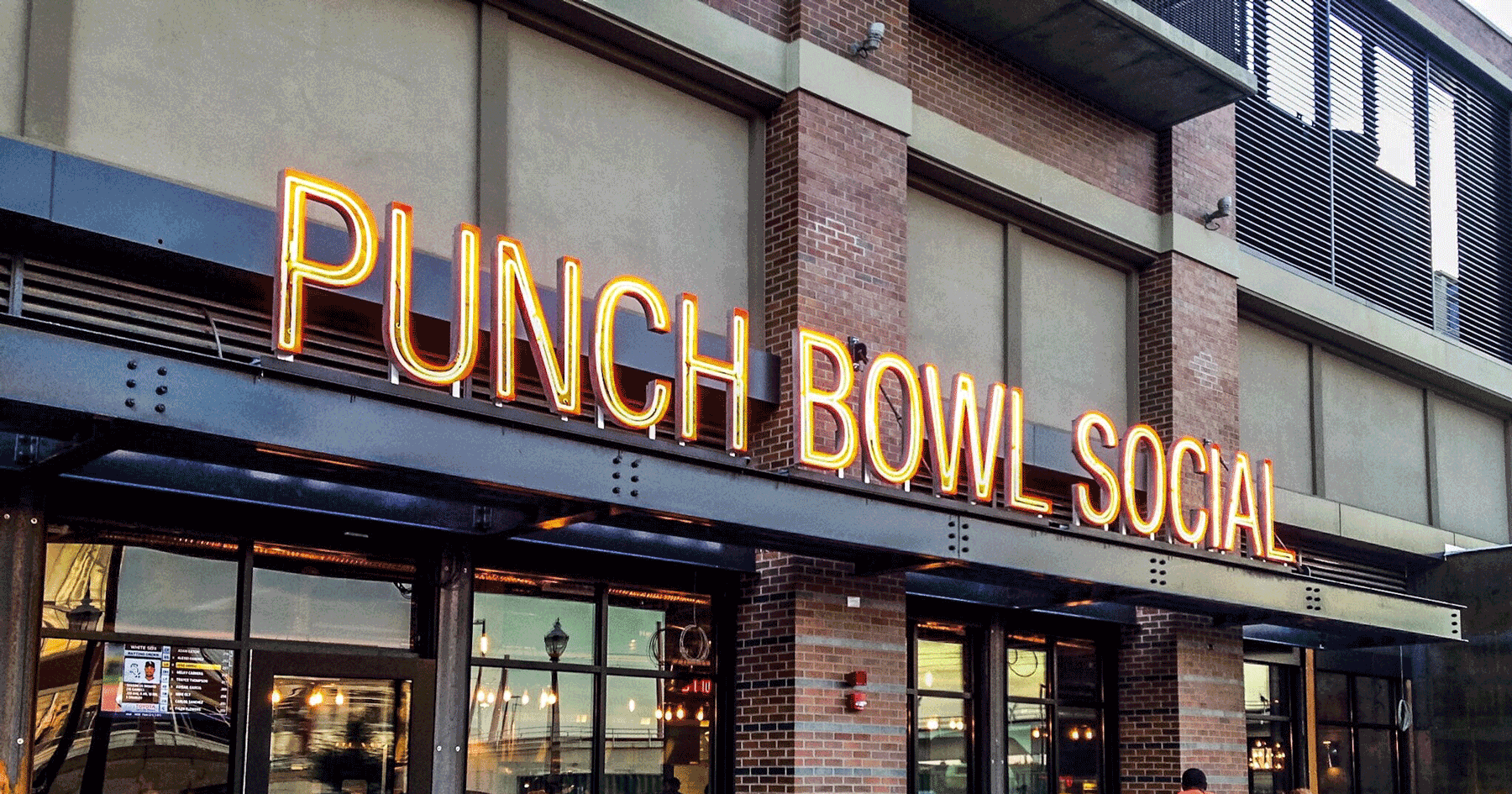

Nothing was quite as surprising as was Cracker Barrel’s decision in 2019 to invest up to $140 million into the “eatertainment” concept Punch Bowl Social—except, perhaps, for its quick decision to walk away from that investment and write off $133 million back in March.

