Investing may be more appealing now than at any other point in history. Not only because stock markets around the world have been buoyant in recent times – the Dow Jones Industrial Average experienced its longest-ever bull run between 2009 and March 2020 – but also because low interest rates mean banks are not able to offer much for savers to get excited about.

But the investment world can also be a scary place; it is easy for the inexperienced to become overwhelmed. In the US, in addition to the Dow Jones index, there is the Nasdaq Composite and the S&P 500 to keep tabs on, as well as countless other smaller indices. If investors want to cast their net even wider, there is a whole world of other countries to invest in, each with their own myriad markets to consider. It’s a lot to take in.

The finance sector is heavily regulated, and entering it can take time – something that not all start-ups have the luxury of

Stephanie Brennan is working hard to make investing more accessible. As CEO of Vilnius-based start-up Evarvest, she believes it’s important to nurture the next generation of investors by providing education, support and the tools needed to invest in whatever assets pique their interest, wherever in the world they are based. The Evarvest stock-trading app makes entering the world of investing as simple as having a smartphone and a Wi-Fi connection, giving users the ability to trade more than 9,000 stocks at the touch of a button.

Declaring an interest

Ever since she overheard her parents discussing their own portfolios at the family dinner table, Brennan has been interested in investing. But the journey towards creating Evarvest has been gradual. One of Brennan’s early job roles was as a policy advisor for Australia’s regional government in New South Wales, assisting then MP Bronwyn Bishop in her role as shadow minister for seniors. Specifically, Brennan worked on legislative reforms in the superannuation space – the Australian equivalent of pensions – which gave her an insight into how investing affects older people and why so many struggle to acquire the financial liquidity and stability needed to support themselves during their retirement.

Her career then moved further into the investment space, first with property while working at real estate firm Richardson & Wrench, and then when she founded Step Wealth, a financial services firm that offered private wealth-planning advice. It wasn’t long before she was personally investing, both in property and the capital markets.

“The idea for Evarvest really came from my own experience,” Brennan told European CEO. “I was always really interested in the stock market, but I found it incredibly complex. That’s why I started with property, to begin with. But then I pivoted back to really wanting to get my head around investing in capital markets. I tried to self-educate, but soon realised that there’s a huge lack of advice and guidance in this space. While there are some great platforms that are really trying to educate people, I still felt like you needed a pre-existing level of understanding to engage with the concepts that they were explaining. It wasn’t simplified enough that I could come in with no experience and really grasp it.”

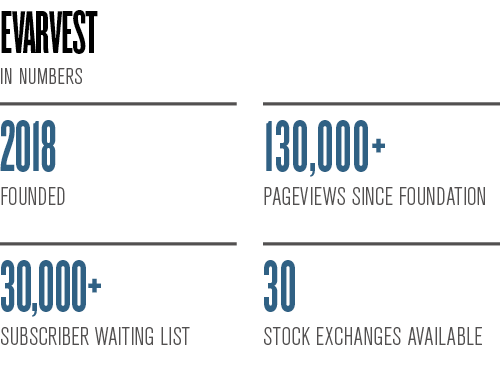

Brennan soon discovered that many others like her wanted to get involved in investing but didn’t know where to begin. After building up her knowledge base, she decided it was time to give back by sharing that information with others – it was then that Evarvest was born. Starting as a video blog in Australia in January 2018, Evarvest grew quickly. In June of that year, the company relocated to Vilnius, Lithuania, to obtain an EU brokerage licence. Partnerships, awards and funding rounds have followed, and today the company has a clear roadmap in place for further expansion.

Finding the funds

The challenge that Brennan had to overcome was greater than simply offering educational support in the field of investment: she found that the cost of getting involved in investing was prohibitive. When there’s also the risk factor to consider, it is easy to understand why high brokerage fees would lead many to simply leave their savings in the bank instead, even if the interest they are accruing is almost non-existent.

“I found that even if I was investing in my local market, it was still incredibly expensive to start investing,” Brennan said. “Most banks in Australia stipulated a minimum of AUD 500 (€294) per trade and about AUD 25 (€14.67) in brokerage. And from there when I wanted to access international markets, like the London Stock Exchange, it was AUD 20,000 (€11,740) to open an account with a stockbroker and AUD 200 (€117) in brokerage.”

