop for economic growth — and his own popularity ratings — for most of his two decades at Russia’s helm. Now forecasters expect that the coronavirus recession will accelerate the decline in global fossil fuel use, with some even predicting that the peak was in 2019, about 15 years earlier than the Kremlin was expecting.

“Oil and gas are becoming just commodities, without the resource rents that were the main driver for the Russian economic miracle at the beginning of this century,” Tatiana Mitrova, director of the Skolkovo Energy Center, said by phone. The coronavirus crisis has likely made the think tank’s economic forecasts even bleaker, she said.

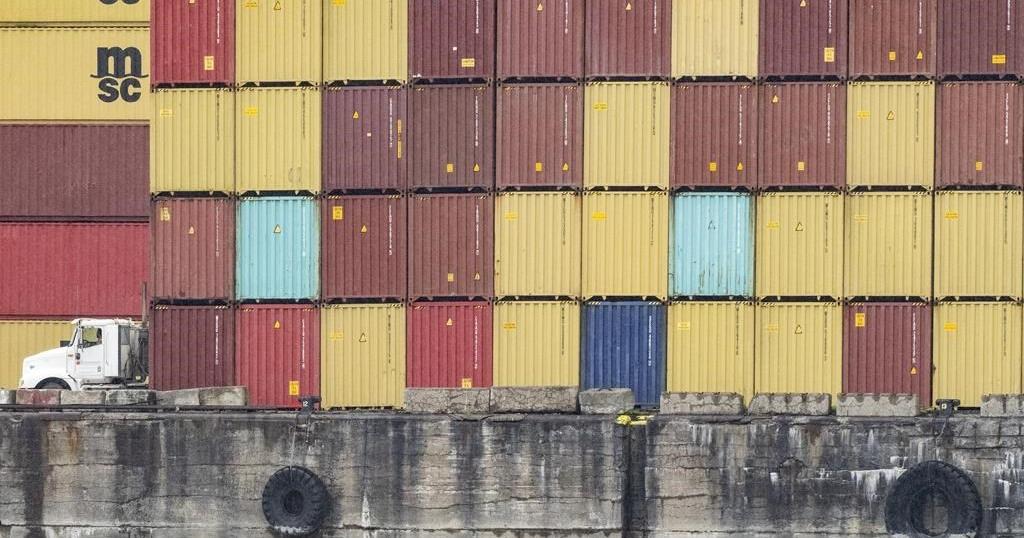

The Kremlin is showing no signs that it plans to move away from the current economic setup, under which almost half of budget revenues come from energy exports. Just this month, Rosneft Chief Executive Officer Igor Sechin boasted to Putin about progress made at an Arctic oil exploration project and Gazprom began design and survey work on a new pipeline to China.

Crude prices have collapsed about 50% since the start of the year as coronavirus lockdowns sap demand. Although the market has rebounded in recent weeks, the price of Russia’s export blend of Urals crude is still well below the $42 a barrel needed to balance the Russian budget.

The International Energy Agency forecasts a plunge in global oil demand of 8.6 million a day this year, or about 9%, while solar and wind demand increase. The European Union, Russia’s biggest export market, wants to put a Green Deal to become climate-neutral by 2050 at the heart of its plan to recover from the coronavirus pandemic.

“All of the countries that are highly dependent on fossil fuels have said ‘we must change’ for many years, but they haven’t done it because it’s hard,” said Kingsmill Bond, a strategist at London-based think tank Carbon Tracker. “It’s no longer a question of hope, it’s a question of necessity because people just won’t want these highly-priced fossil fuels any more.”

In a low-carbon development plan published in March, Russia’s Economy Ministry forecast that coal demand will peak before 2035, and oil demand before 2045. The ministry said Thursday it expects gross domestic product to grow 2.8% next year and 3% in 2022.

The plan envisages cutting the carbon-intensity of the Russian economy by 9% in the next decade. But greenhouse gas emissions — the fifth highest in the world — would still increase on current levels by the middle of the century.

Security Threat

Kirill Tremasov, the head of research at Loko-Invest in Moscow who is about to take up a new role as the head of the central bank’s monetary policy department, warned in a Youtube post Friday that an acceleration in global decarbonization poses a major risk to growth. Just over a week earlier, Anatoly Chubais, the architect of Russia’s privatizations in the 1990s, said the drop in oil demand is a threat to the country’s national security.

Russia ranks 109th in the world for renewable energy capacity, according to Bloomberg New Energy Finance. The Energy Ministry aims to increase the share of renewable energy in power generation from under 1% currently to 2.5% by 2024, a fraction of what other countries are planning.

“Nobody raises these questions with Putin, nobody can,” said Georgy Safonov, head of the Center for Environmental and Natural Resource Economics at Moscow’s Higher School of Economics. “Russia is like a huge ship that is moving in the wrong direction. If someone wants to improve part of it, it poses a risk to the whole ship.”

©2020 Bloomberg L.P.

Bloomberg.com