Both decisions have now come under scrutiny. Activist Sardar Biglari, who has been a thorn in Cracker Barrel’s side for nearly a decade, has criticized both the acquisition and the writeoff, using both to fuel an effort to gain a seat on the company’s board.

“Such activity resembles that of a venture capital operation, in which no one on the board or management, to our knowledge, has any experience,” Biglari wrote last week, referring to Cracker Barrel’s investment in Punch Bowl as well as its acquisition of Maple Street Biscuit Co.

Biglari, who controls 8.4% of Cracker Barrel stock, has nominated Briad Group co-CEO Raymond Barbrick to the board. Cracker Barrel is not endorsing the nomination, arguing that Barbrick is not “sufficiently experienced or differentiated to add value to the board.”

Both Biglari and Cracker Barrel are working to convince shareholders to vote in favor of their respective board members. If shareholders pick Barbrick, it will give Biglari his first win on his fifth proxy fight against the company. He is clearly hoping that shareholder frustration over the Punch Bowl investment provides an opening for him to get a representative on the board.

Cracker Barrel’s investment in Punch Bowl was part of a strategy to extend itself beyond its core brand. The chain is a legacy concept, with diminishing white space to add new locations. As such, the company has been looking for other ways to increase revenue and therefore earnings.

That led the company first to experiment with creating its own concept, Holler & Dash—created in 2016 and which grew to seven units by 2019. Biglari called the chain a “complete failure,” though Cracker Barrel converted those seven units to Maple Street locations after that 2019 acquisition—and companies typically take it slow when creating secondary concepts.

Punch Bowl was considered an up-and-coming concept when Cracker Barrel opened its wallet in 2019. But problems appeared quickly after that investment—Punch Bowl’s Fort Worth unit, opened soon after that investment, closed after less than three months.

Biglari argues that Punch Bowl is too different from Cracker Barrel’s own core concept and did not warrant an investment in the first place. “We believe it is a strategic error to pursue the unknown and unproven when there is a known and proven Cracker Barrel brand with high profit potential attached,” Biglari wrote. “It is time to eliminate the idea of extending beyond the Cracker Barrel brand.”

Cracker Barrel has defended its decision to invest in Punch Bowl, arguing that it was a sound investment at the time and that it was working to fix issues before the pandemic.

“At the time we made our investment, Punch Bowl Social had what our board and I regarded to be a solid sales and profitability profile, high growth potential, a sound management team, a focus on innovation, and a guest base of urban millennials and Gen-Z consumers that was complementary to our own, while also offering us the possibility to better leverage guest and demographic data,” CEO Sandra Cochran wrote earlier this month.

“After making our investment, we worked closely with the Punch Bowl management team to help them refine the company’s business model to address certain issues common to many growth companies, and we were making progress when the pandemic struck,” she added.

In March, the pandemic hit hard on eatertainment concepts in particular, leaving them with a potentially long runway of uncertainty. But all restaurant chains were facing major questions going forward. Cracker Barrel opted to walk away from that investment.

That did not go unnoticed by Biglari, who called Punch Bowl Social “the investment equivalent of Waterloo.”

“Losing $137 million of shareholders’ money in eight months with a venture capital investment is reason enough to add one board member with restaurant experience,” Biglari wrote.

But, said Cochran, “it became clear to us that Punch Bowl would require significant management attention and millions of dollars of capital, above and beyond any funds available under the CARES Act, just to survive. In light of the highly uncertain environment in March, our board and management team determined that these resources would be better spent on Cracker Barrel and Maple Street than on mothballing, and eventually resuscitating, Punch Bowl Social.”

She added that six months later Punch Bowl continues to struggle.

And indeed, Punch Bowl Social’s founder and now-former CEO Robert Thompson harbored no ill will toward Cracker Barrel’s decision to walk away. “They made a choice to shrink their perimeter and protect their core brand,” he said in an episode of the Restaurant Business podcast “A Deeper Dive” in June. “I do not begrudge them the choice that they made. This was an existential crisis for many brands.”

Source: – Restaurant Business Online

Source link

Related