With traditional investment platforms, users may be subject to a set-up charge, an annual fee, dealing costs, exit penalties and other expenses. Collectively, these can subtract significantly from any profits. With Evarvest, however, stock trading across US markets is commission-free, while all other markets are subject to a commission starting at just 0.1 percent. But low costs aren’t the only way Evarvest is trying to differentiate itself.

“What’s really unique about Evarvest is the way it brings all of those elements – accessibility, simplicity and cost – together,” Brennan said. “There are some great companies in our space that are really driving change, but if they are simple enough to use, then they often don’t have access to other markets. So I really wanted to bring everything together in one application.”

And while Evarvest is looking to appeal to a broad demographic, younger users are a growing market. Collectively, Millennials and Generation Z represent 63.5 percent of the world’s population, and these individuals are gaining financial power all the time. Improving their financial literacy is a good way of making sure this power doesn’t go to waste.

Return on investment

As with any start-up looking to disrupt a well-established industry, challenges are inevitable. Finding sources of funding is one obstacle that all company founders are aware of, but fortunately this hasn’t been much of a struggle for Evarvest. Last year, the firm exceeded its initial target in its first fundraising round by over 300 percent, raising €227,963, despite only targeting €75,000.

But while the company’s finances remain in good shape, there are many other hurdles to overcome. The finance sector is heavily regulated and entering it can take time – something that not all start-ups have the luxury of. With Evarvest, Brennan had to think carefully about where she wanted her business to be located based on the regulatory conditions within each market.

“Personally, I think every challenge is an opportunity in itself,” she said. “We started in Australia, but when we were looking to obtain a licence, we had to consider where offered the best return on investment, which led us to looking at different markets all over the world. We found that Lithuania has the fastest licensing time not just in the EU, but more broadly in the world. Normally, in the UK, most parts of Europe and Australia, the licensing time takes about 12 months, whereas Lithuania takes a maximum of six months in general. So for us, this market was hugely attractive, particularly as it gives us fantastic access to the rest of Europe. As a part of our Brexit strategy, we are also simultaneously applying to obtain our FCA approval in the UK.”

Evarvest shifted operations to Vilnius, Lithuania’s capital city, in June 2018, attracted by more than just the regulatory landscape. According to the Global Fintech Index 2020, Vilnius is ranked as the fourth-best location in the world for fintech, employing more than 21,000 technology specialists, 14,000 finance and insurance specialists and 2,400 fintech specialists.

Despite these advantages, Vilnius, like every other city in the developed world, has not been able to avoid the impact of the COVID-19 pandemic. Neither has Evarvest. Brennan is keen to stress that the likely long-term impact of the disease remains unknown, so her main goal has stayed the same – building a resilient business.

“I think in terms of COVID-19, we’re not really sure of the exact impact that it is going to have both in the short and long term, but – particularly in the capital markets – we are seeing a huge uptick in account openings for people looking to take advantage of any opportunities,” Brennan said. “There are some great companies that we use in our daily lives that have really dropped in value. Will these continue to be around in the next 12 months? Are they going to be able to ride out this volatility?”

When it comes to her own business, Brennan has long been prepared to expect the unexpected. “I often return to the wise words of my [mother], actually, when I started my first business,” she said. “She told me to always try to ensure that your company is effectively recession-proof; something that people always need no matter what.”

The volatility that the coronavirus crisis is bringing to the business world will see many firms plummet in value and others go under, but some will see their fortunes improve as consumer patterns and entire industries adapt. In this sort of environment, there will certainly be opportunities for investors to make sizable profits, and Evarvest is ready to give them a helping hand.

The share of responsibility

Leading a new business always comes with pressure, but it’s not often that a global pandemic is listed among the challenges. Brennan has tried to stick to her original timescales for expansion, while also staying true to her leadership style. The aim remains to launch in European markets first, before eventually expanding globally, back to Australia, then New Zealand and Canada, and finally Singapore and the US. Such expansion will require a significant amount of work, but Brennan knows this comes with the territory.

“I guess working for a start-up and having to wear multiple hats means that there is no typical day,” Brennan said. “Being the founder, it’s all about making sure that our marketing and our product aligns with the company’s overall strategy.”

At Evarvest, Brennan’s hands-on approach has ensured that the company has received accolades, funding and plenty of media attention. There remains much work to be done if the firm is to continue expanding and reach a global audience, but the CEO has shown already that she is willing to invest her time and energy into making trading available to everyone.